Conquering the demon that insisted you sell at the pandemic lows

Simon Turner

Fri 5 Apr 2024 9 minutesIt’s a well-known fact in investment circles that the pain of a losing money greatly exceeds the positive feelings associated with investment success. The cognitive bias that explains this is called loss aversion.

Many investors and sports people alike have discovered that loss aversion is a cognitive bias it pays to understand if you want to use it to your advantage. If not, you’re susceptible to loss aversion sinking its teeth into your investment returns when you’re at your most vulnerable.

Loss aversion almost explained

Loss aversion makes sense to most investors when they are honest with themselves about their emotional responses to good and bad news. Just think about all the times success and failure have arrived in your life in equal measure. If you’re like most people, your reactions will resemble this picture:

David Letterman perfectly described loss aversion when he looked back on his TV show hosting career:

‘I think there’s something wrong with me. It’s either a character flaw or a personality disorder. It’s one or the other. I haven’t heard back from the lab. Maybe life is the hard way, I don’t know. When the show was great, it was never as enjoyable as the misery of the show being bad. Is that human nature?’

So if you’re like Mr Letterman and most other humans, you’re probably dwelling a lot more on your investment failures than your winning positions.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why are we hard-wired like this?

Dwelling more on our failures than our successes sounds like a fast track to unhappiness. So why are we like this?

The scientific explanation for loss aversion is that the amygdala, which is the part of the human brain responsible for processing emotions, is activated more strongly in response to losses than in response to wins. Hence, the emotional response inspired by losses is more intense than for wins.

The why behind loss aversion is harder to answer. Some scientists have theorised that this cognitive bias evolved from a time when avoiding losses involved being eaten by animals or attacked by warring tribes. So maybe loss aversion was a rational response to the way of the world for a large portion of human history.

But without a dinosaur chasing you, loss aversion may be causing you problems with your investing rather than saving your life. All that lost sleep it may be costing you could well be for nought.

How loss aversion is wreaking havoc on your investment results

Loss aversion is probably the cognitive bias which is impacting your investment results more than any other because it hits investors when they’re most vulnerable to making costly mistakes.

For example, loss aversion rears its ugly head in a number of common investing scenarios:

When markets are panicking. Market selloffs are periods most investors know they should be ignoring volatility and reminding themselves that they are long term investors. However, as soon as everyone else starts running for the exits, loss aversion takes control of our best intentions and drives us to sell at exactly the wrong moment. You may have found yourself in this situation alongside the millions of investors who sold during the pandemic-inspired selloff of March 2020. Of course, selling was the opposite of what successful investors were doing at the time. Many of us look back at stock charts of that period and experience overwhelming regret that we were driven by our loss aversion demons to sell when we should have been buying.

When assessing risk in general. The fear of making a loss drives many investors to avoid taking risks altogether regardless of the potential upsides. This fearful mind-set is at odds with the mind-set of successful investors. It essentially empowers investors’ fears to be in the driver’s seat during their investment decision-making rather than their investment goals. Taking on risk is core to generating solid investment returns so avoiding risk altogether is extremely detrimental to returns.

When holding onto losing positions. Loss aversion makes it challenging for many investors to sell their losing positions until they’re back at breakeven. However, selling your losers early tends to be a winning investment strategy, while holding onto your losers indefinitely is often a harmful investment strategy. Once again, loss aversion drives us to do the wrong thing.

When deciding on asset allocation. Rather than being objective about matching your risk and return objectives with an appropriate asset allocation, loss aversion guides investors further down the risk and return curves than they’d naturally be matched to. In other words, it pushes investors to accept lower returns in the interests of protecting their capital. But did you ever hear of a successful investor who generated excellent returns by taking on less risk than they’d planned to?

When navigating inflation. You didn’t expect to see inflation on this list did you? Inflation is also associated with loss aversion since it represents a loss of purchasing power. For example, loss aversion often pushes consumers toward buying goods they don’t yet need just to avoid the impending loss created by inflation if they were to buy those same goods in the future. In fact, loss aversion partially explains why inflation is such a psychologically complex subject.

The list goes on but the theme remains the same … left ignored and unhindered, loss aversion drives us to take the wrong action at the wrong moment.

So it’s a big deal for all investors who want to achieve their investment goals.

How age affects loss aversion

Understanding how your age factors into your aversion to loss is also useful information if you’re trying to conquer this demon.

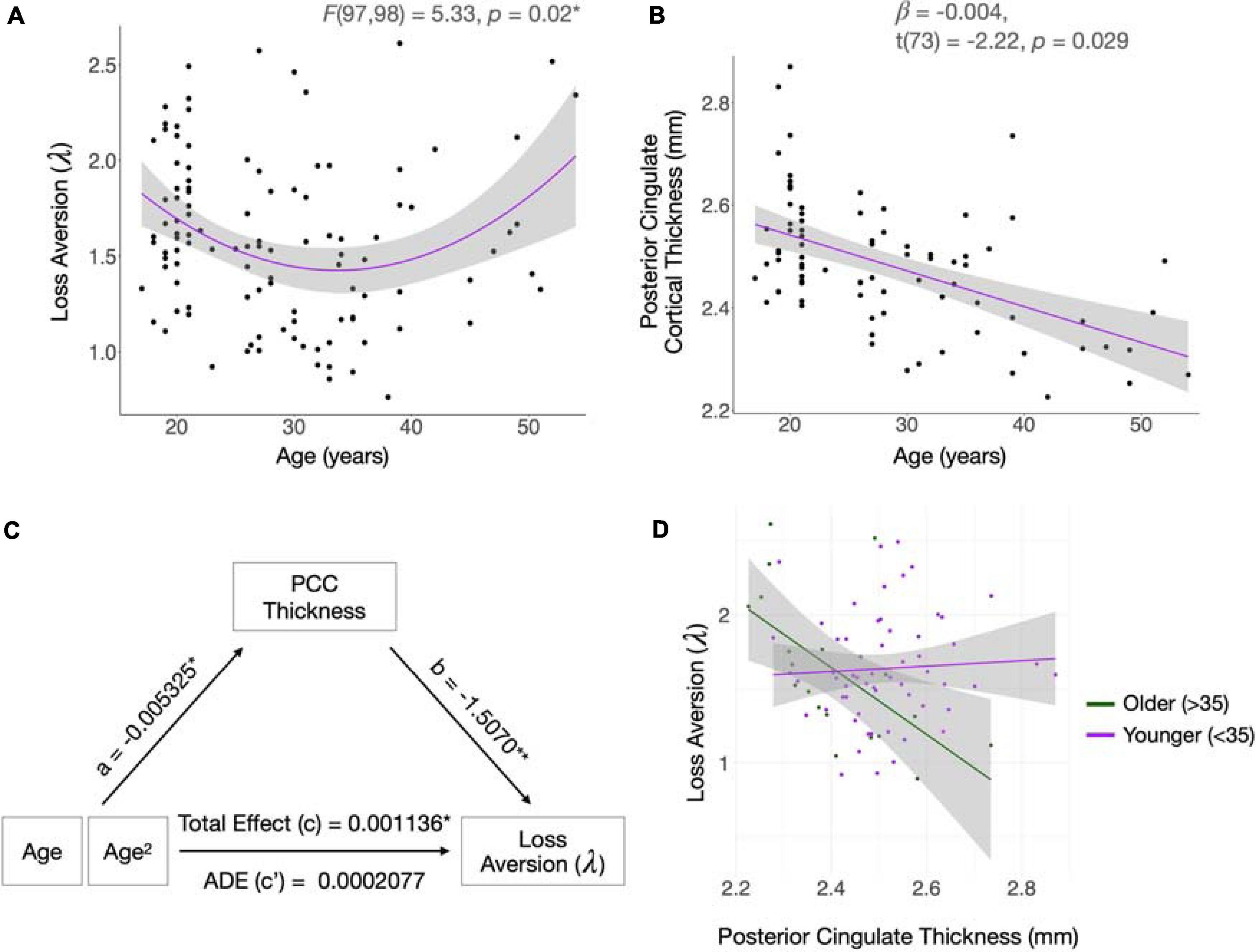

As shown below, loss aversion tends to be highest for those who are both younger and older.

As a result, younger investors in their teenage years and their twenties are particularly vulnerable to loss aversion since they are naturally matched to taking on the highest amount of risk.

Less young investors are also susceptible although it’s natural to take on less risk as you get older. However, risk aversion is still an issue when it pushes older investors further down the risk curve than would otherwise be appropriate to achieve their investment goals.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Transforming your loss aversion into a profit addiction

Knowing what a challenge loss aversion is for most investors, you’ll understand why addressing it is so important to improve your investment returns. In essence, the ability to withstand losses is the difference which makes the difference between mediocre and successful investing.

Here are some strategies which may help:

Journal about your investment journey, including your emotional responses to your winners and losers. As you develop your awareness of how your emotional responses may be guiding you to take the wrong action, you’ll understand how valuable it is to gauge your emotional response prior to letting it guide you. Over time, your emotions will become gifts which help you make the right investment decisions, which will often be the opposite of what your emotions are guiding you to do in the short term.

Stop watching your portfolio on a daily basis. The more we watch our investment portfolios, the more chances we have to test and feed our loss aversion. Only bad things can come from this. Many investors convince themselves that checking their portfolios daily, hourly, or even more often, is helpful behaviour. But this couldn’t be further from the truth. The most successful investors are aware that minimizing all temptations to take action at the wrong moment is a powerful way of minimising the air time their loss aversion bias gets.

Celebrate your wins. This is important. If you’re going to train yourself out of ignoring your wins in favour of crying about your losses, you need to start celebrating your wins. So if you hit your annual investment return target, consider going out for an expensive meal to celebrate. If one of your biggest positions is taken over at an attractive premium, throw a party. Start associating whatever brings you joy with your investment success.

Control the voices you listen to. More than one fund manager has talked of the importance of ignoring most news since it is backward-looking and has been written to create an emotional response in the reader, often a negative one. The investment-wreaking powers of loss aversion can be amplified by reading articles by conspiracy theorists, pessimists, and journalists at large, so it’s important not to allow their voices to enter your mind where they can feed this bias.

Associate with other ex-loss aversion junkees who are focused on success. As with all aspects of success, the more you associate with other investors who are aiming for similar successful investment outcomes, the easier you’ll find it conquer your loss aversion bias.

Conquer your loss aversion tendencies to make more money

It’s no understatement that loss aversion is the cognitive bias which stops most investors from being successful. It’s such a simple concept, but it’s invariably challenging for investors to sidestep its magnetic powers.

Being aware of the power loss aversion has over you and its impact on your investment returns is the first step toward conquering it. As you develop this awareness and gradually add in some of the above-mentioned strategies, you’ll be in a much better position to generate the types of investment returns who’ve always aimed for but have never quite achieved in the past.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.