Avoid the carnage caused by the Dunning-Kruger Effect

Simon Turner

Thu 10 Oct 2024 7 minutesIn the words of Mark Twain: ‘It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.’ Most investors can relate, but few are fully aware of the cognitive bias that explains this quote: the Dunning-Kruger Effect.

The Dunning-Kruger Effect is one of the more conspiratorial of the cognitive biases, and may just be sabotaging your investment returns without your knowledge or approval.

What is the Dunning-Kruger Effect?

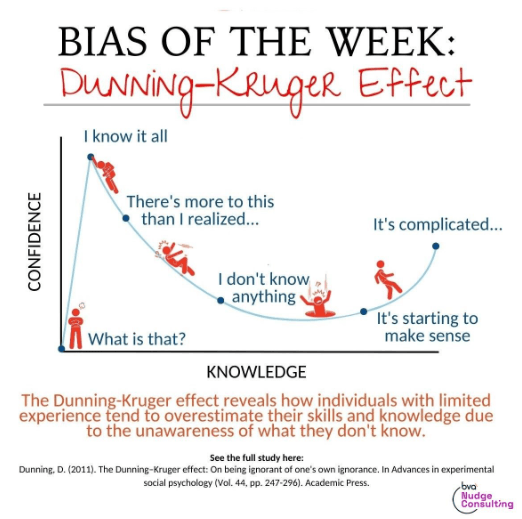

The Dunning-Kruger Effect is a cognitive bias whereby an unskilled investor overestimates his or her ability to find winning and profitable trades. As shown below, it’s the unfortunate point in the confidence-knowledge spectrum where confidence is high but knowledge is low.

The Dunning-Kruger Effect tends to end badly. The combination of high confidence and low knowledge leads to the shock of understanding that there’s a lot more to be learnt through a series of painful mistakes. This disappointment cycle generally leads to Socratic the acknowledgement that we know a lot less than we thought we did.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What the Dunning-Kruger Effect does to investment portfolios

We’ve all been there. Early on in our investment journeys (and not so early for others), we read a little bit about a hot stock which is being marketed as the next big thing. The information is delivered with persuasive text that connects with our goals as an investor: for most of us, to make lots of money and become financially free.

As images of living a carefree life at the beach run through our minds, we start believing this one stock may be the key to unlocking our dreams. We also over-estimate our ability to make sense of the information available to us.

Of course, our over-confidence stops us from understanding any of this. We lack an objective reference point or a third party observer who can pull us away from the cognitive biases that rule our mental roost without our permission.

At the very moment when we should be asking ourselves whether we know as much as we think we do, our egos give us a warm and fuzzy confirmation that we are indeed on the right track. So we keep going.

However, in so many of these cases driven by over-confidence, it ends badly—usually very badly.

As Stephen Hawking said: ‘The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.’

A personal Dunning-Kruger Effect story

I’ve had my fair share of Dunning-Kruger lessons over the years.

The worst one was a private market opportunity offered to me many years ago by a friendly older fellow I’d gotten to know on my daily dog walk.

During our friendly chats, this fellow casually dropped into the conversation that he owned 10% of Australia’s next global technology leader, a fintech with uncapped growth prospects that was going to allow him to enjoy his retirement in a state of financial freedom. On more than one occasion, he estimated his stake in this fintech to be worth upwards of $100m within a couple of years.

This expert stock promoter kept dropping seeds of investment success into our conversations that seemed to confirm this emerging fintech may indeed be the real deal. Then came the equity offer supported by a shiny presentation with lots of pretty pictures which modelled the company becoming as big as Paypal within a few years.

At the time, I had many years of experience as a professional investor in the listed markets, but that didn’t stop me from falling for the Dunning-Kruger Effect. Yes, I invested.

The problem was I misinterpreted my extensive experience of listed market investing. Translation: I was over-confident. I thought my experience would enable me to judge a compelling private markets fintech opportunity when I saw one.

I was wrong.

You can tell where this is going.

The investment has been an unmitigated disaster. The company is currently making less than 1% of the revenue modelled for 2024 at the time of investment thanks to a string of disastrous management decisions.

Hello humble pie. Hello the Dunning-Kruger Effect.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Free yourself of the Dunning-Kruger Effect’s evil clutches

The good news is freeing yourself of the Dunning-Kruger Effect’s evil clutches is a relatively simple awakening process:

- Develop an awareness of the Dunning-Kruger Effect and where you are in your investment journey.

This awareness provides you with valuable context regarding your current confidence and knowledge levels.

But remember: however confident you’re actually feeling is likely to be unjustified.

If you’re early in your investment journey, your high confidence is likely to be misplaced.

Equally, if you’re further into your investment journey, your lower confidence is also likely to be misplaced—although your humility is likely to be helpful.

By knowing ourselves, we’re able to adjust our behaviour to avoid the Dunning-Kruger-Effect-driven mistakes that sabotage so many investment portfolios.

- When you make an investment mistake, use it as a learning opportunity.

Write down what exactly your mistake was so you can learn from it and empower yourself to use your mistakes as future money-making tools. You can also help ensure you avoid the most painful of investment errors: making the same mistake over and over again.

In my private markets example, my mistake was believing my listed markets experience allowed me to navigate the private markets with a similar level of confidence. In hindsight, I should have invested in a quality, diversified private equity fund positioned to weather the inevitable disappointments of investing in emerging businesses.

- If you’re early in your investment journey and over-confidence is your challenge, then consider investing most of your portfolio through managed funds and ETFs.

By outsourcing a large portion of your investment portfolio to seasoned experts, you’ll be able to learn and make mistakes using a smaller, ring-fenced portion of your portfolio.

This approach will ensure you can’t detrimentally impact your long term investment plan as you gain the relevant knowledge and experience to invest with greater confidence and humility.

- If you’re further into your investment journey, you may want to manage a larger portion of your portfolio yourself depending on how much time and energy you’d like to invest into the process.

However, if you discover that investing is not a passion, then high quality managed funds and ETFs are still likely to be your best option.

Once you realise investing is hard you’re ready to invest

Understanding how the Dunning-Kruger Effect ravages so many investment portfolios is ample incentive to be aware of its powers.

The only way to sidestep its evil clutches and thereby generate superior investment results is to lose your over-confidence and understand that you know a lot less than you thought you did. Once your ego has taken a backseat during your investing journey, you’ll understand that successful investing is hard but simple. Only then will you be genuinely prepared to invest.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.