End of Hybrids: A Time for Yield with Franking

Phil Cornet

Tue 18 Mar 2025 4 minutesThe Search for Yield: Liquidity and Transparency

At the beginning of this week, we saw APRA release its decision on the $43B Hybrids market. Hybrids have been an instrument used primarily by banks to increase Tier 1 Capital levels and were a combination of debt and equity, hence the name “hybrid”. In this week’s piece we are going to look at the bank hybrids market, a popular investment category that has grown to be worth $43 billion since first being offered to retail investors in 1998.

High Yielding Debt or Low Yielding Equity? Can I have franking with that please!

Investors, in particularly retirees, were attracted to hybrids for their attractive yield and the 100% franking that came with it. The instruments pay a set rate of interest typically between 6-8% but can be converted to shares or even written off entirely in times of balance sheet stress.

The decision from APRA was to phase out Additional Tier 1 (AT1) capital instruments over the next 8 years. It was deemed, post the Credit Suisse collapse where holders of the Credit Suisse hybrid got wiped out, that there are more effective, cheaper forms of capital available to the banks and less risky options for the mainly retail holders of hybrids in Australia.

What APRA said

Here is part of the reasoning from APRA Chair John Lonsdale “Capital is the cornerstone of the banking system’s ability to withstand financial stress,” he said. “While Australia’s banks are unquestionably strong, overseas experience has shown AT1 doesn’t operate as intended during a crisis due to the complexity of using it, the potential for legal challenges and the risk of causing contagion.”

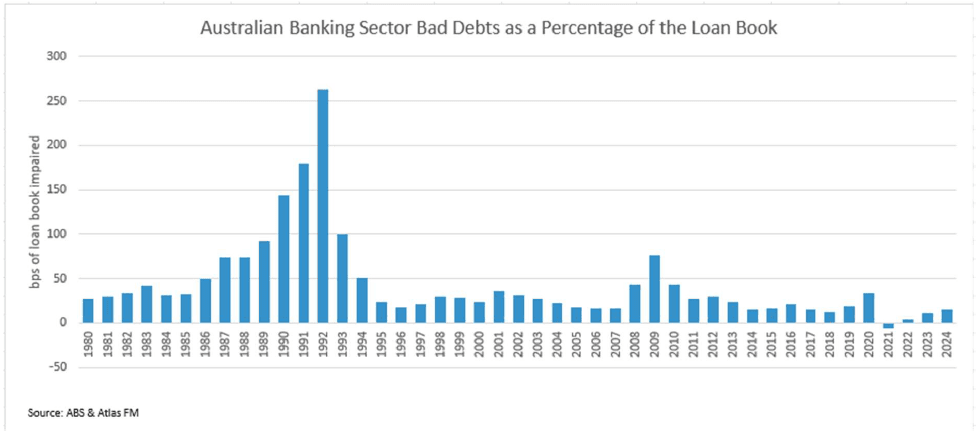

It is worth noting that the destruction in capital required to trigger a conversion to equity or for APRA to force the issuers hand to convert to equity would be unprecedented in recent history. One would expect that even at the nadir of the 1991/1992 recession which saw the largest level of impaired loans in living memory would not destroy enough capital to trigger a conversion (see below).

The truth does remain that it is likely that an investor (and in Australia the bulk of hybrid investors are retail) would be converted into stock in a rapidly falling market if the solvency of one of the issuers was put in question as we saw globally in 2023 with CS, Signature Bank and Silicon Valley bank and is the driver of APRA’s decision here.

Another factor in the decision making process may be the franking credits accrued each year by the hybrid market costing the ATO $1B annually. Existing hybrids on issue are due to expire in 2032 and there will be a gradual wind down between now and then.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

$43B income focused dollars looking for a new home

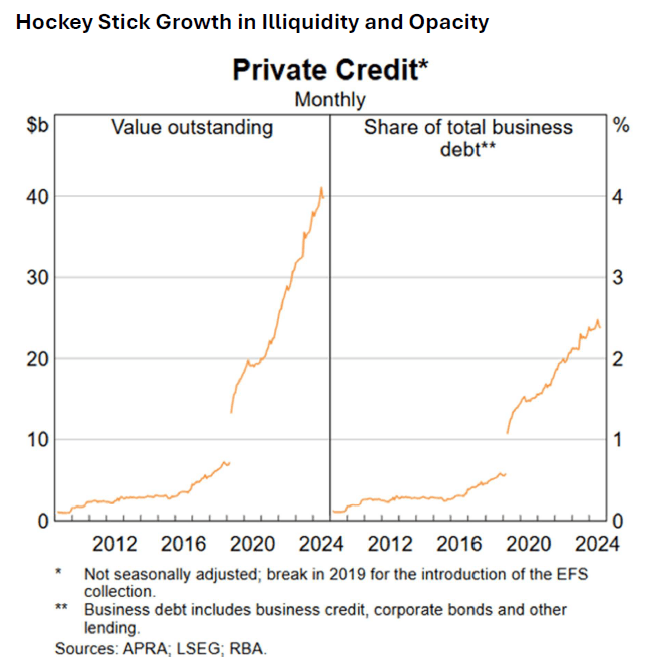

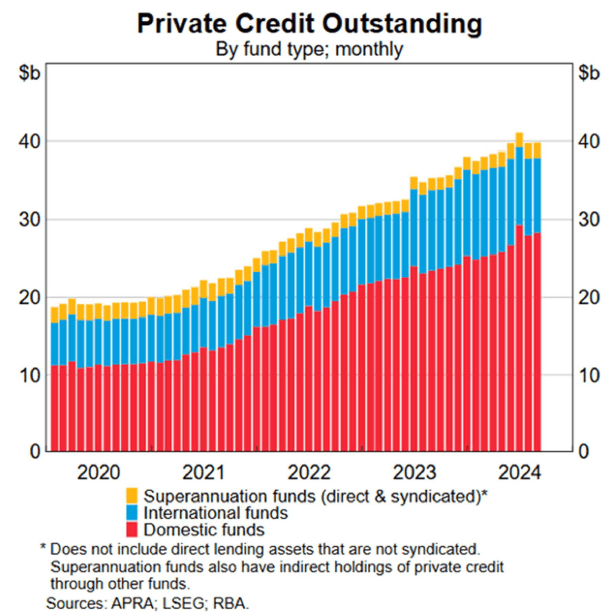

Income allocation as a percentage of investors portfolios has typically been under-invested in Australia with a non-retail friendly bond market and few income products that oered liquidity and transparency. That said growth has been large over recent years, in particular the private credit market (see charts below) which has more than doubled in 4 years and is conservatively put at $40B by the RBA but is seen as large as $188B by EY when increasing the definition of private credit.

The relatively recent rise of the private debt markets in a time of abundant capital and limited stress has been noteworthy and from a risk perspective somewhat concerning. Does the investor know where the exposure lies and do they have the ability to exit if the good times don’t roll forever for the issuer or the greater economy generally? The answer to these 2 questions most likely lies between “maybe” and “no”.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Where can I find regular income? And yes franking is still available

The Australian Equity market is a high yielding market and for Aussie earners still offers franking which is unique to Australian investors and in our opinion undervalued. Despite recent stretched valuations the ASX200 is currently averaging a yield of 3.2% vs a long term average of 4.5% and is a well-regulated and transparent market that offers liquidity.

Disclaimer: This article is prepared by Phil Cornet. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.