Cash is king unless it overstays its welcome

Simon Turner

Tue 5 Nov 2024 6 minutesWith global equity markets partying like its 1999 despite some major risks lurking in the background like the potential unwinding of the yen carry trade and the US Treasury’s precarious financial position, now may well be a good time to hold some cash.

If and when volatility returns, holding a cash weighting will allow you to buy more of your favourite managed funds, ETFs, and stocks into weakness, potentially lowering your average purchase price. So what’s the ideal cash weighting to navigate future market volatility?

Four good reasons to hold cash

Let’s cut to the chase … there are four good reasons to hold cash:

1. Liquidity

Arguably, the number one reason to hold cash is so investors can position themselves to buy more of their favourite funds, ETFs, and stocks during bouts of market volatility without being forced to sell something. This flexibility is highly valuable since it allows investors to take advantage of volatility rather than being a victim of it.

2. Diversification

A cash weighting allows investors to diversify into an asset class with zero volatility which reduces overall portfolio volatility. As such, holding some cash can help improve the likelihood of a portfolio achieving its targeted long term returns.

3. Dollar cost averaging

The benefits of dollar cost averaging are well documented. Maintaining a healthy cash weighting allows investors to dollar cost average without having to sell assets to do so. This is a particularly lucrative strategy to employ during market selloffs.

4. Safe haven

Cash can also serve as a more tactical, shorter term safe haven during periods of market turmoil. That’s another big tick for the asset class.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The problems with holding too much cash

There are also a couple of downsides of holding too much cash to be aware of. Namely:

1. Low returns

It won’t surprise anyone to hear that cash returns tend to be very low. Last century, the average real return on cash was 1% p.a., well below all other asset classes. So there’s no escaping the fact that holding an excessive amount of cash is likely to hinder your portfolio returns over the longer term.

2. Lack of inflation protection

Another challenge with holding too much cash is its lack of inflation protection and the resultant negative real returns that are common from cash investments.

For example, over the year to June 2024, Australian inflation was 3.8% — so all cash holdings generating a return less than 3.8% p.a. earnt a negative real return last financial year. That’s certainly not a good investment outcome.

Learning from the pros

Before we delve into the right cash weighting for you, let’s have a look at how much cash the pros are currently holding.

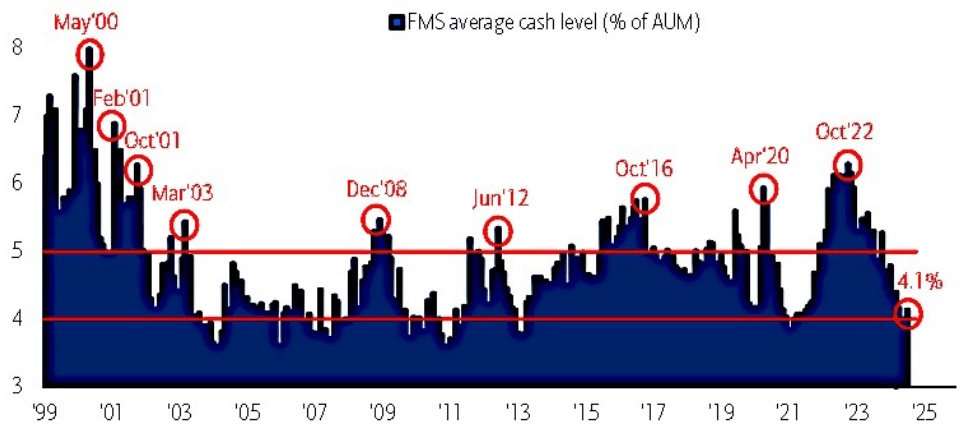

The most recent Bank of America global fund manager survey reveals that global fund managers have a relatively low cash weighting at present. On average, the average global fund manager cash level generally trends between 4% and 6%, but it’s been at the lower end of that band in recent months (currently 4.2%).

The implication is that fund managers are bullish, or at least they have been in recent months. Average cash holdings like this often reveal more about market sentiment than they do about the ideal positioning to navigate what’s coming.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The optimal cash weighting for you … it depends

So you’ve heard the pros and cons of holding cash, and you know how global fund managers are positioned. Does that mean you’re in possession of all the information you need to determine your ideal cash weighting?

Definitely not.

The other key information is your own investment plan which will detail your investor profile, risk tolerance, and investment timeframe. This information is of vital importance when ascertaining your optimal cash weighting.

For example, a younger investor with a high risk profile and a long term investment horizon is likely to prefer a lower cash weighting than an older investor with a lower risk profile and a shorter horizon.

Having said that, here are some general guidelines which may help with your optimal cash weighting decision:

For the vast majority of investors, a cash weighting of 5% or below is likely to be appropriate to enable them to take advantage of market selloffs, dollar cost averaging, etc.

The main type of investor who may want a higher cash weighting are those who are particularly concerned about the strength of the global equity bull market in recent months — and the likelihood of volatility returning. If you’re in this boat, a cash weighting in the order of 10% may be more appropriate.

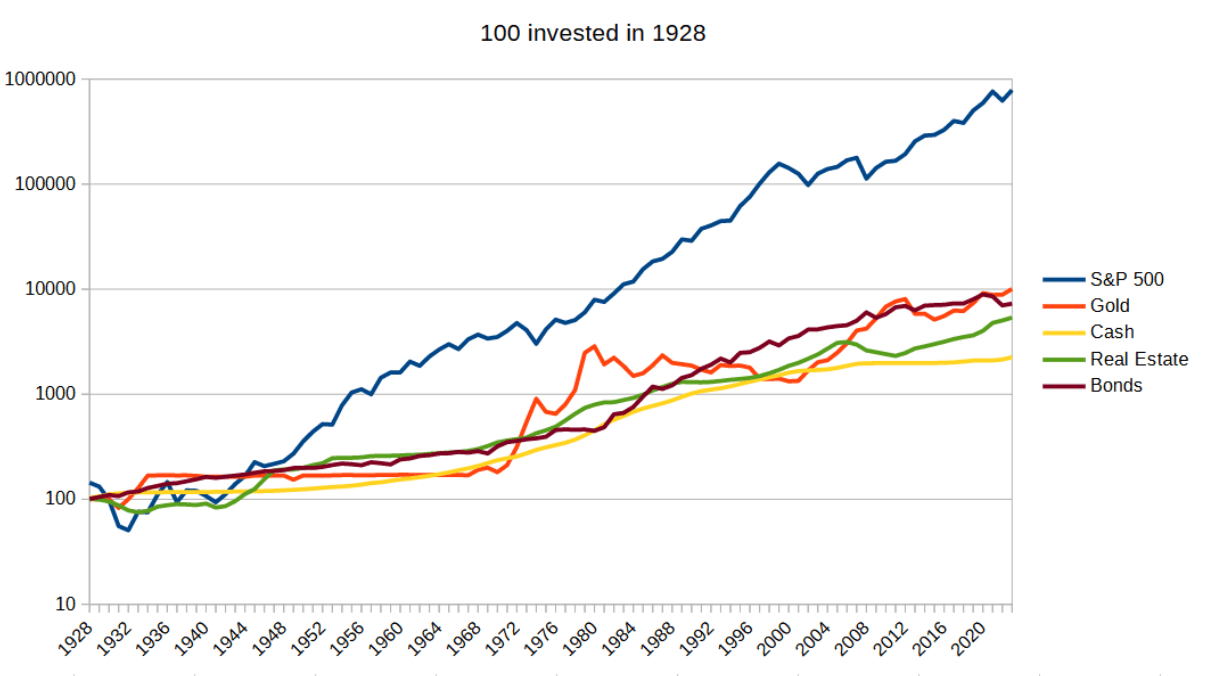

And if you’re thinking of running a much higher cash weighting than 5% or 10%, don’t forget to consider this chart comparing asset class returns over the past century.

The vast gap between the blue line representing the S&P 500’s returns and the yellow line representing cash returns should tell most investors all they need to know about how to manage their cash weighting.

A little bit of cash is king

So holding a cash weighting makes sense for most investors, but ensuring it’s not too much of a drag on your portfolio’s performance is also important.

The best starting point for right-sizing your cash weighting is always your investment plan. For most investors, a cash weighting of up to 5% should provide them with the flexibility to dollar cost average during market selloffs.

With global equity markets at all-time highs, now may well be a good time to ensure your cash weighting is optimal so you are well-positioned to buy more of your favourite managed funds, ETFs, and stocks during future bouts of volatility.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.