Supercharge your portfolio with these 5 powerful tailwinds

Simon Turner

Wed 1 May 2024 6 minutesBeing aware of major investment themes at play often makes the difference between investing with a tailwind behind you versus a headwind in front of you. Needless to say, investing with the benefit of structural tailwinds is a much easier pathway to investment success.

As such, ensuring your portfolio is suitably exposed to the five investment themes below could help supercharge your portfolio over the long term.

1. The energy transition gathers pace

Despite a couple of challenging years for the energy transition investment theme, it’s still happening and remains positioned for enormous growth looking forward.

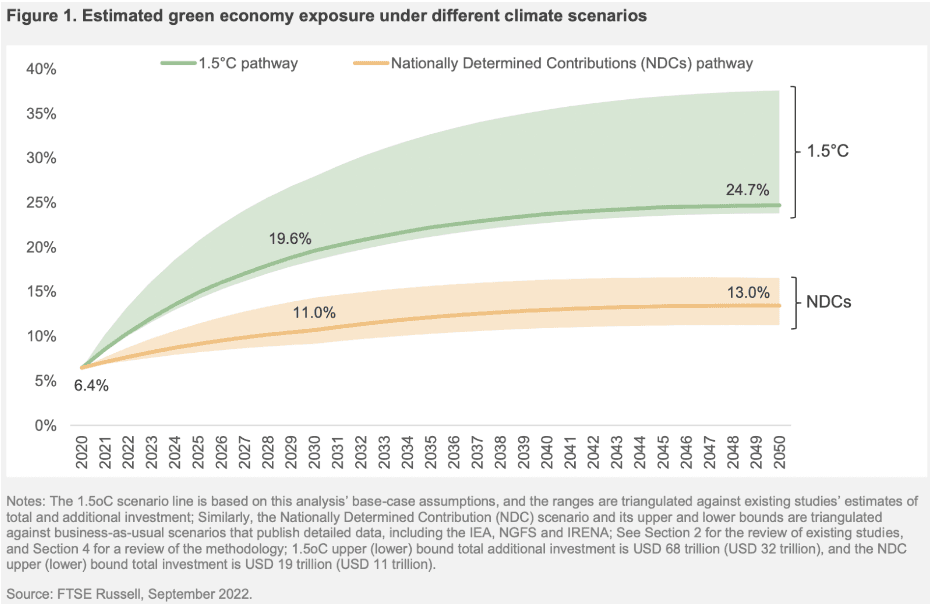

As shown in the chart below, if we’re to limit global warming to 1.5°C by 2050, FTSE Russell estimate that 24.7% of the global listed market capitalisation in 2050 is likely to be linked to the energy transition. That implies a quadrupling of the portion of the global market capitalisation participating in the energy transition over the coming twenty-seven years.

So the energy transition is positioned to remain one of the most prominent and compelling global investment themes over the coming decades. The main beneficiaries are likely to be involved in renewable energy, low-carbon transport, energy-efficient buildings, the electrification of industrial processes, and recycling.

2. Inflation to remain higher for longer

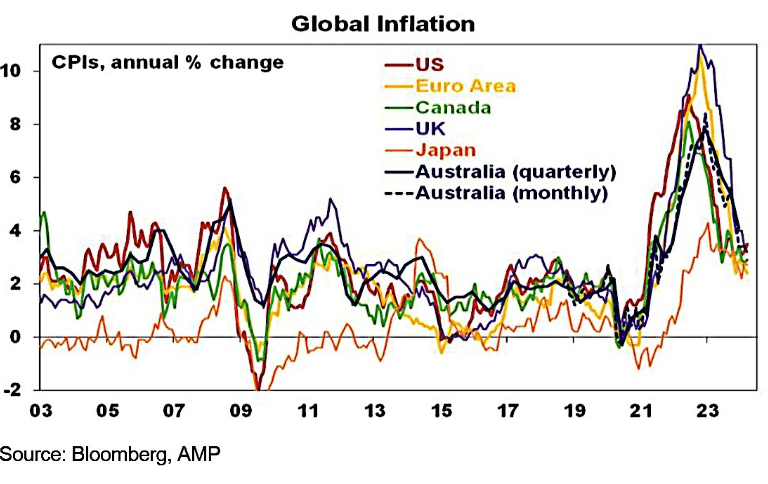

Despite central bankers’ best attempts at quashing inflation, it remains above their targets (2-3% for the RBA, 2% for the Fed) and appears to have bottomed, at least in the short term:

There’s no escaping the fact that central bankers may not be controlling the inflationary strings as much as they’d like. In fact, recent OECD research highlights that the main source of inflation may be corporate profiteering. The term ‘escuseflation’ has emerged to describe how the corporate world has justified higher prices in recent years as a strategy to pass on rising costs to consumers and thus generate higher margins.

This inflationary narrative is being reinforced in consumers’ minds by the media and other economic agents. It’s already rare to read a news story which doesn’t highlight the downsides of inflation or the ‘replay of the 1970s’ narrative. These stories serve to add fuel to consumers’ existing fears and memories of inflation. This is exactly the playbook via which structural inflation becomes a self-fulfilling prophecy which eludes central bank control.

Investors who believe inflationary risks lie on the upside may be well advised to focus on assets which have historically outperformed during periods of structurally high inflation – e.g. real assets such as property and commodities, and equities with strong pricing power.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

3. AI to gather momentum

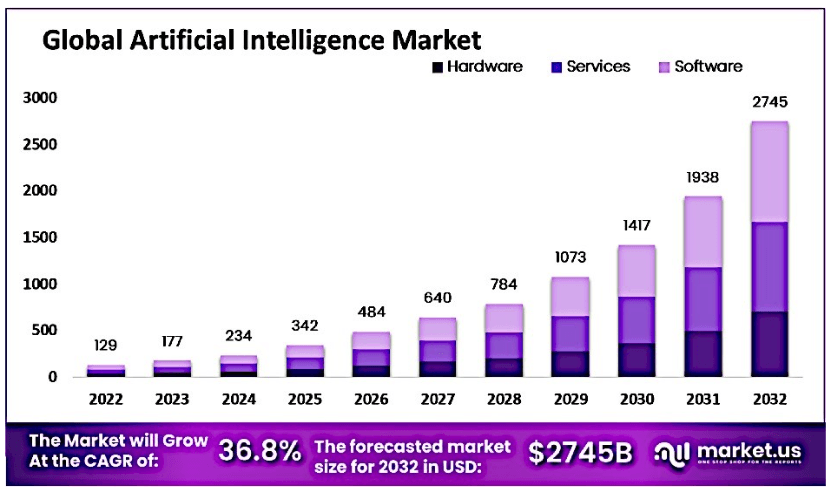

The potential of the global AI market has been a growing investment theme in recent years—and for good reason. The magnitude of the AI investment opportunity is enormous:

AI is a rare investment theme in that it offers the entire corporate world the potential to improve efficiencies, boost margins, and grow earnings per share. So it won’t just be AI companies who benefit, there are also broader global economic upsides associated. In other words, this is the type of structural investment theme that has long-term legs, albeit with many ups and downs likely along the way.

Investors aiming for high quality AI exposure are generally focused on US-listed sector leaders such as Nvidia, Super Micro Computer, AMD, Tesla, and Palantir.

4. Gold re-emerging as a preferred store of value

For centuries, gold was the ‘go to’ real asset investors bought when they wanted to store and grow their wealth.

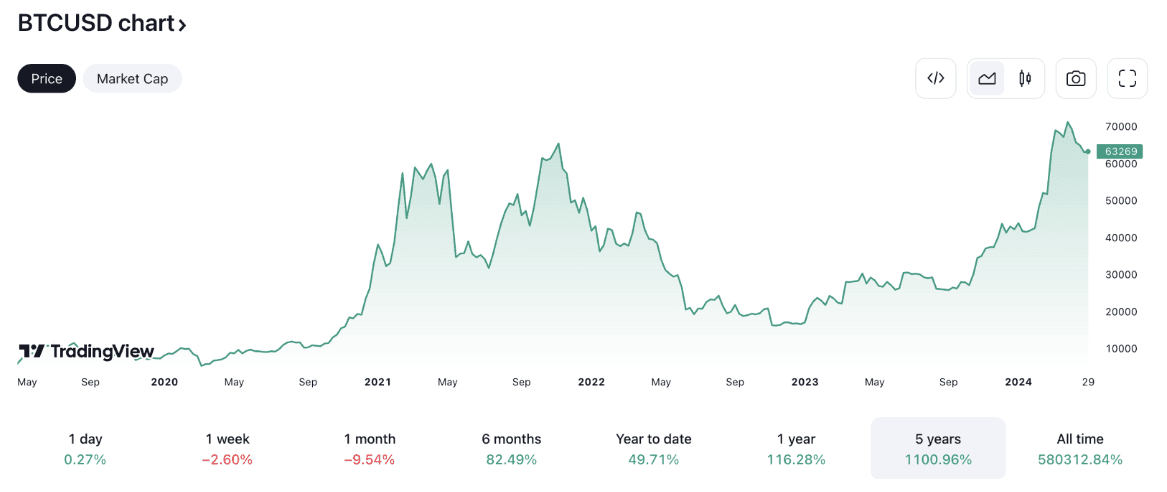

Then cryptocurrencies entered the fray, and offered an alternative independent store of value outside of the control of the world’s governments and central bankers. The popularity of Bitcoin led to a growing number of investors to believe that gold had become a relic of the past:

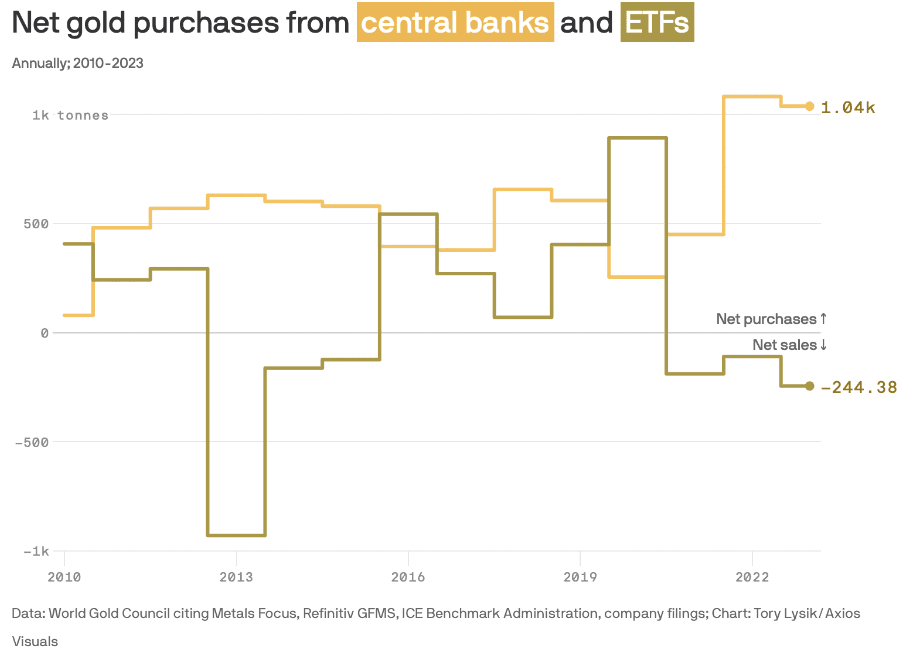

But there’s been a noteworthy development over the past couple of years which may suggest it’s premature to write gold off … central bankers have been loading up on gold on an almost monthly basis over the past couple of years while ETF investors have actually been selling:

The Chinese, Indian, Turkish and Kazakhstani central banks have all been noteworthy gold buyers in recent months to diversify their reserves away from their paper currencies while gaining liquidity from a ubiquitous asset without credit risk.

It’s also likely that these central bankers are watching global debt levels, particularly US Government debt, with a growing awareness that it’s unlikely to be repaid unless more money is printed. That would further stoke inflation while creating an effective a race to the bottom for many leading currencies. In that context, owning gold is a compelling strategy to protect and stabilize central banks’ reserves.

These central bankers may well be onto something. If the wider investment community follow their lead, gold’s recent outperformance could be the beginning of a longer term trend.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. War cycle rising

The Ukraine war changed everything from a global geopolitical risk perspective. Ever since it started, the western world has been hoping for a Ukrainian victory and a resumption of peace in the region. However, more than two years later, the war is still raging and the outcome remains as uncertain as ever. And the recent conflict between Israel and Hamas has only served to compound the world’s mounting geopolitical risks.

Whatever happens in Ukraine and the Gaza Strip, one thing’s clear: the global war cycle is rising. And with the US Government’s debt levels entering unsustainable territory, America’s long-held position as the world’s policeman is becoming more challenging to fulfil.

Most people would agree that war is a disaster for all involved. So the only beneficiaries from a rising war cycle appear to be leading defence players such as Boeing, General Dynamics, Lockheed Martin, Northrop Grumman, and Raytheon, although these businesses may violate investors’ ethical standards.

The other investment theme a rising war cycle connects with and accentuates is higher inflation since war tends to add to inflationary pressures.

Position your portfolio to benefit from tailwinds

It’s certainly not a boring time in the investment world.

The good news for investors is that volatility and change often translate into investment opportunity. On that note, these five powerful investment themes are shaping up as structural in nature so positioning your portfolio to benefit from them could prove fruitful over the long term.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.