The mysterious case of the shrinking ASX

Simon Turner

Tue 4 Jun 2024 5 minutesThere’s a concerning trend at play on the ASX: the number of listed stocks is shrinking year in, year out. This is the opposite of most investors want, which is access to a large and diverse range of listed businesses with high disclosure standards.

We investigate the mysterious case of the shrinking ASX below.

The numbers don’t lie

The number of stocks listed on the ASX is indeed falling. A recent RBA bulletin reveals there were 2,183 ASX-listed stocks at the end of February 2024, down from 2,289 stocks at the end of the 2023 financial year. So 103 companies left the exchange within eight short months. This follows on from the loss of 75 companies in the previous corresponding period.

The trend is clear—and something is afoot.

The culprit has been watching and waiting from the side-lines

After interviewing all the potential suspects, the guilty party owned up to the crime without any fuss at all. In fact, they were somewhat proud of their achievements. The private equity sector is responsible for the shrinking ASX, and their motive is clear: they had an excess of cash which needed a home.

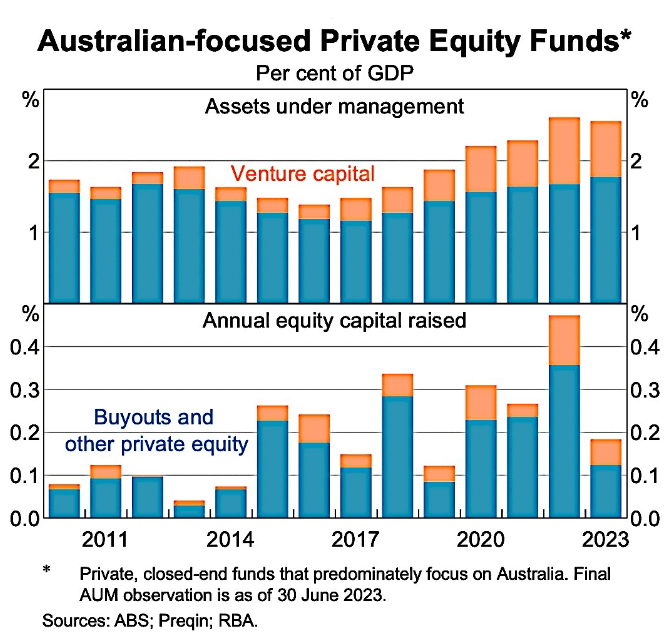

According to Preqin and AIC 2024, private equity funds managed $66 billion in assets as at June 2023, which equates to 2.6 per cent of Australia’s GDP. The sector’s assets under management surged a hefty 75% between December 2019 and June 2023. Of the sector’s assets, $44 billion has been invested in local businesses, some of which were previously listed. Hence, the decline in the number of ASX-listed stocks.

One of the great advantages offered by ASX-listed companies from private equity’s perspective is their high disclosure standards and often long-term public track records. So if you’re a private equity investor looking for opportunities, doing due diligence on an ASX-listed company is arguably a lot easier than starting from scratch with unlisted opportunities. Hence, the ASX is a prime hunting ground for private equity investors.

The gap isn’t being plugged by IPOs

So there’s an outflow of companies listed on the ASX. But what about the inflow of new companies listing on the exchange via initial public offerings (IPOs)?

Unfortunately, the IPO market has been weak since 2021. Over the past couple of years, the amount of capital raised through IPOs ($1 billion in 2022) has been running well below the $9.8 billion average over the prior decade (adjusted for inflation to 2022), and is also well below the amount of new funds being raised by the private equity sector each year ($11.7 billion in 2022).

In other words, the outflow of listed companies on the ASX isn’t being plugged by new listings.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Pros and cons

There are pros and cons to what’s happening.

The main con of private equity eating into the ASX-listed universe is that a smaller ASX represents a less diversified investment universe. Most would agree that this bad news for investors. In addition, companies which delist invariably become less transparent to their private equity investors as disclosure standards are weaker in the unlisted world.

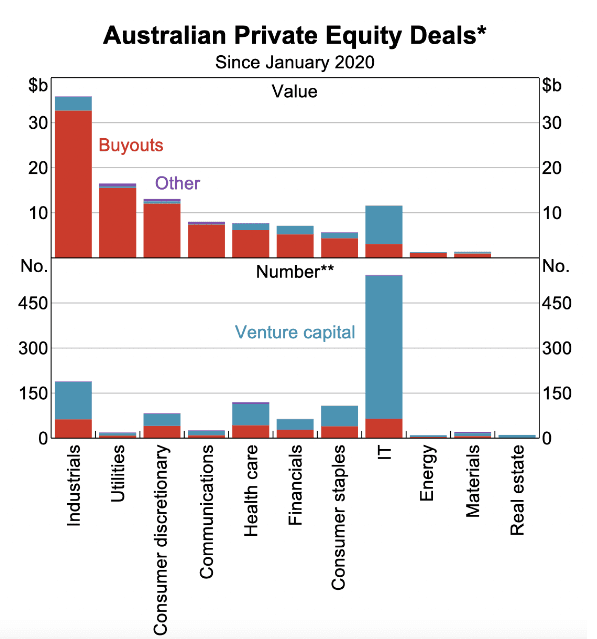

There’s more. Much of the growth in private equity has been driven by larger, leveraged buyouts (particularly in the technology sector).

In leveraged buyouts, private equity investors use debt to buy a controlling stake in a local business. These types of deals tend to bring with them more cons than pros from a bigger picture perspective since these businesses are being delisted to orchestrate valuation upside for their investors. It’s hard to celebrate a shrinking ASX for that goal alone.

The venture capital side of private equity is where the pros of the asset class are more obvious. Emerging companies with innovative business models often need external investment when their growth prospects and earnings potential are less than certain. This early stage funding is valuable for investors and the broader economy alike since it’s effectively funding the economy’s R&D whilst aiming for a return on investment.

There’s another noteworthy pro. Underperforming ASX-listed stocks are common targets for private equity. Not only can this be positive in the examples when private equity investors successfully restructure an underperforming business, but the threat of private equity involvement also provides a healthy incentive for existing management teams to pull their socks up.

More vanishings to come

So we know who the culprit is, and we know their motive. We also know that private equity managers are still watching and waiting for more opportunities from the side-lines of the ASX. In fact, Australia’s private equity sector is still sitting on a large pile of dry powder (cash) with a hefty $22 billion earmarked for future investment. That translates into a lot of future investment in both listed and unlisted companies.

Investors best prepare themselves for a smaller universe of ASX-listed stocks in the coming years.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The ASX is set to continue shrinking

Mystery solved. Australia’s private sector is growing fast and in need of deals. This trend is likely to continue in the foreseeable future driven by the private equity sector’s large dry powder pile and strong fund raising momentum.

Listed investors are positioned to benefit from takeover premiums as and when their stocks are bought out. And if you’re conscious of the ongoing ‘brain drain’ from the ASX, it may be prudent to ensure you have enough high quality private equity exposure in your portfolio so you can still benefit from the long term upside in the country’s best businesses.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.