Market intel from Blackrock

Simon Turner

Tue 8 Oct 2024 4 minutesBlackrock’s Q4 equity outlook report contains some useful intel to help investors make sense of global markets at this juncture. With the US election looming and the Fed’s initiation of a rate cutting cycle, there’s a lot for markets to worry about and celebrate.

One thing’s for sure: it’s unlikely to be a boring end to the year.

Volatility front and centre

Unsurprisingly, volatility is a main theme in Blackrock’s outlook report.

After the volatility global markets experienced in August, Blackrock’s strategists are firmly of the opinion that this will remain a normal part of investing looking forward, including during Q4: ‘Market volatility, while always unsettling, is not at all uncommon. It often presents the opportunity to add to fundamentally sound stocks at sale prices.’

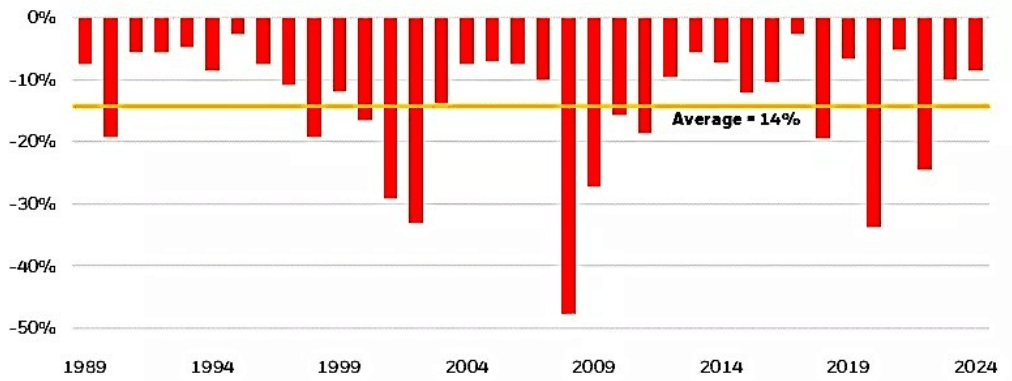

On that note, Blackrock highlight that corrections are not uncommon over the long term with the average S&P 500 drawdown being 14% over the past 35 years.

The key point is that the market returned 11% p.a. throughout this timeframe despite all those drawdowns.

Of course, the investors who benefitted from strong long term market returns were the ones who were able to hold onto their portfolios during the many selloffs along the way. Unfortunately, investors who sold into those selloffs were made victims by the market.

The lesson is clear: think long term about your investment portfolio and accept that volatility is a normal and healthy part of investing.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Big event looming: the US election

Blackrock highlight that the November 5th US election is an upcoming ‘potential volatility-inducing moment’.

Whilst that won’t be news to many, the more useful analysis is that in five of the past seven elections since 1996, the market’s initial one-month reaction to the election result did not hold over the following year.

In other words, investors should be prepared for volatility after the election but they shouldn’t read too much into the initial move.

The Fed’s ever present role in markets

The Fed remains a key player in global financial markets.

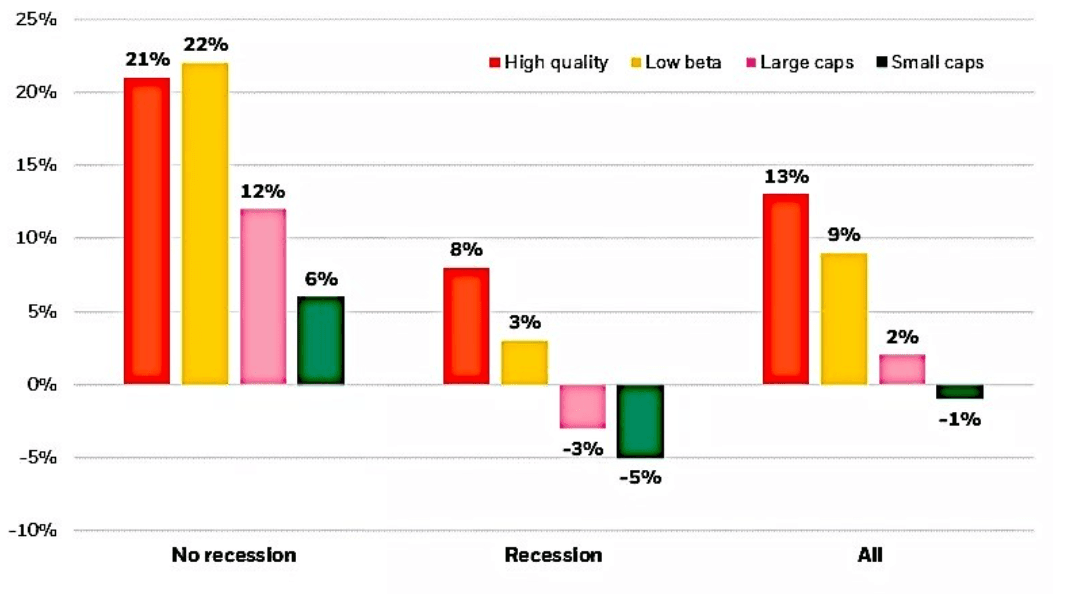

Blackrock distinguish between the market outlook during a Fed rate cutting cycle that results in a recession and the one that doesn’t.

In the no recession scenario, low beta and high quality tends to perform the best, whilst small caps performed the worst. And surprisingly, in the recession scenario, the relative performance rankings remained unchanged, although the numbers were much weaker—as shown below.

Based on this research, investors are likely to be well-served by focusing on quality assets and funds/ETFs with a quality/defensive bias.

The outlook at a sectoral level

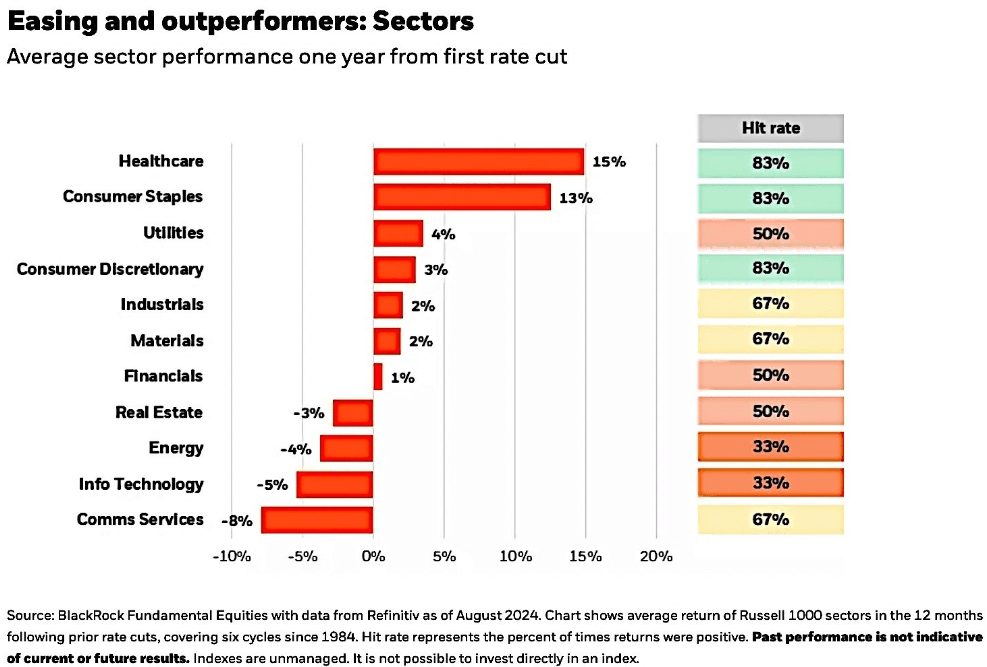

Consistent with Blackrock’s style analysis, the strongest performing sectors one year from the first cut were healthcare and consumer staples, both defensive. And on average, the weakest sectors were communication services and information technology.

If this data provides a steer as to what’s coming next, it could be interesting to watch how the overcrowded Magnificent Seven stocks perform in the short term. Having said that, Blackrock believe the global technology sector is currently better positioned than during previous rate cutting cycles largely due to the addition of AI as a structural tailwind.

The 2-3-year data confirms that defensives have continued outperform past the first year of Fed rate cutting cycles, although cyclicals, particularly financials start to improve over that slightly longer timeframe.

The key takeaway for investors is that high quality, defensive sectors such as healthcare look particularly attractive at this juncture. The healthcare sector is positioned to benefit from the ageing global population and rising healthcare needs, as well as the sector’s innovation-driven growth potential.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Think long term & be ready for volatility

Blackrock are sensibly helping prepare investors for more volatility in the coming weeks and months. As the world’s largest fund manager, they know the types of investors who make a lot of money over the long term: those who invest for the long term and hold onto their portfolios during bouts of market volatility.

More importantly, their research shows that owning high quality, defensive assets and funds/ETFs with a focus on quality are likely to outperform from here regardless of what happens to the US economy.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.