The ugliest two words in the dictionary

Simon Turner

Wed 20 Nov 2024 6 minutesTrump talked a big game on tariffs during his journey back to the White House. ‘If I’m going to be president of this country, I’m going to put a 100, 200, 2,000 per cent tariff,’ on cars from Mexico he forewarned. He went so far as to describe tariffs ‘as the most beautiful word in the dictionary.’

It’s hardly surprising some investors have started worrying about a global trade war. Given China exports over half a trillion US dollars of goods to the US each year, a trade war between these two nations and others has the potential to create some significant unintended consequences across the global economy, particularly in commodity markets.

Let the tariff wars begin

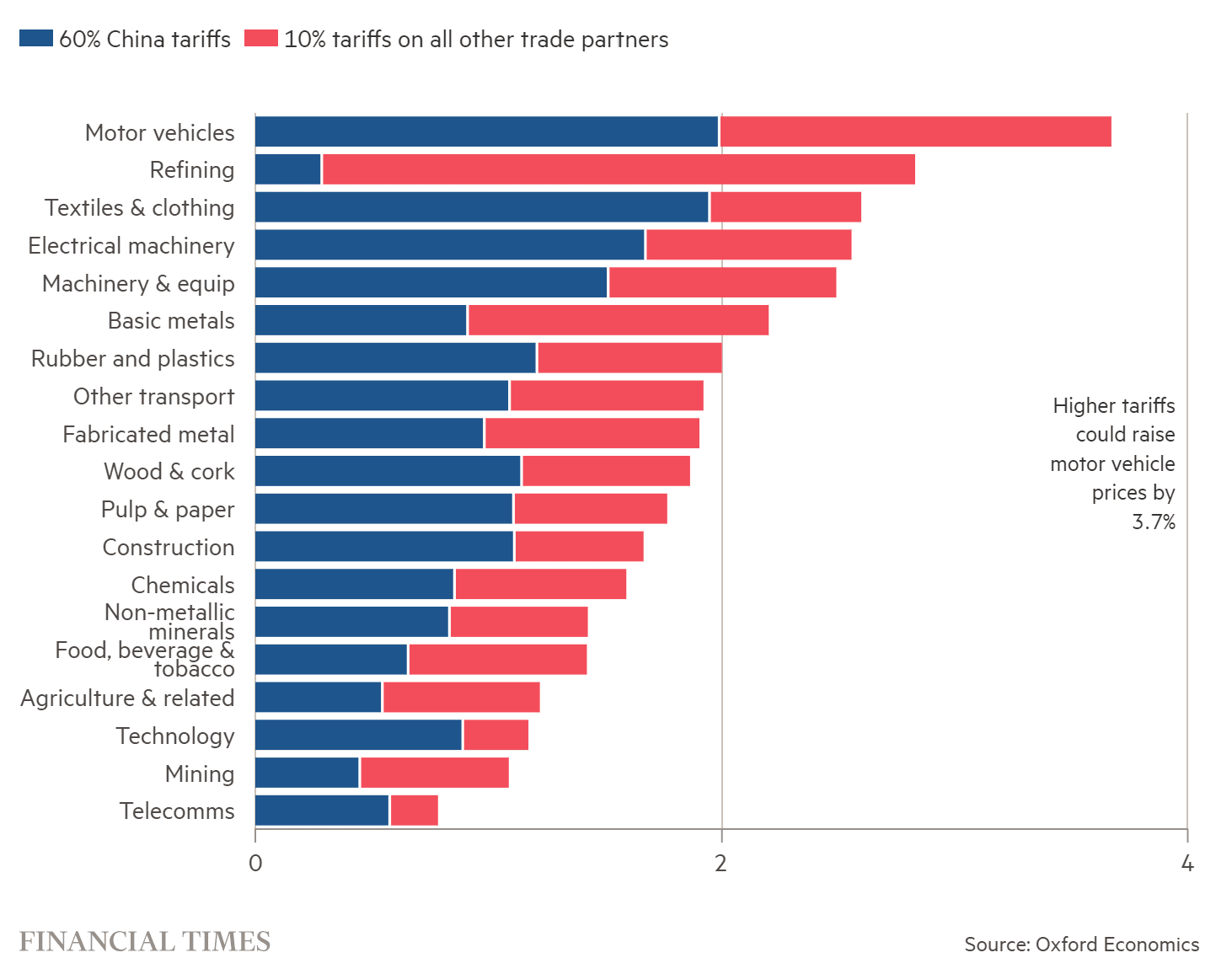

Let’s start by taking a look at the magnitude of Trump’s expected new tariffs on China and other trade partners.

As shown below, the size of the new tariffs is expected to be most pronounced on motor vehicles, refining, textiles and clothing, electrical machinery, and machinery and equipment, while telecoms, mining, and technology are likely to be least affected.

These tariffs are expected to be implemented sooner rather than later—which brings us to the likely impacts investors should be aware of…

1. On-shoring of US production

For the most affected industries such as the automotive industry, one of the biggest impacts is likely to be a step-change in companies on-shoring their production to the US as the extent of the tariffs make Chinese production more expensive for US buyers.

Case in point … in anticipation of a Trump win, Elon Musk paused Tesla’s plans to build a gigafactory in Mexico in favour of increasing the company’s US production capabilities. Unsurprisingly, that was around the time Musk started tweeting about his support for Trump on a daily basis.

In contrast, US companies lacking domestic production capacity or an efficient on-shoring strategy are likely to try to pass the impact of the new tariffs onto their customers in the form of higher prices.

Either way, prices are likely to rise across the US and other affected economies in direct proportion to the impact of Trump’s new tariffs.

The impacts don’t stop there.

There’s also likely to be a volume impact across commodities markets if the cost of cars and other goods increases significantly. There are also likely to be micro impacts within each individual commodity market reflecting demand-supply shifts and supply chain adaptations. The net impact is likely to be negative for most commodities.

These changes are likely to stoke higher inflation. In the words of Barclays’ analyst Dan Levy: ‘If part of the mandate is to avoid inflation, putting in tariffs doesn’t help on the inflationary side.’

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

2. Anti-free trade global economic impacts

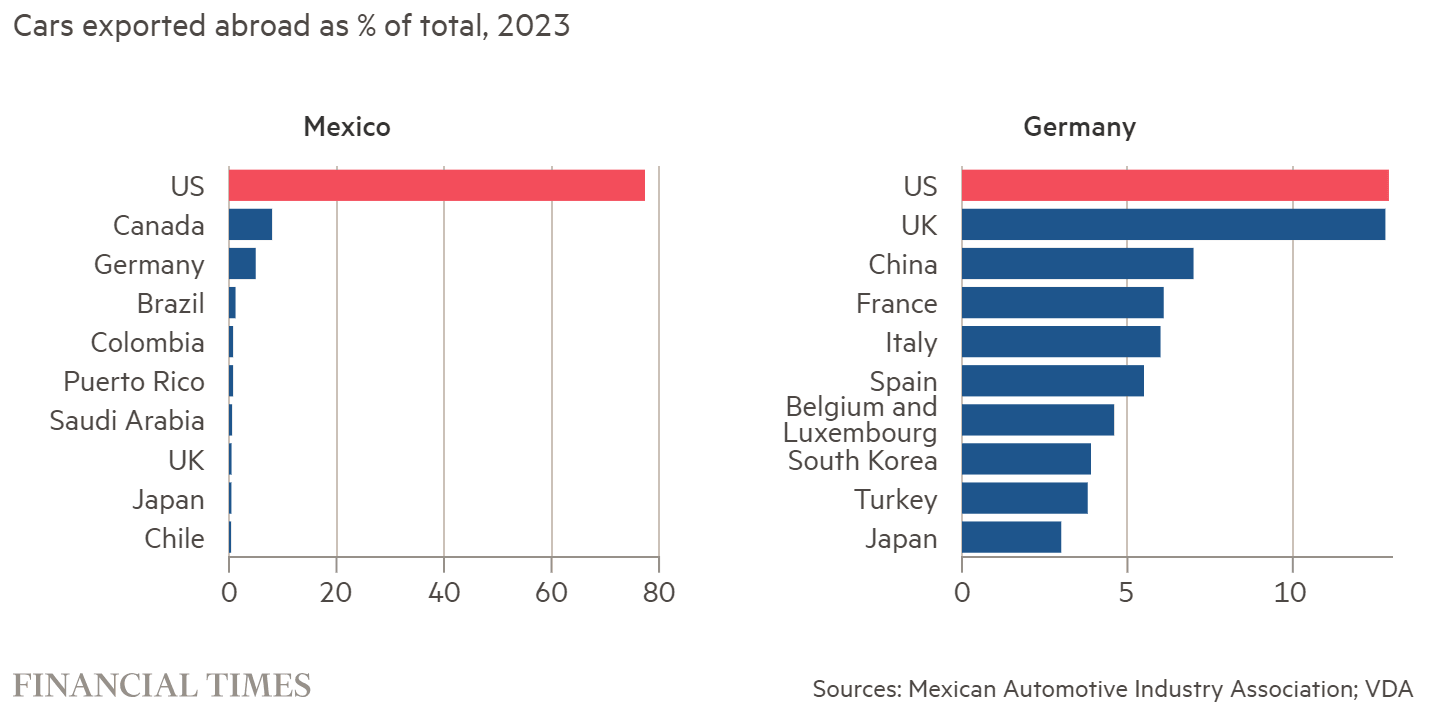

Trump insists that Mexico is ‘not going to sell a single car into the United States.’ That’s a mighty big call, even for Trump. Considering Mexico exports 2.6 million cars and almost 80% of their annual production to the US, the full extent of Trump’s adversarial, pro-tariff mind-set is laid bare in that statement.

It’s hard to imagine such an anti-free trade approach by the leader of the world’s largest economy resulting in anything but negative outcomes for global economic growth.

Of course, given Trump’s track record of using unfounded rhetoric to improve his position during future negotiations it could all be a bluff. But assuming it’s not bluff, the detrimental impact upon global economic growth could lead to lower commodities prices in general.

Global inflation is also likely to be affected.

International free trade is built upon the well-established economic theory that countries with cost advantages in producing certain goods should produce more of those goods to the benefit of themselves and the global economy.

If Trump is able to force this foundational economic concept into retreat, it’s likely to be inflationary at a global level. Offsetting this impact is the likelihood that global economic growth and thus commodities demand and pricing is likely to be impacted.

3. Supply chain impacts

Global supply chains tend to be entrenched, intricate, and long term in nature. If global free trade is indeed impacted by Trump’s tariffs, then the supply chain impacts could be significant.

For example, the global aerospace industry is vulnerable to supply chain challenges, particularly Boeing which could be a sitting duck if retaliatory tariffs were to be introduced due to its inflexible US-based production model.

In a world where tariffs and retaliatory tariffs are being introduced, there are likely to be many more casualties. They will often be industrial companies which lack the flexibility and nimbleness to adjust their production footprints in response to these emerging geopolitical risks.

Global supply chain challenges generally result in less commodities being required whilst they are being resolved, so this scenario is likely to be negative for commodities in general.

Supply chain challenges also tend to be inflationary because there’s not enough supply to meet market demand. For example, in the aerospace industry the most likely outcome of a trade war is higher airline ticket prices.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

No one wins a trade war

If Trump genuinely believes ‘tariff’ is the most beautiful word in the dictionary, investors should prepare for two uglier words: trade war. The likely impacts of that scenario playing out include slower global economic growth, heightened geopolitical risk, higher inflation, and lower commodity prices in general.

Given the Fed is already walking a tightrope to ensure that inflation remains under control without crashing the US economy, these additional Trump-delivered economic pressures would further muddy the investment waters. Let’s hope Trump is bluffing.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.