How to get started investing in funds

Ankita Rai

Fri 26 Jul 2024 5 minutesUnitised funds, which pool investments from multiple investors and invest in a broad portfolio of assets, allow investors to access the in-depth knowledge, research, and ongoing monitoring of professional managers.

There’s an extensive smorgasbord of funds available, such as equity, bond, index, and property funds, which let investors spread out their risk and potentially beat the market’s returns.

For example, managed funds with exposure to themes such as AI, digital currencies, and small caps have been some of the top performers of the last financial year.

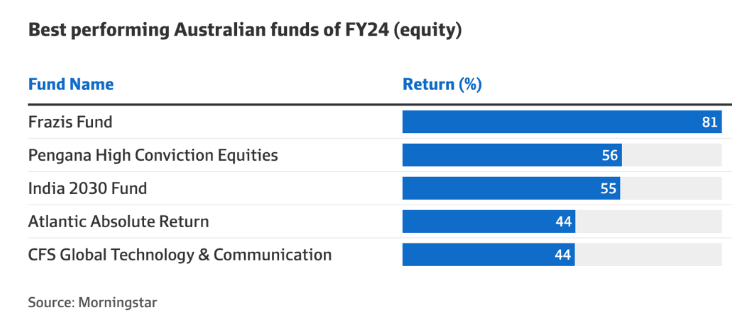

Among the best performing equity funds, a combination of global exposure led by semiconductors combined with local small caps helped a few managers beat the competition. According to Morningstar, the Frazis Fund topped the list with an 81.3% return over the last year, followed by Pengana High Conviction Equities with a 56% return.

These top funds didn't just stick with the largest mega cap stocks, but also included holdings like defence tech developer DroneShield and Clarity Pharmaceuticals, which are up 400% and 500%, respectively.

This is why investing in quality funds can help you achieve better returns than the market. These managed funds offer a practical way to diversify your portfolio with the expertise of professional fund managers by targeting innovative, fast-growing companies and diversifying across geographies and asset classes.

A guide to getting started

Getting started with unitised investments can seem daunting, given the vast array of choices available in the market.

However, once you narrow it down by asset class, themes, index funds, and ETFs, the process becomes more manageable.

First things first, determine your investor status, whether you are a retail or wholesale investor. Retail investments usually require a lower minimum investment amount. In contrast, high-net-worth investors typically have over $2.5 million in liquid assets and often have access to more exclusive investment products such as private credit, hybrids, higher-yielding fixed-income funds, money market funds, and so on.

Next, decide what kind of investments you want—growth, income, or a balanced approach—and evaluate your risk tolerance to determine how well you can withstand market volatility and possible losses.

Establish the duration of your investing goals, whether they be short, medium, or long-term, to determine your investment horizon.

Once done, it's easy to get started through a fund manager, a fund information provider like InvestmentMarkets, or an online brokerage.

Balancing risk and return

No matter which investment you choose—whether it's index funds, bond funds, private equity, private debt, or real estate funds—it's important to remember that not all return profiles are the same. And diversification is crucial for managing risk.

As American economist Harry Markowitz said, "Diversification is the only free lunch in investing,” emphasising that spreading investments across different assets can help minimise risk.

This principle is especially true in today's higher-for-longer inflation scenario.

According to the 2023 High Net Worth Investor report, high-net-worth individuals primarily invest in direct shares (33%), residential and commercial property (29%), and cash and term deposits (14%). But they've been diversifying more recently, boosting their allocation to alternative assets to 15% of their portfolios, up 4% from 2022.

The reason is that alternatives such as hedge funds and private equity, credit, and royalties have low correlations with stocks and bonds, and have historically performed well during inflationary periods.

So, as you refine your investment approach to include managed funds, it is important to take inflation, the global economic outlook, and potential market volatility into account.

Building a portfolio of funds

For many long term investors there is a need for resiliency in the form of an all-weather portfolio of funds that can hold value in adverse conditions.

For example, niche and alternative funds such as Regal’s Australian Small Companies Fund, TAMIM’s Australia All Cap Fund, and hedge fund LHC Capital returned more than 30% last year with a focus on mining and energy stocks, pre-IPO companies, and listed small-cap stocks.

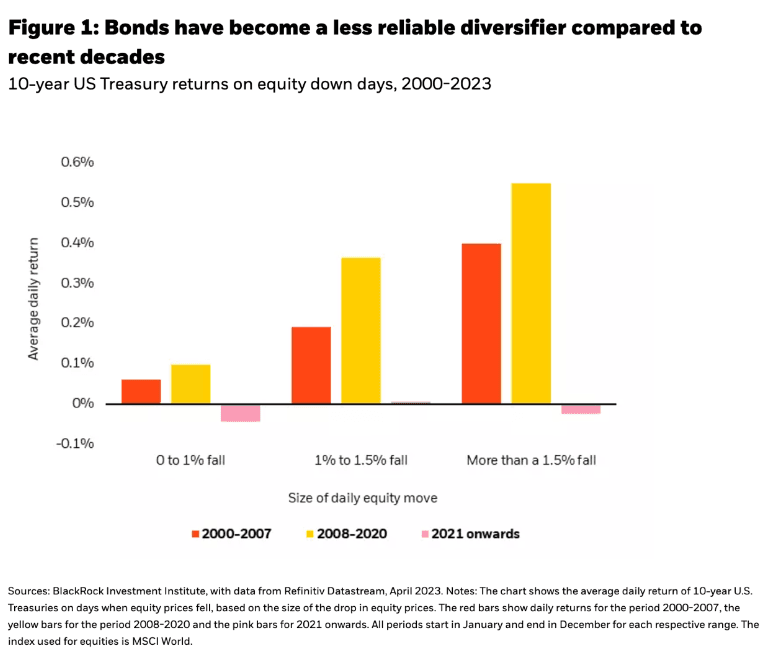

Diversified fund strategies like these are especially important when the traditional diversification effect of bonds relative to equities may be less reliable in an environment of persistent higher inflation.

Building a resilient portfolio with managed funds

The main advantage of investment funds lies in their ability to handle the heavy lifting of asset allocation and rebalancing. Managed by market experts, these funds can offer significant benefits even when investing in passive index funds where strategic asset allocation alone can drive returns.

Diversification through funds not only helps smooth out long-term returns but may also reduce overall risk.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.