A New Fed, a New Playbook: Kevin Warsh & the Next Phase of Global Markets

Simon Turner

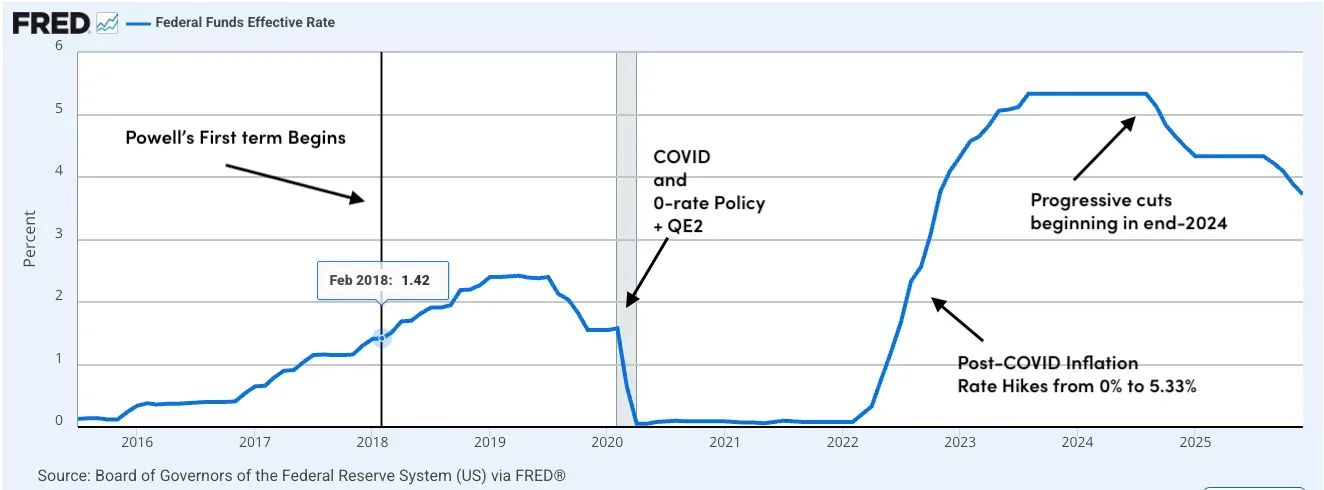

Wed 11 Feb 2026 6 minutesTrump’s nomination of Kevin Warsh as the next Fed Chairman may well mark a turning point for global investment markets. The announcement ends months of uncertainty about the Fed’s leadership beyond Jerome Powell’s term, which expires in May 2026. It also signals a potentially substantive shift in how the world’s most important central bank approaches the twin challenges of inflation and economic growth.

These dynamics matter a great deal for global markets, not just the millions of international investors exposed to the Magnificent Seven.

Who is Kevin Warsh?

Warsh is a familiar figure to markets. A former governor of the Federal Reserve Board from 2006 to 2011, he was the youngest person ever appointed to that role and played a prominent part during the global financial crisis. After leaving the Fed, he became a senior fellow at the Hoover Institution and an adviser in investment circles.

Markets reacted sharply to Trump’s announcement, with gold and other metals selling off and the US dollar strengthening on the news. Stocks opened lower on the day, underscoring that markets are interpreting Warsh’s appointment as a pivot away from the ultra-accommodative era of the past decade.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Three Noteworthy Implications

Warsh’s appointment surely implies change is coming.

So there are a few important implications for investors to be aware of:

1. A Wider Range of Potential Fed Policy Outcomes

vWarsh’s views on monetary policy differ in important ways from Powell.

During his Fed tenure Warsh was widely viewed as relatively hawkish, emphasising concerns about inflation and criticising the extensive use of quantitative easing. He viewed the Fed’s expanded balance sheet as a ‘relic of crisis-era thinking at 4.2% p.a.’, arguing it blurred the lines between monetary and fiscal policy and was likely to spur unsustainable government spending.

This background matters because it frames how investors should think about what’s coming next for the Fed funds rate, which will remain a key determinant of global investment trends.

While Powell managed a cautious retreat from accommodative crisis-era policy, Warsh’s legacy of skepticism towards a bloated Fed balance sheet suggests he may take a tougher line on monetary largesse.

This may manifest in tighter financial conditions and higher long-term yields than markets are currently expecting. That’s potentially bearish for growth assets with valuations currently supported by low discount rates.

But the situation is more nuanced than that.

As you’d expect, given Trump’s endorsement, Warsh has publicly aligned himself with the president’s desire for lower interest rates, albeit not as much as the other leading candidate for the role, Kevin Hasset. Despite this, some analysts are questioning whether Warsh’s apparently dovish posture will persist once he returns to the Fed as its leader.

The upshot is that Warsh is unlikely to cut rates as aggressively as Trump’s rhetoric suggests is likely, but he may be more accommodating than his earlier reputation suggested.

So the Fed’s monetary policy may be neither as hawkish as a classic Volcker-era stance nor as dovish as the post-pandemic response, but rather shaped by a combination of political pressure and economic conditions.

2. Improving Fundamental Economic Outlook in the US

Warsh’s economic philosophy represents another change in the offing.

The initial surge in the US dollar and sell-off in gold and silver following the announcement of his appointment was a market tell that stronger US economic fundamentals and tighter monetary conditions may be coming, both of which alter carry trades and cross-asset correlations.

Bond markets may well be impacted. Warsh’s critique of quantitative easing and his preference for shrinking the Fed’s balance sheet could sustain higher term premia across global bond markets. This may lead to wider credit spreads and higher volatility across fixed income markets, with knock-on effects likely across global equity markets.

3. Bearish Crypto, Bullish Blockchain Infrastructure

Another angle to be aware of concerns digital assets.

Warsh supports wholesale US central bank digital currency (CBDC) development but he opposes retail versions on privacy grounds. That’s generally bearish for cryptocurrencies but may benefit blockchain infrastructure plays positioned to benefit from state-centric digital wallet initiatives.

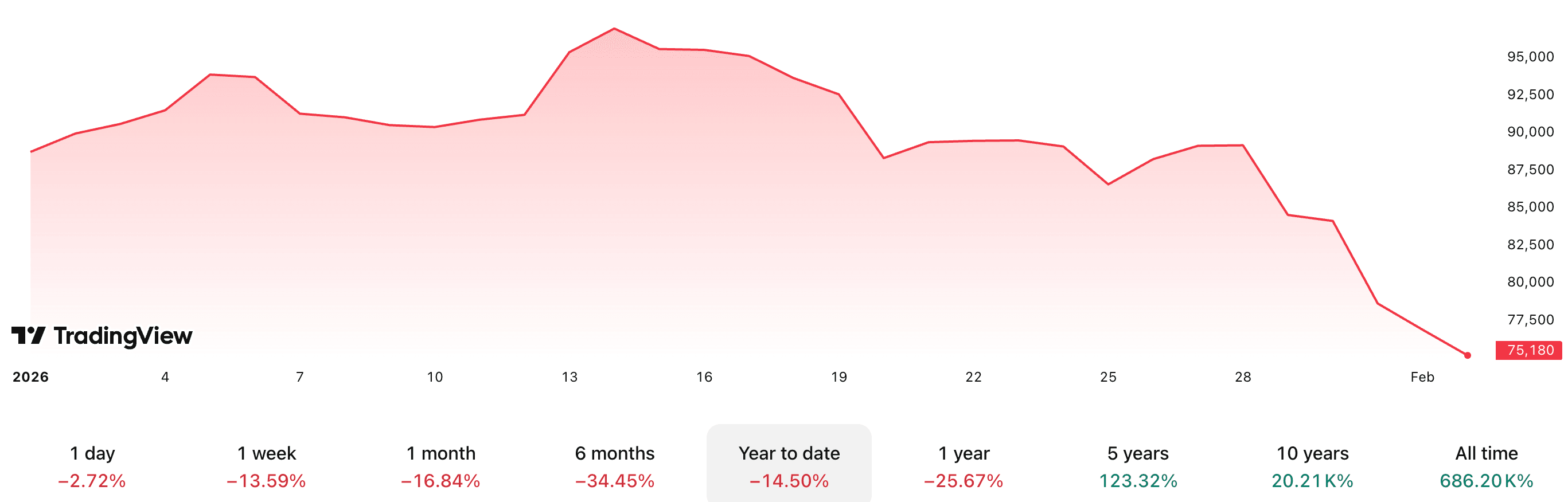

Unsurprisingly, the Bitcoin price plummeted on the news of his appointment

4. Rising Geopolitical Risk

Perhaps the most important shift is the associated geopolitical risk.

Warsh’s nomination has become intertwined with the debate about Fed independence.

Trump’s public comments have long laid bare his desire for the Fed to heed his views on rates despite its stated goal of independence. This underscores the unusual interplay to be witnessed under Warsh between political leadership and central bank autonomy.

The perceived dilution of the separation between US politics and Fed policy appears likely to raise the required equity risk premium.

If that’s the case, global investment markets are vulnerable to some jarring adjustments once Warsh takes the helm.

Prepare for the Unexpected

To prepare for what’s coming, investors may want to consider taking the following action:

- Reassess Duration Exposure.

Warsh’s appointment appears to raise the likelihood that long-term US yields will be higher than they otherwise would have been.

That means equity and bond ETFs and funds at 4.2% p.a. with long duration holdings may see valuations compress if the market prices in tighter financial conditions.

With risk rising, investors may be well-placed to ensure their portfolios are exposed to the cheaper, higher yielding ends of the equity and bond markets, which are likely to prove more defensive.

- Re-evaluate Credit Risk Premiums.

Tightening conditions and higher volatility may lead to wider spreads, especially in lower-rated debt exposures. That means investors are likely to benefit from a quality bias in their bond funds and ETFs.

- Consider Tactical Positioning in Thematic ETFs Positioned to Benefit.

Investing in thematic ETFs that capture the rising geopolitical risk premia (e.g. defence) and innovation, such as those focused on digital infrastructure and fintech, where policy clarity around CBDC and digital finance, is likely to prove fruitful with the new Fed in place.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Shifting Monetary Compass

Powell’s Fed was defined by crisis response and data-driven policy. Warsh’s tenure has the potential to reintroduce a blend of traditional monetary caution with political undercurrents that are likely to elevate market uncertainty. However, no one really knows how aligned with Trump’s expectations Warsh will remain once he starts in his new role.

One thing’s for sure: Warsh’s appointment is a recalibration of the monetary compass that will reverberate through yield curves, currencies and cross-asset correlations. This change could well represent a new era for investment markets.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.