Relying on an Inheritance? That’s Not a Risk You Can Afford

Ankita Rai

Thu 8 May 2025 6 minutesInheritances are becoming a key part of Australia’s wealth story. Over the next two decades, more than $3.5 trillion is expected to change hands — with around $10 billion inherited each month.

But for most investors, the timing, size, and certainty of that windfall remains unclear.

This presents a financial planning challenge: how do you factor in something that may never arrive, or turns up too late to make a real difference to your future?

If inheritance is on your radar, it’s worth a closer look — not just at the what and when, but also at what role it should play within your broader wealth planning.

1. Separate Hope from Your Strategy

Before anything else, ask yourself: are you building your plan around what you hope to receive — or what you can actually control?

The challenge is it’s easy to fall into the trap of mentally spending money that hasn’t arrived. In response, maybe you ease up on saving — after all, there’s an inheritance coming ‘one day’. Or worse, you take on debt, assuming a future windfall will bail you out.

But here’s the thing: receiving an inheritance is a possibility, not a promise. And building your plan around your parents’ house or investment portfolio means betting on things you can’t control — like their lifespan, spending habits, or the market.

Even if one is likely, relying on it is risky — and for many, unrealistic.

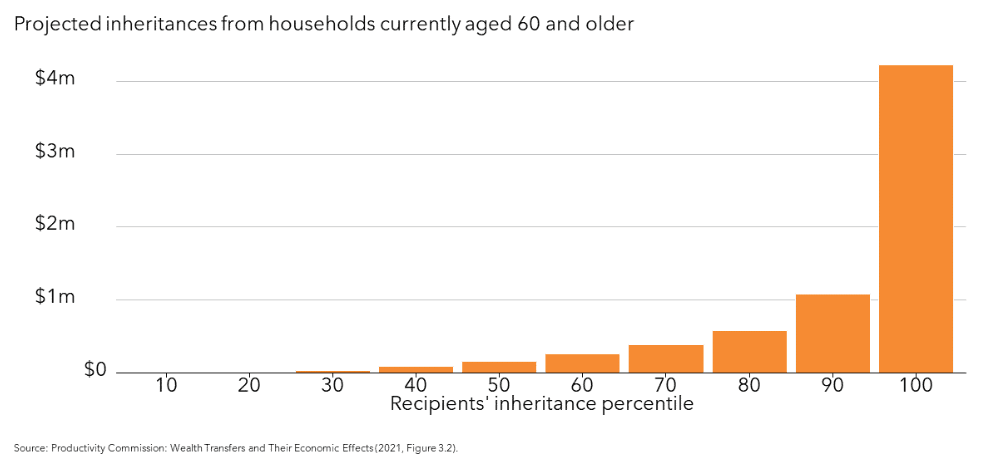

The Productivity Commission found that just 10% of inheritances account for nearly half the total value passed on. In other words, inheritances are heavily concentrated, and not everyone receives the same amount.

In fact, among those who received an inheritance over the past decade, the wealthiest 20% received on average three times as much as the poorest 20%.

And even for those who do receive an inheritance, the timing is rarely perfect — and that can make all the difference.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Understand Timing & the Real Cost of Delay

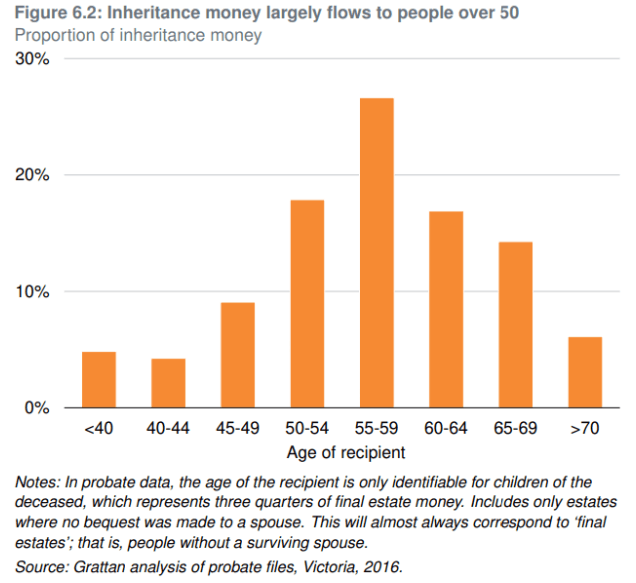

Inheritances are increasingly coming later in life. As shown below, most inheritances are being received between the ages of 55 and 70, with the late 50s or early 60s being the most common window.

That’s well after the peak decades of financial strain — home ownership, raising children, or building a business. As life expectancy increases, so does the gap between when financial support is needed and when it actually arrives.

Even if the amount is substantial, its usefulness depends heavily on timing. An inheritance at 65 won’t help with a home deposit at 40. And if it’s intended to reduce debt, much of the benefit may be lost if interest has already compounded for decades.

It’s also important to account for erosion. Longer lives, rising medical expenses, and the cost of aged care can significantly diminish what’s ultimately being passed down.

3. Inheritance Isn’t Tax-Free

Australia doesn’t have a formal inheritance tax — but that doesn’t mean inheritances come without strings attached.

Take superannuation, for example. In most cases, super death benefits are paid to a dependent — typically a spouse or a child under 18 — and are therefore tax-free. But if the beneficiary is a non-dependent under tax law (such as an adult child), the taxable component of the super can attract up to 30% tax, plus a 2% Medicare levy.

Similarly, you might inherit a $1 million share portfolio. While there’s no tax on the transfer itself, any capital gains realised when the shares are sold may trigger a tax liability.

This is where tax planning becomes critical. Understanding the form of the assets — whether held personally, in trust, or via an SMSF — and their embedded tax position can significantly impact your post-inheritance outcomes.

4. The Inheritance Chat You Can’t Keep Avoiding

Talking about inheritances can be uncomfortable. For many families, it’s easier to avoid the conversation than deal with the emotions, assumptions, or sibling dynamics that come with it.

But if you’re expecting to receive an inheritance, that silence comes at a cost. Open conversations can lead to smarter decisions around asset structures, ownership, estate planning, and tax.

Talk timing. Talk structure. Talk intentions.

For example, many Australians expect an inheritance — but their parents may have a very different view.

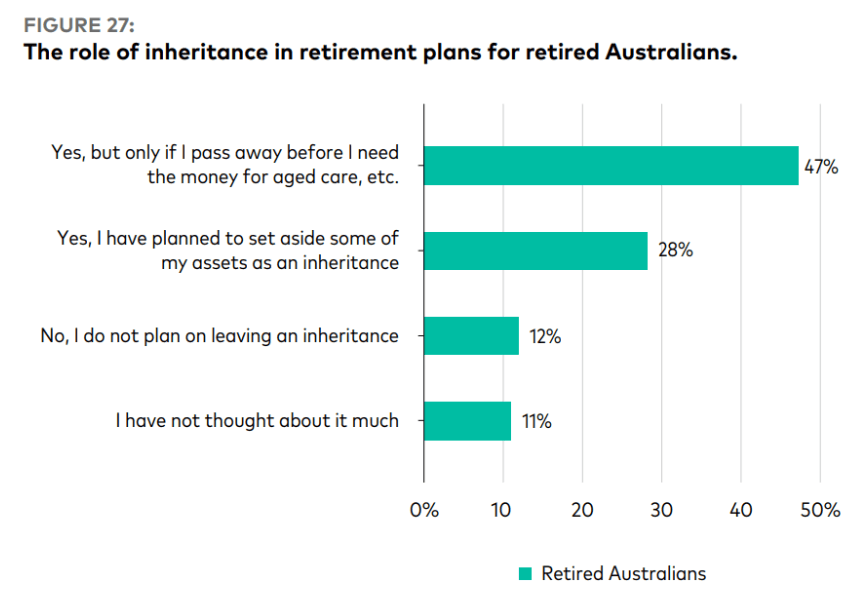

In fact, while around one in two Australians expect to receive an inheritance, a 2024 Vanguard survey found that nearly half of retirees will only leave one if there’s money left after their own care — and 12% don’t plan to leave anything at all.

What complicates things further is that most retirees are drawing down their super at the minimum rate — largely out of fear they’ll run out of money, especially with rising care costs. That means they may leave more behind than intended — but without a clear plan in place.

That’s why having an open conversation matters.

Understanding your parents’ wishes — and making sure there’s a valid will and proper estate plan in place — helps everyone involved. It also gives you the chance to prepare: for the timing, the structure, and the potential tax impact of what you might receive.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Adjust — Don’t Abandon — Your Strategy

Let’s say an inheritance is likely — and significant. What does that mean for your investment plan?

Even if you don’t rely on the full inheritance when building your core financial plan, the possibility of receiving it might still influence smaller, strategic choices — especially those involving risk, debt, or cash flow.

Such as:

-Home loan strategy – A future inheritance could enable a lump-sum repayment. That might mean directing current cash flow into investments instead of early repayments.

-Asset allocation – You may take on more growth exposure if you're confident a cash injection is coming later.

-Liquidity planning – Knowing an inheritance could arrive in your 60s may influence how much you keep in cash buffers now.

These adjustments can create more flexibility — or even accelerate your goals.

A Bonus, Not a Blueprint

A well-timed inheritance can be life-changing — especially as a circuit breaker for younger Australians who’ve missed out on the property boom of recent decades.

But it’s not a plan you can bank on. With so much outside your control, the smartest move is to build your financial future without relying on it. That way, if it does come through, it simply strengthens your position.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.