Healthy vs Unhealthy Financial Goals

Simon Turner

Mon 9 Dec 2024 6 minutesUnusual question … how often have you questioned the healthiness of your financial goals? You may be wondering what that even means, and why it’s a question worth asking.

The truth is many investors have unhealthy financial goals. They aren’t unhealthy in the sense they aren’t real financial goals which their owners are focused on achieving. They’re often unhealthy on two fronts: a) They aren’t framed in a way that connects with investors’ real/authentic underlying goals, and/or b) They aren’t aligned with investors’ real/authentic values.

The problem with unhealthy financial goals is that they are much less likely to be achieved than healthy financial goals. Ask any psychologist about the importance of connecting your headline goals with your deeper desires, and you’ll understand why this alignment is so important in the financial sphere.

Examples of unhealthy financial goals

The thing with unhealthy financial goals is that they are usually unhealthy because of their poor alignment with an investors’ real desires and concerns. So it’s hard to generalise about them. But that won’t stop us from trying.

Here are some examples of financial goals which aren’t healthy for most investors:

- ‘I want to reduce my tax as much as possible.’

- ‘I want to use my credit cards more so I can be rewarded more air miles.’

- ‘I want to contribute less to my superannuation each year so I can boost my disposable income.’

- ‘I want to hold all my investments in cash.’

- ‘I want to raise my income so I can spend more.’

- ‘I want to use my emergency fund to go travelling.’

Most of these examples won’t surprise you, but the majority of financial planners encounter similarly unhealthy financial goals on a daily basis.

The reason these types of goals are so common is simple: most people don’t want to be constrained by their finances and will make up financial goals that match up with what they want or need at that moment in time. But of course, these aren’t true financial goals. They are more like a list of short term wants and needs.

The problem with these reactive, shorter term goals is that they are at odds with achieving long term financial success which requires consistent, small steps towards healthy long term goals.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Examples of healthy financial goals

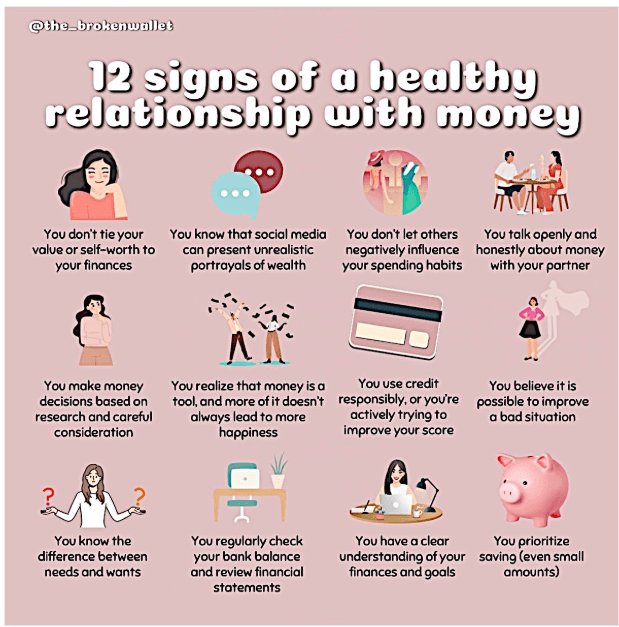

In contrast, healthy financial goals are born out of a healthy relationship with money. On that note, here are some signs that money and you are getting on well…

With a good relationship with money in mind, some examples of financial goals which are healthy for most investors include:

- ‘I want annual income of at least $x p.a. for the rest of my life.’

- ‘I want to grow my net worth to $x in present day value.’

- ‘I want to protect my net worth against inflation.’

- ‘I want to increase my income by x% during retirement to allow me to travel more without eroding into my capital.’

- ‘I want to save for my children’s education.’

- ‘I want to save for a down payment on a house.’

- ‘I want to leave at least $x to my children when I pass away.’

- ‘I want to build an emergency fund of 3-6 months of living expenses.’

- ‘I want to pay off all my debt.’

What all these goals have in common is a direct connection with investors’ long term financial goals, and they’re all framed positively.

The question to ask of all your financial goals

The key to understanding whether your goals are healthy or unhealthy is to ask of your financial goals the question so many young children specialise in: why?

Why you want to achieve that financial goal in particular?

One of the great benefits of having a financial adviser is that they can have why-driven conversations with you aimed at delving deeper into your financial goals.

For example, a why-driven conversation aimed at uncovering the healthy financial goal buried beneath an unhealthy goal may go something like this…

‘I want to reduce my tax as much as possible.’

‘Why?’

‘Australians are so over-taxed. Even the idea of paying the standard rate of tax makes me feel physically sick.’

‘Why is that? Do you believe paying a standard rate of tax will threaten your financial future?’

‘Not really, but I do have financial fears.’

‘Such as?’

‘I guess you’d call it an irrational fear of poverty. I’m worried I’ll end up homeless and destitute, and I don’t want the government to push me down that pathway against my will.’

‘A fear of poverty is far from irrational. In fact, it’s one of the most common human fears. Could it be that you’re externalising that fear onto the government? Could it be that wanting to avoid tax is a manifestation of the same thing?’

‘I suppose so, yes.’

‘So what’s a healthier way to reframe that goal that will help ensure you avoid becoming poor in the future?’

‘What about: I’d like my investment portfolio to generate enough income that I can live comfortably, travel, and save each year?’

‘Bingo.’

You get the picture. Behind the surface level unhealthy goals are usually the real reasons for those goals. By uncovering and owning those reasons, you can find healthier financial goals that address your concerns while aligning with your long term financial objectives.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Healthy financial goals are more likely to be achieved

Do you have any unhealthy financial goals? If you do, you’re in esteemed company. Most investors’ financial goals veer into the unhealthy realm from time to time, if not always.

The good news is turning an unhealthy financial goal into a healthy one can be as simple as asking yourself why your unhealthy financial goal exists. There’s usually a more positive, values-aligned, and achievable financial goal lying in wait.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.