How ETFs are helping investors get wealthier

Ankita Rai

Thu 1 Aug 2024 6 minutesWhat began as a tool for young investors and self-managed superannuation funds seeking diversification and exposure to harder-to-access asset classes like international equities has now become a mainstream investment.

From retail investors to large institutions and wealthy individuals, ETFs have become a cornerstone of many investment portfolios.

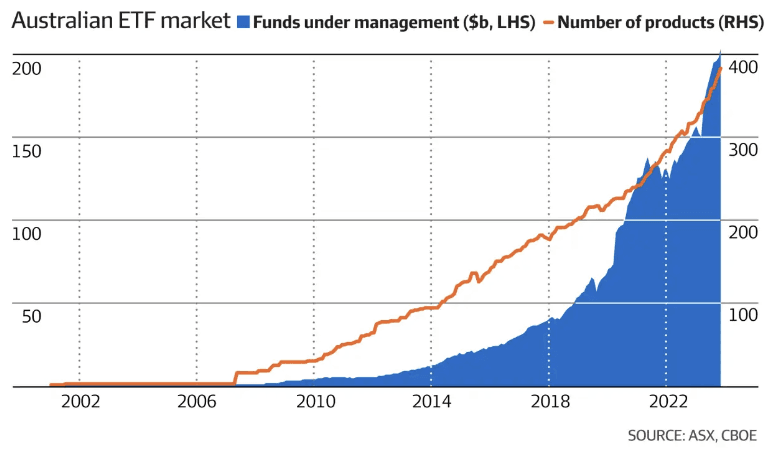

Over 2 million Australians are invested in ETFs, a 7% increase from last year. This growth has pushed the Australian ETF Industry past $200 billion in the 12 months to June 2024, up 36%. This includes ETFs listed on Cboe.

The growth is expected to continue. The Australian ETF Industry is expected to reach $500 billion by 2030.

The growing adoption of ETFs is largely driven by increased investments from high-net-worth individuals (HNWIs).

According to the Australian Investor Study, 2023, 55% of high-value investors—those in the top 10% by wealth and trading volume—now include ETFs in their portfolios. This percentage is just shy of the equivalent 57% for residential investment property, and 75% for Australian shares.

The volume of ETF transactions also accelerated, jumping 50% compared to a year ago as investors piled into international and Australian equity ETFs.

Equity ETFs emerging as a key entry point

Driven by their diversification benefits, global exposure, and liquidity, ETFs are becoming an essential part of the investment toolkit.

They offer a way to tap into broader market trends that even Warren Buffett recognises. Buffett’s Berkshire Hathaway owns two ETFs: SPDR S&P 500 ETF Trust and Vanguard S&P 500 ETF.

Both funds passively track the S&P 500, invest in large-cap stocks and have low fees. They accounted for 20% of global equity ETF buying in the first two months of 2024, according to Vanguard.

Similarly, Bridgewater Associates, a large US fund manager, holds iShares Core S&P 500 ETF and iShares Core MSCI Emerging Markets ETF among its top holdings.

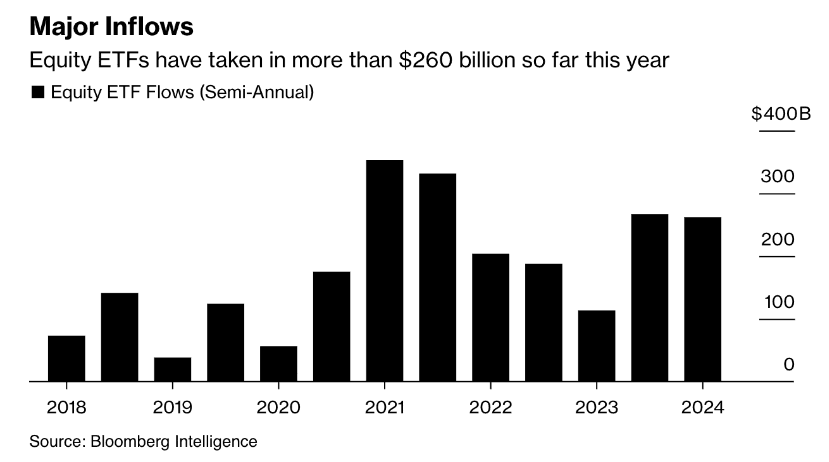

Low-cost equity ETFs, particularly those tracking the S&P 500, are the most popular and have seen the strongest inflows so far this year. They’re estimated to have received $262 billion of inflows during the first half of 2024.

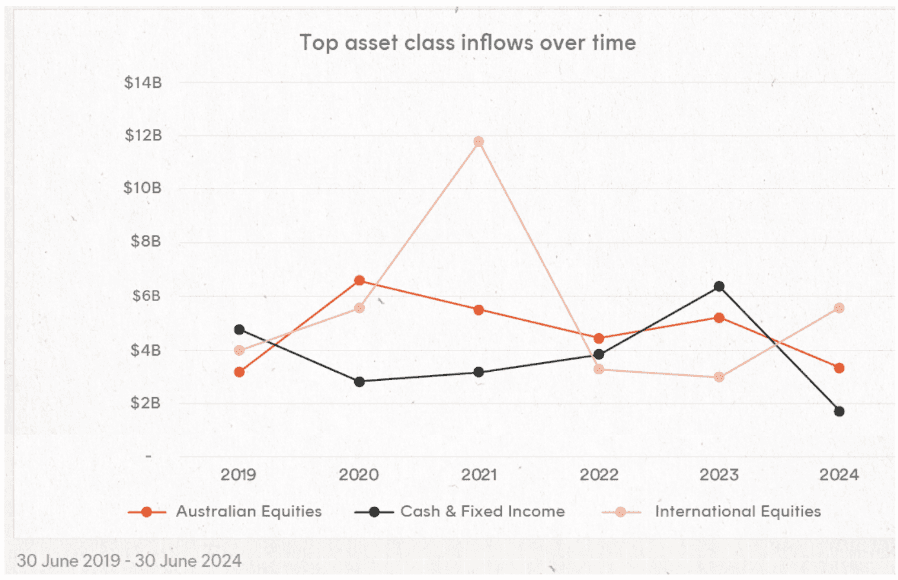

In Australia too, equity ETFs focused on international and local equities are popular, with net inflows of $5.6 billion and $3.3 billion, respectively, during the first half of 2024 (see chart below). The Australia 200, Nasdaq 100, and Global Shares ETFs led the pack.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Making diversification easier

Globally, there’s been a noteworthy shift toward ETFs among high-net-worth investors.

In Australia, these investors control nearly $3 trillion in investable assets and are increasingly adding ETFs to their portfolios.

While high-net-worth investors mostly use ETFs for targeted exposure to specific sectors, BetaShares notes that sophisticated investors are also adopting ETFs for ethical, thematic, and fixed income exposure.

This shift is driven by the ability to make targeted investments that would have been hard to achieve without ETFs, focusing on specific characteristics such as duration and credit quality.

As a result, there’s a sizable and growing basket of ASX-listed ETFs which are focused on the fixed-income space.

Notable examples include the BetaShares Australian Investment Grade Corporate Bond ETF and the iShares Core Composite Bond ETF, which returned 8.8% and 3.7% respectively over the last year. Additionally, there are ETFs like the Vanguard Australian Government Bond ETF that specialize in Australian government debt.

Fixed-income ETFs are currently valued at around $28 billion, making up 14% of the total Australian ETF market, according to Global X. They are the third most popular category, after international and Australian equities, with $1.8 billion in net inflows in the first half of the year.

ETFs have also made it easier for high-net-worth investors to access commodities like gold and uranium, as well as emerging sectors such as clean energy and regional equities in markets like Japan and India.

This allows for more effective diversification across various asset classes and markets that are typically harder to get into.

Investing for wealth creation

ETFs have become a top choice for high-net-worth individuals (HNWIs), offering a blend of low management fees, liquidity, and growth potential. Research from Vanguard highlights that HNWIs are increasingly turning to diversified, multi-asset, and low-cost ETFs to help them manage their portfolio risks.

In Australia, multi-asset and growth ETFs are gaining popularity. These funds give investors access to cutting-edge sectors like robotics, artificial intelligence, and emerging markets by combining high-growth assets and mitigating risks.

For example, the iShares S&P 500 Growth ETF, which is heavily weighted in technology (51%), consumer discretionary (13%), and communication services (13%), has delivered an annualized return of 7.4%. Similarly, the BetaShares Diversified All Growth ETF, which includes Australian shares, US equities, and emerging market stocks, has achieved a 13.7% return over the past year.

Many HNWIs invest in ETFs via their SMSFs. According to the 2024 Vanguard/Investment Trends SMSF report, 43% of SMSFs are now invested in ETFs. On average, SMSFs are allocating $250,000 to ETFs, with the average portfolio allocation rising from 5% in 2023 to 8% this year. This is an important trend since SMSFs now represent 13% of Australia's ETF investor base, which stands at two million.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

An essential investor toolkit

The growing popularity of ETFs highlights their value, especially with their broad exposure to diverse companies, regions, and asset classes.

This trend signals a shift away from investors accepting the payment of high fees for underperforming funds.

Their potential for wealth creation, combined with their flexibility and liquidity, makes ETFs a compelling choice for investors.

Key takeaways for investors

High-net-worth individuals are increasingly incorporating ETFs into their investment strategies. This trend underscores ETFs’ role as a key component in investment portfolios, driven by their ability to offer targeted exposure, manage risks, and achieve growth.

The shift towards ETFs signifies a departure for many investors from high-fee, underperforming funds. ETFs offer cost-effective access to a wide range of investments.

ETFs provide investors with the flexibility to adjust their portfolios quickly and efficiently, catering to both growth and risk management needs.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.