Holding onto your investment gains is harder than making them

Simon Turner

Wed 4 Dec 2024 6 minutesThere are countless stories of investors who’ve made their fortunes only to lose them just as fast.

Masayoshi Son’s story is one of the more extreme wealth rollercoaster rides. After making billions during the dot-com bubble through his investment in Softbank, the company he founded, he lost almost all of it when Softbank crashed 99%. As a result, he earnt himself the dubious accolade of being the larger loser of net worth in human history.

Masayoshi is once again riding high, but you don’t want to have to lose a similarly large portion of your net worth to learn how to hang onto your investment gains.

Making money = investment dopamine

There’s a good reason why it’s so hard to hold onto your investment gains. Making a lot of money triggers feelings of euphoria and a dopamine rush that overrides our memories of what can go wrong as an investor.

Worse, making money strokes investors’ egos, and whispers into their ears that they are investment geniuses.

These euphoric feelings tend to feed into an addictive feedback mechanism. Once an investor experiences investment success, it can become a type of drug which they grow to crave.

Most investors’ rational minds agree with their budding addiction to making money. After all, the evidence is irrefutable. Investment success means your net worth is rising, and the more that happens the sooner your financial freedom can be achieved.

This feedback mechanism pushes investors to invest time and time again. Every time they’re successful, it further confirms that they are indeed investment genius while providing inconclusive evidence that they’d be mad not to continue with their winning strategy.

The next step in the cycle is larger investment amounts.

Once an investor becomes sure of their talent, they’ll often start raising the amount they invest into each opportunity. Their rational minds again override the idea that they’re being driven by their egos. After all, if they can easily make an amazing return on a $5,000 investment, they can surely do the same with $50,000.

And so the cycle continues…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

But markets have a way of humbling investors

Investment markets have a way of making intelligent people look stupid at the very moment they feel most intelligent.

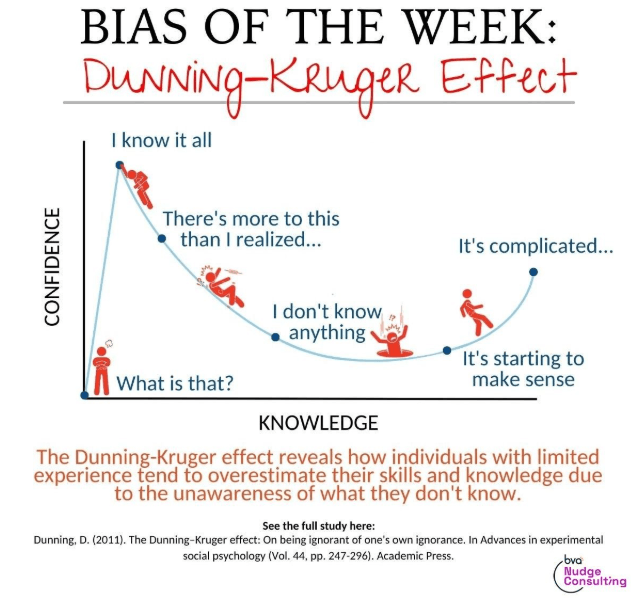

We recently wrote an article on the Dunning-Kruger Effect, which largely explains why over-confidence as an investor is such a big problem.

The Dunning-Kruger Effect is a cognitive bias whereby an investor overestimates his or her ability to keep identifying winning and profitable trades. It’s the unfortunate point in the confidence-knowledge spectrum where confidence is high but knowledge is low.

The reason the Dunning-Kruger Effect enters the discussion at this point is that seasoned, successful investors tend to remain humble while recognising the role that luck plays in investment success—and vice versa.

On that note, one of the truths of investing is that risks come in both upside and downside forms—and it’s the upside risks which can be most misleading. The reason is simple: stocks often go up for very different reasons to why investors invested.

For example, throughout 2023 and the first half of 2024, Dell initially benefited from huge investor interest in the AI thematic. Many of Dell’s longer term investors hadn’t invested with this catalyst in mind, but they were in the right stock at the right time to benefit from the surge.

It was an unexpected upside risk in all its glory, but what it wasn’t was valuable market feedback that Dell investors were all AI experts who should invest of all their net worth in other AI-driven investment opportunities.

Learn from a master of losing money

Let’s circle back to Masayoshi Son’s story…

After losing 99% of his net worth during the dot-com bubble, Masayoshi has recaptured a lot (but not all) of what he lost. Along the way he’s had some spectacular investment wins such as Softbank’s $US54 million investment in Alibaba which resulted in an astronomical return of $US72 billion when the company sold its stake in 2023.

So what can Masayoshi Son’s wild journey teach us about wealth building versus wealth retaining?

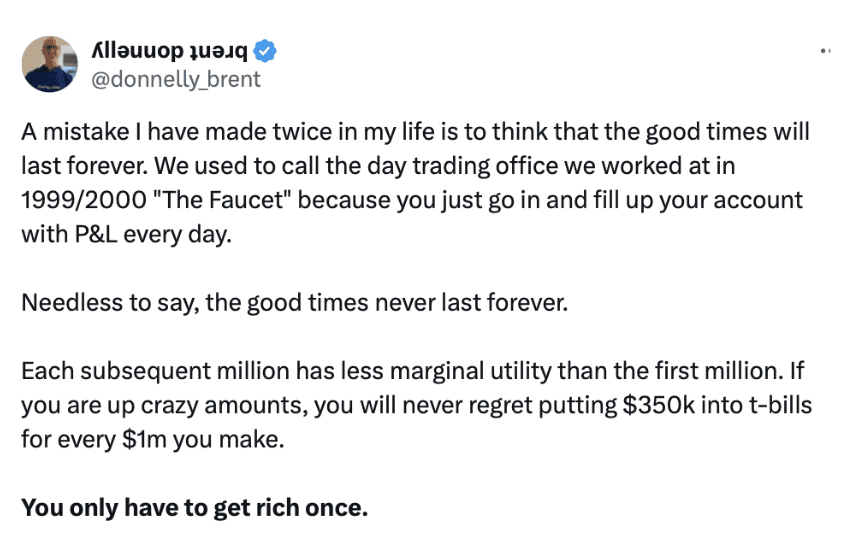

- Building wealth and retaining wealth are very different skillsets. Building wealth requires an innate desire to take on risk in return for future upside, whereas retaining wealth requires a more conservative and risk averse mind-set. Most investors are one or the other, but it’s rare to be good at both.

Tip: Ask yourself whether you’re better at wealth building or wealth retaining. If wealth building is your strength and you want to retain your wealth, it may be worth looking for opportunities to lower your risk.

- When you’ve suffered enormous losses as Masayoshi Son did, there’s only one way to regain them: by keeping going.

If Masayoshi had stopped investing at the point when he’d lost more net worth than any other human in history, he’d have checked out at exactly the wrong moment. By maintaining his belief in his longer term investment journey, he was able to turn a bad situation into a much better one.

Tip: Don’t give up when times are tough. Remember that today is just one day in a long journey.

- Masayoshi’s net worth remains well below its 1999 peak despite almost a quarter of a century of hard graft.

If he’d realised some or all of his net worth while the opportunity was unusually attractive at the top of the dot-com bubble, Masayoshi’s life and investment journey would surely have been a lot less stressful.

Tip: Ask yourself whether you are holding onto any investment funds or assets where the valuation is at an extremity. Are you looking a gift horse in the mouth?

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Be ready to hold onto your investment gains

By being aware of the tendency for wealth builders to transform into wealth losers rather than retainers, investors can prepare themselves for the mind-set shifts needed to hold onto their investment gains without replicating Masayoshi Son’s wild investment journey. Stay humble. Stay wealthy.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.