Four charts that show why the private markets are booming

Simon Turner

Mon 18 Nov 2024 4 minutesThe rise of private market investing is continuing unabated with more and more individual investors allocating up to 20-25%+ of their portfolios to the asset class. This trend appears set to continue with a growing number of investors who don’t currently have private markets exposure actively considering whether it’s aligned with their investment plan and goals.

As a result, the story of why private markets allocations have been rising has rarely been of greater interest. The four charts below tell the story.

1. The public markets exodus is a one-way street to the private markets

We recently wrote an article on the mysterious case of the shrinking ASX discussing the exodus of ASX-listed stocks reflecting growing private equity demand for publicly listed investment opportunities.

This is not just happening on the ASX. It’s a global trend. As shown below, the number of publicly traded US companies has declined by over 30% during the past couple of decades.

In other words, the private markets opportunity set has been expanding for some time now, which is leading to a growing number of high-quality companies on offer for private equity investors. Conversely, the public markets opportunity set is declining.

This trend is pushing more investors to consider private markets investing.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. It’s all about performance

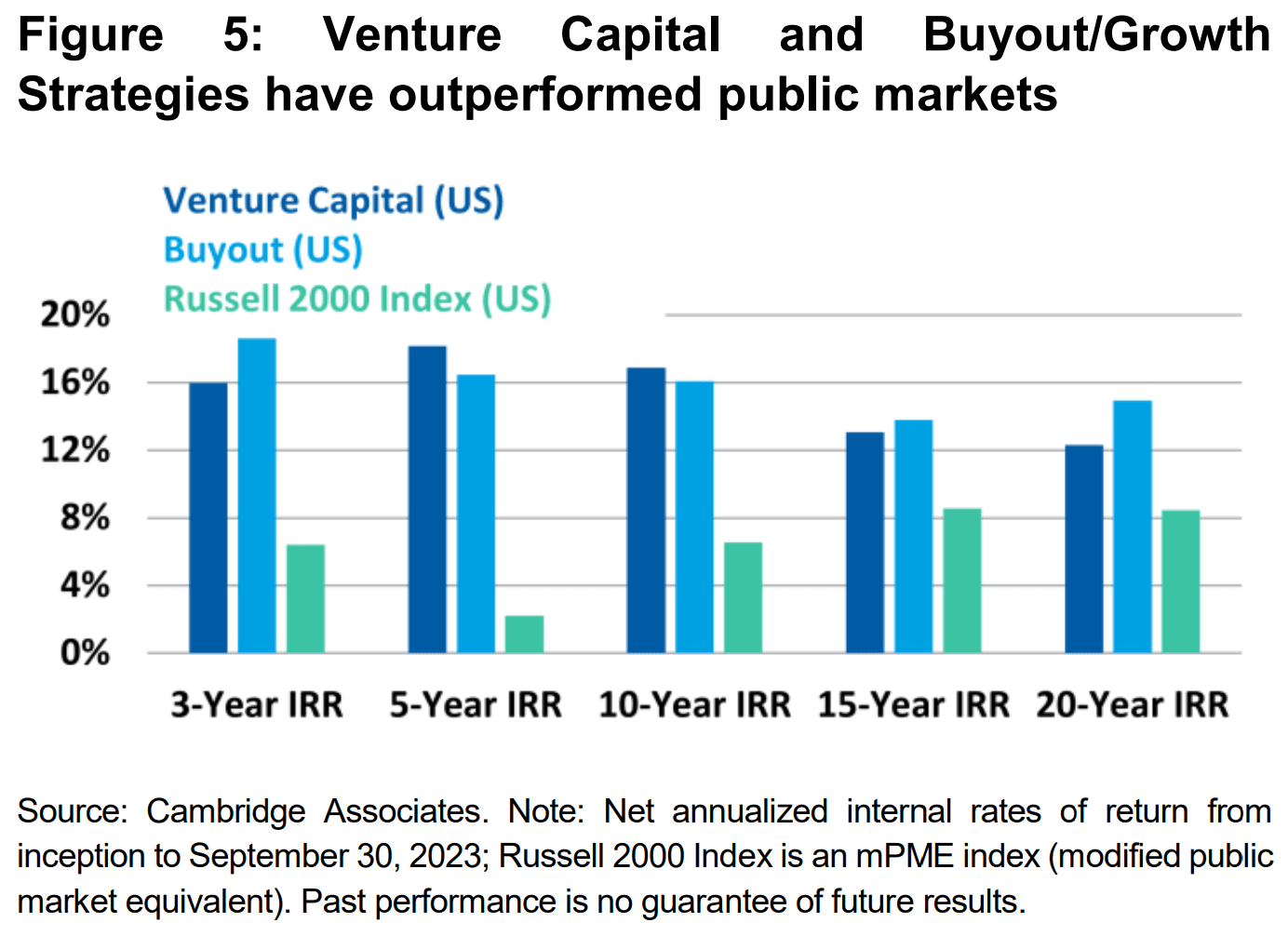

The long term performance data shows why private market strategies are already core to so many investors’ portfolios. As shown below, venture capital and private equity buyout strategies have strongly outperformed the Russell 2000 over all timeframes.

These numbers make intuitive sense to most investors. Private markets strategies are generally regarded as higher risk than their comparable listed strategies, so investors require a higher return as compensation. The good news is the private markets have a track record of delivering on those higher return expectations.

3. Illiquidity is both a gift and a curse

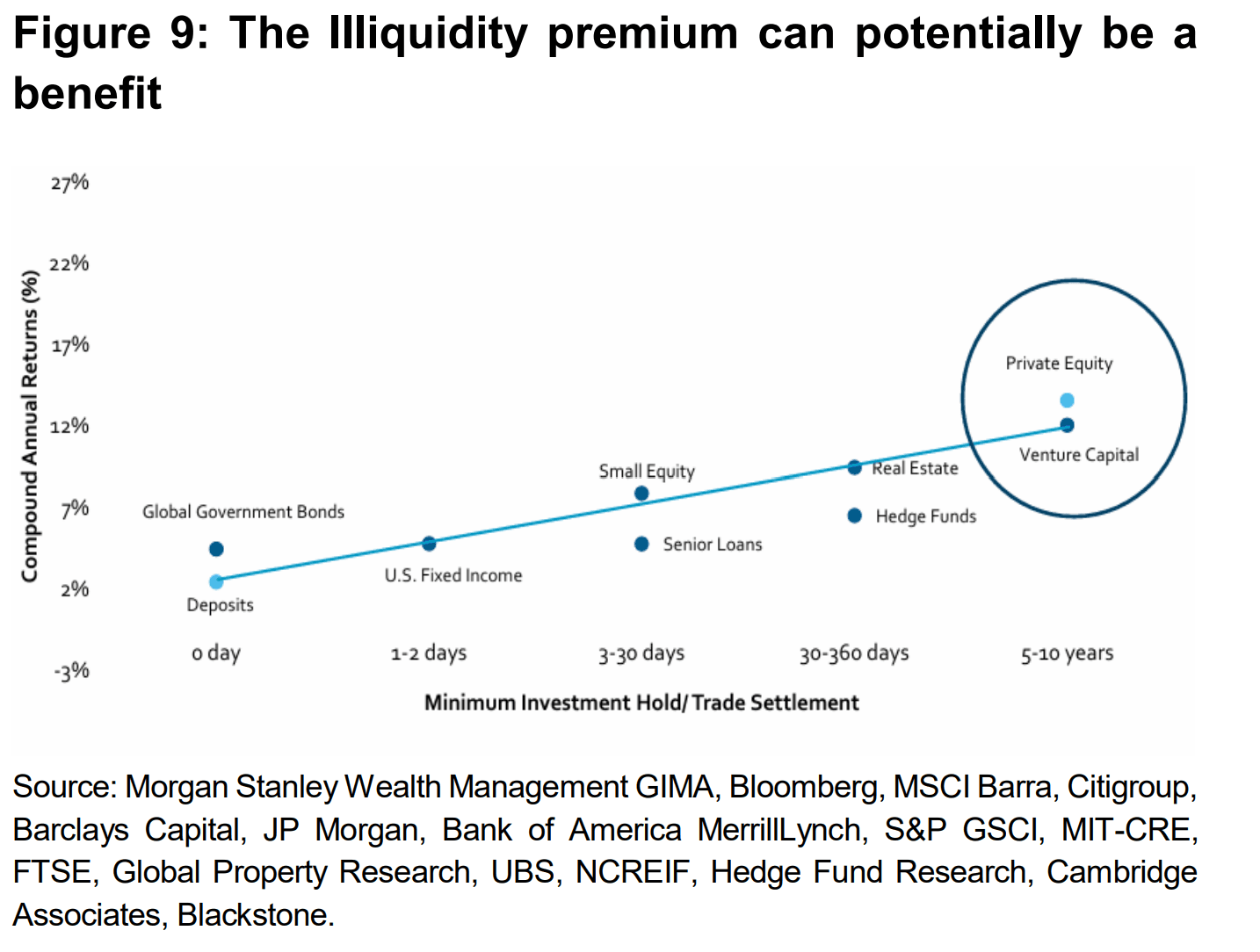

Of course, to generate those types of attractive private markets returns, investors have to be prepared to invest in illiquid assets which they intend to hold for the long term.

In fact, illiquidity is one of the greatest risks of investing in private markets opportunities, and the illiquidity premium largely explains the asset class’s higher returns versus public markets—as shown below.

4. Private markets are defensive during periods of volatility

One of the lesser known attractions of private markets investing is that the asset class’s returns tend to be more defensive than for its listed counterparts during periods of market volatility.

As shown below, private equity and venture capital almost always outperform when public equity markets strongly decline.

With global equity markets looking toppy, this private markets advantage may well have an opportunity to shine in the coming weeks or months.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The private markets boom looks set to continue

So these four charts illustrate the four compelling reasons why the private markets appear to be positioned to continue growing their share of the equities world.

The implications for investors are significant. In particular, ensuring you have an appropriate allocation to the private markets is becoming more important as the private markets opportunity set continues to expand at the expense of the publicly listed markets.

If you’re ready to investigate your private markets opportunities, check out InvestmentMarkets’ Alternatives asset class where investors can search for the best private equity, and venture/seed/early stage capital fund opportunities. The unlisted property fund opportunities can be found in the Property asset class, while in the Startups asset class investors can discover high growth, early stage private markets opportunities they can invest directly in.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.