Global tech stocks now tick income investors’ boxes

Ankita Rai

Thu 30 May 2024 5 minutesGlobal tech companies, once focused solely on rapid growth, are now adopting a strategy typical of more traditional value businesses — issuing dividends.

Meta's introduction of its maiden dividend earlier this year marked a significant departure from the tech sector's usual emphasis on buybacks. Shortly after, Salesforce, Booking, and Alphabet followed suit, announcing dividends for the first time.

Investors have traditionally viewed the introduction of dividends as a sign of declining growth prospects, as was the case when Microsoft first announced its dividend in 2003. However, this perception is now shifting. Five of the 'Magnificent Seven' stocks—Apple, Microsoft, Nvidia, Alphabet, and Meta—now pay dividends, with Tesla and Amazon being the exceptions.

Flush with cash, these companies are leveraging strong AI tailwinds to maintain robust revenue growth while rewarding shareholders with dividend payments.

Alphabet's recent earnings call exemplifies this shift. While discussing their strong Q1 results in Search, YouTube, and Cloud, Alphabet’s CEO Sundar Pichai said, “Google has the best infrastructure for the AI era,” before explaining that innovation and dividends can go hand in hand. That’s good news for income investors all around the world.

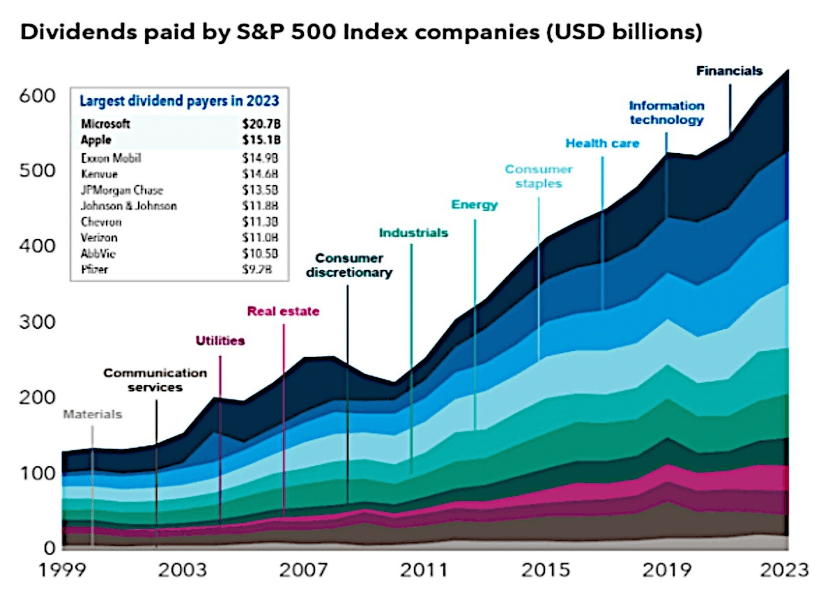

Tech sector emerging as a major dividend payer

The list of tech stocks paying dividends has grown. In fact, in 2023 the technology sector was among the largest contributors to S&P500 dividends, trailing only the financial sector, healthcare and consumer staples—as shown below.

Microsoft and Apple are leading the tech sector’s dividend payments with Microsoft distributing $20.7 billion, the largest dividend of any company, followed by Apple's $14.9 billion last year.

Much of the dividend growth in the first quarter of this year was fuelled by first-time payouts by large cap tech companies. Dividend surged by $16 billion, primarily due to dividends from Meta, Salesforce and Booking Holdings. These three companies alone accounted for nearly one-third of the increase.

Notably, 35 of the 65 tech companies in the S&P 500 are currently paying dividends, so there’s potential for further growth in tech dividends looking forward. For 2024, forecasts suggest further growth, with S&P Global predicting a 4% increase in dividends globally and a 6% increase in the US.

But tech yields remain low

Though more tech stocks are paying dividends, their yields remain low, largely reflecting modest dividend payouts from these firms.

For example, the indicated yields for both Meta and Alphabet are below 0.5% and Apple’s is only slightly higher. Nvidia, one of the fastest-growing tech companies, only offers a yield of only 0.01% despite its recent announcement of a 150% increase in its quarterly dividend.

Traditionally, income-focused investors have regarded 3%+ as a solid dividend yield. Most tech stocks, on the other hand, currently offer yields ranging from 0.02% to 3% reflecting their soaring share prices and modest dividend increases. Take Nvidia, for example. Despite its share price growing at 61% p.a. from 2013 to 2023, its yield shrank by around 34% annually during that time.

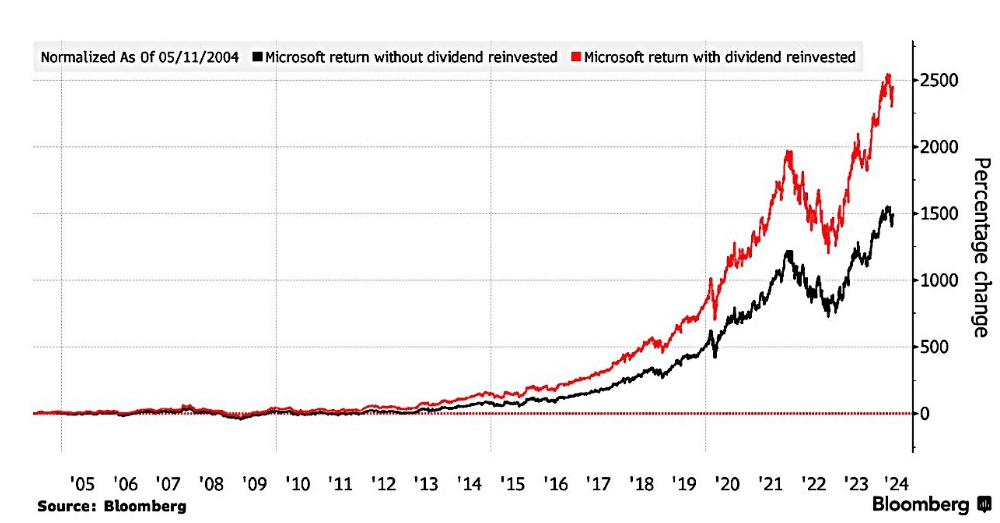

Whilst the sector’s initial dividend yields might not catch the eye, their impact compounds over time, as demonstrated by Microsoft's trajectory:

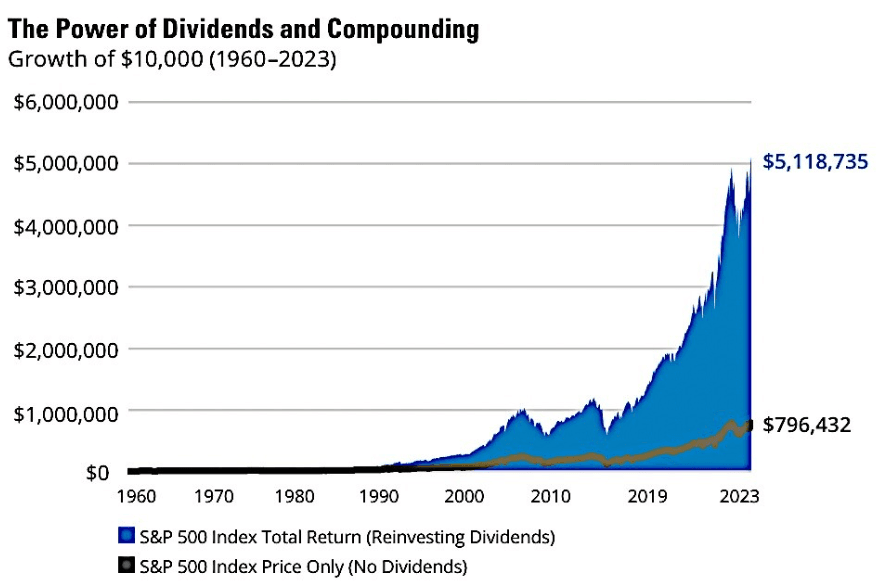

Similarly, 85% of the S&P 500's cumulative return stems from reinvested dividends and compounding:

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Tech dividend growers

From a low base, payouts in the tech sector are on the rise.

Data from S&P Dow Jones Indices indicates that tech companies within the S&P 1500 index nearly quadrupled their dividend payouts between 2011 and 2022. This growth rate is the fastest among all sectors, significantly outpacing the growth in dividends for the entire S&P Composite 1500 index.

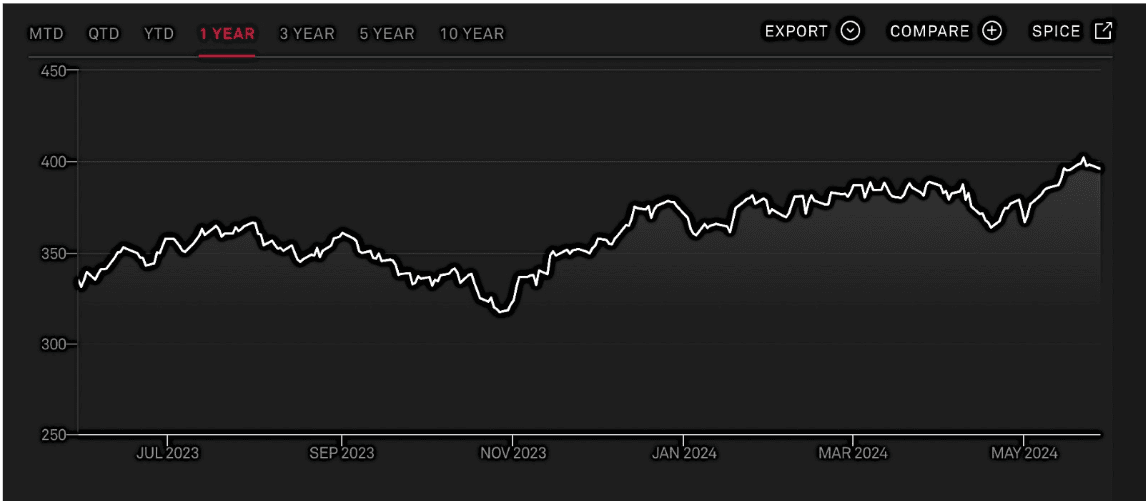

Moreover, the S&P Technology Dividend Aristocrats Index serves as a compelling testament to tech dividend investing having gained 18% over the past year:

The index tracks the performance of tech companies with at least seven consecutive years of dividend growth and includes IBM, Cisco Systems, Visa, Mastercard, and Apple amongst its esteemed ranks.

Changing dividend growth investing

As more tech companies initiate dividend payments and evolve into income-generating stocks, they have the potential to fundamentally reshape the dividend growth investing landscape.

More funds may now incorporate tech stocks like Meta and Alphabet into dividend growth strategies and income strategies, increasing their exposure to the broader market and the 'hot' stocks driving market gains.

Moreover, the global tech sector’s potential to increase payouts alongside earnings over time is likely to be appealing to investors seeking to grow their dividend income.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Striking a balance

With dividends increasingly becoming an integral part of global tech investing, overlooking this sector could mean missing out on income-generating opportunities as well as potential capital appreciation. Blending income-paying tech stocks with traditional dividend-paying stocks like financials or utilities can help create a well-rounded portfolio.

What it means for investors

More tech companies are pivoting towards paying dividends, traditionally associated with slower-growth industries, signalling a maturing phase for these tech giants driven by high cash balances and cash flow generation.

Despite more tech companies paying dividends, their yields remain low, reflecting modest payouts. Yet, shareholder payouts could become more generous for these big tech stocks with dividends and share repurchases expected to increase as earnings and free cash flow grow.

Integrating income-paying tech stocks with more traditional dividend-paying stocks, such as financials or utilities, can help build a balanced portfolio.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.