Why the popularity of active ETFs is surging

Ankita Rai

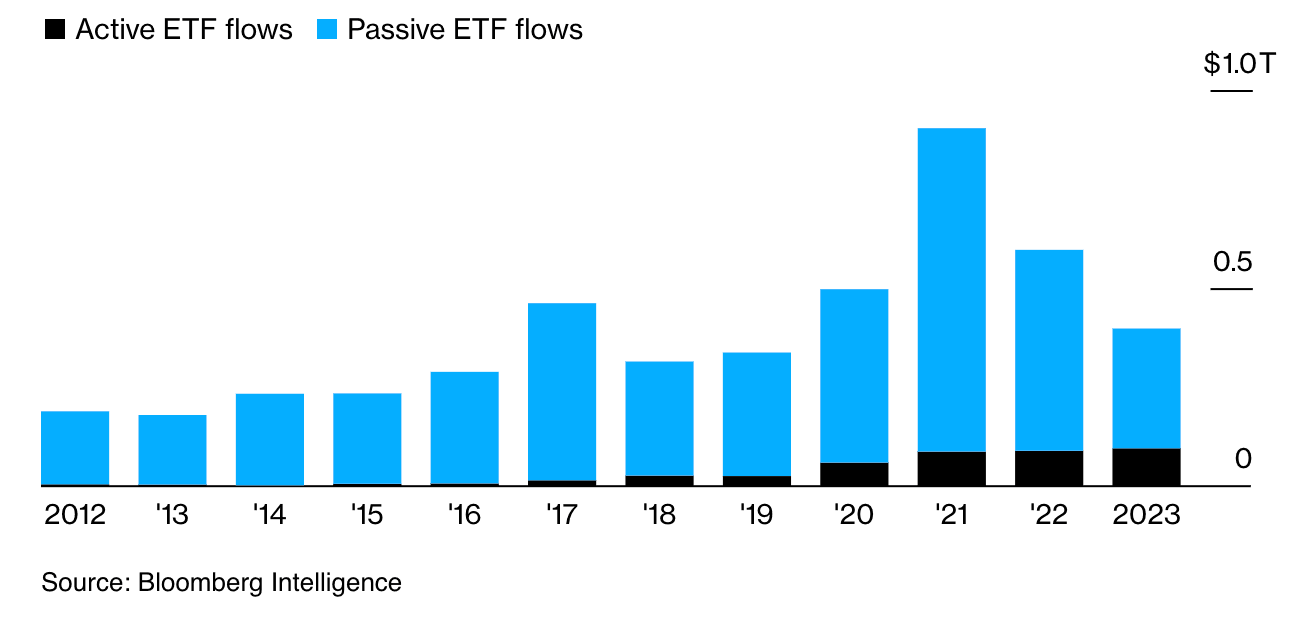

Thu 4 Apr 2024 5 minutesUntil recently, investing in ETFs typically meant opting for a passive, index-based approach, foregoing the benefits of active management. However, 2023 saw a marked acceleration in active ETF uptake across the globe.

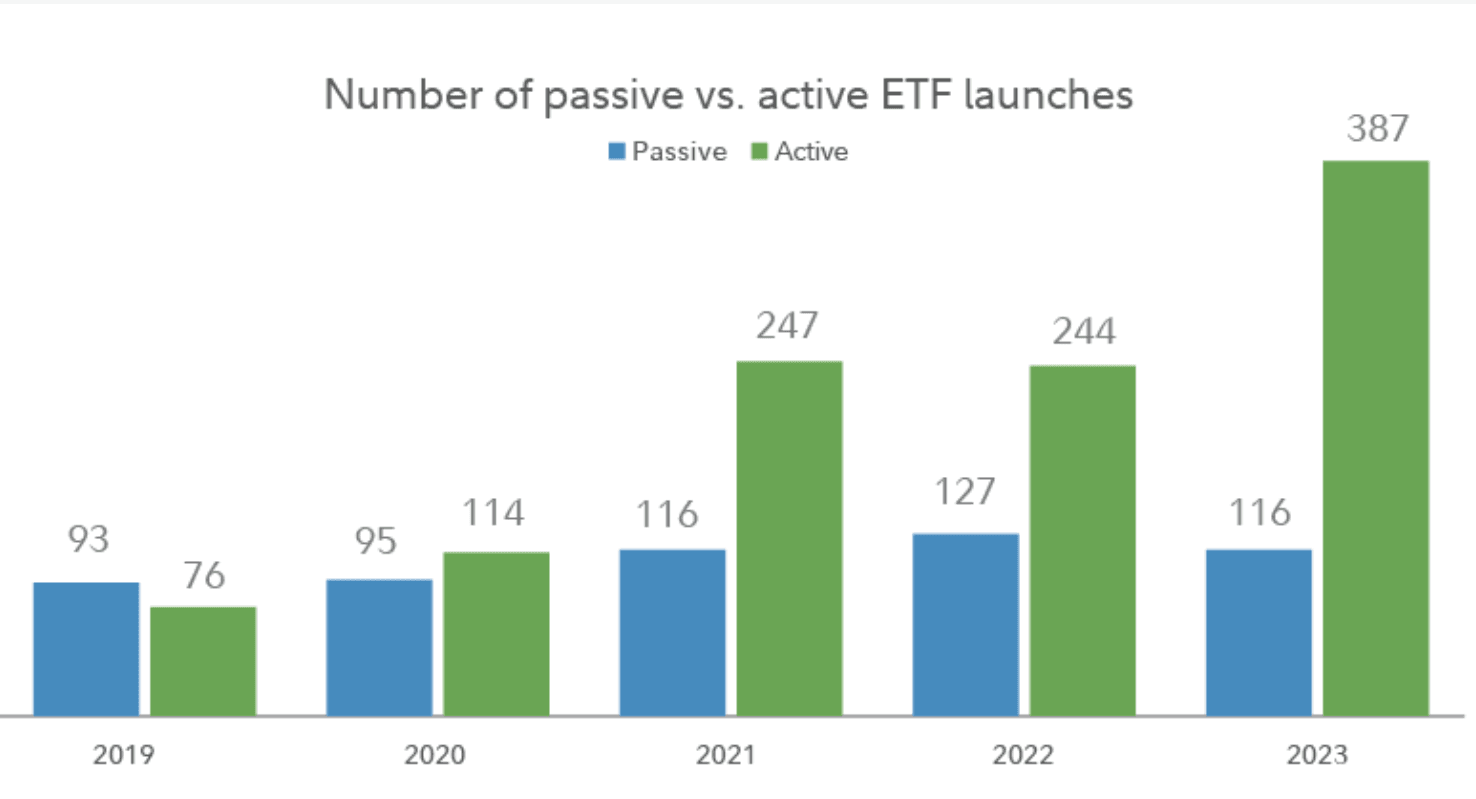

Active strategies captured nearly a quarter of the net flows into US ETFs and accounted for a staggering 81% of new launches last year. From a modest $112 billion in 2019, these ETFs soared to $509 billion by 2023 in net asset terms, representing a 35% compound annual growth rate, according to Morningstar.

In Australia, too, active ETFs continued to gain momentum, with 55% of new fund launches belonging to this category last year, according to Zenith.

What's making active ETFs so popular?

According to Morningstar, a combination of factors, including product innovation and evolving investor preferences, has fuelled the rise of active ETFs. This is due to several advantages of active management, especially in navigating concentrated market rallies. Given their more focused portfolios, actively managed ETFs offer investors tactical opportunities such as capitalizing on short-term market movements.

The ease of converting mutual funds into ETFs has also accelerated the expansion of the active ETF market. In fact, investors are shifting away from actively managed mutual funds, which saw a record $1 trillion exodus in 2022. This trend suggests that while active management may have been out of favour, active ETFs have flourished due to their unique positioning within the ETF structure.

Another contributing factor to the proliferation of active ETFs is the increased accessibility and tradability they offer. Furthermore, active ETFs boast several advantages over their mutual fund counterparts, including lower costs, tax efficiency, transparency, and tradability.

These unique benefits have resonated with investors, especially in light of recent market events like the US banking crisis and the collapse of Silicon Valley Bank, which have emphasized the need for transparency and tradability.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The growing momentum

Amidst economic uncertainty, high inflation, and higher-for-longer interest rates, the demand for active ETFs has surged. In fact, times like these serve as a tailwind for them.

Of the record 520 ETF launches last year in the US, 387 were actively managed—as shown below.

Investors are favouring active investment strategies over passive ones due to their perceived ability to navigate volatility and offer investors broader access to diversified investment options.

No wonder fixed income is among the biggest asset classes in active ETF allocations. Active management thrives in this space, allowing for swift portfolio adjustments in response to shifting economic indicators and central bank policies.

The category saw the launch of several bond funds such as BlackRock Flexible Income ETF, PIMCO Multisector Bond Active ETF and so on, which invest in fixed-income sectors such as high-yield bonds, securitised assets and emerging markets debt.

In the equity space, defensive funds like JPMorgan’s covered-call ETFs and Dimensional's systematic funds saw greater inflows than any other actively managed funds globally.

In Australia, the ETF industry closed out 2023 with $177.5 billion in funds under management, marking a $43.7 billion increase over the past year, as per Betashares. While passive ETFs continue to dominate, active ETFs saw increased flows as well, accounting for over 50% of new fund launches.

Overall, inflows reached $15 billion, representing a 12% rise, led by fixed income ETFs with $5.3 billion inflows, closely followed by Australian equities at $5.2 billion.

The case for active ETFs

While active ETFs represent only a fraction of the overall market share, they continue to dominate new fund offerings. With more launches coming and existing ETFs picking up steam, investors should weigh the potential benefits of integrating active ETFs into their portfolios.

In the current volatile market conditions, led by high-interest rates, passive ETFs may not adequately shield against downside risk nor offer avenues for pursuing above-average returns.

This is where the appeal of active ETFs becomes evident, as they offer a means to navigate market fluctuations and potentially generate higher returns.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What it means for investors

Unlike passive ETFs, which aim to mirror the performance of a specific index, active ETFs are managed by investment professionals who actively select investments within defined themes. This hands-on approach allows managers to target specific opportunities to outperform passive equivalents.

Actively managed ETFs provide investors with tactical opportunities that passive ETFs may not offer. For instance, in active bond ETFs, portfolio managers can strategically select securities based on various factors such as interest rate fluctuations, global credit risks and so on.

The ease of converting mutual funds into ETFs has also accelerated the expansion of the active ETF market. Active ETFs offer numerous advantages over mutual funds, such as lower costs, tax efficiency, transparency, and tradability, making them a compelling alternative, particularly in uncertain market conditions.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.