Debunking the myths about what the rise of ETFs is doing to the market

Simon Turner

Tue 12 Nov 2024 5 minutesIt’s a popular pastime for professional and individual investors to bemoan the impacts the rise of passive funds is having on markets. Their main argument makes intuitive sense: a growing portion of funds are being invested purely based upon a stock’s index or sector weighting, so stock fundamentals are becoming a weaker driver of market performance.

However, recent Goldman Sachs research questions the validity of this argument. We use that research as we embark on a myth-debunking journey below.

A megatrend that continues to gather steam

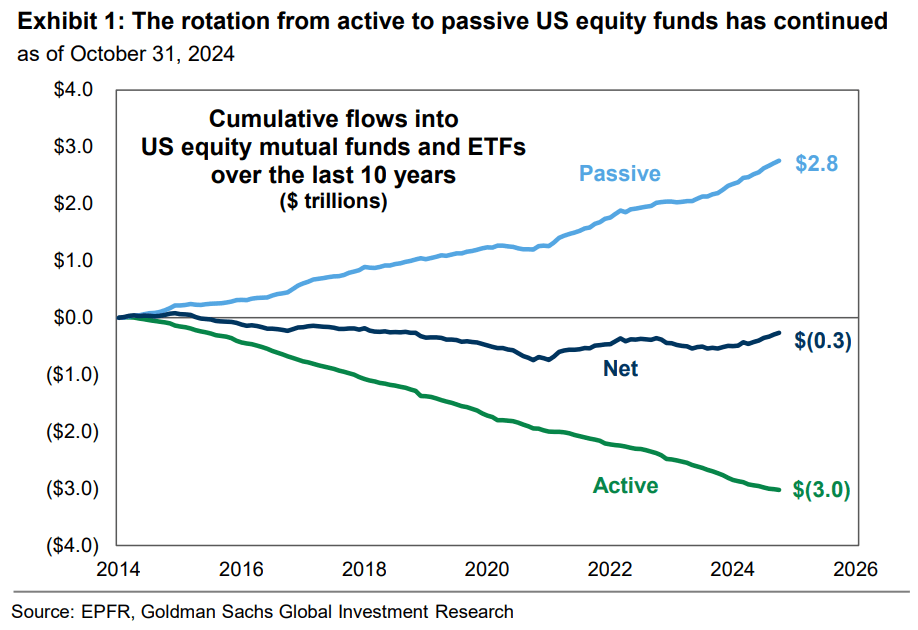

It’s hard to understate how dramatic the shift from active to passive managed funds has been over the past decade.

Goldmans estimates that a massive $US2.8 trillion has flowed into passive strategies over the past decade (in the US alone), whilst $US3 trillion has exited actively managed funds.

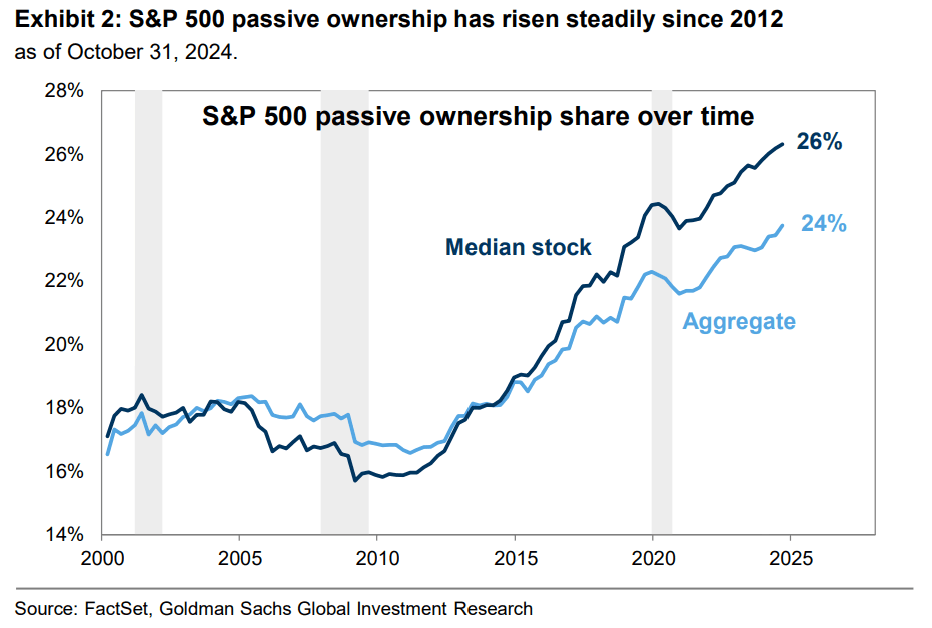

As a result, the median percentage of S&P 500 shares owned by passive funds has risen from 18% twenty years ago to 26%. And that rise doesn’t even include the money that’s flowed into index-tracking, non-fund strategies.

It’s easy to understand why so many investors believe this shift is leading to all sorts of ugly unintended consequences. How could it not? The active to passive transition implied stock picking is losing market sway.

But the answer isn’t as cut and dry as you may think.

Let’s delve into the three main impacts investors have long believed are occurring due to the rise of ETFs…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

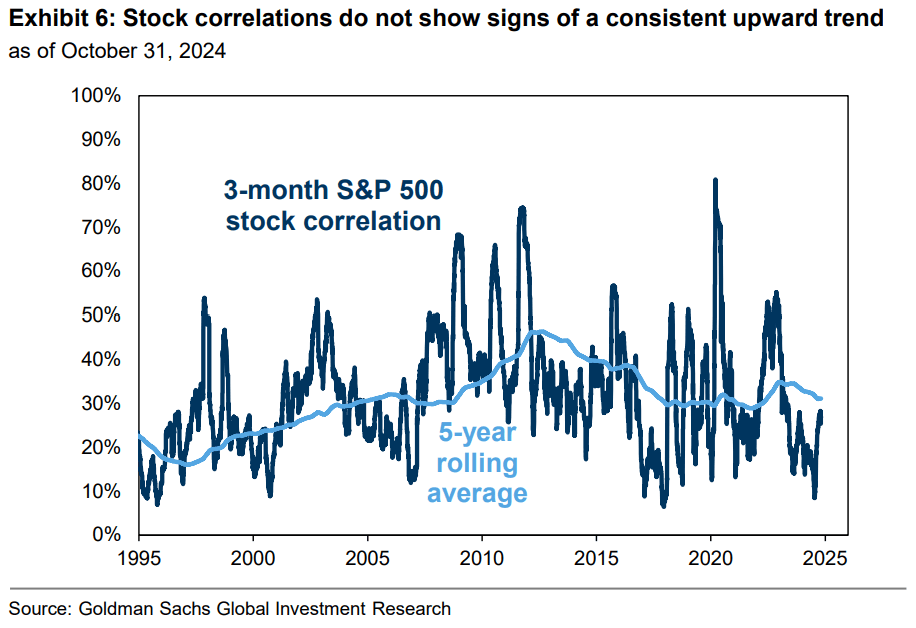

Myth 1: The rise of passive investing is increasing stock correlations

It’s a common held viewpoint that the rise of passive investing is leading to greater correlations between stock performances which implies investment markets are becoming less efficient over time.

However, the Goldmans research firmly debunks this theory.

The long term data shows S&P500 stock correlations have actually been falling over the past decade whilst the growth in passive funds has accelerated—as shown below.

Those numbers are hard to argue with—and that’s one passive investing impact myth debunked.

Myth 2: The rise of passive investing is driving valuations higher

This argument is built upon the premise that passive money is valuation blind, so the more dollars that flow into passive funds the higher market valuations will naturally trend.

But this argument neglects the hugely supportive impact of falling interest rates in recent decades—that is, until recently.

Then there’s the high likelihood that the funds which have flowed into ETFs would have otherwise been invested in active funds with a similar valuation-raising impact on the market.

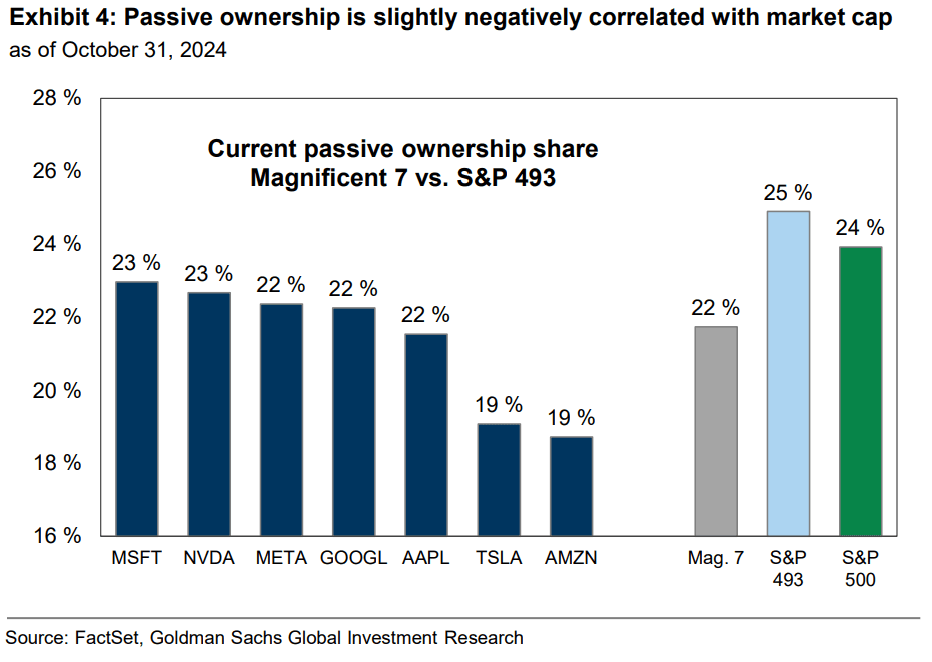

And finally, passive fund ownership of S&P500 stocks is slightly negatively correlated with market cap due to the fact that most passive strategies use capitalisation-weighted indices. In other words, passive funds don’t need to chase rising stocks since they already own the correct proportional amount of those stocks. It’s only when new funds flow into passive funds that they need to buy more stock.

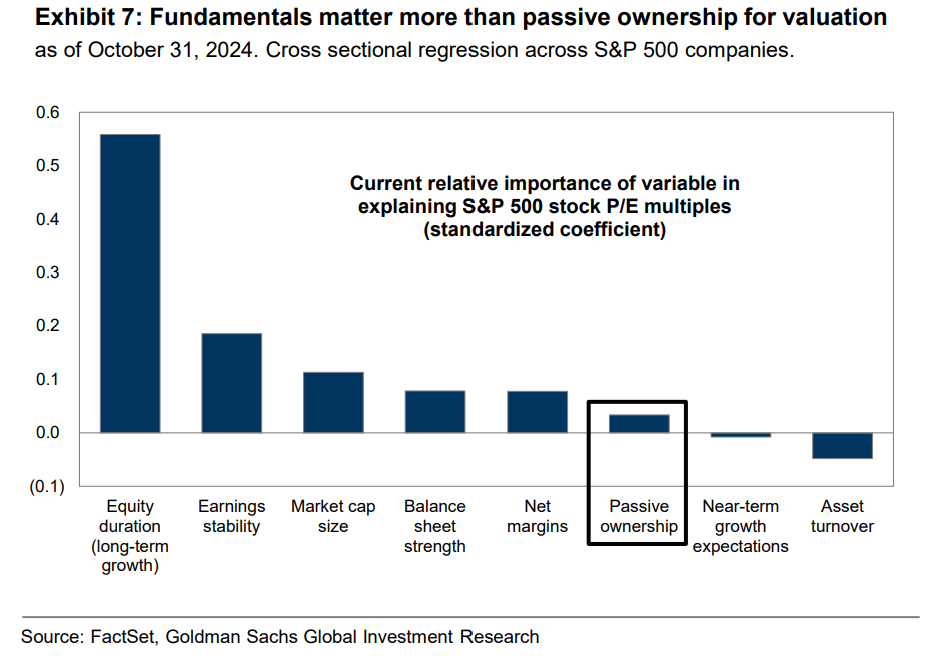

Goldmans have furthered settled this argument by disentangling the various factors driving S&P 500 valuations. As shown below, passive ownership barely rates a mention as a valuation driver. As you’d expect in a relatively efficient market, the main drivers are long term growth, earnings stability, market cap, balance sheet strength, and net margins.

The conclusion is clear: fundamentals trump the growing presence of passive funds.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Myth 3: The rise of passive investing is impacting stock returns

Whilst this is related to the valuation question, it also delves into the risk that passive funds are driving returns by effectively reducing corporate free floats.

You may have heard the accusation being bandied about in recent years that momentum-driven passive funds are largely responsible for the inexorable rise of the Mag7 stocks.

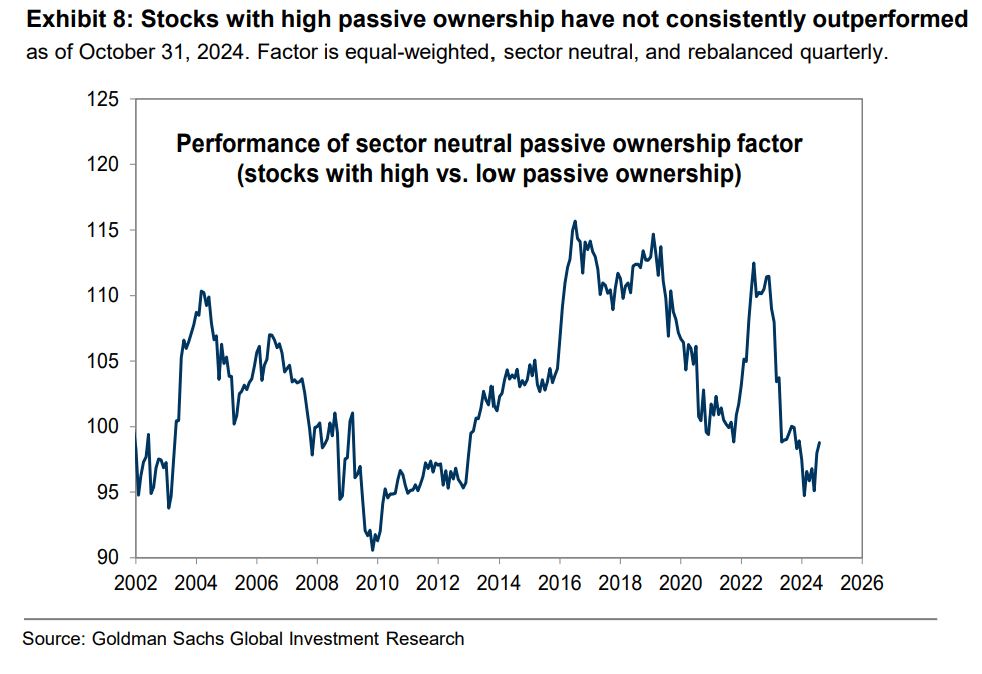

But once again, Goldmans have debunked this myth by showing that stocks with high passive ownership have not consistently outperformed—as shown below.

Circling back to the Mag7 example, Goldmans’ research confirms that they are relatively less owned by passive funds than the US stock market as a whole.

So they’ve once again provided conclusive evidence that the rise of passive investing does not impact stock returns. Q.E.D.

Passive funds are not the bad guys

The next time you hear passive funds being blamed for all the negative changes in investment markets, be ready to go into bat for the ETFs of the world.

Goldmans’ research confirms that investment markets remain relatively efficient and functional, and serves to debunk the three main myths of what the rise of ETFs is doing to the market. All the growing presence of ETFs has been responsible for is providing easy, low-cost access to a vast range of markets, sectors, and asset classes.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.