How the rich get rich and stay rich

Simon Turner

Wed 12 Jun 2024 7 minutesAsk most wealthy people how they built their wealth, and the answers you’ll receive are likely to be obvious and somewhat unexciting rather than sounding like the secret keys to a kingdom of wealth. But therein lies the truth of wealth-building … it’s about taking small, mundane steps in the right direction over the long term.

At the heart of most effective wealth-building strategies are two core elements: an abundance mind-set and a commitment to follow an investment plan based upon the wealth-building secrets of those who’ve succeeded before. We delve into these secrets of how the rich get rich and stay rich below.

An abundance mind-set

Let’s start with the mind-set needed to accumulate wealth, which is generally referred to as an abundance mind-set.

Developing an abundance mind-set starts with appreciating all you already have in your life. In the words of Buddha: ‘If you look at what you have in your life, you’ll always have more. If you look at what you don’t have in your life, you’ll never have enough.’ This advice contains the seeds of the mind-set required for all wealth building, and not just financial wealth.

Once you start appreciating all you have, your abundance mind-set will empower you to attract the opportunities and experiences that match your higher vibrating energy and goals. This may sound like mumbo jumbo to some, but the more time you spend with wealthy people the more apparent it is that an abundance mind-set is everything when it comes to wealth generation.

The wealth-building secrets behind successful investment plans

So you’re dreaming big when it comes to your wealth-building. Perfect. Now it’s time to take the required action to turn your dreams into reality.

Here are 7 of the most powerful wealth-building (and retaining) secrets to be incorporated into your investment plan:

1. Save, save, save – One of the core tenets of wealth building is to spend less than you earn. In the words of Charles Jaffe: ‘It’s not your salary that makes you rich, it’s your spending habits.’ Never before has this advice been more relevant, nor harder to execute in practice. The world’s marketers are now able to leverage the power of the digital world combined with their deep understanding of our human biases in their efforts to program the world’s population to buy their products. These experts are adept at using our enjoyment of gratification and our desire to keep up with the Joneses to encourage us to buy things we don’t really need. The secret to wealth building is to make yourself immune to their powers. If you reduce your spending, you’ll achieve your financial goals much faster. Understanding this point may be the most important part of successful investment planning.

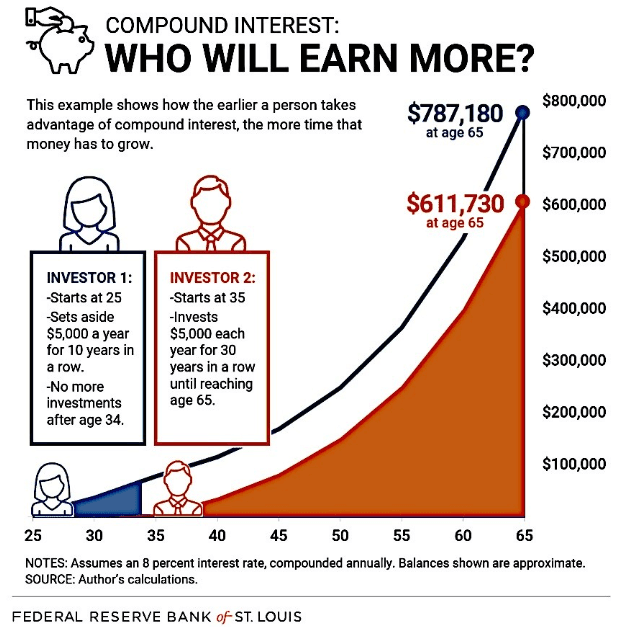

2. Invest and compound your returns over the long term – With your mounting pile of savings, you’ll be well-positioned to invest. This is a vital part of wealth building which is best explained by the master, Mr Buffet: ‘If you don’t find a way to make money while you sleep you will work until you die.’ That’s no exaggeration. Wealth accumulation without investing is similar to driving a speedboat without a functional engine installed. Importantly, investors who invest for the long term gain access to the indomitable power of compounding. When Einstein referred to compounding as the eighth wonder of the world, he wasn’t joking. The compounding of returns is an extraordinary force which all wealth accumulators should be leveraging in their favour. In the words of Jerimiah Say: ‘The power of compounding is not just about money; it applies to every aspect of life. Small, consistent efforts can lead to remarkable results over time.’ The sooner you get started compounding your returns, the better—as shown below.

3. Avoid debt – Avoiding the use of debt is a core part of an abundance mind-set since debt has a habit of creating a scarcity of financial freedom in the future. In the words of Grant Cardone: ‘Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.’ This goes beyond investing. Most people would agree that avoiding debt helps them retain peace of mind which is core to general contentment. With interest rates being significantly higher than they’ve been in recent years, this is a lesson many property owners are learning in a hurry.

4. Learn from your mistakes – Arguably, learning from your mistakes is one of the hardest aspects of wealth building. The truth is we all make investment mistakes, but we don’t all learn from them. The first step is to put your ego aside and admit you made a mistake without taking it personally. Rick Rubin reveals the secret to doing this: ‘If someone takes criticism personally the game is over. Taking the ego out of it is such a key component of allowing the thing to the best thing it can be. If it’s about you, it’s not about it.’ A helpful way to reach this state of objective curiosity is to write down your mistakes and your lessons learnt as though they were made by a third party. And don’t forget the final step which so many investors do forget: don’t repeat your mistakes. If you genuinely learn from your mistakes and adapt your strategy accordingly, you’ll be fast-tracking your wealth-building journey.

5. Don’t panic when markets do – Average holding periods have plummeted in recent years with most investors preferring a trading strategy over long term investment. But there’s a reason Mr Buffet described the stock market as a device for transferring wealth from the impatient to the patient. Falling holding periods have only served to exacerbate that situation. Wealthy investors don’t fall victim to this reactive mind-set. They are able to hold their investments throughout periods of volatility when the impatient effectively transfer their wealth to them.

6. Prioritise income generation – One of the secrets of maintaining an abundance mind-set is to ensure you have plenty of income flowing in your direction. Not only do these income flows enable you to live in genuine financial abundance, they also allow you to continue reinvesting to generate those compound returns that are core to wealth generation.

7. Network and collaborate with successful people – Helping others increase their wealth is one of the most effective ways of maintaining your own wealth. If you’ve ever been helped in this way by a friend or colleague, you’ll no doubt recall how much you wanted to return the favour. This is why successful people tend to be friends with other successful people. Networking and collaborating may be the unsung hero in your investment planning toolbox.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Your riches are awaiting you

So building the wealth of your dreams is within all of our reaches. Achieving your goals depends upon cultivating an abundance mind-set and translating that into an investment plan based upon the above-mentioned wealth-building secrets. It also depends upon being able to execute that plan over the long term without being scared by markets, the media, economics, or even wars. Building wealth is about holding tight through market volatility and reinvesting each year to ensure your returns compound over time.

Your riches are awaiting you if you’re willing to take the required action.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.