The CRED advantage: equity-like returns with the security of debt

Ankita Rai

Fri 22 Nov 2024 5 minutesWith interest rates remaining elevated, commercial real estate debt (CRED) funds have emerged as an increasingly attractive option for investors.

Offering stable, income-generating opportunities and attractive, risk-adjusted returns, these funds are gaining ground as one of the fastest-growing segments of the private debt market.

Despite challenges in the broader real estate sector, including declining office valuations, structural tailwinds like housing undersupply in key markets, population growth, and the rise of e-commerce and data centres are driving long-term demand for CRED.

What are commercial real estate debt funds?

CRED funds are investment vehicles that pool investor capital to provide loans secured against commercial properties such as office buildings, retail centres, industrial facilities, and residential apartment complexes. These loans finance the purchase, development, or refinancing of these properties.

The commercial real estate debt opportunity

Recent market dynamics and structural changes have reshaped the commercial real estate debt landscape.

Rising interest rates have disrupted projects and caused builder failures, making financing harder to secure. At the same time, major banks are retreating from real estate lending due to tighter regulations and compliance requirements.

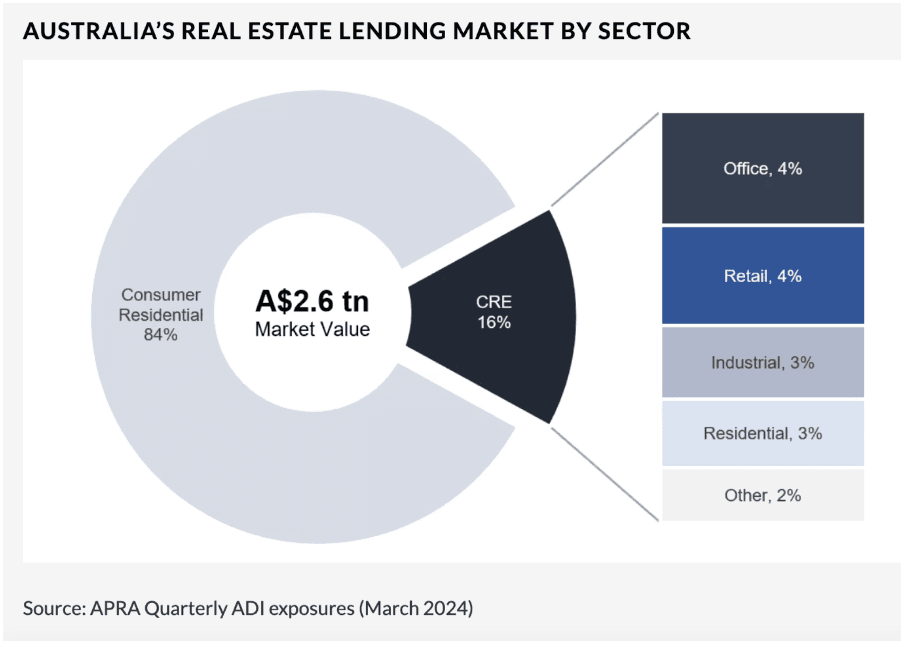

Yet, these challenges have created opportunities. The CRED market, valued at around $450 billion, is growing steadily at 2-5% p.a.

This growth is supported by strong demand for property amid housing shortages and the expansion of e-commerce, which has driven the need for larger, modern warehouse facilities.

With traditional lenders scaling back in this market due to regulatory reasons, non-bank lenders are stepping in to fill the gap. The sector has grown at a robust 7.9% p.a. since 2013, fuelled by borrower demand and investor interest in private debt opportunities.

According to Foresight Analytics, non-bank lenders now hold 16% of the market ($74 billion), up from 10% in 2020, and their share is expected to double over the next five years.

The growth of retail and industrial real estate further supports this positive outlook. While lower-grade office spaces remain challenging, industrial properties continue to perform well, providing an additional avenue for strong, consistent returns.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Attractive returns with risk mitigation

What makes CRED unique is its ability to encompass three asset classes: fixed income, property, and alternatives, which makes it particularly appealing to investors seeking lower capital volatility than equity, especially in the current high-interest rate environment.

Moreover, with yields of 5-9% p.a., private CRED presents an attractive opportunity, offering regular monthly or quarterly payouts.

Though often viewed as complex and opaque, these funds are backed by tangible commercial properties, providing a layer of security for investors. In the event of default, CRED investors are prioritised in the capital structure, meaning they are repaid before equity investors, as shown below.

CRED tends to perform strongly in higher interest rate environments, whereas other real estate investments such as A-REITs may face challenges. CRED funds can offer similar or even higher yields while providing greater capital preservation and lower exposure to the risks typically associated with equity investments.

For instance, Zagga CRED Fund has a targeted net return of 4% p.a. above the benchmark while Lambert Capital Property Credit Fund's target return is 7-10% p.a.

There are also funds like the RAM Australia Healthcare Opportunity, which offers investors exposure to sectors such as healthcare with limited exposure to negative macroeconomic factors, along with total target returns in the range of 12–14% p.a. over a 3-year period.

Understanding the risks

While CRED funds offer attractive returns, they also come with risks that require careful consideration.

Although senior debt has the highest priority or first claim, not all credit investments are created equal. Larger or more complex projects, particularly those with longer timelines, tend to carry higher risk.

Another key risk is credit risk, which arises if a borrower fails to repay the loan. Even though CRED funds are backed by tangible property assets, if the sale proceeds from the property fall short of covering the debt, investors may face losses.

Borrower default is also a risk—if the borrower defaults, there may be shortfalls if the sale of the collateral doesn’t fully cover the loan. This could lead to missed monthly payments, and a loss of principal.

Additionally, liquidity risk is an important consideration. Once invested in a CRED fund, investors typically cannot access their capital until the loan term expires, which can range from several months to years. This can be challenging for investors if market conditions change or if liquidity is needed in the short term.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The role of CRED funds in a diversified portfolio

Incorporating commercial real estate debt funds into a well-diversified portfolio can provide significant benefits, especially for those seeking equity-like returns with the security of debt.

With their counter-cyclical returns and low or negative correlation to other asset classes, CRED funds can help stabilise and improve overall portfolio performance.

However, like any investment, it's crucial to approach CRED funds with caution and conduct thorough due diligence to properly manage potential risks.

For investors looking for a balanced approach to real estate exposure and capital preservation, professionally managed CRED funds are worth considering as a valuable addition.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.