The One Habit That Builds Wealth Faster Than Any Other

Simon Turner

Tue 17 Feb 2026 6 minutesThere’s a crossroads in the financial lives of most households when wealth growth is either ignited or postponed. It’s a single habit shift that’s simple, and far from glamorous.

It happens on a monthly basis when a household’s income hits their bank account. That’s when everyone has an important choice to make. Do you spend a portion of your monthly income first and hope you can maintain your discipline for the rest of the month? Or do you save and invest first, automatically, before you start spending?

That single, seemingly innocuous decision is likely to have a greater impact on your long term wealth building than any other.

Why This Matters

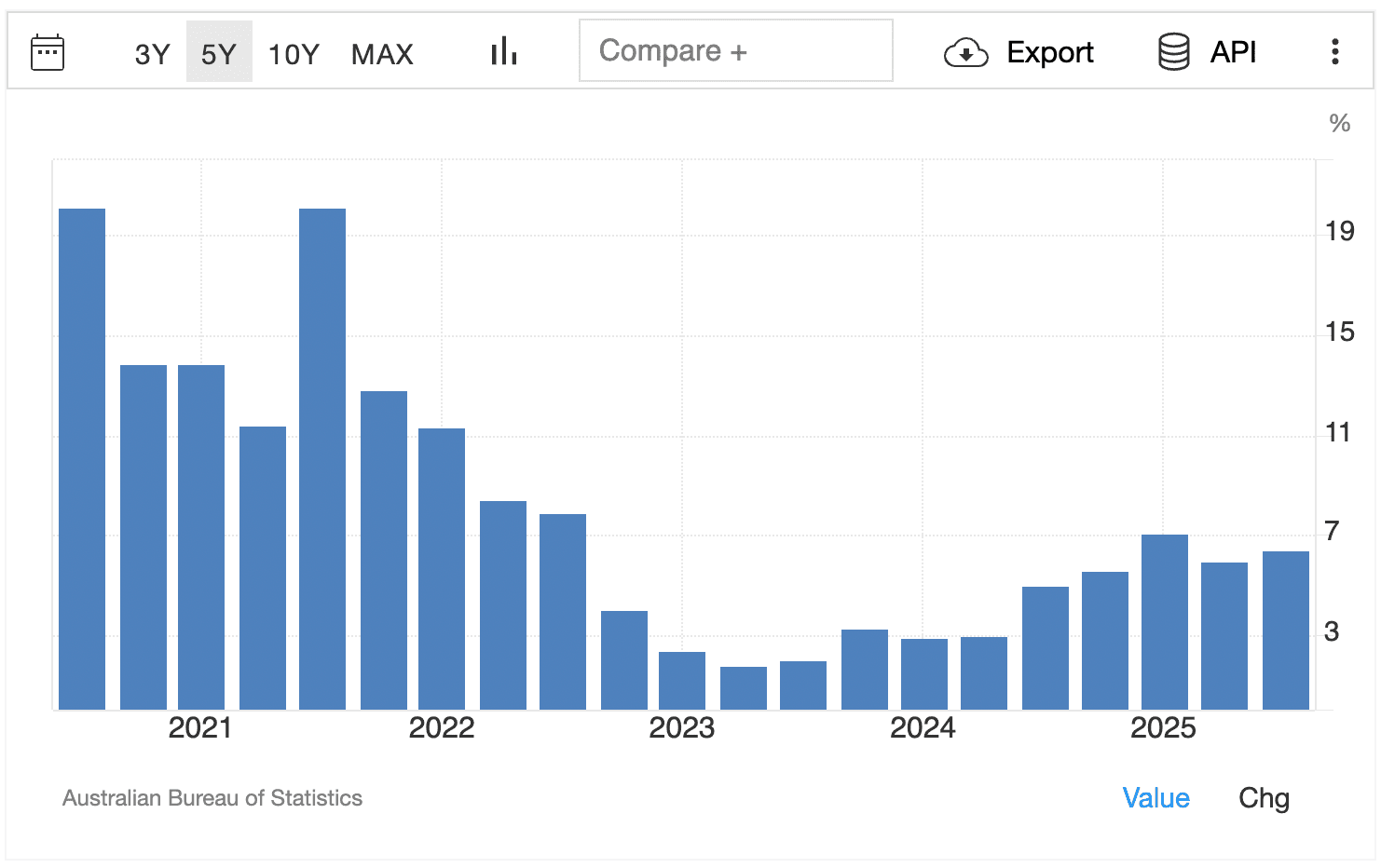

Australian households are living through a long lesson in why this matters. The household saving ratio remains historically low, particularly compared with the post-pandemic highs. In the September 2025 national accounts, the ABS put the household saving ratio at 6.4%, a far cry from the high teens in 2021 and 2022.

When making ends meet is challenging and the cost of living keeps rising, saving what’s left over is a fragile strategy. So an investment plan that depends on willpower is destined to fail precisely when conditions are hardest.

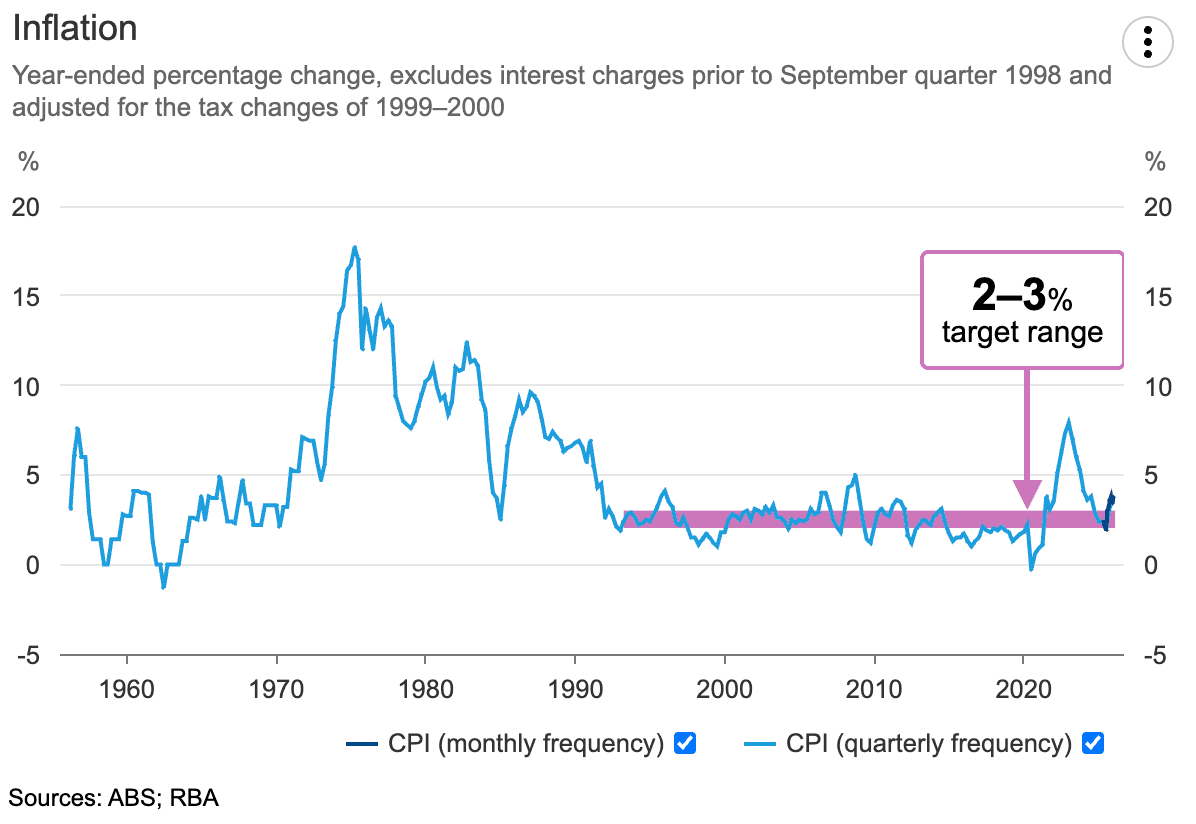

This is one of those times. Inflation, the arch-nemesis of saving, is proving sticky. Australian inflation was 3.8% in 2025, well above the RBA’s target range of 2-3%.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Bring the Odds of Success Back into Your Own Hands

There’s one particular habit that brings your long term financial success back into your own hands.

It’s so simple, so mechanical: automate the monthly investment that funds your future self.

Make it happen on payday. Not after a month of exhausting financial decisions.

This isn’t just one of those over-quoted pieces of wealth-building advice that sound good in theory, but means little in the real world. There’s plenty of data that shows it’s a game-changer for investors.

One of the most useful contributions of behavioural economics was to show that self-control is not a character trait you either possess or lack. It’s a habit you develop and either chose to stick with or ignore.

Case in point: Richard Thaler and Shlomo Benartzi created the ‘Save More Tomorrow Program’, which asked workers to commit in advance to lift their retirement contributions when they next received a pay rise. 78% of those offered the plan joined, 80% stayed through the fourth pay raise, and average saving rates rose from 3.5% to 13.6% over 40 months. That was an engineered behaviour improvement which translated into the desired habit change and wealth increase.

Australia’s superannuation system is another illustration of how effective this type of mind-set shift can be.

Whatever your view of the policies behind it, superannuation is the country’s most successful ‘pay yourself first’ system. The key point is that contributions occur before the money becomes spendable. In other words, the system forces a sequencing decision in favour of workers’ future wealth.

Wealth Building is Boring

One of the harder lessons for many younger investors to learn is that really effective wealth building tends to be boring.

The investor who contributes steadily, through dull months and chaotic ones, tends to capture the one thing no forecast can replace: time in the market.

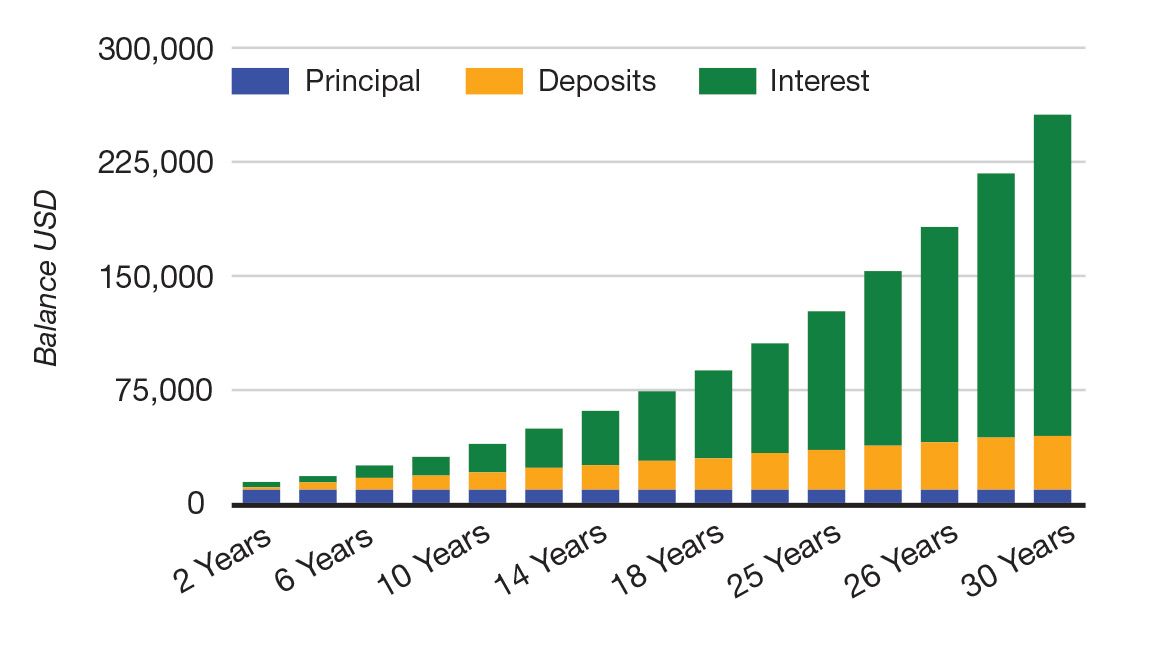

And time in the market allows something remarkable to happen: compounding.

Einstein once famously referred to compounding as the eighth wonder of the world and it’s easy to see why. Investors who keep investing each year, and remain invested for the very long term, benefit from the profound growth generated by a rising return on a rising capital base. As shown below, the power of compounding over longer time frames is extraordinary.

One of the easiest ways to benefit from the power of compounding is to ensure you’re investing on a regular basis, preferably monthly.

Automated investing is simply dollar-cost averaging with discipline baked in.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Consistency = the Real Edge

Automated investing on a monthly basis is arguably the most accessible edge available to most investors for the simple reason most investors fail at being consistent.

A well-constructed portfolio that receives irregular contributions is like a high-performance engine that rarely gets fuel.

In contrast, an unexciting, diversified portfolio that’s topped up automatically generally outperforms over the long term.

Hence, automating your investing before you spend is a game-changing habit for investors focused on wealth accumulation. Even small, regular contributions make a significant difference over the long term.

The key takeaway is that this strategy of consistency shouldn’t be open to debate. The monthly contributions should survive busy weeks, volatile markets, family expenses, and the daily frictions that gnaw away at best-laid plans.

An Easy Starting Point

If you’re ready to put this into practice, start with your monthly pay cycle.

Set an automatic transfer on the day your salary arrives into a dedicated account that feeds your investing plan, whether that’s inside or outside of your superannuation. And set an automatic investment into broad, liquid, low-cost funds or ETFs that suit your risk tolerance.

Investing for your Future Self

In an investing world obsessed with optimisation and sophistication, automating your investing may sound too simple to be meaningful.

But the highest-returning investment habits are rarely the ones that sound clever at a dinner party. Yet, they keep working when you’re tired, distracted, or anxious, and when markets are doing their best to turn long term investors into short-term decision-makers.

Pay yourself first, automatically, and let your portfolio do what all long term portfolios should do: compound into a much bigger portfolio that will allow you to meet your financial goals.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.