How to generate high yield despite the concerning ASX dividend trend

Ankita Rai

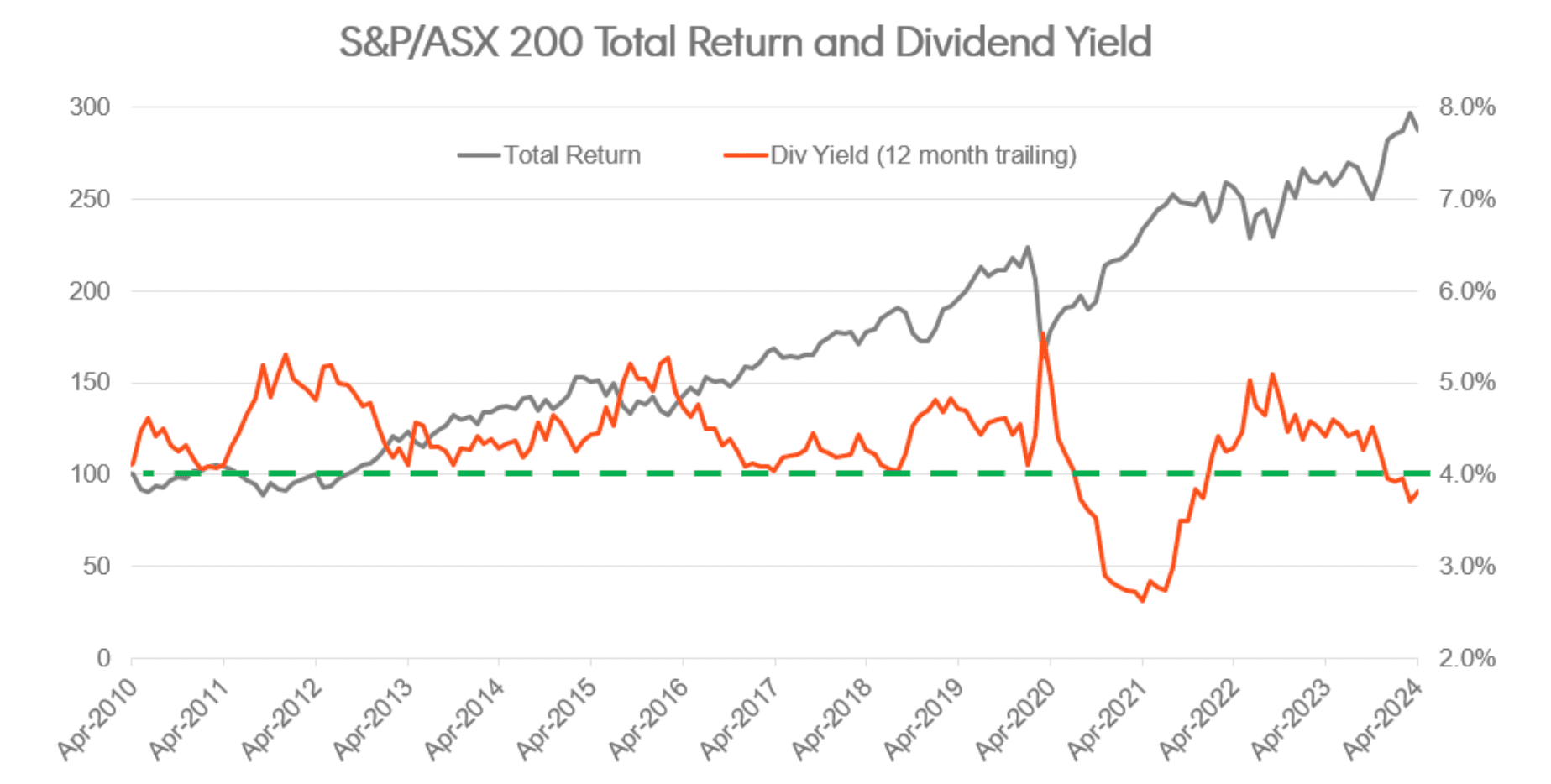

Wed 9 Oct 2024 6 minutesAustralian shares have traditionally been a go-to for income investors due to their attractive dividend yields. However, the market is undergoing a significant shift and the record payouts that followed the resources boom seem to be coming to an end.

Recently, the base yield of the Australian market dipped below 4%, with rising costs and a weakening Chinese economy contributing to the decline.

Morgan Stanley forecasts that the S&P/ASX 200 dividend yield will drop to just 3.6% in FY25, potentially marking the lowest yield for the ASX 200 in decades, excluding the COVID-19 period.

Case in point: during the August reporting season, S&P/ASX 200 companies declared only $34.4 billion in dividends—the lowest since 2020. And the downward trend is likely to continue for some time with some of the largest ASX-listed companies potentially being dividend traps.

Identifying dividend traps

As yields continue to decline, income investors must remain vigilant against potential dividend traps. A recent analysis by Morningstar reveals that only 15 companies within the ASX 300 currently offer a dividend yield above 3%.

While analysts forecast strong dividend growth potential for companies like Macquarie and QBE over the next five years, the outlook for the larger miners such as BHP, Rio Tinto, and Fortescue is less favourable, with significant drops in their dividends expected. Additionally, companies like Woodside and NAB are projected to face declines, while Santos, ANZ, Westpac, and Telstra may experience only minimal growth.

This market backdrop poses risks for income investors who typically prefer passive strategies since concentrated exposure to a few high-yield stocks increases vulnerability to dividend cuts.

To mitigate the risks associated with dividend traps—where a stock offers a high yield based on past dividends but faces declining future payouts—investors should strike a balance between current yields and future growth potential.

One effective strategy is to consider Equal Weighted ETFs, which provide balanced exposure across a selection of companies. This diversification helps reduce reliance on the largest players in the industry, particularly in over-concentrated indices.

Another option is to invest in funds like the Hamilton12 Australian Shares Income Fund, which focus on securities with high-franked dividend yields while incorporating diversification to mitigate risk and improve after-tax returns for Australian investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Shifting investment focus to robust sectors

Falling yields also indicate the emergence of new opportunities for income investors.

While some resources and energy stocks, such as Rio Tinto, Santos, and Origin Energy, have managed to increase their payouts, the most significant growth has been observed in the insurance sector, where most companies are benefitting from raised premiums.

So investors seeking stable income growth should consider pivoting away from the miners, which are burdened by high capital expenditure plans, and focus on industrial and insurance stocks generating robust profit growth.

For example, Atlas is among a growing number of income funds without holdings in major iron ore miners, instead relying on dividends from insurers such as QBE and Suncorp, as well as companies such as CSL and Transurban. The Atlas Concentrated Australian Equity Portfolio, which targets high-quality companies with consistent, forecastable earnings, offers a net dividend yield of 5.3% (FY23).

Diversify your portfolio in a low-yield environment

As rising business costs pressure dividend payouts, rising share prices are also making it difficult for income investors to meet their goals if dividend growth fails to keep pace. This is where strategies like fundamental indexing, covered calls, and corporate bond investments become valuable options. These strategies not only help enhance yield but also improve risk-adjusted returns, serving as effective supplements to core Australian equity and fixed-income portfolios.

For example:

- Fundamental approach to investing

Fundamental indexing prioritises a company's financial health over its share price, helping to avoid market trends, bubbles, and crashes.

Unlike market-cap-weighted indexes which size holdings based on share prices, managed funds based on fundamental indexes use metrics like revenues, cash flow, dividends, and book value.

This strategy helps build portfolios of financially strong companies better positioned to pay steady dividends, steering clear of those reducing their payouts.

For example, the FTSE RAFI Australia 200 ETF follows this strategy, offering a yield of 5% p.a. (or 6.5% with franking credits) and has outperformed the ASX 200 over time.

- Increasing yield with covered calls

While dividend ETFs provide a blend of income and growth, covered call funds are gaining popularity among investors seeking additional income beyond dividends.

These funds generate returns from both dividends and premiums from selling call options. This dual-income strategy often yields higher returns compared to traditional dividend stocks, particularly in flat or moderately bullish markets.

For instance, the BetaShares Australian Equity Yield Maximiser Fund has a distribution yield of 8% p.a., while the Global X S&P/ASX 200 Covered Call ETF yields 7.6% p.a.

However, investors should be aware that this strategy may limit capital growth if the market rises significantly, leading to underperformance during bull markets.

- Bonds and credit offer yield advantages

Additionally, dividend investors can explore investment-grade corporate bonds for higher yields.

The Artesian Corporate Bond Fund, for instance, delivers an active return of 1.9% p.a. (net fund return minus the RBA cash rate).

Furthermore, Australian credit currently offers attractive relative value compared to global corporate bonds, largely due to the higher yields on offer.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Opportunities amidst falling yield

While the dividend outlook on the ASX may not be very promising right now, there are still attractive opportunities for income investors willing to look beyond the usual options. Strategies such as fundamental indexing and covered calls offer the potential to boost portfolio income while improving risk-adjusted returns.

By focusing on diversification and exploring alternative income sources, investors can navigate the challenges posed by falling yields and thus position their portfolios to outperform.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.