Finding the Wood for the Trees Amidst the ETF Universe

Simon Turner

Mon 19 May 2025 7 minutesThey track well-known indexes. They have easy to understand themes. They’re straightforward to trade. Exchange-traded funds (ETFs) are here to stay as mainstream investment vehicles which make millions of investors’ lives easier.

For most investors, choosing the right ETFs can be a pivotal step in building a successful investment portfolio. With the vast array of ETFs available, each tailored to different sectors, asset classes, and investment strategies, selecting the right ETFs requires careful consideration…

Clearing Up a Popular Misconception about ETFs

First, let’s put to bed a popular misconception about ETFs: they’re sometimes portrayed as investments for beginner investors.

That couldn’t be further from the truth. In fact, many of the world’s most successful investors have compounded their returns by dollar cost averaging into top performing ETFs each year.

Even Warren Buffet can see the compelling benefits of employing this strategy with S&P 500 ETFs: ‘I continue to advice investors to buy an S&P 500 index fund…’

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Eight-Step ETF Selection Process

Simple as ETFs are, don’t assume that selecting the right ETFs is as simple as flipping a coin.

There are eight steps to work through. For each step, we’ll reference the example of Trudie, a fifty-five-year old Australian investor, who’s seeking the right U.S. ETF for her balanced portfolio with a ten-year investment horizon…

1. Define your objectives, risk profile & holding period in your investment plan

An investment plan is the non-negotiable starting point for all prudent investment decisions.

For many investors, this step is easier with a financial advisor who can guide you through the process. If you’re doing it by yourself, make sure you write it down, including your investment goals, risk profile, and timeline.

Your investment plan should also include your target asset allocation along with details of your targeted ETF allocation.

Bear in mind that ETFs are low-cost, passive funds which are constructed to perform in line with their benchmarks, whereas active funds are constructed with the intention of outperforming.

Also, remember that longer holding periods reduce the risk of making poor timing decisions on the purchase and sale of ETFs.

U.S. ETF example: Trudie wrote up her investment plan herself and decided to allocate 10% of her portfolio into a U.S. ETF with a ten-year horizon. This allocation is part of her growth-focused equity allocation so she’s looking for a top performing, growth-focused U.S. ETF rather than an income-focused one.

2. Decide on the type of ETFs

Start with understanding the asset class exposure you want given the rate of return you need to achieve your goals, and the amount of risk you’re prepared to weather.

Picking specific parts of the market (e.g. small cap vs large cap) or investment themes (e.g. commodities, AI) requires more in-depth understanding than a broader ETF does and is generally higher risk.

As a result, broad-based ETFs are a better match for most investors.

U.S. ETF example: Trudie doesn’t have sector or thematic expertise, so she wants a broad-based U.S. ETF which is well-diversified rather than a sector or thematic ETF.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

3. Review long-term ETF performance

Of course, the main thing all ETF investors are looking for is strong performance looking backwards and forwards. What matters most are the long term returns after taxes and fees, so focus on the three and five-year performance data.

U.S. ETF example: Most successful U.S. ETFs have generated double digit annual returns over the past five years, although there’s a wide range of returns. Trudie is wisely focusing on the top performers over five years rather than one year.

4. Review ETF fees

You’ll want to find low-cost ETFs because fees are a significant drag on long-term performance. There are several ETF fees to bear in mind, including management fees, and administrative and operational expenses. You should think about these fees on a total cost basis.

In Australia, total ETF fees range from 0.07% to 1.3% p.a. with the average being 0.55% p.a.

U.S. ETF example: Most ASX listed U.S. ETFs charge total fees of 0.4-0.6% p.a., so Trudie is focused on ETFs with a fee structure in this range.

5. Check ETF liquidity

Most investors invest in ETFs with the objective of being exposed to liquid assets they can trade in and out of when required. So it’s worth checking liquidity prior to investing. In general, the larger ETFs tend to be more liquid.

U.S. ETF example: Trudie doesn’t want any liquidity headaches, so she’s focusing on ETFs with at least $1 billion under management.

6. Review ETF turnover

Turnover refers to how often the underlying ETF holdings are rotated. ETF turnover is typically caused by rebalancing, or if there’s a periodic rerunning of the security selection criteria. Each fund’s mandate stipulates how often its portfolio needs to be rebalanced.

ETFs with low turnover have higher tax efficiency, which may lead to better after-tax returns. For example, an ETF with portfolio turnover of 10% p.a. is likely to be less tax efficient than one with 1% p.a. turnover.

U.S. ETF example: Trudie has noticed that not all ETFs publish their turnover data. She’s focused on ETFs who do publish this data, and with portfolio turnover of less than 10% p.a. to ensure tax isn’t a drag on performance.

7. Consider ETF hedging strategy

Hedged ETFs remove currency fluctuations, providing their returns solely from the underlying investments, while unhedged funds include currency movements and are thus influenced by geopolitical and economic factors.

Choosing between them depends on your outlook and investment horizon.

U.S. ETF example: Trudie wants to invest in an unhedged U.S. ETF as she is more bearish on the Aussie dollar than she is on the U.S. dollar, despite Trump’s rhetoric.

8. Consider ETF ESG factors

ESG is an important investment theme in global markets. So ask yourself: do you want to invest in ETFs which invest in companies with high ESG standards? If the answer is yes, focus on ETFs with an ESG overlay.

U.S. ETF example: Trudie has a separate ESG allocation in her target asset allocation, so this U.S. ETF doesn’t need to have an ESG overlay.

And the winner is…

After searching through the available U.S. ETFs, Trudie settled on the Betashares Nasdaq 100 ETF (ASX: NDQ) for her portfolio.

Here are some of the reasons:

- Right assets

NDQ tracks the performance of the Nasdaq 100 Index which comprises one hundred of the largest non-financial companies listed on Nasdaq, and includes many companies that are at the forefront of the new economy.

So NDQ provides the broad-based U.S. exposure Trudie was looking for.

Solid long term performance

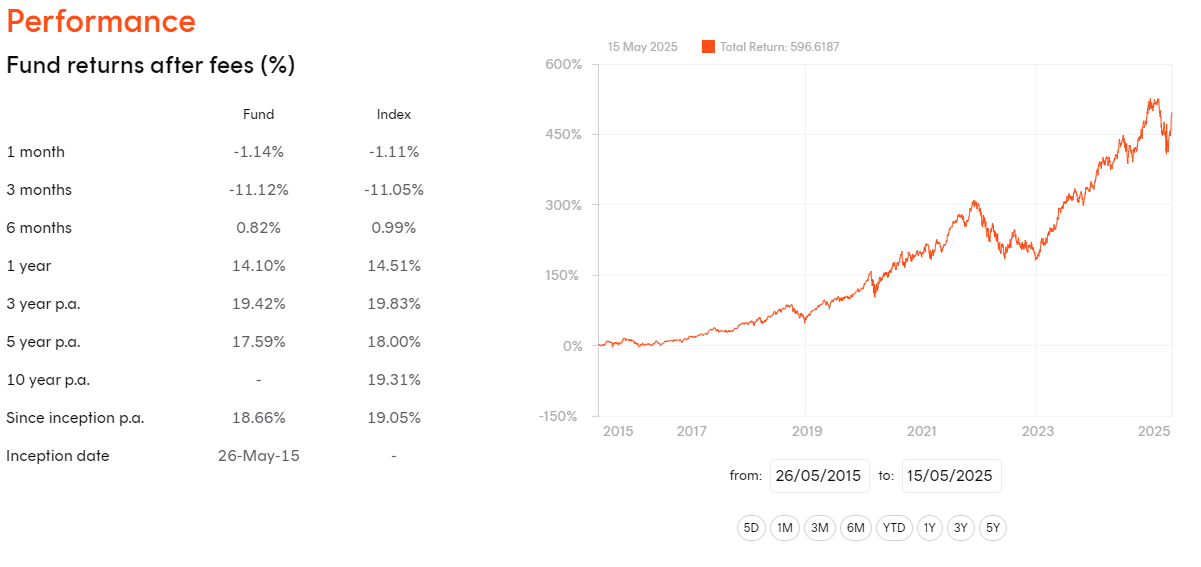

NDQ has generated a five-year return of 18% p.a. which compares favourably with similar ETFs, and the other investment options available to Trudie.

Fair fee structure

NDQ’s management fee of 0.48% is in line with similar funds.

Liquidity

With net assets of over $6 billion, NDQ is one of the more liquid U.S. ETFs on the market.

Other factors

NDQ is unhedged, its portfolio turnover is in a normal range (under 10% p.a.) and it doesn’t have an ESG overlay.

In short, Trudie appears to have made a solid ETF choice which ticks all her boxes. She wisely allowed her investment plan to guide her through the process.

Finding the Right ETFs for Peace of Mind

Choosing the right ETF requires balancing your investment goals with what’s available in the universe of ETFs. The aim of the game is to find the closest match that suits you. Carefully considering the eight ETF selection steps mentioned above could well mean better long-term investment outcomes, along with peace of mind.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.