Agriculture: an overlooked asset class with powerful tailwinds

Ankita Rai

Fri 29 Nov 2024 4 minutesMost investment portfolios have limited exposure to agriculture, but this under-represented sector is as an attractive asset class, driven by rising global food demand, shrinking arable land, and resource scarcity.

While the global trends of population growth and a rising Asian middle class have long supported agricultural demand, supply constraints—exacerbated by the pandemic and geopolitical tensions—have created powerful tailwinds for agricultural investments.

Global megatrends fuel the agriculture investment opportunity

The United Nations projects that the global population will reach nearly 10 billion by 2050, requiring a 60% increase in food production to meet rising demand.

This demographic shift creates a long-term structural opportunity for agricultural investors, with significant potential returns on offer as the sector evolves to address mounting global food security challenges.

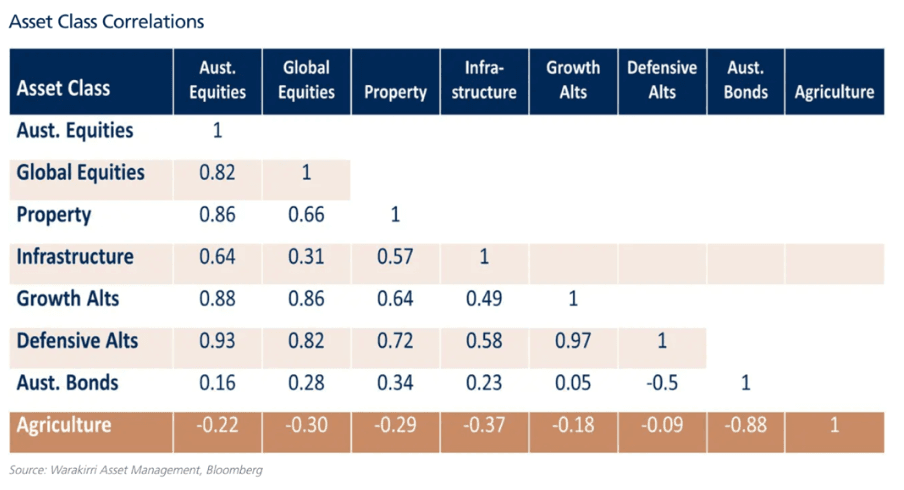

The sector’s returns stack up on a relative basis. The asset class has the potential to provide fixed-income-like benefits, whilst its low correlation with stocks and bonds makes it an effective diversifier—as shown below.

Agricultural assets also tend to perform well during inflationary periods, as the prices of commodities and land generally rise in tandem with inflation. This makes agriculture funds an appealing investment during times of rising prices—like now.

For example, the AgFood Opportunities Fund targets returns of 8-10% p.a. by investing in both listed and unlisted opportunities within the agriculture and food sectors.

Furthermore, with interest rate cuts expected next year, the investment outlook for agriculture looks increasingly promising. The cost of debt for growers increased from 3% of farm expenditure in 2021-2022 to 12% in 2023-2024. So lower rates could provide much-needed relief, boosting farm profitability.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Farmland values continue to climb

Agricultural land is a standout performer in the Australian investment landscape, consistently outpacing equities and housing over the long term, according to Rural Bank analysis.

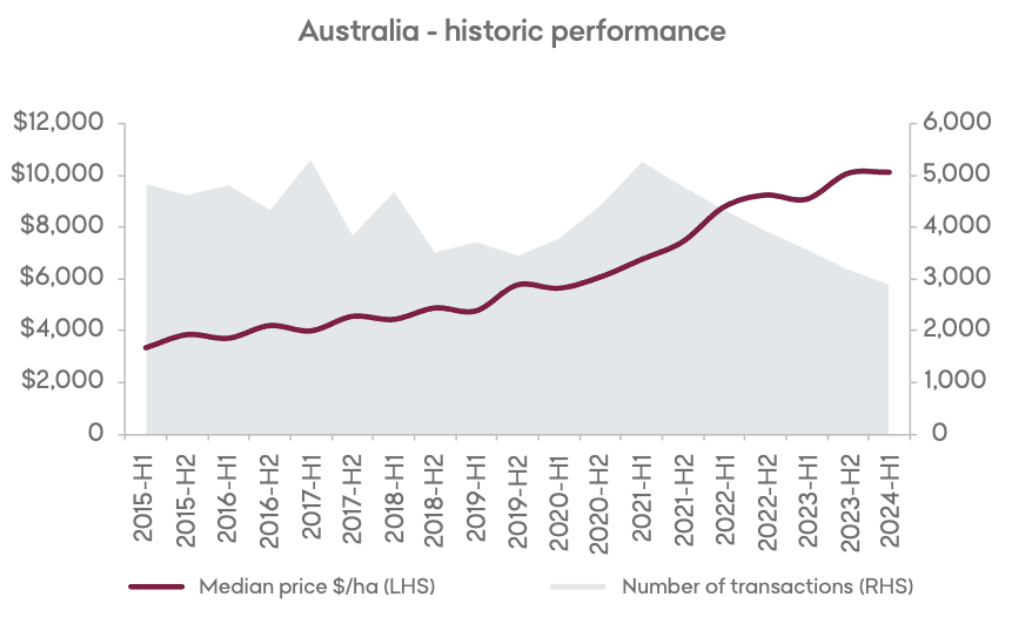

In fact, farmland values have more than tripled over the last 10 years, with the national median price rising by 201% largely driven by rising resource scarcity, particularly in land and water.

In 2023, the median price per hectare increased by 6.4% to $9,575/ha, marking the tenth consecutive year of growth.

As agricultural production continues to grow—it is projected to increase by 4% p.a. to reach $86.2 billion in 2025 according to the ABARES Agricultural Commodities Report—land and water rights are also becoming increasingly valuable.

Having said that, the growth rate of farmland values has slowed in recent times.

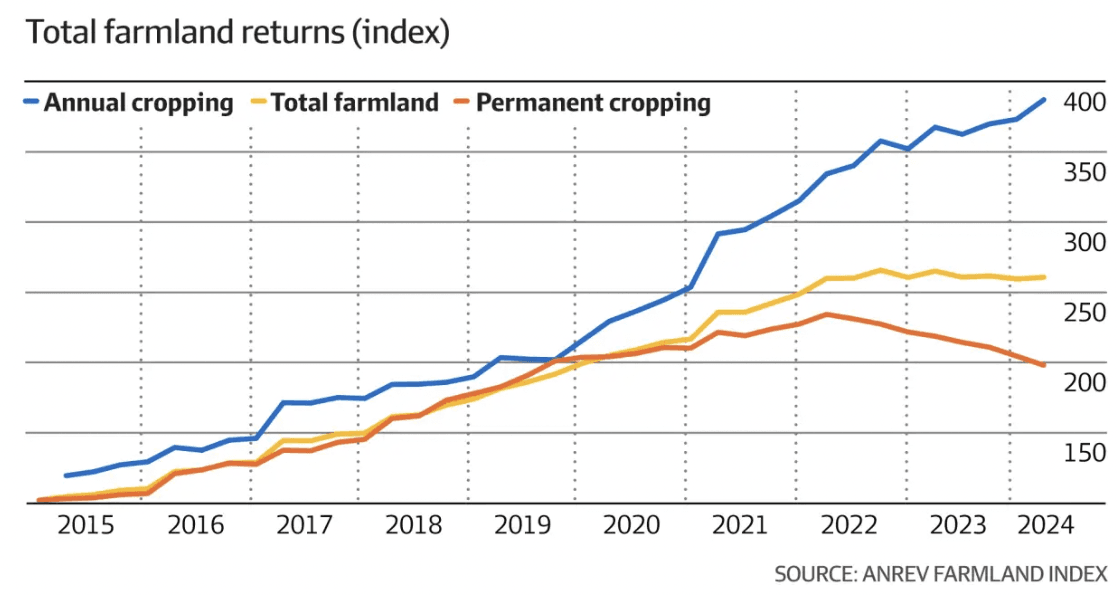

The latest quarterly update of the ANREV Farmland Index, which tracks agricultural properties managed by asset managers, shows that farmland has delivered a 10.6% p.a. return since the index’s inception in 2015. But the performance has been weaker over the past 12 months to June 2024, with the index posting a negative return of 1.7%, largely due to the impact of higher interest rates and falling commodity prices.

While key drivers of farmland values—interest rates, commodity prices, and seasonal conditions—have dampened buyer appetite in the short term, the longer-term outlook remains positive.

Looking forward, demand could strengthen with favourable rainfall forecasts and the possibility of interest rate cuts next year.

Given the positive outlook, it's no surprise that more funds are focusing on farmland, anticipating that the sector’s solid returns will continue. Leading agricultural property funds are generating results ranging from high single digits to low double digits.

For example, the Compass Meadowbank Investment Trust, which focuses on irrigated dairy properties in Tasmania, offers an expected return of 12-15% p.a.

In addition, investors targeting ESG-friendly agricultural funds are well-positioned to benefit from long-term trends. There's growing potential in carbon credits from actions like carbon sequestration, planting native vegetation, or reducing methane emissions, as well as renewable energy projects like wind and solar on farmland.

For example, the Kakariki Land Generation Fund invests in agricultural land to develop carbon sequestration projects, earning income from premium Australian Carbon Credit Units and other environmental credits. The fund targets a return of 12-14% p.a.

Capitalising on agriculture’s long-term growth

With interest rates stabilising and a renewed focus on sustainable farming practices, now could be an opportune time to consider investing in agriculture.

Despite challenges like climate risks and extreme weather, the limited supply of arable land and rising global food demand are expected to drive agricultural asset values higher, making them compelling long-term opportunities.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.