The case for gold

Simon Turner

Fri 11 Aug 2023 6 minutesGold investors seem to be a dying breed. With momentum-focused investors increasingly focused upon AI opportunities at the expense of all other sectors, it’s easy to see why. Age is also a factor. Some younger investors question whether the gold investment case carries as much weight in an era when digital solutions dominate.

But what if the market is dismissing gold at the very moment it’s about to break out and prove its role as an important portfolio diversifier?

Newsflash: gold is inching towards an all-time high

One of the more surprising aspects of gold investing in 2023 is how few investors are focused on gold at the very moment it’s approaching an all-time high.

As shown below, gold is closing in the important psychological barrier of $US2,000 which analysts have long talked about as the key level gold needs to break through if it’s to continue its upward trajectory towards new all-time highs.

In technical speak, once gold confirms it has broken through the $US2000 level, that long-term resistance level is likely to become support. That’s the catalyst many gold bulls have been waiting for and may explain why many of them have been less vocal during gold’s recent rally. It may be a case of wake me up once the party starts.

With gold’s most vocal community largely missing in action during the recent rally, the question remains…what’s been driving the gold price up?

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Mystery solved

The answer is central bank buying.

Central bank buying has been gold’s main demand growth driver over the past year.

What’s noteworthy is the size of the increase in central bank buying. During the first quarter of this year central bank buying skyrocketed to 228 tonnes, which was 34% above the previous quarterly buying record—set in 2013. This follows a massive 152% increase in central bank buying witnessed in 2022.

Change is clearly afoot. And it’s being witnessed in both developed and emerging economies. In particular, the central banks of Singapore, China, Turkey and India have been big gold buyers of late.

A changing of the guard

So a significant shift appears to be underway within the gold market, but the question is: why are central banks buying so much more gold?

In short, there’s a growing feeling across the global community that the US is in the process of losing its reserve currency status for the first time since the Second World War ended.

With this perceived shift occurring, central banks are increasingly viewing gold as a more stable store of value than the US dollar.

In addition, heightened geopolitical risks and elevated inflation are increasing the allure of gold as a store of long term value.

This dynamic was exacerbated when the US decided to freeze Russian forex reserves when the Ukraine war started. Since then, the world’s central bankers have noted the lack of security US dollar reserves offered Russia at a time when its actions contravened the global community’s wishes. It was a lesson many central bankers appear to have taken to heart.

It’s not just central bank gold buying which confirms the long talked about de-dollarisation process has begun. Similar trends are also emerging in recent international trade agreements.

For example, France recently sold LNG to China priced in renminbi, Brazil agreed to sell iron ore and soy to China in renminbi, and Saudi Arabia agreed to sell oil to China in renminbi.

If this trend continues, the outlook for the US dollar is increasingly bearish, and hence the outlook for gold is increasingly bullish.

“Any time you’re going to get a major monetary shock like that, like the end of a reserve currency system and bringing in a new system, I think that’s going to be really good for gold,” Adam Rozencwajg, Goehring & Rozencwajg

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What's next for gold?

Now the Fed has paused its rate rises, at least for now, the headwinds against gold and gold stocks have arguably come to an end. This is significant since gold appreciated in recent months despite these headwinds for the reasons mentioned above.

The key point some market participants may be missing right now is that if a commodity goes up when there’s a strong headwind against it, it’s underlying drivers are often more bullish than its price appreciation may suggest.

In the case of gold, if the Fed were to cut interest rates in the coming months as many investors expect, its recent headwinds would turn into two powerful tailwinds. Namely, the US dollar is likely to fall and US Treasury yields are likely to decrease.

Those events are also likely to trigger more central bank gold buying since central banks would face growing pressure to diversify away from a weakening US dollar with its decreasing allure as a store of value.

All these factors are bullish for gold.

Significant upside potential

Let’s be honest, no one knows where the gold price is heading.

However, having a rough idea of gold’s potential value may be helpful for gold investors who are trying to time an entry point and define their investment period.

Contrarian natural resource investing house, Goehring & Rozencwajg, believe once gold breaks through $US2,000, it has a long way to run.

Their price target for gold is between $US12,000 and $US15,000.

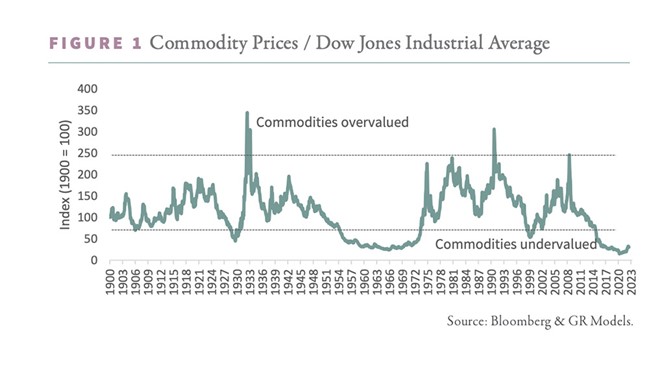

Before you dismiss their forecast as too optimistic, bear in mind their calculation is based upon the amount of gold backing the US currency, as well as the price of gold relative to other financial assets. Check out the chart below which shows how commodities are valued versus the Dow Jones.

Commodities, including gold, are currently as undervalued as they’ve ever been. And if history is any guide, it seems fair to expect the commodity pendulum to swing hard in the other direction once momentum returns.

That’s bullish for gold and the commodity sector in general.

The case for gold is compelling

The next time someone tells you gold is a relic of the past, remind them central banks certainly don’t think so.

And if the de-dollarisation process continues as appears likely, we’re on track for a situation in which the price-insensitive central banks will be competing with a growing list of investment buyers to buy gold for its superior value storage properties.

The case for gold has rarely been stronger—nor more worthy of your attention as a potential portfolio diversifier.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.