Fortify your portfolio with alternative investments

Ankita Rai

Fri 15 Nov 2024 6 minutesMany investors still see alternatives as complex, illiquid, and opaque—an asset class best avoided. Yet with the equity-bond mix delivering less consistent results, alternatives are becoming essential for those aiming for stronger portfolio resilience, higher returns, and alpha generation.

A Bain study reveals that demand for alternative investment products among high-net-worth investors is growing exponentially. In fact, more than half of ultra-high-net-worth individuals and nearly 40% of high-net-worth investors plan to increase their allocations to alternative assets over the next three years.

This trend is particularly strong in Australia, which has been named an APAC hotspot for alternative investments by private markets data provider Preqin.

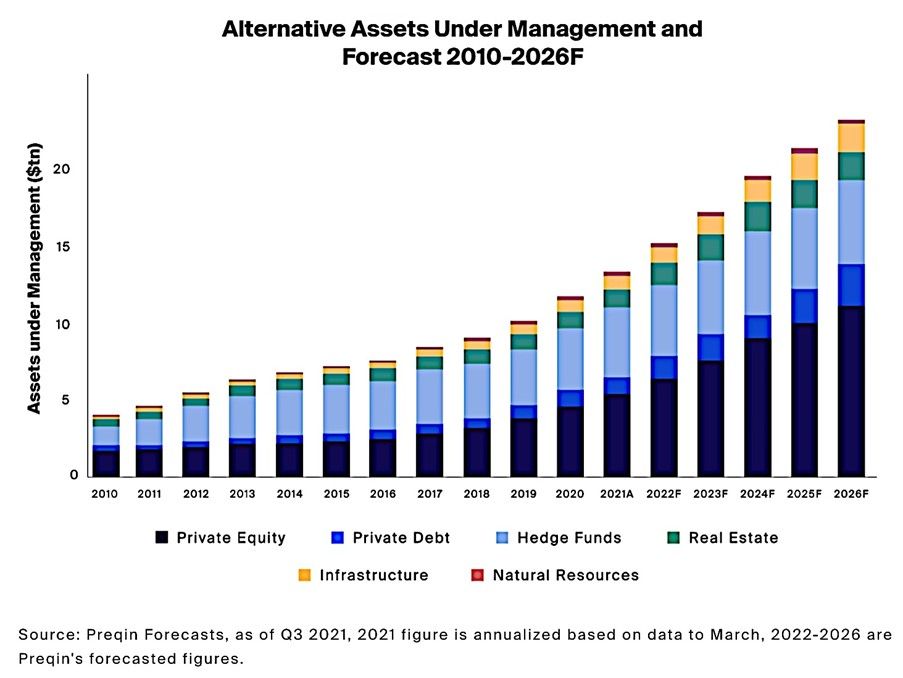

Globally, the alternative assets market is expected to exceed $US17 trillion by 2025. In Australia, the sector reached a record $1.2 trillion AUM in December 2022, driven by investments in data centres, life sciences, infrastructure, agribusiness, and renewables.

What are alternative assets?

Alternative assets are investments outside traditional stocks and bonds, such as private equity, venture capital, hedge funds, and private debt. These investments span various asset classes, each with unique risk and return profiles.

Below is an overview of the key alternative assets available to Australian investors on InvestmentMarkets:

1. Private equity and venture capital

Private equity and venture capital involve investing in private companies with high growth potential. These investments tend to be riskier and less liquid than public stocks, but they offer opportunities for significant returns.

Private equity generally focuses on capital appreciation, while venture capital funds typically support early-stage companies, especially in high-growth sectors like AI.

After the post-COVID slump, returns in these sectors have stabilized in the 7-11% p.a. range.

For example, Pengana Private Equity Trust offers a diversified portfolio of global private equity investments and has achieved 7.7% p.a. returns since inception.

With the Fed's rate-cut cycle underway, an increase in deal-making activity is expected in the coming months.

2. Private debt

Private debt, also known as private credit, includes subsets like real estate private debt and commercial real estate debt, and refers to loans provided by private investors rather than traditional banks.

Although typically riskier due to the lack of ratings, private debt offers higher yields and attractive return premiums. Yields are usually in the 6-13% p.a. range, depending on the fund's risk strategy, making it a potential alternative to cash or bonds.

For example, EG Private Wealth’s Private Debt targets returns of 9%+ p.a., while the Credit Connect Select Fund offers returns of 9-11% p.a.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

3. Hedge funds

Hedge funds are pooled investment vehicles managed by professionals using a range of strategies, including long/short positions and leverage, to generate returns. They aim to achieve positive returns regardless of market conditions and are often non-correlated with traditional assets.

Funds such as Claremont Global Fund and QVG Long Short Fund use strategies like long-only equity investing and flexible mandates to generate returns. The Claremont Global Fund targets absolute returns of 8-12% p.a. over a 5-7-year cycle, while QVG has delivered a net return of 16.3% p.a. since inception.

Australian hedge funds have outperformed this year, with a year-to-date return of 7.6%, surpassing the global average of 6.5%, according to With Intelligence.

4. Real assets

Real assets, including infrastructure and real estate, provide income stability and protection against inflation. From REITs to infra stocks to private commercial real estate debt there are multiple options in the area.

Funds like the Resolution Capital Real Assets Fund offer exposure to Australian listed real estate (A-REITs) and infrastructure investment securities, with an 9% p.a. return since inception. Active ETFs, such as JPMorgan Sustainable Infrastructure Active ETF, focus on sustainable infrastructure, delivering a 7.8% year-to-date return.

5. Commodities

Commodities such as gold, oil, and agricultural products serve as a hedge against inflation and market volatility. They often move inversely to stocks and bonds, offering a defensive layer.

For instance, the Acorn Capital NextGen Resources Fund provides exposure to a range of commodities like lithium, graphite, and copper, with a net performance of 12.7% p.a. since inception.

6. Cryptocurrency

Cryptocurrency offers high-risk, high-reward opportunities, with digital assets like Bitcoin and Ethereum increasingly recognised as alternatives to traditional stores of value like gold.

Rising interest in alternatives to the US dollar has fuelled demand for digital currencies. While Bitcoin remains a top choice, initial coin offerings and other blockchain projects focused on DeFi, gaming, and data privacy present significant growth potential.

However, the volatile market and regulatory uncertainty mean crypto investments should be approached cautiously.

Key takeaways: Why invest in alternatives?

Diversification is one of the main benefits of alternative investments, but understanding the unique characteristics of each asset class is essential for building a balanced portfolio.

Here are some key points to consider when adding alternatives to your investment strategy:

- Broader growth opportunities: The decline in publicly traded companies and the surge in private companies highlight the growth potential in private markets. By focusing solely on public markets, investors miss out on opportunities in private equity, which has historically outperformed global equities by 4-12% p.a..

- Fortifying your portfolio for challenging times: Alternative assets like private credit, hedge funds, and real assets provide vital diversification, especially during market downturns. Hedge funds can reduce portfolio volatility, while private credit benefits from higher rates and spreads, and real assets like infrastructure and real estate offer stable returns and inflation protection.

- Filling the yield gap with liquidity premium: Although alternative assets are often illiquid, investors are compensated with higher returns for the lack of liquidity. This trade-off is a reasonable price for the additional benefits these assets provide, especially compared to public market investments.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A balanced approach to alternatives

Incorporating alternative investments into your portfolio can be a worthwhile diversifier away from traditional asset classes.

While they offer the potential to deliver compelling, risk-adjusted returns, they also improve your chances of achieving your investment goals, even during economic downturns and unforeseen events.

As always, it’s important to conduct thorough due diligence before investing.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.