Don’t overlook active equity funds for long-term gains

Ankita Rai

Wed 11 Dec 2024 6 minutesMany investors lack the time, expertise, or desire to manage their stock portfolios, making actively managed equity funds an easy and practical solution.

Unlike passive funds, which simply track the market, active equity funds employ stock-picking and strategic adjustments to target objectives like growth, income, or diversification. This active approach allows fund managers to capitalise on market opportunities and adapt to changing conditions.

Active funds prove their worth

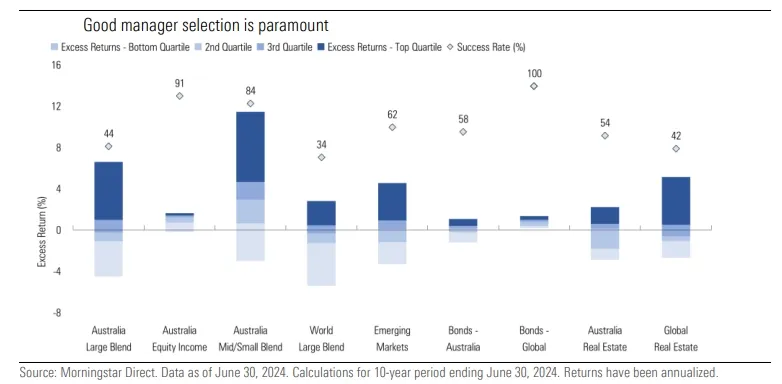

A recent Morningstar report underscores the value of active funds, revealing that many have performed well compared to passive options when measured by net-of-fee returns, rather than comparing them directly to a benchmark index.

The study examined over 800 fund strategies and found that the top-performing active funds consistently delivered excess returns compared to their comparable passive counterparts over the past decade.

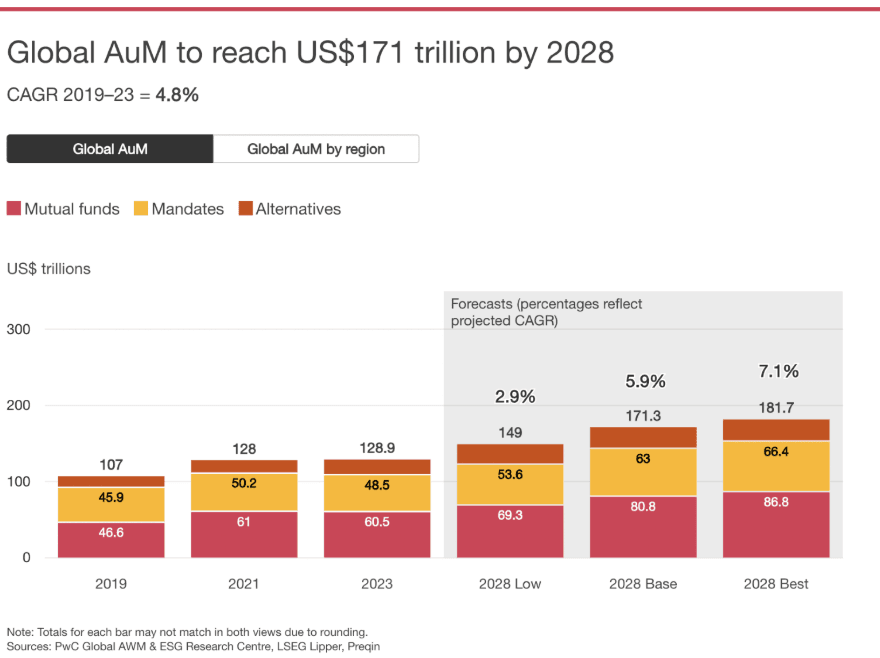

This trend is reflected in the growth of global assets under management, with managed equity funds making up a significant portion.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Understanding actively managed equity funds

Actively managed equity funds pool money from investors to invest in stocks selected by professional fund managers, who research, monitor, and adjust the fund's portfolio with the objective of beating market benchmarks by capitalising on market inefficiencies.

The primary advantage of actively managed equity funds is the diversification they offer, which helps spread risk and reduce the potential for loss that comes with individual stock investments.

How to invest in equity funds

Investing in equity funds requires the careful consideration of three key factors: your financial objectives, risk appetite, and investment horizon. Once these factors are clear, it becomes easier to choose the right equity funds for you.

There are several types of equity funds available to investors, including thematic funds, growth funds, value funds, and sector-focused funds. These funds are categorised based on factors like investment style, risk level, geographic focus, or industry sector to align with investors' goals.

Below is an overview of the main categories of equity funds available to Australian investors on InvestmentMarkets. To find these funds, select ‘Managed Fund’ and choose ‘Shares/Equity’ under the ‘Asset Class’ filter.

1. Market-cap funds

These funds invest in companies based on their size: large-cap, mid-cap, small-cap, or a mix. Among them, smaller companies typically present higher potential risks and returns, and offer significant growth opportunities due to market inefficiencies.

For example, the Seneca Australian Small Companies Fund, which targets small and mid-cap ASX-listed companies, has delivered a 28.9% p.a. return since inception.

2. Investment strategy-based funds

Growth funds target companies in their early growth stages, often focusing on sectors such as AI or biotech, aiming for rapid profit acceleration.

Value funds target undervalued stocks with potential for price appreciation.

Income funds prioritise steady payouts through regular dividends.

For example, the Betashares Australian Dividend Harvester Fund focuses on generating franked income that exceeds the net income yield of the broader Australian share market on an annual basis. It has delivered a net return of 9.6% p.a. since its inception.

Similarly, the Talaria Global Equity Fund adopts a value-based strategy, investing in a diverse range of developed-market companies, and has generated a return of 7.1% p.a. since inception.

3. Sector and thematic funds

Focused on specific industries or themes such as healthcare, renewable energy, electric vehicles, or ESG, these funds allow investors to align their investments with particular market drivers or values.

For example, the Emit Capital Climate Finance Equity Fund targets global equities focusing on mitigating climate change. The fund has delivered a total return (net of fees) of 230.7% p.a. since inception.

Another example is the Australian Unity Future of Healthcare Fund, which invests in healthcare equities, and related real estate, and infrastructure. It has provided a return of 10.5% p.a. since its inception.

4. Index funds

By combining active management with traditional index investing, index funds aim to outperform their benchmark indices by making selective adjustments to their portfolios, rather than simply tracking them.

For example, the Platypus Australian Equities Fund seeks to outperform the S&P/ASX 300 Accumulation Index by investing in companies and trusts listed, or soon to be listed, on the ASX. It has achieved a total return of 10.1% p.a. over five years.

5. Balanced Funds

Balanced funds are designed for moderate risk-takers, blending equities and bonds to create a smoother return profile.

They typically follow a traditional allocation of around 60% stocks and 40% bonds and are ideal for investors who seek higher returns than fixed income but cannot tolerate the volatility of an all-stock portfolio.

For example, the Perpetual Balanced Growth Fund provides exposure to both growth assets, such as Australian and international shares, and income-generating securities. It has delivered a 5-year total return of 6.7% p.a.

6. Hedge funds

Long/short equity funds, also commonly known as hedge funds, utilise a strategy of taking both long positions in stocks expected to outperform and short positions in those expected to underperform.

This approach helps them manage volatility and provides diversification, especially when traditional asset classes like stocks and bonds experience high volatility or positive correlation.

For example, the Auscap Long Short Australian Equities Fund has generated net returns (post fees and expenses) of 15.2% p.a. since inception, while the QVG Long Short Fund has achieved a 16.3% p.a. return by employing leverage, derivatives, and short-selling strategies.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Key takeaways for equity fund investors

Diversification is a key benefit of investing in managed equity funds, as it spreads investments across different sectors, helping reduce risk and offering investors broader exposure beyond what indexes typically capture.

Here are some key considerations when adding equity funds to your investment strategy:

1. Risk and return potential

Equity funds can offer substantial returns and diversification but come with market risks, including economic downturns, geopolitical events, or shifts in investor sentiment. Market volatility can lead to significant fluctuations in fund prices, resulting in potential short-term losses.

2. Fund evaluation

When selecting an equity fund, it’s important to evaluate several key factors such as the fund's holdings, performance history, its management team, and the investment strategy it employs. These aspects can help determine if the fund aligns with your financial goals.

3. Management fees

Actively managed funds often have higher management fees than ETFs, which can reduce returns. Understanding the impact of fees on long-term returns can help ensure that the fund is a worthwhile investment.

Active equity funds for long-term growth

Active equity funds have the potential to deliver solid long-term returns by swiftly adapting to market shifts and emerging trends. However, success depends on selecting funds which align with your specific financial goals and risk tolerance.

Before diving in, make sure you do your research and fully understand what you're investing in.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.