Does the ASX Offer the Income Generation Potential It Once Did?

Simon Turner

Tue 6 May 2025 6 minutesWith the ASX 200 yielding a mere 3.5%, it’s not just lagging behind traditional term deposits but is also outshone by the enticing offers from private credit providers.

When you throw into the mix the fact that ASX dividends are trending downwards, it’s no surprise that some investors are dismissing the once-popular dividend strategy.

This raises an important question, particularly for retirees or those approaching retirement: Does the ASX offer the income generation potential it once did?

The Classic Dividend Investing Playbook

The classic dividend investing playbook recommends buying stocks in companies that pay-out a healthy chunk of their profits to their investors in the form of dividends, as opposed to companies that reinvest everything back into the business.

It’s a tactic cherished by investors who favour consistent returns over more speculative stock price gains.

In Australia, dividend investing has long been a staple investment strategy—especially with the bonus of franking credits which essentially magnify investors’ income returns.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Enter the Era of Shrinking Dividends

Unfortunately, there’s bad news to report … the ASX has entered an era of shrinking dividends.

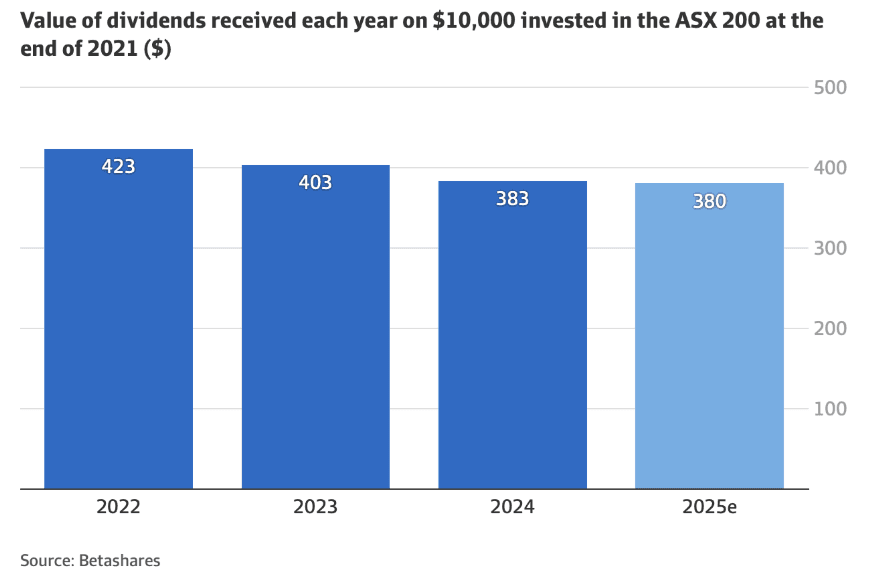

Recent research by Cameron Gleeson, a Betashares strategist, paints a not-so-rosy picture on this front.

If you’d invested $10,000 in the ASX 200 at the start of 2022, you’d have received $423 in dividends during that year. Fast forward to 2024, and you’d have received $383 from the same portfolio. That’s the opposite of the classic dividend investing playbook which aims for rising dividend streams.

Gleeson underscores that while existing investors are witnessing their dividends dwindle, newcomers might experience even worse returns, since they’ll have missed out on the capital growth many of these companies experienced in recent years.

What’s Going On?

There are a few noteworthy factors contributing to this dividend decline including stagnation among reliable dividend payers like the banking sector and a downturn in mining sector pay-outs. For example, BHP reported a 16% drop in its recent dividend to a record low.

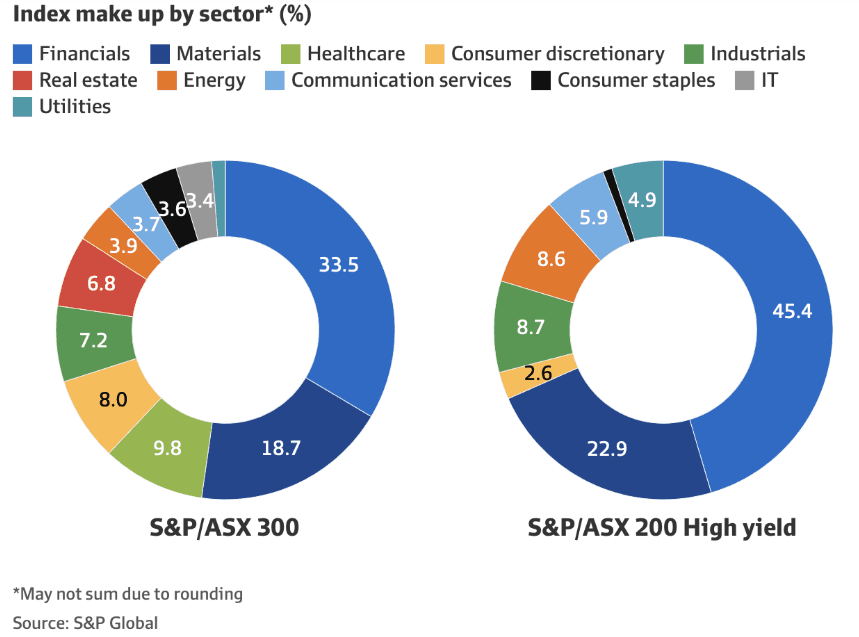

In combination, the banking and mining sectors represent more than half of both the S&P/ASX 300 and the S&P/ASX 200 so they’re taking their toll on the country’s dividend streams.

Meanwhile, a few other larger companies like Wesfarmers, Origin, and Coles have attempted to infuse some life into the dividend arena, but it hasn’t been enough to counterbalance the losses.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Time for a More Focused Strategy

Despite this sobering backdrop, there’s hope yet for Australian dividend investing as a strategy.

The key is to focus on the highest yielding stocks.

For example, if you zeroed in on the highest yielding stocks on the ASX in the form of the S&P/ASX 200 High Dividend Index, you’d have generated a more attractive 5.3% trailing yield as of January 31st 2025.

That’s not only more than most term deposit rates, but with capital growth that strategy’s total annual return rise to 11.2%.

Now, let’s talk longevity.

The S&P/ASX 200 High Dividend Index has churned out a solid total return of 10.7% p.a. over the last five years, eclipsing the ASX 200’s 8% p.a. return during the same period.

However, the longer you extend your gaze—say, over a decade—the more returns align between the highest yielding stocks at 8.2% p.a. and the 8.7% p.a. generated by the ASX 200 overall.

In other words, being focused in the higher yielding ASX opportunities has helped shorter term returns, and has generated around the market’s return over the longer term.

Surely most income-focused investors would be satisfied with that outcome in an era of shrinking dividends.

Franking Credits a Bonus

Let’s not forget the allure of franking credits.

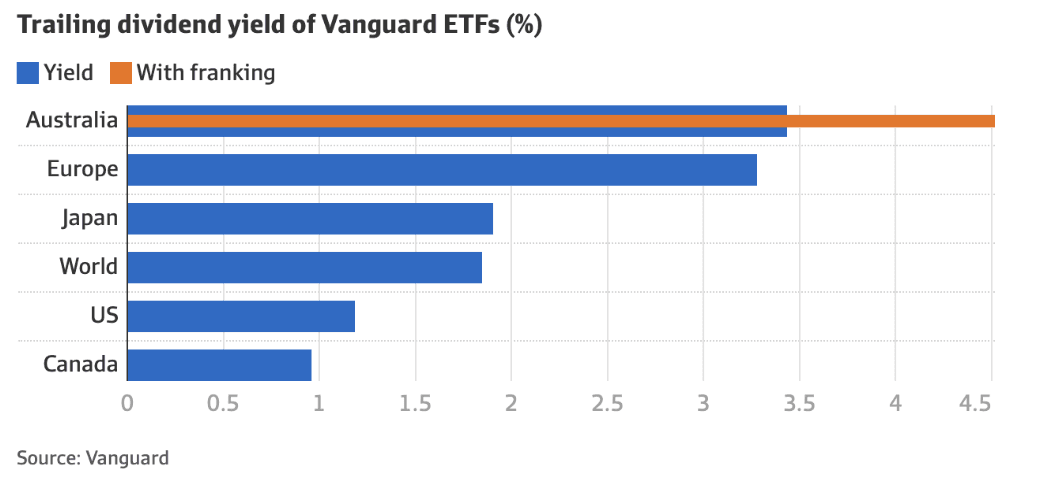

In essence, when you receive dividends from Australian companies, the taxman has already taken a cut, and you can claim that credit back. With franking, Australian income-focused ETFs such as Vanguard’s high yield ETF generate attractive yields relative to the rest of the world.

For investors with self-managed super funds, this can create a double delight of tax efficiency, which is especially beneficial for retirees.

But Tread Carefully

Having said that, the importance of treading carefully as an income-focused investor can’t be ignored.

In short, high yields can sometimes be a wolf in sheep’s clothing as a seemingly robust dividend yield may indicate that a company’s earnings are on the decline—a red flag for smart investors. For example, Telstra is an example of a company with a history of high yields that ultimately underperformed due to falling profits.

Key Takeaways for Investors

There are a couple of key takeaways for income-focused investors:

1. There are still plenty of dividend-paying gems on the ASX.

If you’re after income, the ASX remains rich with opportunity despite the headline dividend data heading in the wrong direction. For example, sectors like energy, with a solid 6%+ yield, as well as various picks in utilities and materials, remain promising.

2. Income-focused funds and ETFs provide easy, diversified access to the ASX income opportunity

For most investors, accessing the ASX income opportunity will be most convenient through a high quality fund or ETF which encompasses a diversified portfolio of dividend-paying companies and a strategy of ensuring those income streams are rising rather than falling.

ASX Dividend Investing Here to Stay

Dividend investing in Australian equities and funds hasn’t kissed the dust yet. With careful analysis, and perhaps a little help from a few well-chosen funds and ETFs, investors can still enjoy the benefits of dividend investing.

So play it smart and pick funds and stocks that align with your income strategy, regardless of what the headlines say.

Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.