The fast improving investment case for listed property funds

Ankita Rai

Thu 5 Dec 2024 6 minutesAfter a challenging period, the outlook for Australia's interest rate-battered property funds is improving. Stabilising borrowing costs and the prospect of a rate cut next year are paving the way for a market recovery.

With attractive valuations and strong income growth, listed property funds that invest in portfolios of Australian Real Estate Investment Trusts (or A-REITs) are poised for solid gains, especially as early signs of recovery are emerging across the retail, industrial and office sectors.

What are listed property funds?

Listed funds invest in A-REITs which own, operate, or finance real estate.

As such, these funds provide investors with access to commercial real estate assets such as offices, hotels, shopping centres, and warehouses.

Often seen as an alternative to fixed-income investments, A-REITs offer steady cash flows, the potential for capital appreciation, and portfolio diversification benefits.

The case for listed property as rate cuts loom

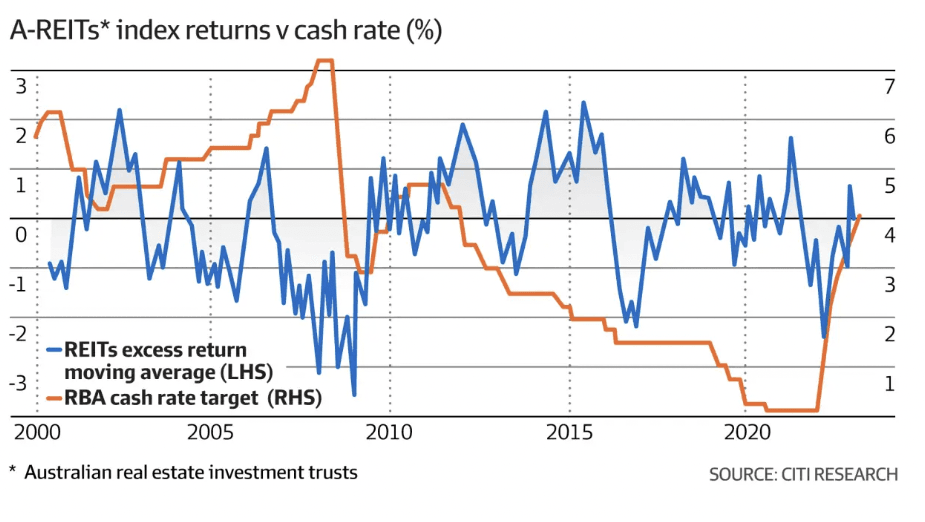

Historically, A-REITs have performed well when rates have fallen because lower borrowing costs lead to lower financing expenses and capitalisation rates.

According to Citi Research, A-REITs often outperform the broader market before the first rate cut happens—usually about four months in advance. With the RBA expected to cut rates around May next year, that suggests the outlook is becoming more favourable for the asset class.

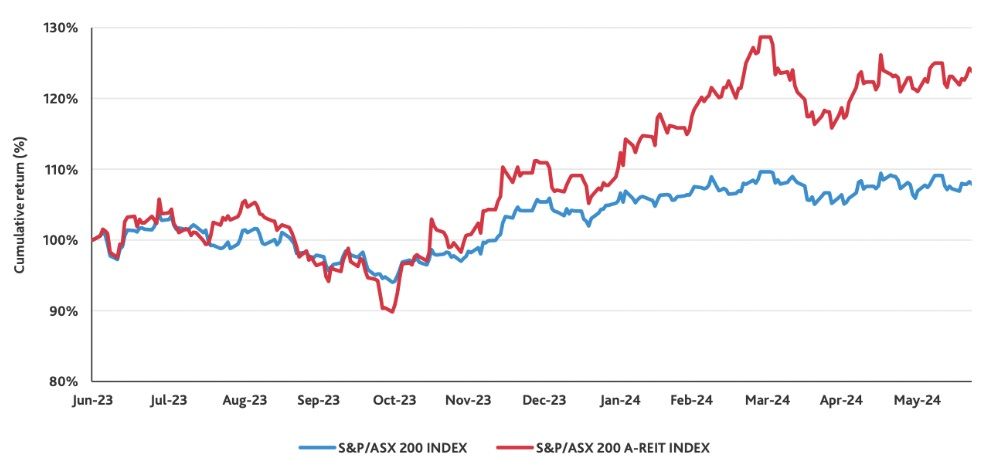

In fact, investors have already started to return to the sector. The S&P/ASX 200 A-REIT Index is up 21.8% year-to-date, outperforming the broader equities market by 11%.

The S&P/ASX A-REIT Index also delivered a 19.9% return for FY24, outperforming the ASX 200 Index by 12%...

This performance was largely driven by expectations of lower rates as well as outperformance by the industrial sector.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Industrial and retail leading the charge

Not all properties are created equal, and the A-REIT sector is no exception.

Two key areas to watch are industrial and retail, which have demonstrated surprising strength, while the office sector continues to faces structural headwinds.

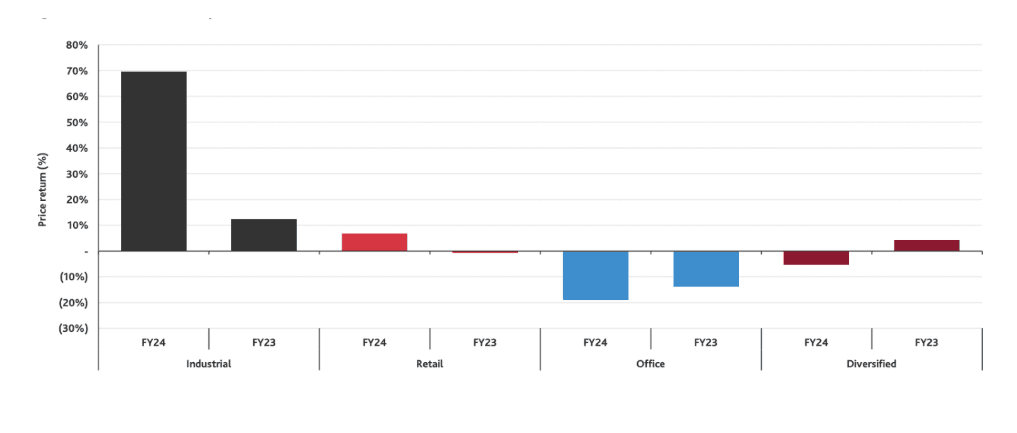

The industrial sector had an exceptional FY24, generating a return of 69.7% fuelled by increased e-commerce adoption and rising demand for alternative assets, such as childcare, healthcare, and data centres.

2024 A-REIT sector price returns

This performance divergence has created opportunities for alpha generation—offering investors the chance to identify and capitalise on the strongest performers in the sector.

For example, Goodman Group, a standout among Australia's major REITs, benefitted the most, generating a 75% return in FY24, far surpassing the ASX 200 REIT sector, which returned 24.7%.

Meanwhile, retail REITs have proven more resilient than expected. Despite the rise of online shopping, many retail-focused A-REITs have adapted effectively, maintaining strong occupancy rates and even seeing their net operating income growth accelerate. Early signs of a retail sales rebound have further boosted confidence in this sector.

In contrast, the office sector continues to face challenges, although signs of stabilisation are emerging as businesses return to physical offices and migration drives demand. While vacancy rates remain high, interest in higher quality office spaces is growing, which could support a gradual sector recovery.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The case for unlisted property funds

Despite the recent sector rally, many A-REITs are still undervalued, presenting investors with an opportunity to take advantage of discounted stocks that offer solid income yields.

Additionally, smaller, niche A-REITs are gaining popularity, with more opportunities emerging in sectors like data centres, build-to-rent, and student accommodation. This growing market opens up valuable opportunities, especially in managed funds.

Managed funds offer diversified exposure to the A-REIT sector, providing access to both core property groups and high-growth assets. By spreading their investments across multiple A-REITs, these funds can reduce risk and mitigate volatility, particularly with large REITs like Goodman Group that can dominate market movements.

For example, the SGH Property Income Fund follows a value-oriented approach and has been increasing its exposure to smaller REITs, such as Peet Ltd, to capture superior value and return potential. With the largest holding capped at 15%, the fund aims to spread its risk across a broad portfolio of properties and targets a return before fees of CPI + 3% p.a.

Another example is the Pengana High Conviction Property Securities Fund, which integrates an ESG theme into its strategy. It has delivered a solid 11.6% p.a. return since inception. The fund’s portfolio includes key holdings like Charter Hall Group, Goodman Group, and Scentre Group, providing investors with access to high-quality A-REITs with a sustainable investment approach.

For those seeking to boost their income, the Atlas High Income Property Fund sells call options on its portfolio of ASX-listed property securities. This strategy aims to deliver a 7% p.a. yield, with income distributed to investors quarterly, providing an added layer of income stability.

The Resolution Capital Real Assets Fund offers exposure to Australian and global listed real estate and infrastructure securities, with up to 20% allocated to global markets. With an 8.6% p.a. return since inception, it aims to provide a balanced real assets portfolio by diversifying across global and domestic REITs.

Listed property funds are well placed to outperform

Despite a slowdown in the office sector, the listed property market continues to offer compelling opportunities, driven by demographic trends, housing shortages, and growing demand for alternative assets.

However, like any investment, A-REITs carry risks, including stock and sector concentration, shifts in macroeconomic conditions, and volatility.

Investing in A-REITs through managed funds can help create a more balanced investment strategy by offering diversified exposure to a range of assets, from core property groups to smaller, high-growth opportunities. This could enhance investors’ portfolio stability and risk-adjusted return potential.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.