Is your portfolio WWIII-proof?

Simon Turner

Wed 29 May 2024 8 minutesThe war in Ukraine signalled a step-change in global geopolitical risk which was further escalated by events in the Gaza Strip. Whilst the investment world remains hopeful (and possibly correct) that global peace will resume after these events, history is less comforting.

The risk of a third world war has rarely been higher, and investors have rarely been less prepared for it. Being ready for the unthinkable may be more prudent than you currently believe.

Geopolitical risks on the rise

Most investors understand that global geopolitical risks are on the rise, but few are focused on the risk of a third world war.

There are plenty of reasons investors are justified for not focusing on this risk, not least of which is that predicting a world war is almost impossible. The decision to go to war, or to escalate one, is always made by flawed humans under pressure, so it’s not possible to forecast with any accuracy.

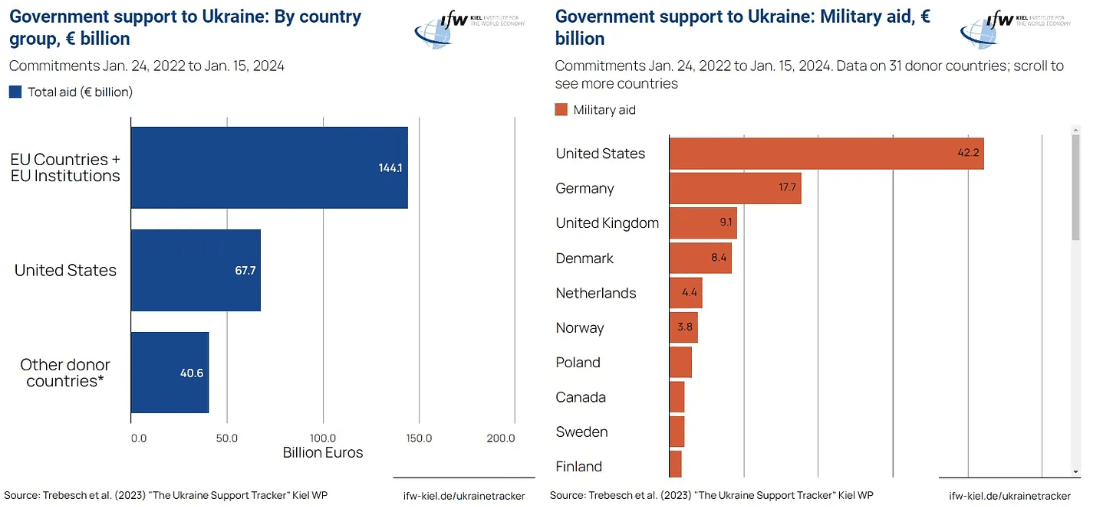

What we do know is that the global war cycle is trending upwards. The Ukraine war upped the ante from that perspective, and involves many countries beyond Ukraine and Russia. Many would argue it has already evolved into a proxy war between China and the US/Europe. You just need to look at which countries are supporting Ukraine for a picture of the West’s proxy involvement:

The key question at this juncture is whether this is peak geopolitical risk, or a relatively early innings in a much longer term period of escalating geopolitical risks.

Voices of warning

Whilst a world war is something we all hope and pray doesn’t happen, there are some noteworthy warning signals which are currently flashing red—and some voices of wisdom have been translating those signals.

JPMorgan Chase CEO Jamie Dimon, worries current geopolitical events may be ‘creating risks that could eclipse anything since World War II.’ ‘America's global leadership role is being challenged outside by other nations and inside by our polarized electorate. We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy.’

Economics blogger Noah Smith goes further. ‘If China and the U.S. go to war, it’ll make what’s happening now in East Europe and the Middle East look like child’s play — not just because the forces involved would be larger, but because the existing wars in East Europe and the Middle East would likely expand into regional wars as well. As I see it, the mere fact that not many people are talking about the danger represents evidence that we’re still not taking it seriously.’

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The investors of yesteryear’s war playbook

So what should investors expect if the worst case scenario eventuates in the form of a world war?

As with most risks, financial history provides us with useful context since the investors of yesteryear devised a playbook to help them navigate war cycles.

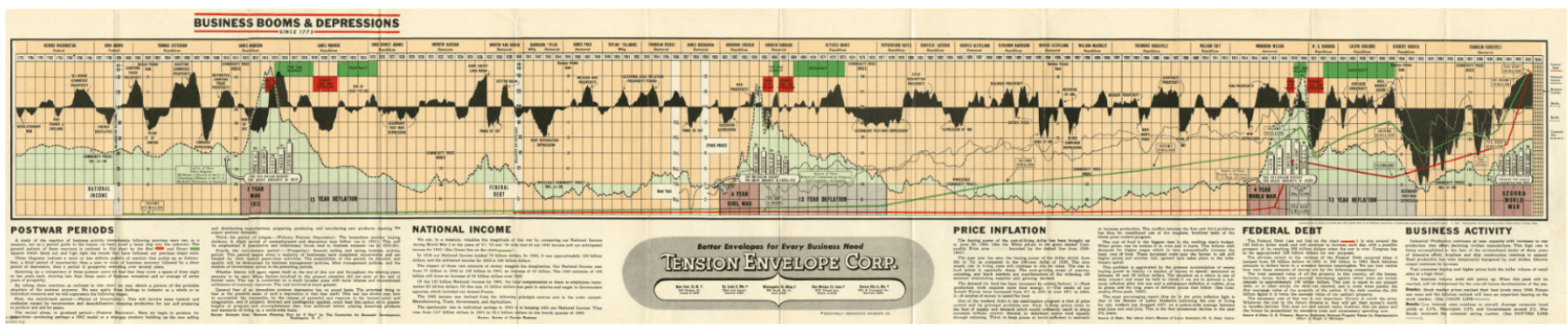

In summary, markets tended to selloff at the onset of war, but once it was apparent that increased wartime government expenditure was boosting the economy, markets recovered and then boomed.

Once the war ended, there tended to be a period of greater economic uncertainty and heightened market volatility as the global economy established a new peacetime equilibrium.

One of the biggest shifts during this phase was the presence of elevated inflation on the back of the higher government spending and reduced global commodities supply. Greater market speculation followed and market excesses ensued. These excesses generally ended in a deflationary bust and post-war depression. Years later, economic normality and prosperity would return.

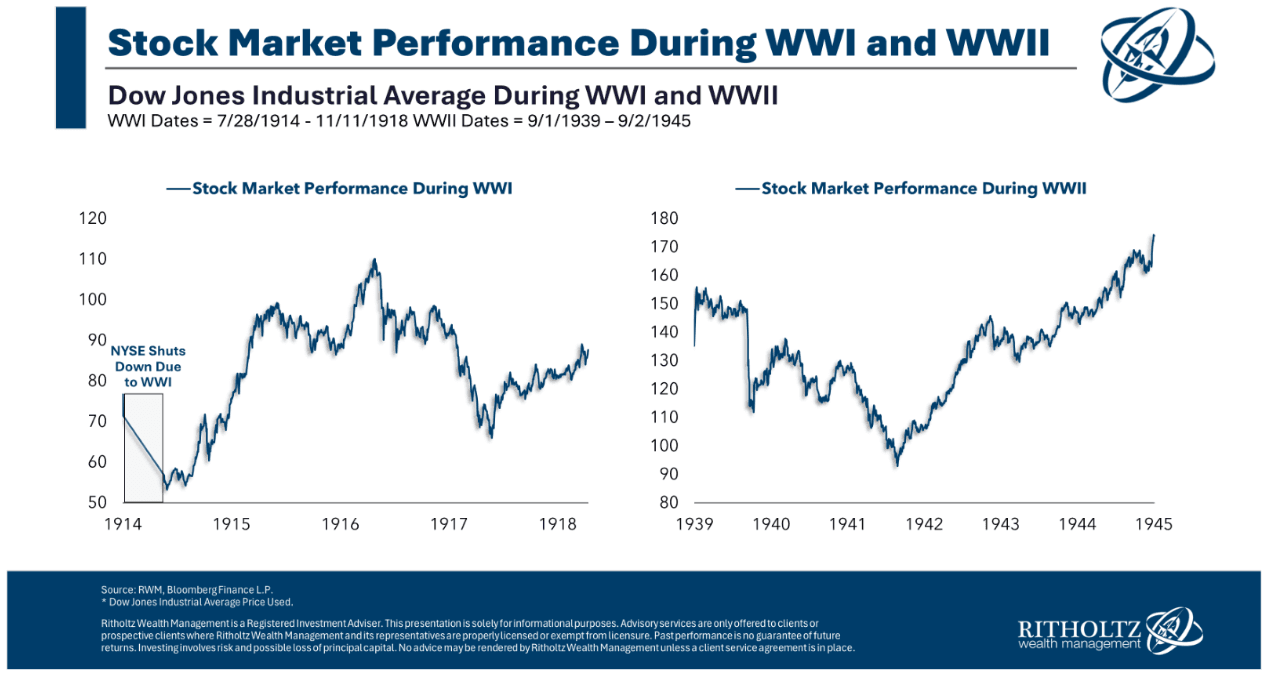

WWII was similar but different from this playbook in that the deflationary bust didn’t emerge—due largely to supportive government policies. As shown below, the period following that war was generally positive for the (US) stock market:

The modern investor’s war playbook

Based on this financial history and the current state of the global economy, there are a number of assumptions it’s fair to make in the event of another world war:

Volatility would rise dramatically. This one is obvious, but it’s worth remembering that in the cases of both prior world wars, markets initially crashed. If the pandemic taught us anything, it’s that markets move much faster now than in the past, so a short, sharp crash is likely at the beginning of a world war.

After the initial selloff, stocks are likely to rally hard. From a stock market perspective, it’s always darkest just before the dawn, and markets often seem heartless in the face of human tragedy. At the very moment investors are running for the exits driven by a fear that the world is ending, equities are likely to bottom and rally hard. It’s not often we witness these mass capitulation events, but when they occur they tend to be followed by equally dramatic rallies—as evidenced by the pandemic.

The US Government’s current high debt levels (which would trend much higher in a world war scenario) may preclude the super-supportive outcome needed to shield global markets from a WWI-esque deflationary depression. That’s not to say politicians wouldn’t do everything in their power to provide market-friendly solutions, but there’s a financial limit imposed by bond markets that can’t be ignored. Hence, the global economic cycle is more likely to turn negative after a spending-driven economic and inflationary boom.

In other words, a WWIII scenario is arguably likely to play out in markets more along the lines of WWI rather than WWII.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

How to WWIII-proof your portfolio (just in case)

So how can you WWIII-proof your portfolio? Here are a few strategies which are likely to help navigate the emergence of a world war:

Include navigating a world war in your investment plan. In other words, ensure your long term investment plan is ready to weather extreme short term volatility whilst ensuring you remain invested. Just writing down your intentions to remain invested no matter how much volatility emerges in the short term may be the difference that makes the difference.

Ensure your portfolio is positioned to outperform in the event of an inflationary spike. Even without a world war adding to global inflationary pressures, inflation remains well above central bank targets. In the event of a global war, it would almost certainly spike much higher. That means you’ll want to be exposed to assets which are positioned to outperform in a more inflationary world. For example, real assets like commodities (particularly gold), real estate, and capital-intensive industries are likely to outperform in this scenario since the value of their assets would skyrocket. In contrast, financial assets without any real asset backing may be at risk of underperforming.

Ensure you have enough cash on hand to profit in the event of a market selloff. On that note, Berkshire Hathaway’s record cash pile talks volumes about Mr Buffet’s current view of market valuations and risks. It may well be that holding all that cash will allow Berkshire Hathaway to benefit from the re-emergence of volatility in ways most investors won’t be positioned for. There could be a lesson in this for all of us. In the event of a world war, holding cash will allow investors to see through the noise by profiting from market weakness whilst remaining focused on their achieving their longer term goals.

Hope for the best, prepare for the worst

Preparing for a scenario that so many investors dread and don’t consider likely is a challenging prospect, but with geopolitical risk trending upwards it may be a prudent strategy. In the event of a world war kicking off, markets are likely to move fast in both directions. If the pandemic taught investors anything, it was the importance of knowing how to handle extreme market volatility before it shows up.

Being ready for WWIII may be as simple as holding more cash in your portfolio and being positioned to benefit from higher inflation, while being ready mentally may allow you to ride out any extreme war-driven market moves better than most. The ability to sit tight amidst heightened volatility may indeed be the strongest weapon in your investment arsenal in the event of a world war—or any other market selloffs for that matter.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.