A storm is brewing in the US

Simon Turner

Wed 6 Nov 2024 6 minutesWith the S&P 500 rallying an historic 40% over the past twelve months, you’d be forgiven for thinking all is well with the US Government’s finances. After all, the state of the world’s largest economy is inextricably connected with the US Treasury’s financial health.

Sorry to shatter that illusion, but the truth is very different. Do not read what follows if you prefer to believe in the US fairy tale…

A sobering picture of US Government debt

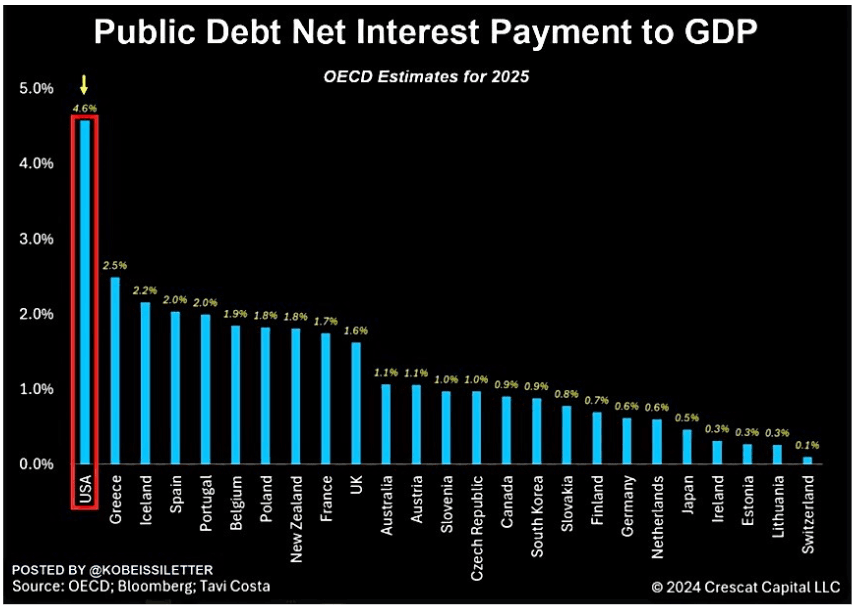

US federal debt recently hit a new record of $US35.8 trillion. Here’s what their net interest payments represent as a percentage of GDP versus other OECD countries…

To provide context, if US public debt net interest reaches a record 4.6% of GDP next year as expected, that will be more than double World War II levels, and will exceed the all-time highs seen in the 1990s. It will also much higher than every other country in the OECD—including the nations with a precarious relationship with debt such as Greece, Ireland, Spain, and Portugal.

To make matters worse, these OECD forecasts assume that interest rates fall over the next year. That means the US Government is in desperate need of rate cuts by the Fed. Can you imagine what would happen if those expected Fed rate cuts don’t eventuate?

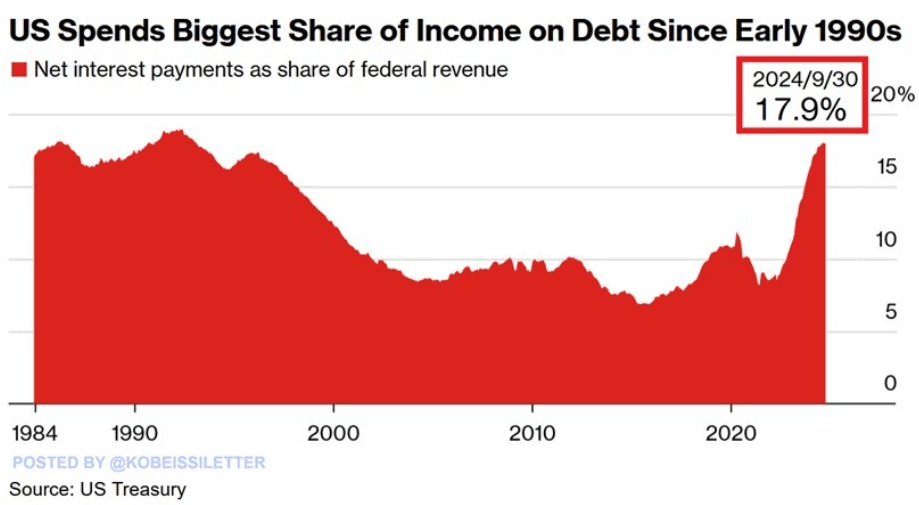

The other key reference point is the portion of US federal income being spent on net interest payments. The news is equally concerning on that front—as shown below.

So the US Government is currently spending 18% of its income on servicing its debt. That’s a doubling over the past three years and translates into $US1.1 trillion of interest payments over the past twelve months.

You may well look at this chart and say to yourself: yes, it’s bad, but the US Treasury has been here before in the eighties and nineties, so it’s not a code red situation.

But here’s the most sobering news … CBO estimates show that net interest as a percentage of US Government revenue are likely to double again over the next three decades, expanding to more than a third of revenue.

If that happens, it’s hard to understate the associated financial risks. And yet, the US Government continues to spend like its finances are healthy and sustainable.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Who’s lending to the US Treasury?

You may be asking yourself: who on earth is lending to the US Treasury given how precarious their position has become?

It’s a very good question.

The latest available data shows the US Treasury owed $US34.8 trillion in outstanding debt at the end of Q2 2024, of which 33% was held by government funds such as Social Security and the Fed.

$9.2 trillion, or 26%, was owned by foreign governments, with the most held by Japan and China.

$US4.9 trillion, or 14%, was held by mutual funds, and $US3.1 trillion by individuals.

And banks and pension funds held $US2.2 trillion and $US2.0 trillion, respectively.

So the risks posed by holding US Treasuries are spread across the global economy with governments, mutual funds, and pension funds particularly exposed.

Does it matter who won the US election?

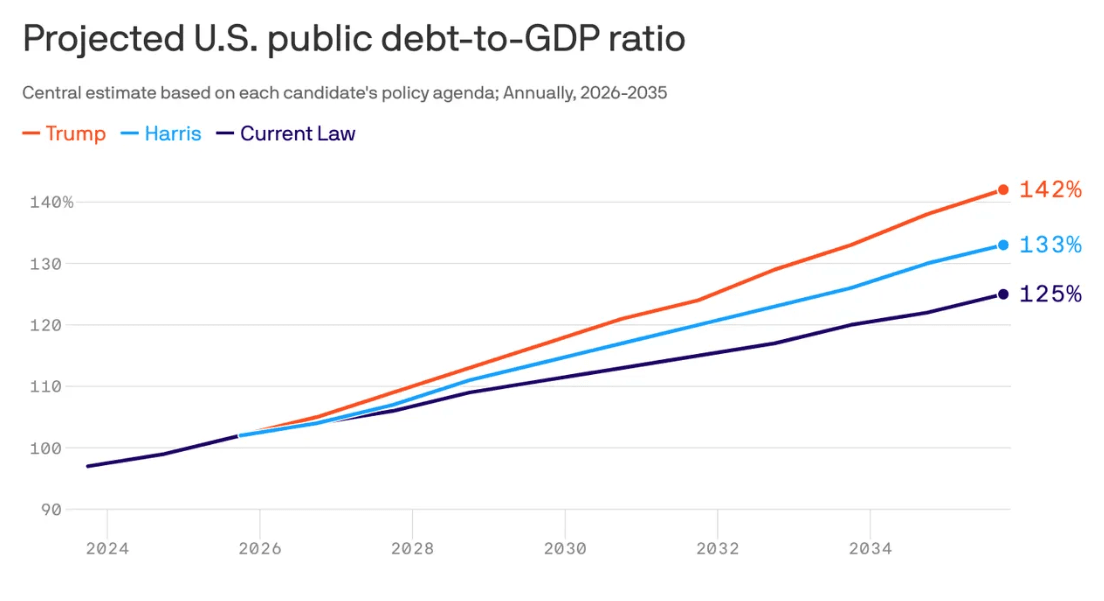

The final part of the puzzle is Trump’s election victory. Will it make a difference to US Government debt levels?

In short, it does matter.

As shown below, under a Trump presidency the US public debt-to-GDP ratio is expected to escalate a lot faster than if Harris had won.

So with Trump winning the election the US Government’s insolvency risk is likely to rise even faster than it was on track to. Whilst markets are initially rallying in response to Trump’s victory, investors should remain cognisant of this growing systemic risk.

Implications for investors

The investment implications of the US Treasury’s precarious financial position are significant, not least because they are such an enormous player in the global bond markets. Namely:

- Investors need to be aware of the two very different pathways the Fed could take.

The US Government is now dependent upon more Fed rate cuts, but the US Treasury’s growing insolvency risk calls for higher interest rates to reflect this risk. That’s the way free markets work: higher risk needs to be compensated for with higher returns.

How this situation resolves itself will depend on how focused the Fed is on the state of the US economy and global financial markets versus their inflation-fighting role. If they are thinking holistically, they are more likely to cut rates to help save the US Treasury from insolvency. That would mean a likely inflation resurgence and continued support for all inflation-linked asset classes.

The almost unthinkable alternative is that the Fed is forced by bond markets to raise rates rather than cut them in order to price in the systemic risks created by the US Treasury’s financial position. That picture may be harder for many investors to visualise but would entail a lot more volatility and economic pain.

- The US Treasury’s dominant position in bond markets means that however this risk plays out it’s likely to have a pronounced impact on global bond markets.

For example, if bond markets decide that the current 10 year US Treasury yield of 3.88% p.a. is too low to reflect the growing financial risks, then all bonds which are priced off the US Treasury rate are likely to be impacted.

If bond markets were to price 10 year US Treasuries at a yield of say 6.5%, that implies 40% downside versus their current value. Whilst that may sound extreme, a 6.5% yield in return for being exposed to the risks posed by the US Treasury’s financial position does not feel out of the realms of possibility.

- The implication of both of the above is that volatility is likely to rise at some point.

The least helpful words in the above sentence are “at some point”. That’s the very nature of this risk. It’s a systemic risk which is lurking and building in the background. When it impacts financial markets is anyone’s guess.

In the meantime, the best that investors can do is be aware of the risk and understand that once this thread starts unravelling, it may be a big deal.

A storm is brewing

The solvency of the US Government is currently a bigger risk than many investors are aware of. Whilst this is a longer term risk which is simmering in the background rather than boiling, the implications for markets are significant.

Being aware of this risk, and preparing in advance for the potential knock-on investment effects may well prove wise.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.