Are markets too bullish?

Simon Turner

Mon 2 Dec 2024 6 minutesIt’s fair to say the S&P 500 has led global markets up a wall of worry over the past couple of years. But the S&P 500’s gradual grind higher evolved into full on market euphoria when Trump won the US election so convincingly.

We all know that market euphoria tends to end in tears. The dot-com bubble was a memorable example. With those memories in mind, it’s worth asking the question: are US/global markets too bullish?

What market euphoria looks like

Euphoria is a word the media loves to quote whenever markets go on a bullish tear. According to the Oxford Dictionary, euphoria is ‘a feeling or state of intense excitement and happiness.’

So euphoria is a more extreme state than a typical market bull run. It’s a feeling of elation in the market’s air that results in a higher than normal level of collective confidence, or rather belief, that markets will continue rising.

The world’s media tends to represent a good gauge of market euphoria. When you see headlines like the very real ones below, it’s often a signal that markets have entered a euphoric stage.

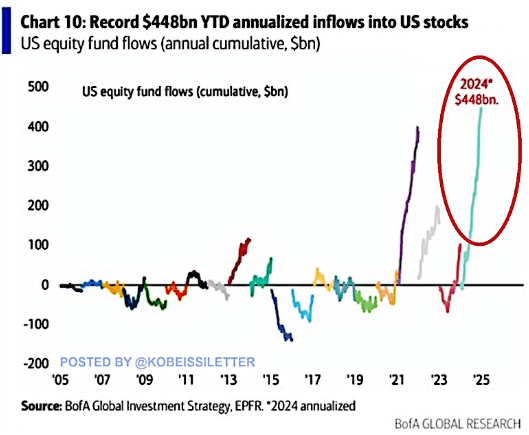

The most recent US fund flow data confirms this euphoric state in the US. As shown below, recent fund flows into US equities reached a new all-time high: $US448 billion year-to-date. To put that number into context, that’s nearly twice as much as 2022 and 2023 combined.

Market sentiment surveys also generally signal when the market enters a euphoric stage. Most US market surveys confirm that euphoria has indeed arrived.

In fact, American investors have never been so bullish. A record 56.4% of them believe that stocks will be higher over the next 12 months. That percentage has doubled over the last 2 years, according to the Conference Board Consumer Survey.

So there’s no mistaking what’s going on in the US right now: market euphoria has arrived in all its glory.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The danger of market euphoria

The main reason euphoria is such a dangerous state for markets to be in is that it leads to unwarranted investor confidence. In other words, it inspires more and more investors to consider themselves geniuses when their stocks rise.

For example, in a recent Wall Street Journal interview with a 37-year-old investor by the name of Joe Johnson, he discussed his success in buying ‘hot stocks’ including Nvidia, Tesla, and MicroStrategy. Joe confessed that he’s feeling so confident about this market that he’s considering investing all his cash into economically sensitive stocks such as Caterpillar and Deere. ‘I am bullish on the market,’ he explained. ‘The euphoria everyone is feeling is warranted.’

If this interview doesn’t slightly worry you, the chances are high that you and Joe Johnson have a lot in common…

The Australian market is marching to a different tune

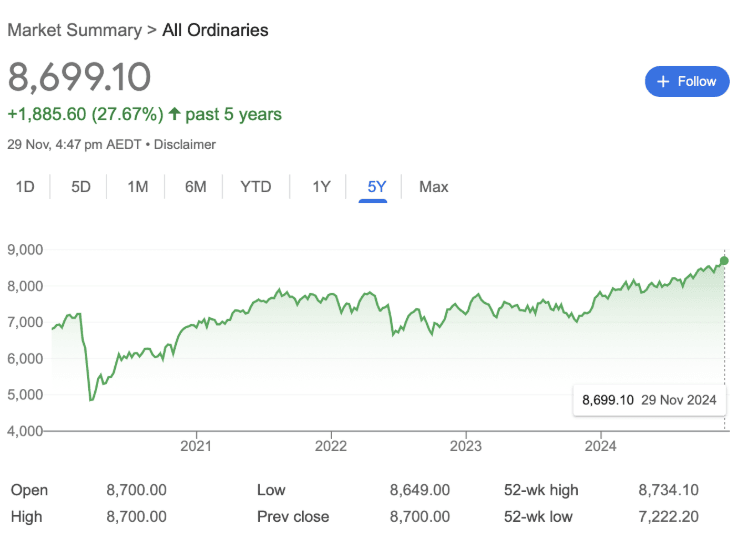

It has to be said that the Australian market is not experiencing anywhere the same level of market euphoria as the US market, if any.

The All Ords has only increased by 28% over the past five years, which is just over a quarter of the S&P 500’s historic rise, and the market has not been keeping pace with the US market’s post-election gains.

However, the implications of the US market’s euphoria remain significant for local investors since the All Ords tends to correlate with the S&P 500 in direction, if not magnitude.

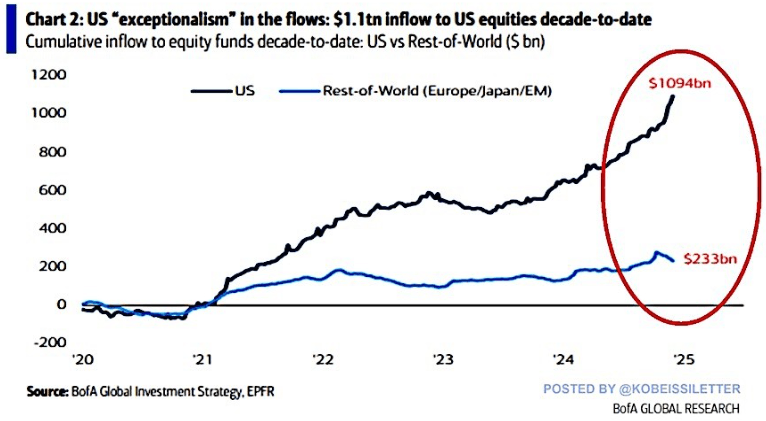

Then there’s the elephant in the room for local investors … foreign participation in the US market recently hit an all-time high record of 60%. Needless to say, amidst that swelling proportion of foreign owners are a vast number of Aussie investors who’ve been attracted to the US equity party.

On that note, check out the chart below of US fund inflows versus the rest of the world.

These are extraordinary times. Everyone clearly wants to join a party like the US party.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

But … there are also reasons to be bearish

As unpopular as it is to mention market risks, let’s keep it real.

There are some significant risks in US/global markets right now. Focusing on them when the rest of the market is partying is likely to prove fruitful longer term. Namely:

The US Government’s precarious financial position may lead to negative consequences for global bond markets with potential negative knock-on effects for the global economy.

The carry trade may unwind again which would result in a short, sharp selloff in most risk assets.

Trump’s tariffs could catalyse a global trade war which could lead to a slowdown in global economic growth, the re-emergence of global inflation, and challenges across some commodities markets.

The list goes on—as it always does. The key point for investors to be aware of is that any one of these risks, or one of the many not listed, could result in a market selloff from these lofty levels.

Pride before the fall

The world is currently ‘all in’ on US equities, and the wall of worry has evolved into market euphoria.

But let’s not forget: even during the most powerful bull markets, there are ups and downs along the way. In fact, regular selloffs are often signs of a healthy bull market which has longer term legs. It’s during these selloffs that overly confident investors like Joe Johnson are taught that they’re not the geniuses they believed themselves to be. This results in the hot air being let out of the market and a more secure footing being established.

Remember the four most dangerous words in finance: it’s different this time.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.