Could This Relatively Unknown Asset Class Be the Answer to the $3 Million Super Cap?

Ankita Rai

Thu 17 Jul 2025 5 minutesThe planned new tax on super balances over $3 million has prompted many high-net-worth investors to reassess their investment strategies.

With the tax rate on the affected portion of earnings set to rise to 30%, there’s a surge of interest in tax-efficient and flexible ways to build and protect wealth within an increasingly complex superannuation system.

One option quietly gaining traction is investment bonds. They’ve been around for decades, but for investors with larger balances, especially those nearing retirement, investment bonds can offer a compelling mix of options that traditional super can’t always match.

The Rise of Investment Bonds

Like super, investment bonds are a tax-advantaged way to hold assets and can be tailored to suit investors’ specific personal needs. You can choose from a range of investment options across asset classes like property, shares, and fixed interest.

While the tax benefits aren’t quite as generous as super (with tax on earnings capped at 30%), investment bonds come with far fewer restrictions and sit entirely outside the super system. That means no Division 296 tax, no death benefit tax, and no contribution limits or rigid withdrawal rules. You retain full control over how much you invest and when you access your funds.

Here’s why investment bonds are gaining a greater following:

a. Tax Benefits That Grow with Time

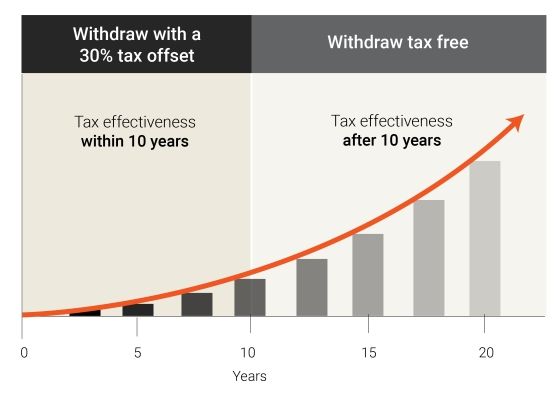

One of the standout features is that you don’t have to pay personal marginal tax on investment bond earnings each year. The investment fund takes care of the tax until the bond is cashed in. Alternatively, if you hold your investment bonds for more than ten years, you may not have to pay any tax at all, as shown below:

Even if you withdraw earlier, a 30% tax offset typically applies for tax already paid within the bond, which can soften the blow, especially for those on higher marginal tax rates.

While there’s no limit on your initial bond investment, future contributions are capped: you can only add up to 125% of the previous year’s amount. Breaching this limit, skipping a year, or withdrawing within ten years could reset the ten-year tax-free period.

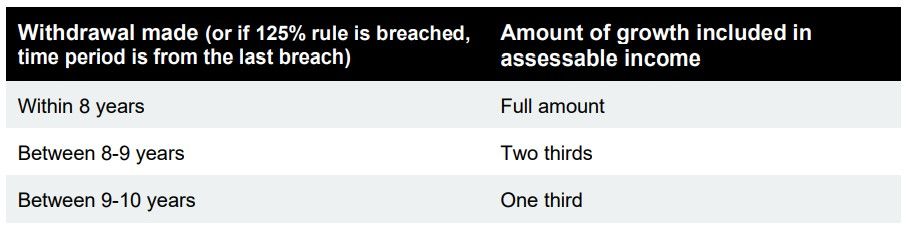

Withdrawals made within ten years of starting, or within ten years of breaching the 125% rule, are taxed as shown in the table below:

When it comes to estate planning, investment bonds can make life a lot simpler. Because they’re structured as life insurance policies, they fall outside of will territory and go straight to nominated beneficiaries, minimising disputes.

Unlike super, where tax-free death benefits are only for dependents, investment bond proceeds can be paid tax-free to any beneficiary. You can even set up a bond in a child’s name or transfer it later without resetting the ten-year clock, making them a handy tool for intergenerational wealth transfer.

This structure makes bonds especially appealing once you’ve hit your super contribution limits. Compared to investing in your name, where tax rates can reach 45% plus the Medicare levy, that 30% cap starts to look a lot more attractive.

Of course, it pays to weigh up the costs, control and long‑term flexibility, but for many, the certainty around estate planning makes investment bonds worth considering.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Catch with Investment Bonds

Despite their appeal, investment bonds aren’t a cure-all. If your marginal tax rate is already low, shifting money out of super and into an investment bond might not stack up. Couples with surplus cash may find it simpler and cheaper to invest in the name of the partner on the lower tax rate, rather than use an investment bond.

But if your marginal tax rate is above 30%, investment bonds become much more attractive, especially if you plan to hold them for at least a decade.

Of course, there are trade-offs. Investment bonds often carry higher fees due to their structure. And while super funds offer hundreds of investment options, investment bonds usually have a more limited menu.

Your retirement timeline matters, too. Super withdrawals are typically tax-free after age 60. If you’re planning to hold your investments until retirement, you may be on a much lower tax rate by then, making the capital gains exemption inside an investment bond less valuable.

Are Investment Bonds Right for You?

Investment bonds aren’t always the most tax‑efficient option for everyone.

Their appeal is strongest for higher‑income earners staring down the $3 million cap, or for those prioritising flexibility, control and smoother wealth transfer.

There is no silver bullet, but with the right approach, they can be a genuine contender for investors looking to diversify amid the superannuation changes.

As always, the best strategy is the one that fits your personal investment goals.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Investment Bonds Worth Checking Out

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.