The asset allocation secret Howard Marks believes more investors need to understand

Simon Turner

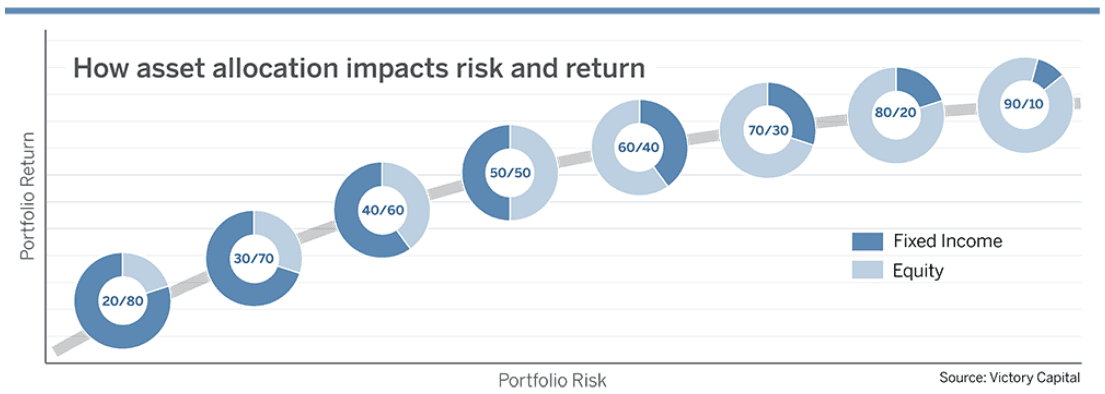

Tue 26 Nov 2024 7 minutesLess-young investors may remember the days when asset allocation was as simple as translating your age into a percentage which represented the amount of your portfolio that should be invested in lower risk, fixed income opportunities with the balance to be invested into higher risk assets like equities.

How the investment world has changed since those simpler days! Asset allocation has evolved into a more nuanced and complex decision-making process which needs to address a much larger universe of available asset classes, as well as some profound market shifts.

As Howard Marks highlighted in his recent investor letter, there’s one particular modern asset allocation secret that most of the world’s investors aren’t focusing enough on…

More investment options = more asset allocation complexity

Long gone is the investment landscape where the main asset allocation decision investors had to make was the split between their equity and bond allocations in accordance with their theoretical risk profile. It used to be as simple as the chart below.

These days, investors must make a vast array of asset allocation decisions including public versus private assets, developed versus emerging markets, large caps versus smalls caps, and alternative versus traditional asset classes.

In the words of Howard Marks: ‘It’s enough to make your head spin.’

Reframing and reapplying simple theories of yesteryear

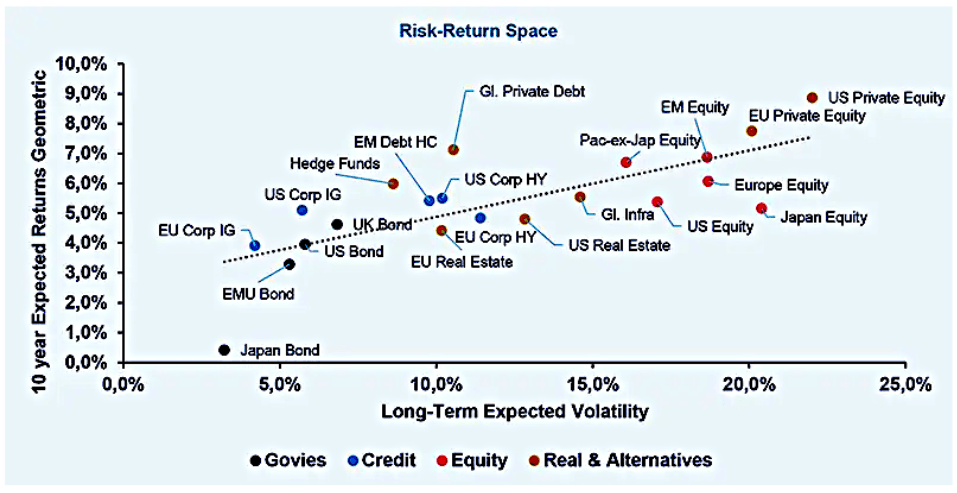

At the heart of all asset allocation decisions is the trade-off between risk and return across the investible asset classes. Historic models present alternative investments and shares as higher risk asset classes, whilst cash and fixed income was generally perceived as lower risk—as shown below.

The problem many investors face is that historical asset allocation models like this are often too simplistic and outdated to provide guidance valuable guidance relevant to the modern world.

Enter the first challenge with this outdated way of allocating capital: most investors understand the risk-return equation, but many believe the relationship between risk and return is an unwavering line that arguably misinterprets the very nature of risk.

Howard Marks explains the issue: ‘Many investors use computer models to help with these decisions, but the models require inputs regarding expected return, risk, and correlation, and most of these are based on history and thus of questionable relevance to the future. Correlation between asset classes is particularly difficult to predict. It’s often a case of garbage in, garbage out.’

Those are strong words—and well said.

Yes, over the long term higher risk asset classes like equities and private equity have tended to deliver higher returns than more defensive asset classes like bonds, but this has not always been the case. Understanding the nature of risk means understanding that the relationship between risk and return across various asset classes is not linear or predictable.

The key point to remember is that the range of outcomes in higher risk asset classes is much wider than for defensive assets. Hence, equities and alternative assets often endure periods of prolonged underperformance when their higher risks manifest into fundamental challenges.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Two fundamentally different main asset classes

The differences between equities and debt don’t stop there, and arguably the greatest mismatch in the way many investors look at asset allocation is in misunderstanding the fundamental differences between the two main types asset classes: equity and debt.

As you’ll be aware, equities are a higher risk, higher return asset class, whereas debt is a lower risk, lower return asset class. Both are true generalisations.

But many investors arguably need to focus more on the very definition of these two fundamental asset classes to understand their alignment as people with each.

Howard Marks agrees: ‘I’ve always felt most investors don’t grasp viscerally the essential difference between stocks and bonds . . . that is, between ownership and lending. Investors seem to think of stocks and bonds as two things that fall under the same heading. But the difference is enormous. In fact, ownership and lending have nothing in common.’

So let’s delve into these fundamental differences:

Equities represent units of business ownership, and thus carry all the risks associated with business ownership with no guaranteed return. In the event of winding a business up, equity owners are at the end of a very long queue.

In contrast, debt is a contractual promise of fixed returns with limited upside potential. Rather than being an ownership stake in a business, debt is a liability owed by that business so its risk profile purely relates to the financial state of the business.

With these differences in mind, it’s important is to ask yourself whether you tend to be an offensive player in life, the type of person who would rather play for big wins than avoid the small losses that are inevitable along the way? Are you the type of person who is able to understand risk, live with it, and navigate mistakes without straying from your investment course?

If you are, equities should probably be your bread and butter asset class.

Or … are you the type of person who believes small, regular wins add up to big wins over the long term, and are a lot less stressful to achieve?

If you are, now is a great time to accept this about yourself. After the rise in interest rates, some fixed income markets are offering investors the potential to generate equity-like returns without taking on equity-like risks.

The asset allocation secret

So the asset allocation secret that most successful investors have accepted and made peace with is: you need to know yourself as an investor and pick a lane that works for you as a person.

This gets to the heart of the modern asset allocation dilemma: how to create an investment plan that’s right for you for you as a real person rather than a theoretical person of a certain age and profile who is aiming to generate theoretical returns year in, year out.

The reason this is so important is that by owning the right assets for you as a person, you’re far more likely to hold onto them over the long term and thus benefit from the eighth wonder of the world: compounding.

Key takeaways for investors

Asset allocation is not a one size fits all process.

The relationship between risk and return is not linear nor predictable.

The range of potential investment outcomes increases as you move up the risk curve reflecting the nature of risk. Hence, taking on more risk does not always generate a higher return.

The best way to align your asset allocation with your investment persona is to understand the fundamental and significant differences between the two main asset classes, equities and debt, rather than relying on outdated asset allocation guidelines based upon your theoretical investment persona, age, etc.

Now interest rates have risen, some fixed income markets offer the potential to generate equity-like returns without equity-like risks. That creates an opportunity for investors to make a solid yield from more defensive asset classes while most risk assets are looking toppy.

By getting the asset allocation decision right for you, you’re more likely to hold onto your investments over the long term and benefit from compounding.

Asset allocation is about you as a person

Asset allocation is really about looking in the mirror as an investor while understanding the fundamental differences between the main asset classes. As Howard Marks highlights, this process appears to have become a lost art across the investment world.

Now is an ideal time to ensure your asset allocation aligns with a well thought out investment plan that honestly reflects you as a person. The good news is you can currently generate solid risk-adjusted returns in fixed income markets so making decent returns in a more risk averse way is back on the table.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.