The 5 steps to an information advantage over the market

Simon Turner

Thu 17 Oct 2024 5 minutesWith the vast array of information investors have at their fingertips, you’d think it would be easy to spot investment trends before the rest of the market. If only.

The problem is there’s too much available information for most investors to make sense of. After a while, reams of written text become just more words rather than a source of learning. Hence, interpreting and understanding the vast universe of words that relate to investing is almost impossible for most investors.

So the question is: how can investors side-step this information overload challenge to spot investment trends before the rest of the market?

The 5 steps to an information advantage

The good news is it’s possible to generate an information advantage over the market (known in investment circles as edge), but the bad news is it takes a lot of work.

Here are the 5 steps:

1. Observe the world around you with an open mind.

This may sound obvious but many an investment trend was identified by investors who simply observed the world around them with an open mind. The truth is it’s not uncommon for investment analysts who are busy analysing financial statements to completely miss the bleeding obvious.

One of the more obvious examples is the ever-evolving social media-led fashion trends of Gen Z. The best (read: easy) way to identify the next big fashion trend has often been to follow the leading Gen Z social media influencers to see what they’re recommending. But most investment analysts aren’t doing this, so the related investment opportunities have generally been enjoyed by retail investors.

There’s an investment advantage to be gained by opening your eyes.

2. Follow inspirational business leaders who have a habit of identifying emerging trends.

For many years listening to Elon Musk talking about electric vehicles, self-drive cars, and a host of other technological advancements helped investors develop an edge over the broader market in these areas. Arguably, this information is now consensual and mainstream.

So who are the next Elon Musks of the world, the leaders who are ahead of the curve and bringing the curve with them?

Here are a few contenders for that crown who may be worth following:

- Edan Mann – A sales industry disruptor.

- Alexandr Wang – The Scale AI CEO.

- Henrique Dubugras and Pedro Franceschi – The Brex founders who are redefining the fintech sector.

- Tim Ellis – An aerospace disruptor.

The commonality between these emerging business leaders is an innate ability to see through the noise to identify structural investment trends.

3. Sign up to a few select investment newsletters and fund manager letters.

The good news is that many of the best investment newsletters are free, and conversely, there’s often minimal correlation with the fees charged by investment newsletters and the value they add.

For example, here are a couple of worthwhile free investment newsletters:

Most of the world’s best fund managers also publish their investment reports which often include a wealth of free information about emerging investment trends. These reports can be a treasure trove of investment learnings.

For example, here are some high value fund manager letters worth reading:

- Fundsmith letters

- Berkshire Hathaway letters

- Aquamarine Fund reports

- Pershing Square Holdings reports

The discussions in these high quality reports will be substantive, interesting, and focused on long term trends.

4. Keep on top of the latest research

Being aware of research developments is easier said than done considering the vast amount of scientific research being conducted each year around the world.

A shortcut to gaining a broader understanding of emerging scientific research trends ahead of the market may be as simple as subscribing to a magazine such as Scientific American.

And for technology, the MIT Technology Review is hard to beat as a predictor of future technology trends.

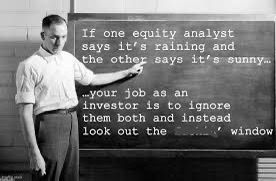

5. Ditch the news

Counter-intuitive as it may be, reading the financial news every day may actually be inhibiting your ability to identify investment trends ahead of the market.

The evidence shows that reading the news too often negates our ability to make sense of the information we’re digesting. We can no longer see the proverbial wood for the trees. This is why picking and focusing upon the right information sources has never been more important for investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

An easy alternative

Does developing an investment edge sound like a lot of work?

That’s exactly what it is. Identifying emerging investment trends ahead of the rest of the market requires a lot of time, energy, and focus. It also depends on filtering out the immense amount of noise coming at investors from all angles these days.

The easier alternative is to invest in a managed fund which is focused on investing in emerging trends, technology, and innovation.

It’s hard work but it’s worth it

Sorry if you were looking for a shortcut to identify the next big investment trend ahead of the market. Whilst some investors have discovered emerging investment trends by being lucky, this is not a repeatable process which can be replicated over the long term.

The only route to this land of opportunity ahead of the market is by reading the right material and tuning out the noise. And the only shortcut to this same end goal is to invest in a fund managed by experts at identifying investment trends.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.