Why Managed Funds & ETFs Happily Coexist in Most Portfolios

Simon Turner

Wed 21 May 2025 6 minutesThe managed fund versus ETF debate continues to rage across financial markets. Whilst some would argue that ETFs have been winning that debate for many years, there are compelling benefits of investing in managed funds alongside ETFs that are worth being aware of.

Let’s unpack the nuances, and discover the benefits of a combined ETF/managed fund strategy…

The Old Guard Meets the Newcomer

Managed funds are the seasoned veterans of the investment world. In Australia, some of the earliest managed funds date back over 65 years. Historically, they were the domain of financial advisers serving high net worth clients preferring a hands-off approach.

Case in point: Perpetual, one of Australia’s oldest fund managers, still primarily caters to advised clients to this day, with about 80% of its assets under management coming from investors who consult with advisers.

In contrast, ETFs (Exchange-Traded Funds) are relatively new entrants with only twenty years in the Australian market. During that time, they’ve rapidly gained popularity due to their simplicity, low costs, and ease of trading.

Unlike most traditional managed funds, ETFs trade like stocks on the stock exchange, offering liquidity and flexibility.

For many investors, especially those comfortable with self-directed investing, ETFs provide an easy and accessible entry point into the markets. And importantly, ETFs have a better track record than many of their active peers for the simple reason that they don’t generally underperform their benchmarks, in contrast to a large portion of active managers.

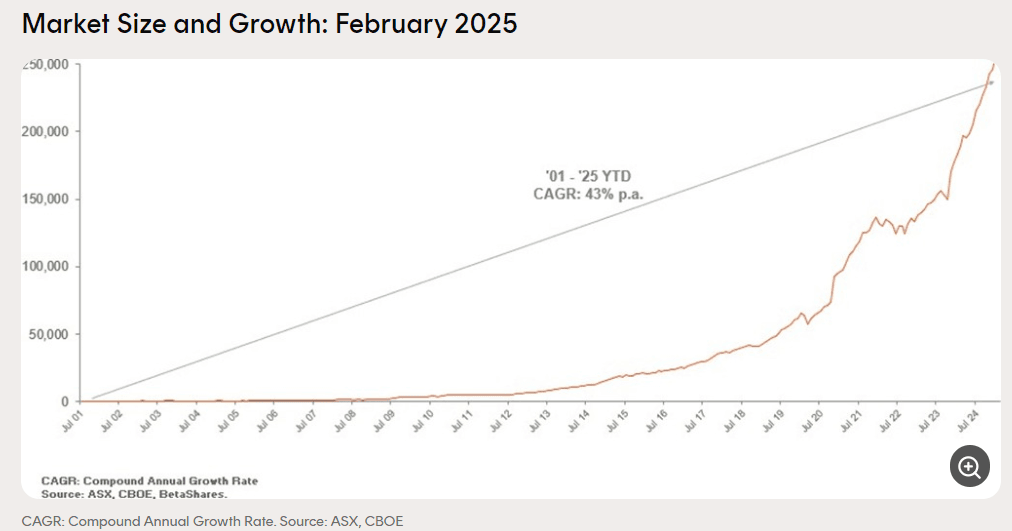

The numbers speak for themselves. The ETF market has grown at an astounding 43% p.a. over the past twenty-three years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Understanding the Core Differences

Whilst the arguments in favour of ETFs are compelling, don’t write off the entire managed fund universe just yet.

For context, let’s delve into the key differences of managed funds versus ETFs:

Accessibility & Minimum Investments

Managed funds often welcome small, regular contributions, making them ideal for consistent, dollar-cost averaging over the long term.

Many ETFs, while also accessible, require a minimum trade amount (e.g. $100 or more), and frequent trading can incur transaction fees which eat into returns.

Cost Structure

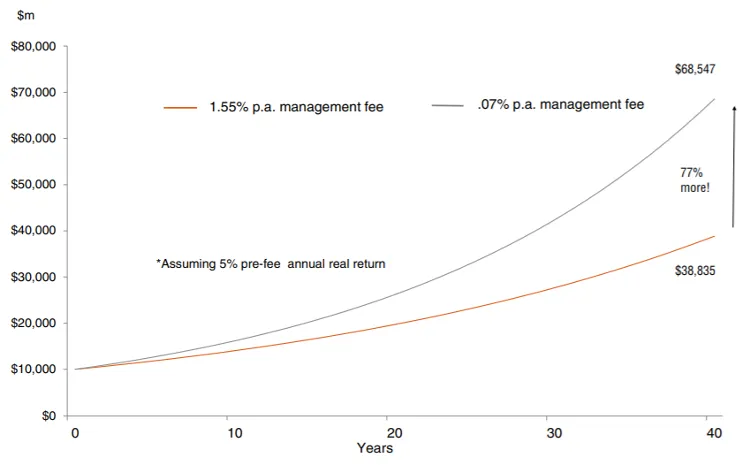

It’s common knowledge that managed funds typically charge higher annual management fees than ETFs, which adds up to a significance difference over the long term—as shown below.

What some investors ignore are the brokerage costs of buying and selling ETFs. These trading costs can also add up if you’re making frequent contributions or portfolio rebalancing.

Tax Implications

Managed funds pool investors’ money, so when investors sell out they can trigger capital gains which may be taxable.

ETFs, on the other hand, are generally more tax-efficient due to their structure which often allows investors to defer capital gains until they sell.

Ease of Setup & Management

ETFs are straightforward to setup. They trade on the ASX, and you can buy or sell them instantly through your brokerage account.

In contrast, managed funds require paperwork and processing time before new units are issued. But once set up, they often run automatically and offer valuable features like direct debit or automatic investment plans.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Personal Experience: Why I Invest in Managed Funds

For me, the choice to invest in managed funds alongside ETFs comes down to a blend of discipline, convenience, and behavioural considerations:

Potential for Outperformance

Whilst ETFs outperform managed funds on average in most asset classes, that’s not always the case. There are still active managers in the market who are outperforming year in, year out. Admittedly, these top performing managers are often investing in less efficient markets such as small caps and bonds, but you’ll find them in all asset classes.

Managed fund investing in these less efficient asset classes where there’s potential for outperformance aligns with my goals.

Consistent Contributions

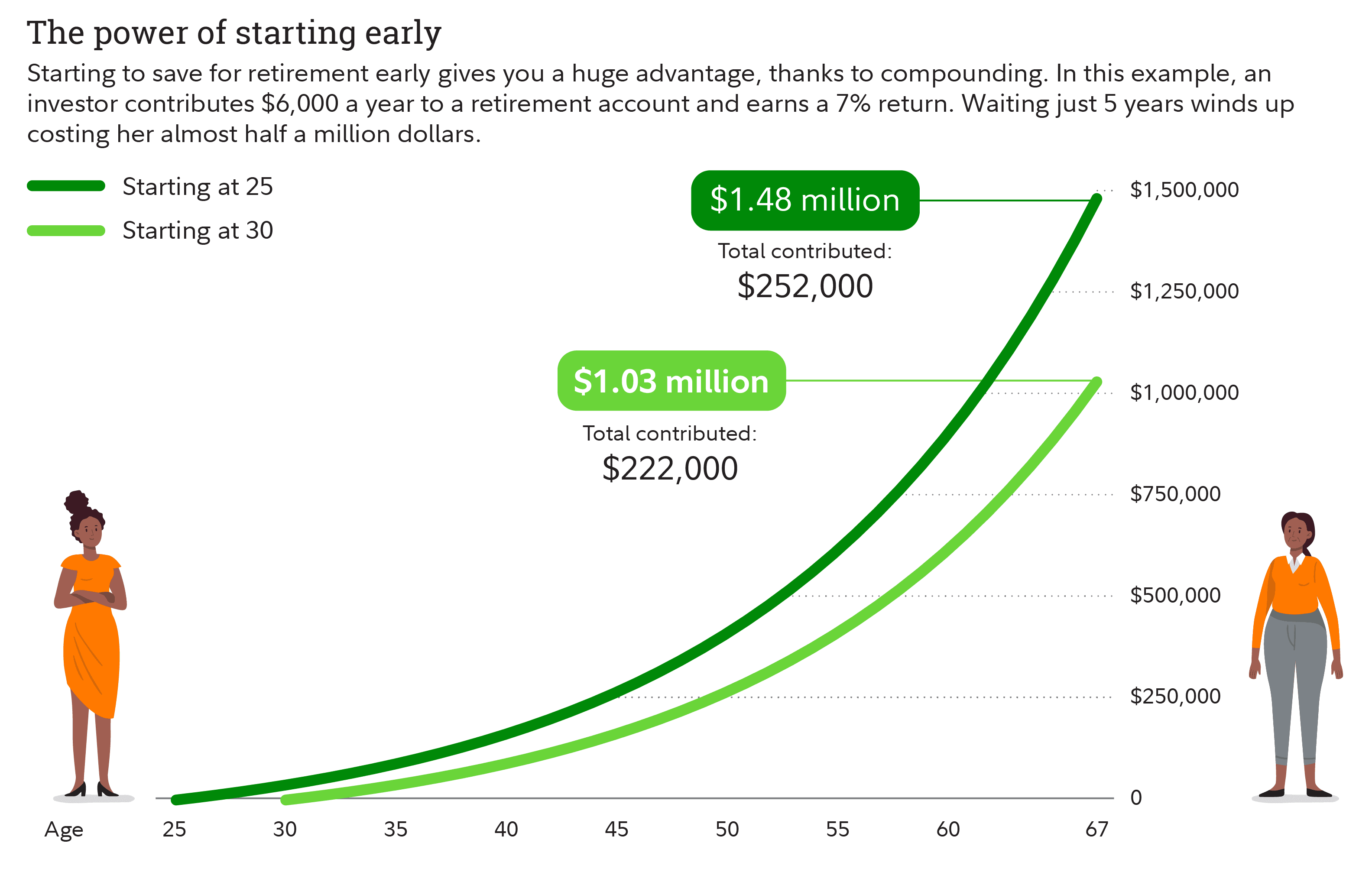

The low minimum investment required by most managed funds makes it easy to contribute small amounts regularly. This approach aligns with my goal of growing my wealth steadily over time, without the temptation to time the market or chase short-term gains.

Reducing Behavioural Risks

Investing isn’t just about numbers. It’s also about psychology.

Having money sitting in an account waiting to be invested can lead to impulsive decisions driven by market noise, analyst reports, or the latest investment fad.

I’ve learned that ‘out of sight, out of mind’ helps me stay focused on my long-term investment plan. When funds are automatically invested via managed funds, I avoid the trap of emotional trading or market timing, which can erode returns over time.

Cost-Effective Compounding

Let’s illustrate the incredible power of compounding via managed funds with a simplified example care of Morningstar.

Suppose I have $100,000 to invest in managed funds and contribute $1,000 monthly over 20 years. Assuming an 8% p.a. return (a reasonable long-term expectation for most equity funds), I’d end up with $1,035,094. Add an extra $50 from each pay-check, and that figure climbs to $1,091,994. Over decades, these small, consistent contributions into managed funds, combined with compound growth, make a substantial difference.

Minimising Transaction Costs

Frequent ETF trading can eat into your returns through brokerage fees. For example, with a broker charging $5 per trade, making 24 trades a year adds up quickly.

Managed funds, especially those with low minimums and automatic investment options, sidestep this issue, ensuring more of your money works for you.

Behavioural and Strategic Edge

Peace of mind is so important as an investor.

I’ve found that having a disciplined, automated approach to investing in managed funds helps me avoid impulsive decisions based on market hype or fear. When I see the market fluctuate, I remind myself that my consistent contributions and long-term focus are my best allies.

Also, by investing regularly, I avoid the pitfalls of waiting to ‘save up enough’ to buy in, which can lead to missed opportunities or buying at market peaks. Small, consistent investments regardless of market conditions capitalize on dollar-cost averaging, smoothing out entry points and reducing risk.

Final Thoughts: Use the Right Tools for Your Goals

So there’s no one-size-fits-all answer. Both managed funds and ETFs have their place in most investors’ portfolios. In the end, the decision hinges on your personal circumstances and preferences.

Managed funds work well for regular, disciplined investing, especially when automatic contributions are possible. They also reduce behavioural risks and simplify long-term planning.

ETFs, on the other hand, are fantastic for cost-conscious, self-directed investors who want instant trading and tax efficiency.

The key is to avoid feeling compelled to choose a ‘side’. Investing is a toolbox, and the best investors use a variety of tools tailored to their goals, risk tolerance, and lifestyle. So stay disciplined, and use the right tools that enable you to stay the course.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.