Why the Debasement Trade Matters

Simon Turner

Mon 9 Feb 2026 7 minutesIf you know many gold bugs, and there are certainly more of them around these days, you may have observed that the number of them touting the arrival of ‘debasement trade’ is on the rise. However, this idea is far from being a new or short-term phenomenon, nor for gold bugs’ eyes only. It’s been a simmering issue for years, and is likely to matter for all investors for many years to come.

The Origin of the Term ‘Debasement Trade’

The term ‘debasement trade’ only originated a few months ago in a Guardian article which referred to how investors are piling into assets such as gold, bitcoin and shares amid worries about government debt, central bank independence and the weakness of major currencies such as the dollar.

That shift in narrative coincided with a rare but significant fall in the US dollar. Hence, the notion emerged that investors are taking proactive action to avoid the debasing of their equity holdings in US dollars. The concept of the debasement trade was born.

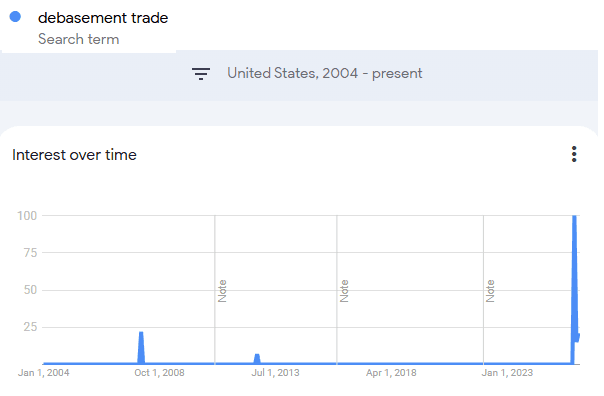

Google search data shows that the term has developed quite a following of late:

As Ken Griffin, founder and chief executive of Citadel, pointed out in October 2025, the debasement trade is having dramatic ramifications across global investment markets:

‘Investors are looking for ways to effectively de-dollarise and de-risk their portfolios vis-à-vis US sovereign risk. Inflation is substantially above target in all forecasts for next year. And it’s part of the reason the dollar’s depreciated by about 10% in the first half of this year. It’s the single biggest decline in the US dollar in six months, in 50 years.’

Why is the Debasement Trade Happening?

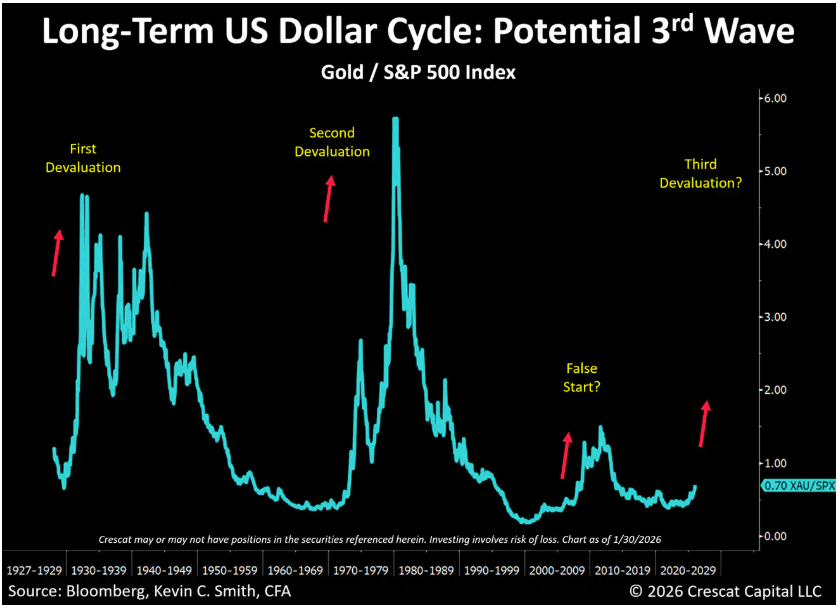

Whilst the term may be new, the concept of devaluing fiat currencies for political or economic gain dates back decades.

The modern debasement trade is arguably the continuation of currency weakening that accelerated many years ago when the world’s major powers moved off gold pegs and embraced discretionary monetary policy.

So the underlying force appears to have been building for decades.

It’s all about debt management.

Governments are increasingly tolerating, and in some cases encouraging, currency devaluation because it eases the burden of high public debt levels, supports economic growth, and protects financial stability. In short, a weaker currency often boosts a country’s exports, lifts its nominal tax revenues through inflation, and reduces the risk of deflation during downturns.

For heavily indebted governments like the US, moderate inflation and gradual currency depreciation are politically easier to accept than spending cuts or defaulting on their debt repayments.

Hence, currency devaluation is an attractive, if implicit, policy tool.

For the same reason, the debasement trade is likely here to stay.

The Government Bond Dilemma

The asset class most negatively impacted by the debasement trade is government bonds, particularly in the US.

Over the past five years, US Government bonds suffered their worst period of performance ever with a 40%+ fall on a nominal basis, and a much worse result on an inflation-adjusted basis.

Meanwhile, both risk-on and risk-off assets ranging from equities to gold and bitcoin have massively outperformed government bonds, driven by monetary expansion and investor preferences for real or scarce stores of value.

The asset allocation implications have been hard to ignore.

Investors who used to allocate to long-duration government bonds as a defensive play have been forced to reconsider whether that’s still realistic. Or are the defensive attributes of government bonds being eroded by the pace of money supply growth?

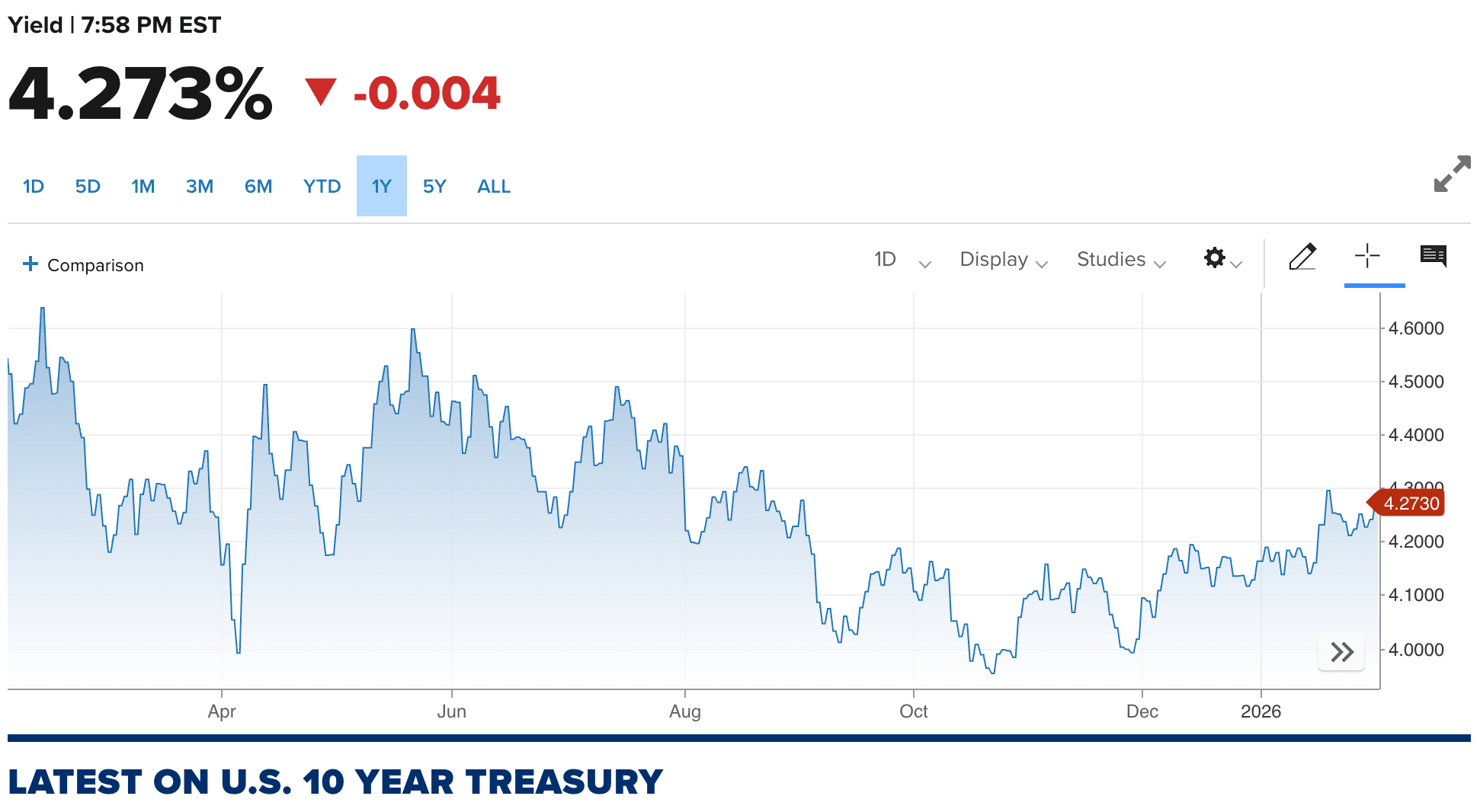

For example, if the broad US money supply is expanding at 4.2% p.a. while 10-year US government bonds yield only 4.27%, the real purchasing power of cash and bonds is close to zero.

In other words, nominal interest alone barely protects investors against currency debasement.

Hence, the importance of evaluating not just nominal bond-fund and ETF yields but real returns after adjusting for broad money expansion and inflation expectations.

In an environment in which central banks may maintain or resume accommodative measures to support liquidity and economic stability, nominal rates may offer attractive coupons while still lagging the underlying rate of monetary expansion.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Debasement Trade Investor Checklist

If the debasement trade is indeed a longer term macro theme, here’s a checklist to help investors use it to their portfolio’s advantage:

- Reconsider Duration Exposure & Its Portfolio Purpose

Investors may need to reconsider their duration exposure, especially in funds and ETFs that are sensitive to interest rates which may be more likely to rise rather than fall longer term.

If that’s the case, bond proxies and other interest rate sensitive assets may not reliably mitigate equity risk, especially during macro stress episodes that trigger liquidity repricing.

- Be Aware of Likely Central Bank Responses

The debasement trade narrative is inextricably connected with central bank policy signals, particularly from the Fed.

On that note, recent stress in repo markets led the Fed to end its balance sheet reduction and consider resuming growth in asset holdings at a measured pace that aligns with nominal GDP growth.

This strategy of gradually rising liquidity suggests that central banks may provide a backstop to markets, albeit without replicating the aggressive quantitative easing of past cycles.

For investors, this suggests that a consistent floor under market liquidity could persist.

If this remains the case, assets sensitive to liquidity conditions such as equities could outperform in nominal terms even if their real returns are compressed by broader monetary expansion.

- The Era of Hard & Scarce Assets is Here to Stay

If money supply continues to grow faster than the real output of the global economy and investors keep searching for stores of value that are insulated from sovereign currency risk, allocations to hard and scarce assets such as gold and bitcoin are likely to play a growing hedging role in diversified portfolios.

Whilst gold has been outperforming for some time now, this core debasement trade could last for a number of years, albeit with ups and downs along the way.

- Exchange Rates Likely to Impact Portfolio Returns More Than Ever

Against this macro backdrop, portfolio returns are likely to be more impacted both positively and negatively by currency movements, which are likely to become more volatile.

In particular, the interplay between US monetary dynamics and AUD valuations is likely to matter for Australian investors.

For example, a weaker US dollar driven by the debasement trade may lead to AUD strength in risk-on environments, affecting currency-hedged ETF and fund performance and resource-linked sectors that are sensitive to commodity price shifts.

💡 Tip: Australian investors in global funds and ETFs should generally invest in hedged funds and ETFs if they believe the AUD is likely to strengthen longer term against the currencies the funds are exposed to. And vice versa. Investors who believe the AUD is more likely to weaken, unhedged exposure is likely to be better. And for investors who don’t have an opinion, it’s generally advisable to invest in hedged funds and ETFs to ensure currency doesn’t cause any nasty surprises.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Nothing is Likely to Stop This Train

Ultimately the debasement trade is less about a short-term tactical call and more about the evolving structure of the global financial system. It invites investors to think beyond cyclical narratives and consider how money supply, interest rates, liquidity policy and valuation frameworks are likely to interact over decades rather than shorter term cycles.

For investors focused on long-term wealth preservation, it’s arguably time to rebalance their portfolios towards funds and ETFs that offer real yield or scarcity value, while recalibrating duration exposure, and integrating currency and liquidity dynamics into portfolio construction.

Recognising where the underlying mechanics are changing is the first step towards thriving rather than surviving in this evolving market environment.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.