Crypto’s Value Problem: Why Utility Isn’t Enough

Simon Turner

Mon 16 Feb 2026 7 minutesCryptocurrencies must surely be the most polarising asset class in the modern financial era. On the one hand, they promise decentralised finance, immutable digital money, and permissionless innovation. On the other, most of the 20,000 available digital tokens never find sustainable economic value despite plenty of early hype and speculative inflows. The gulf between use cases and value accrual has become one of the defining challenges for crypto traders and long-term investors alike.

So the question is: which, if any, parts of the crypto ecosystem might generate enough enduring value that investors should consider exposure within a diversified portfolio?

Monetary Value vs. Utility

To unpack this, it helps to separate two fundamentally different crypto goals: monetary value accrual and utility provision. Though they often overlap in promotional material, they behave very differently as investable assets.

Digital assets that achieve monetary value do so by creating the perception amongst investors that they offer an effective store of value. Their worth comes from their scarcity, broad acceptance and network effects.

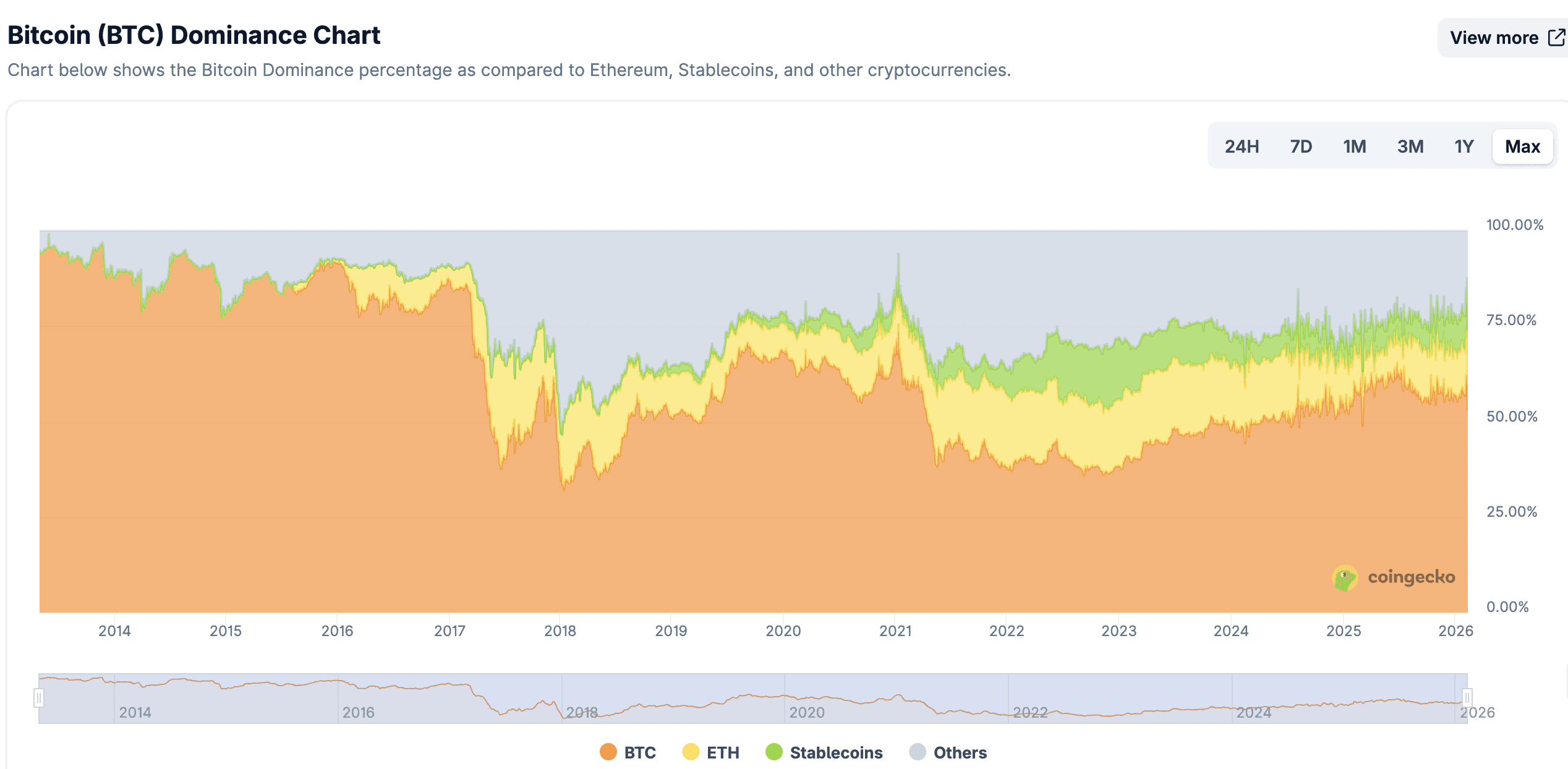

Bitcoin is the largest example. Because it ticks all of these boxes, it represents 57% of the total market value of cryptocurrencies, as shown below.

Bitcoin’s dominance signals an important truth: in the crypto world, money tends to gravitate toward one or a few leaders rather than fragment into countless alternatives.

A classic historical analogue is the gold standard, where a single store of value emerged over millennia not because it was endlessly useful in every context, but because societies broadly agreed on its scarcity and stability.

Contrast this with digital tokens that primarily serve as utility mechanisms within specific blockchains. These tokens are often consumed or competed away as the system matures. They support smart contracts, decentralised applications, or network governance, but their value depends on competitive dynamics and fee structures within their ecosystems.

Many utility blockchains issue tokens to pay validators or developers. Hence, they often see market support upon launching.

But longer term, rising competition among networks, from faster block time alternatives to layer-2 scaling solutions, often drives transaction fees and token demand down toward the marginal cost of network operation. This makes enduring value capture for token holders more challenging to achieve unless the blockchain in question has enduring economic frictions that funnel surplus value back to its native token.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Stablecoins: Utility Without Upside

Another major crypto category is stablecoins. These are digital tokens which are pegged 1:1 to a fiat currency such as the US dollar.

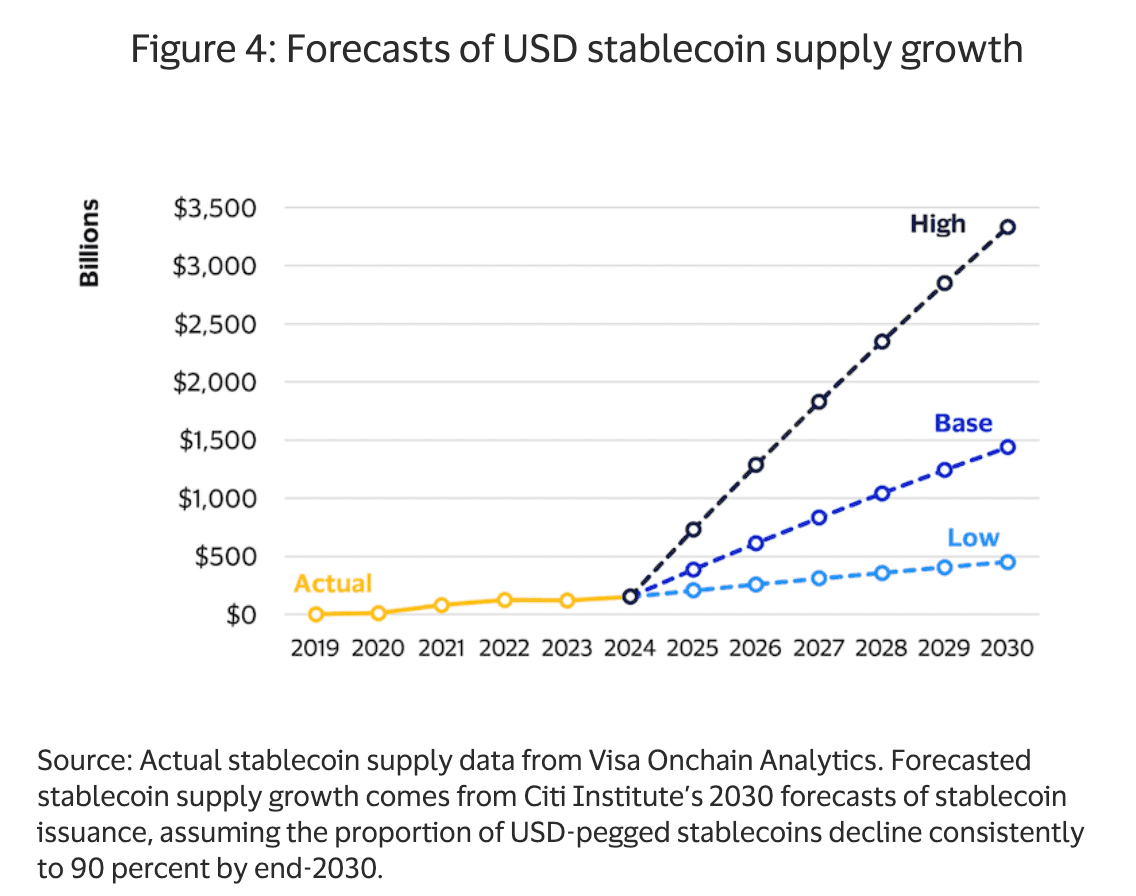

These have seen explosive adoption in recent years, rising from a combined market cap of $US32 billion in early 2021 to more than $US300 billion.

Their rise underscores their key benefit: stablecoins solve a real problem. Namely, fast, digital dollar settlement. But that benefit doesn’t inherently create capital appreciation for holders.

By design, stablecoins trade at a fixed price because their purpose is to mirror the value of a fiat currency. So they’re effective as liquidity tools, especially within decentralised finance and cross-border flows, but they’re not effective as value accumulators.

Investors should thus treat stablecoins as cash equivalents within the digital markets rather than speculative holdings.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Rational Investor’s Lens: Value Capture First

A useful mental framework for crypto-curious investors is to ask: who captures the economic surplus?

This has always been core to successful investing. In traditional markets, companies with sustainable competitive advantages, whether they be network effects, pricing power, or barriers to entry, can convert economic activity into profits and shareholder returns.

Cryptocurrencies that merely facilitate activity without also capturing the economic surplus are likely to disappoint in the long term. Their initial trading activity may grow, but their market value may not keep pace unless there are structural reasons for investors to accumulate and hold it over time.

How Can Australian Investors Access Crypto Sensibly?

Seen through a portfolio lens, crypto funds and ETFs behave less like a new asset class and more like a high-volatility satellite allocation.

Their role isn’t to replace equities or bonds, but to introduce exposure to a distinct return driver in an emerging, high-risk asset class: one that is cyclical, sentiment-driven, and highly sensitive to global liquidity conditions.

Bear in mind, Bitcoin-linked ETFs have delivered bursts of explosive upside during favourable market environments, followed by deep drawdowns when liquidity tightens.

Ethereum-linked ETFs, while still volatile, have generally lagged Bitcoin over full cycles, reflecting the difference between monetary-style assets and utility-driven networks.

Crypto-equity ETFs, meanwhile, tend to sit somewhere in between, behaving more like speculative growth stocks than pure digital assets.

For all crypto exposure, investors need to be ready for one thing in particular: volatility.

With the regulatory response still in its infancy, the risk of left-field market changes is a clear and present danger.

Having said that, there’s a growing array of digital asset funds and ETFs that offer professional vehicles to participate in the long-term upside of crypto without direct exposure to wallets, private keys or the full volatility of individual tokens.

For example:

VanEck Bitcoin ETF (ASX: VBTC) and BetaShares Bitcoin ETF (ASX: QBTC) provide direct exposure to Bitcoin price movements in Australian dollars. They are ideal for investors seeking pure monetary asset exposure without self-custody risks.

Global X 21Shares Ethereum ETF (Cboe: EETH) and BetaShares Ethereum ETF (ASX: QETH) offer exposure to Ethereum, the leading smart contract platform. Ethereum’s ecosystem is one of the most used in decentralised finance and tokenisation, but investors should arguably view this exposure through the lens of utility adoption rather than targeted value accrual.

Ecosystem innovation products like the BetaShares Crypto Innovators ETF (ASX: CRYP) give diversified exposure to companies in the digital asset value chain such as service providers, infrastructure firms, and innovators rather than to individual token prices themselves.

For wholesale client portfolios, funds such as the Ainslie Bitcoin & Bullion Fund blend Bitcoin exposure with traditional stores of value like gold and silver, offering an alternative approach to diversification in a multi-asset strategy.

The great benefit of funds and ETFs like these is that they allow investors to access the digital asset adoption thematic, while still anchoring their portfolios in regulated markets, transparent pricing and familiar custodial structures.

A Balanced View on Crypto Exposure

Investing in cryptocurrencies requires a clear differentiation between where economic value might accrue to holders and where utility is the best case scenario. Not all crypto is created equal, and almost none should be treated as equity or income-generating assets. This is a high-risk alternative asset class best suited to investors with a high risk tolerance who understand the significant downside risks.

For investors for whom this is a good fit, the smartest crypto strategy likely involves investing a minor portfolio weighting in the most widely adopted monetary form of crypto, Bitcoin, via best-in-class funds or ETFs. By focusing on value capture and the right investment vehicles, investors can invest in this emerging asset class without succumbing to speculation or ignoring market realities.

Funds Mentioned:

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.