Profiting from the energy transition

Many investors are aware that climate change is an important investment theme. But few are aware of the investment implications of the acceleration in the energy transition we’ve witnessed over the past couple of years. Like a watched kettle that’s taken many years to boil, many investors have taken their eye off the ball at the very moment boiling point has arrived in the energy transition space.

It’s time for investors to take note…the energy transition is game on from an investment perspective.

Why climate change is a high priority investment theme

The Intergovernmental Panel on Climate Change (IPCC), which is leading the global scientific assessment of climate change, estimates that human activities have already caused around 1°C of global warming above pre-industrial levels.

If global warming continues at the current rate, the IPCC estimates it will reach 1.5°C above pre-industrial levels between 2030 and 2052. If that happens, the climate-related risks for natural and human systems will rise. That means we’re on track for more extreme weather events, sea level rise, biodiversity loss, and climate-related health risks such as food and water insecurity in the coming years.

The more sobering news is that the UN has highlighted if we continue on the current global emissions trajectory without taking the required action, the world is on track for even more extreme warming of over 3°C by the end of the century. That would mean we’re on track for more extreme impacts such as prolonged heatwaves and droughts. This longer term business-as-usual scenario of 3°C warming is regarded as disastrous by most scientists.

Hence, the transition toward a low carbon world has become a high priority issue for most governments, countries, and companies—as well as the global investment world.

The importance of net zero

You may have heard the term “net zero” being mentioned more in the media of late.

Net zero means a state of net zero carbon dioxide emissions. In other words, by using less carbon, or removing it, the objective is to achieve carbon neutrality so we are no longer releasing carbon into the atmosphere. You’ll hear this term more often because it is core to the long term global objective the IPCC has presented.

The IPCC estimates that if we are to limit global warming to 1.5°C, global carbon dioxide emissions need to decline 45% by 2030 versus 2010 levels. And they estimate we’ll need to achieve the much talked about state of global net zero emissions by 2050. That may sound like a long time in the future, but twenty-seven years isn’t a long time to address a challenge of this magnitude.

As a result, the vast majority of listed (and unlisted) companies are targeting net zero emissions by 2050 or earlier. At the same time, many companies are aiming to benefit from the vast array of business opportunities created by this transition toward net zero.

Climate commitments poles apart from climate action

Government climate change commitments are also a key consideration. In recent years, there’s been a significant raising of the bar on this front thanks to a string of successful COP meetings. As a result, most of the world’s carbon emissions have been committed to achieving net zero by around 2050.

However, as the famous expression goes: it’s easy to say, harder to do. The reality is the required global climate change action to achieve net zero by 2050 remains well behind the government commitments. In other words, significantly more investment is needed.

Hence, the energy transition has a powerful structural tailwind behind it which is likely to continue gathering pace over the coming decades.

The clean energy boom is accelerating

None of this is new news.

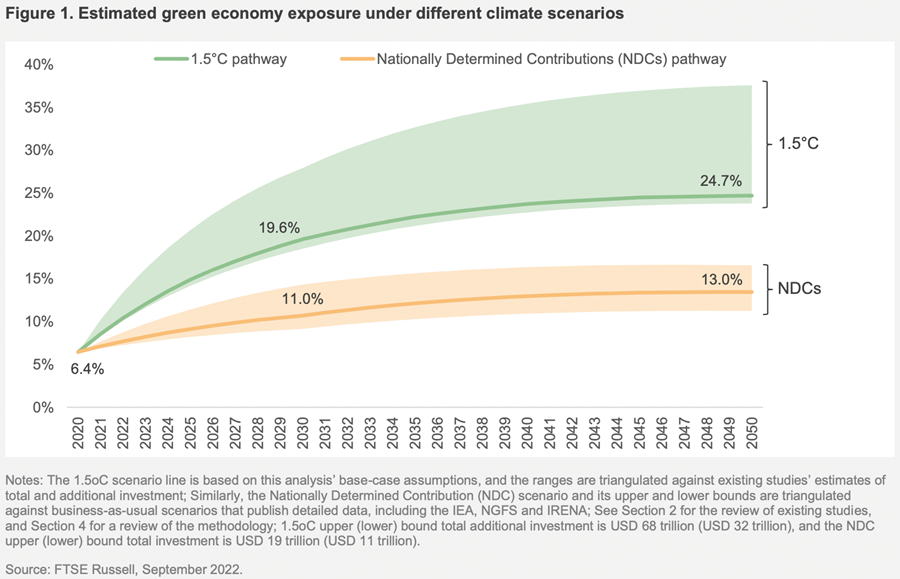

FTSE Russell estimate over $US3 trillion (c.6%) of the global listed equity market capitalisation is already linked to climate and environmental solutions associated with the energy transition. At the same time, revenue from green products and services have grown by 5.4% p.a. since 2009, well in excess of the 3.4% p.a. revenue growth achieved by global listed equities in general. So participating in the energy transition has made good business sense for many years already.

Despite this, the growth in the green economy is just getting started. As shown in the FTSE Russell chart below, if we are to limit global warming to 1.5°C by 2050, 24.7% of the global listed market capitalisation in 2050 is expected to be linked to the energy transition. That implies a quadrupling of the portion of the global listed equities market capitalisation participating in the energy transition over the coming twenty-seven years.

Translating that into investment dollars, BNEF estimates a massive $US194 trillion needs to be invested in the global energy transition by 2050. To put that into context, the entire global economy generated GDP of $US100 trillion in 2022, so we’re talking about two years of global GDP being invested in the energy transition over the next twenty-seven years.

Hence, the energy transition is positioned to remain one of the most prominent and compelling global investment themes over the coming decades.

Two key takeaways for investors to be aware of:

A growing portion of global investment opportunities will be exposed to the energy transition in the coming years and decades.

The companies positioned to generate revenues from the energy transition are benefitting from a structural tailwind which is creating above-average revenue growth.

How to profit from the energy transition

As a starting point, the types of companies positioned to benefit from the energy transition are often involved in: renewable energy, low-carbon transport, energy-efficient buildings, the electrification of industrial processes, and recycling.

The good news is there’s a growing universe of listed companies in these sectors which are directly benefiting from the energy transition. The bad news for Australian investors is that the vast majority of these companies are international companies, mainly listed in the US and Europe. However, with most Australian investment platforms providing access to international stocks these days, the global energy transition plays remain within reach for most Australian investors.

By way of example, some high profile global companies positioned to benefit from the energy transition include: Vestas (wind energy), Tesla (electric vehicles), BYD (electric vehicles), Solaredge (solar energy), Trane Technologies (climate technologies), Nexans (electrification), Carrier Global (climate technologies), Energizer (batteries), Eaton (intelligent power), Erex (renewable energy), AGC (sustainable glass), and AcuityBrands (lighting technology). The list goes on and will continue to grow. Please note: these are not investment recommendations.

Energy transition = investment opportunity + impact

With more investors understanding the energy transition is an opportunity to generate outsized long term investment returns, this investment theme is expected to benefit from structural tailwinds for many years to come. This is good news from a climate change perspective as the more investors who profit from the energy transition tailwinds, the more capital will be attracted by the companies addressing the challenge. In other words, the more successful these businesses become, the more likely the global climate change goals are to be met. As a result, the energy transition provides a rare opportunity for investors to generate positive impact whilst potentially generating strong investment returns.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.