Beyond Cap Rates: The New Metrics That Matter for Property Fund Investors

Simon Turner

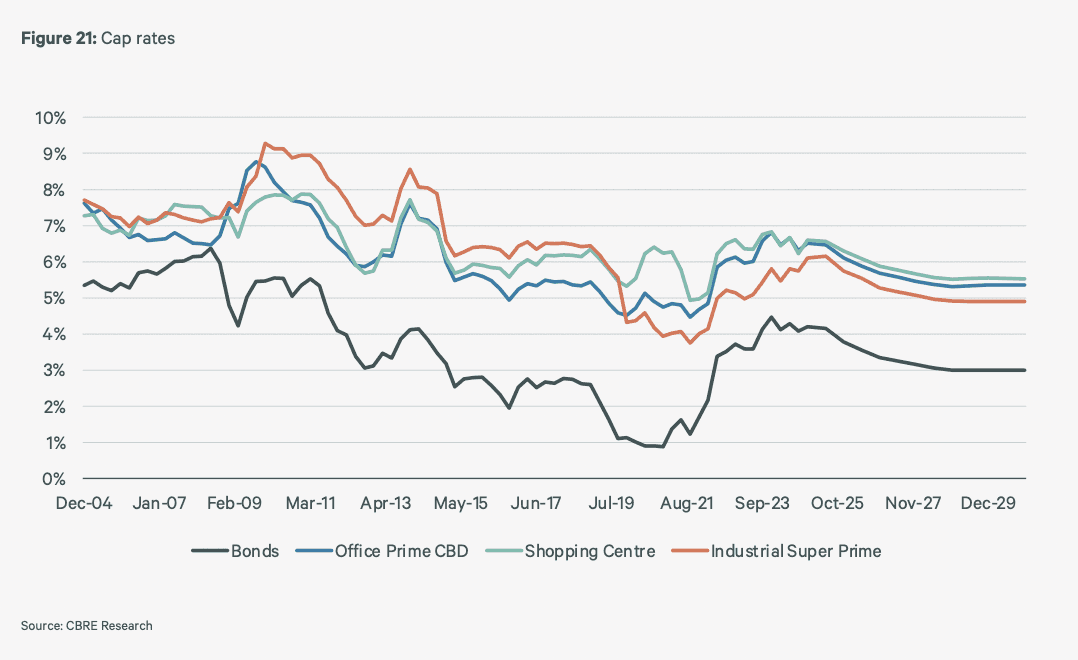

Fri 31 Oct 2025 7 minutesCommercial property investors used to be fixated on one number. For half a century, the cap rate was the North Star of commercial property investing, the single figure believed to capture risk, return and value. On that basis, the picture below used to tell the main story of the various commercial property sectors.

Not so in 2025. Australia’s commercial property investors have learnt that cap rates in isolation tell them almost nothing about asset quality. Lease duration, inflation protection, tenant strength, energy intensity, and covenant resilience determine a property’s real worth.

So the age of fixating on cap rates is over. The new language of commercial property valuations is more nuanced, dynamic, data-driven, and behavioural. Translation: the market is more professional and efficient. It’s good news for investors in the know…

From Yield to Durability

The post-pandemic commercial property challenges have made one truth unavoidable: commercial property income streams, rather than headline yields, are what matter most to investors.

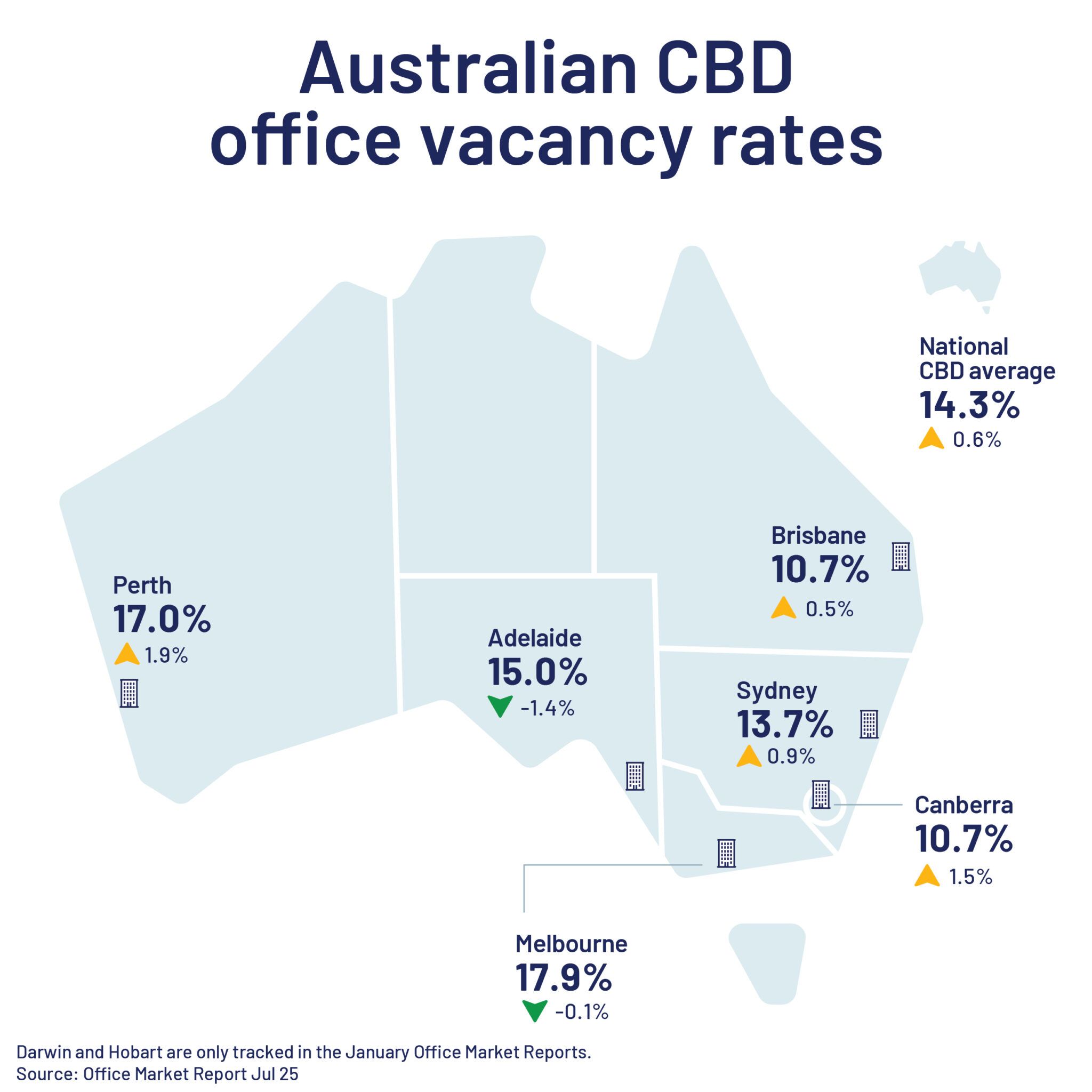

The main driver of this more nuanced approach has been the dramatic divergence in the performance of the main commercial property sectors. In an office property environment with vacancy rates in Sydney and Melbourne’s CBDs at 13.7% and 17.9% respectively, versus national industrial vacancies at a lowly 2.8%, the length and quality of lease covenants is increasingly defining an asset’s defensibility.

As a result, weighted average lease expiry (WALE) has become a focal point in the institutional due diligence process. Not for its technical precision, but for what it implies about asset quality: i.e. higher WALEs are increasingly being equated with higher asset quality. They also spell time for value creation. Property funds targeting WALEs of seven years or more are effectively buying time to refinance, lease all unoccupied space, and adapt. In the slow-moving world of commercial property, that time is valuable.

👉 Investor Takeaway: Avoiding commercial property funds with WALEs of below five years is a prudent strategy to help investors avoid lower quality portfolios. Short WALEs no longer align with the timeframes quality-focused commercial property funds are working with.

Inflation Protection in Focus

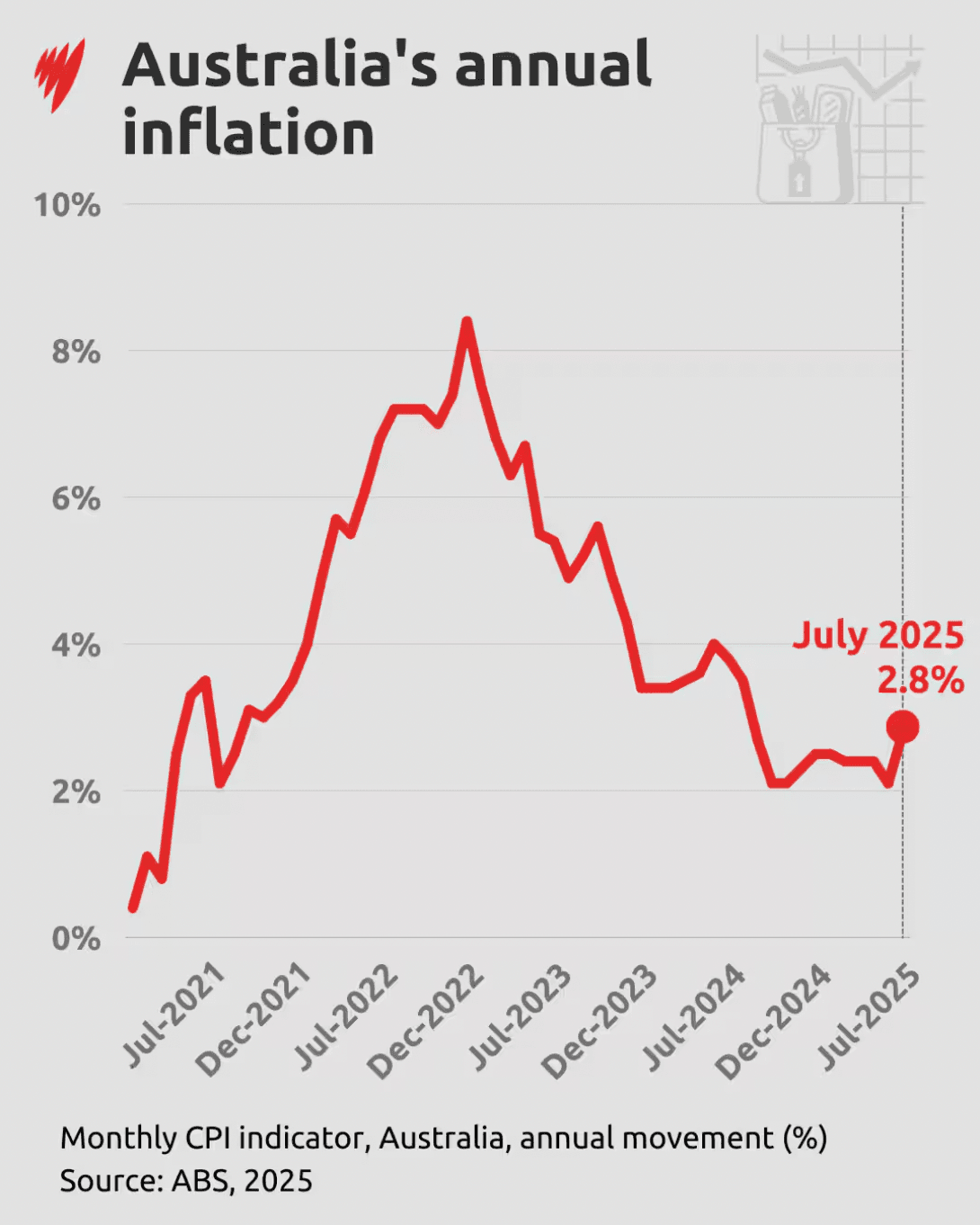

Inflation protection is another important theme commercial property investors are painfully aware of. With Australia’s annual inflation running at 3% p.a. in the year to August 2025, now’s the time to focus on real returns.

As such, many commercial property landlords have rediscovered the CPI-related fine print in their leases. In fact, CPI-linked rent reviews are now prized as built-in inflation hedges. In a 3%+ p.a. inflation world, those clauses are worth as much to most investors as a good location.

👉 Investor Takeaway: The real yields of property funds mean more than nominal yields in an inflationary world. Inflation protection tends to be highest in industrial, medical, and childcare assets. These defensive assets offer investors not just solid nominal yields, but also positive real yields.

A Nuanced Approach to Occupancy

Headline occupancy is another quality illusion which requires a more nuanced approach these days.

For example, building that’s 100% leased but heavily incentivised may be earning less than an 80% leased property with disciplined rent collection.

So high-quality commercial property funds now focus on effective rent, which is adjusted for abatements and downtime, and pair it with a ‘yield spread to cost’, the gap between a property’s stabilised yield and the cost of replicating it. When construction costs rise 30% in one year and yields expand only 50 bps, that spread becomes a measure of both scarcity and prudence.

👉 Investor Takeaway: Not all property fund occupancy is created equal. Effective rent + ‘yield spread to cost’ provides a more useful gauge of asset quality.

The ESG Premium is Real

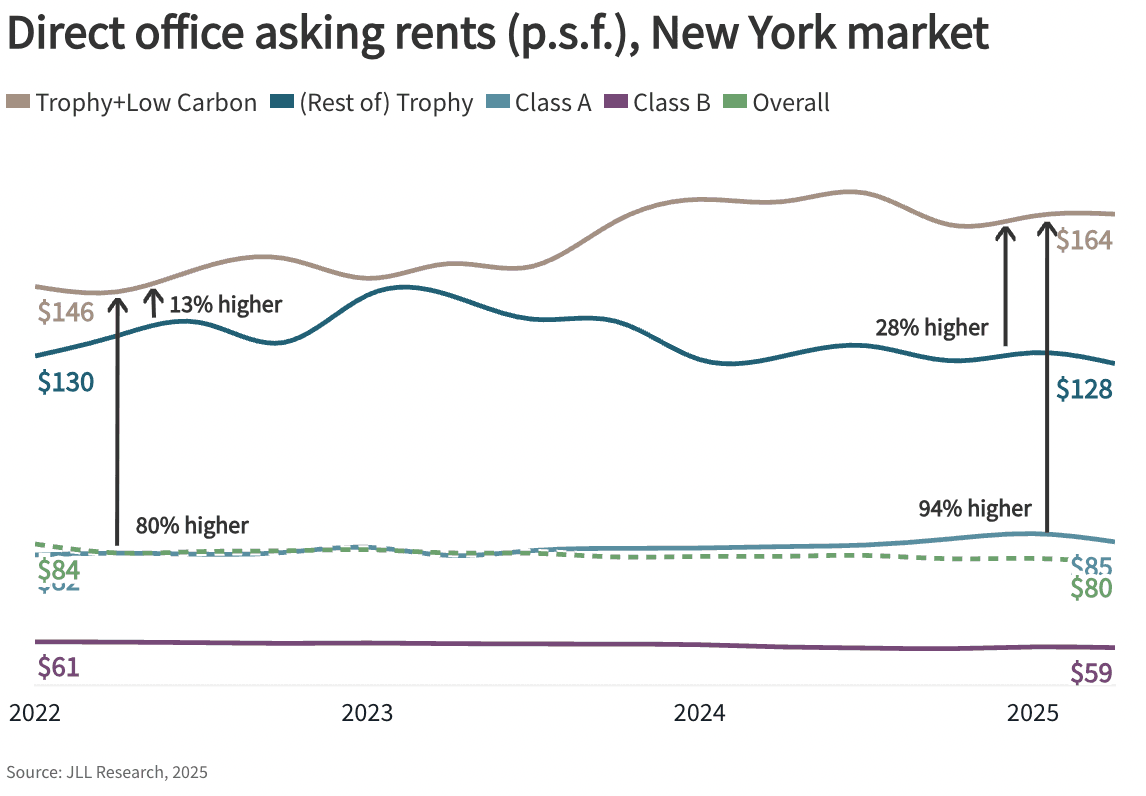

Finally, environmental performance has evolved from a moral preference for commercial property investors into a financial strength. The brown discount is real, and measurable.

For example, recent research shows that low carbon trophy assets in New York generate a 28% rental premium over comparable properties.

That type of premium is hard for investors to ignore.

For example, an 8% cap rate from a weak covenant in a brown building may now be riskier than a 5.5% cap rate from a CPI-linked medical lease in a low carbon building with a 15-year term.

The upshot is that buildings which achieve 5.5-star NABERS ratings with solar integration and efficient HVAC systems are securing longer leases and higher tenant retention.

In addition, institutional investors, particularly super funds, are now demanding portfolio-wide disclosure of energy intensity and embodied carbon. The result is significant valuation premiums for assets that align with Australia’s decarbonisation goals, and early obsolescence for those that don’t.

👉 Investor Takeaway: Best-in-class property funds are leveraging the green premium to their investors’ advantage. And those who aren’t, are suffering from the brown discount. It’s an either/or situation which should guide investors towards the funds with best-in-class sustainability expertise.

Integrating the New Metrics: A Hypothetical Case Study

To illustrate, imagine a diversified commercial property fund considering the acquisition of a $100 million mixed-use asset comprising:

- A 20-storey premium office tower (40% of the estimated NAV);

- A neighbourhood retail neighbourhood centre (20%);

- A medical centre (15%);

- A light-industrial logistics building (15%);

- A boutique resort or tourism component (10%)

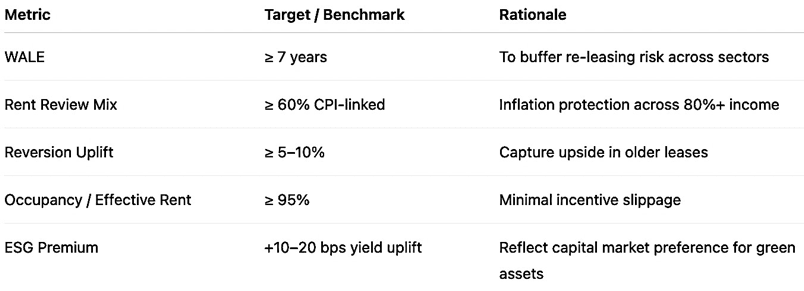

While the proposed acquisition’s cap rate is 6%, here are the more nuanced metrics described above:

So we’re looking at a solid WALE, reasonable inflation protection and potential lease upside, and yield upside from ESG improvements.

During the process the fund also performed a number of scenario stress tests:

- If inflation falls from 3% p.a. to 2% p.a., how will the asset’s expected income be affected?

With 60% of rent being CPI-linked, a 1% fall in inflation knocks 0.6% of next year’s expected income. That’s a small impact. More importantly, the fund is largely protected against a large rise in inflation.

- If the main tenant vacates the office property, how much re-leasing downtime is realistic in a post-pandemic world?

Their analysis suggests twelve months of downtime is a likely scenario, which would knock 30% of the asset’s income in any single year.

- If a green retrofit is mandated in 5 years, what is the likely cost vs the upside?

Their analysis suggests they may need to spend $1 million to generate a $2 million+ valuation uplift as well as a 20% rental premium. That’s a solid return for the fund’s investors and confirmation that ESG is now an important returns driver.

In short, the expected return of property fund assets is no longer purely yield-based. It’s evolved into a quality-adjusted IRR, discounted for leasing and ESG risk. This more nuanced approach provides a multidimensional view of risk and resilience which accepts it’s the quality of income, rather than the quantity, which defines a fund’s long-term performance.

A Market Rich with Opportunity for Informed Investors

Commercial property fund investing used to reward leverage and timing. It now rewards patience and discipline.

The best commercial property funds in Australia, those who own long-WALE social-infrastructure portfolios or mixed-use ESG-accredited assets, are proving that ‘defensive yield’ is not the same as ‘low yield.’ It’s yield that adjusts with inflation, resists long-term vacancies, and is backed by tenants whose businesses are growing.

In this post-pandemic world, the cap rate is not obsolete. It’s just incomplete. The smarter question is no longer ‘what’s the yield?’ but ‘what makes this yield last?’

A Diversified Commercial Property Fund Worth Checking Out

Learn More at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.