Positioning, positioning, positioning: the key to 2024 outperformance

Simon Turner

Thu 11 Jan 2024 6 minutesAs a new year kicks off, investors face an investment landscape which doesn’t resemble many past periods. After the fastest interest rate rising cycle in history, the impacts of higher interest rates are still filtering through whilst two wars continue to rage, US Government debt levels reach unprecedented levels, and global growth is expected to run at well below trend.

At face value, investment markets face a long list of risks in 2024. However, the same could have been said throughout 2023 when the All Ords returned +6% and the S&P 500 generated a more impressive +24% return. 2023 was a year when it paid to understand the underlying mechanics of investment markets, in particular how the rest of the market was positioned.

It’s likely to be similar with different implications in 2024.

Empower yourself by understanding the future is a mystery

First, one of the most important questions investors can ask themselves at the start of this year is … what are you most confident will happen in 2024? The reason being most investors are wrong about most short-term predictions. This includes economists and market experts who spend all day working in this field. That’s not to suggest that economists and analysts are stupid en masse. Financial forecasts are hard to get right.

For example, if we step back in time to December 2022, a massive 85% of economists predicted a US recession in 2023. Bearing in mind that forecast was made just before 2023 kicked off, you can imagine how many investors started 2023 with bearish expectations believing they were well informed by professionals who knew a lot more about the economic outlook than they did. However, they were all wrong.

The reality is no one knows what the future holds, no matter how many confident voices proclaim their superior knowledge.

The data investors don’t focus on enough: how are investors positioned?

2023 was a year when positioning mattered, a lot more than economic forecasts. Whenever a sector or asset class became extremely overcrowded or over-shorted, it was invariably a signal that things were about to change.

So as 2024 starts, it could well be that the most valuable information to arm yourself with is how global investment markets are currently positioned. This information is arguably going to provide a more accurate steer as to how to outperform in the year ahead than any forecasts.

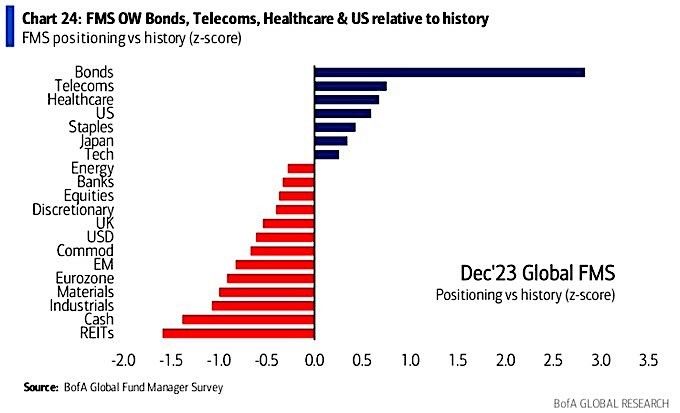

To the data … the recent BofA Global Fund Manager survey reveals how global investors are currently positioned:

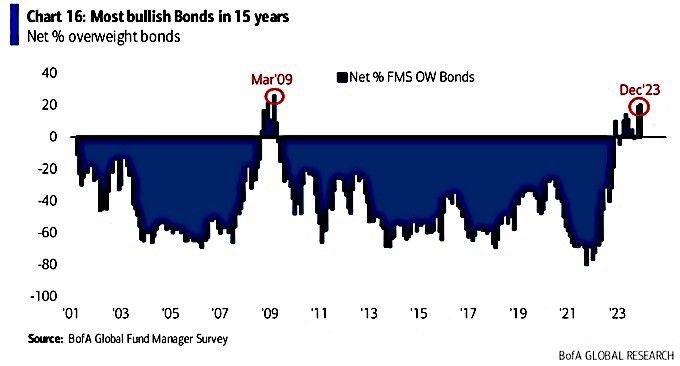

Warning: the overweight position in bonds is extreme

The extreme overweight in bonds may surprise some after one of the most volatile years in the history of bond markets. In fact, not since March 2009 have investors been so overweight bonds—as shown below.

This suggests investors en masse have bought into the story pedalled by the world’s central bankers—that inflation is now under control and thus the next move in interest rates is likely to be down.

However, it’s noteworthy that despite this extreme confidence in the outlook for interest rates and thus bonds, the Fed’s latest guidance implies half the number of rate cuts markets have currently priced in.

That’s an unusually large expectations gap which suggests either the Fed or financial markets are wrong.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Defensiveness is the name of the game

The other major global overweight positions align with the market’s bullish positioning in bonds. Telecoms, healthcare and staples are all defensive sectors which investors are generally overweight when they’re cautious about the economic outlook and thus confident that central bankers are likely to cut interest rates in the foreseeable future.

That’s all consistent with the current subdued global economic growth expectations:

So as we start 2024, investors are extremely defensively positioned.

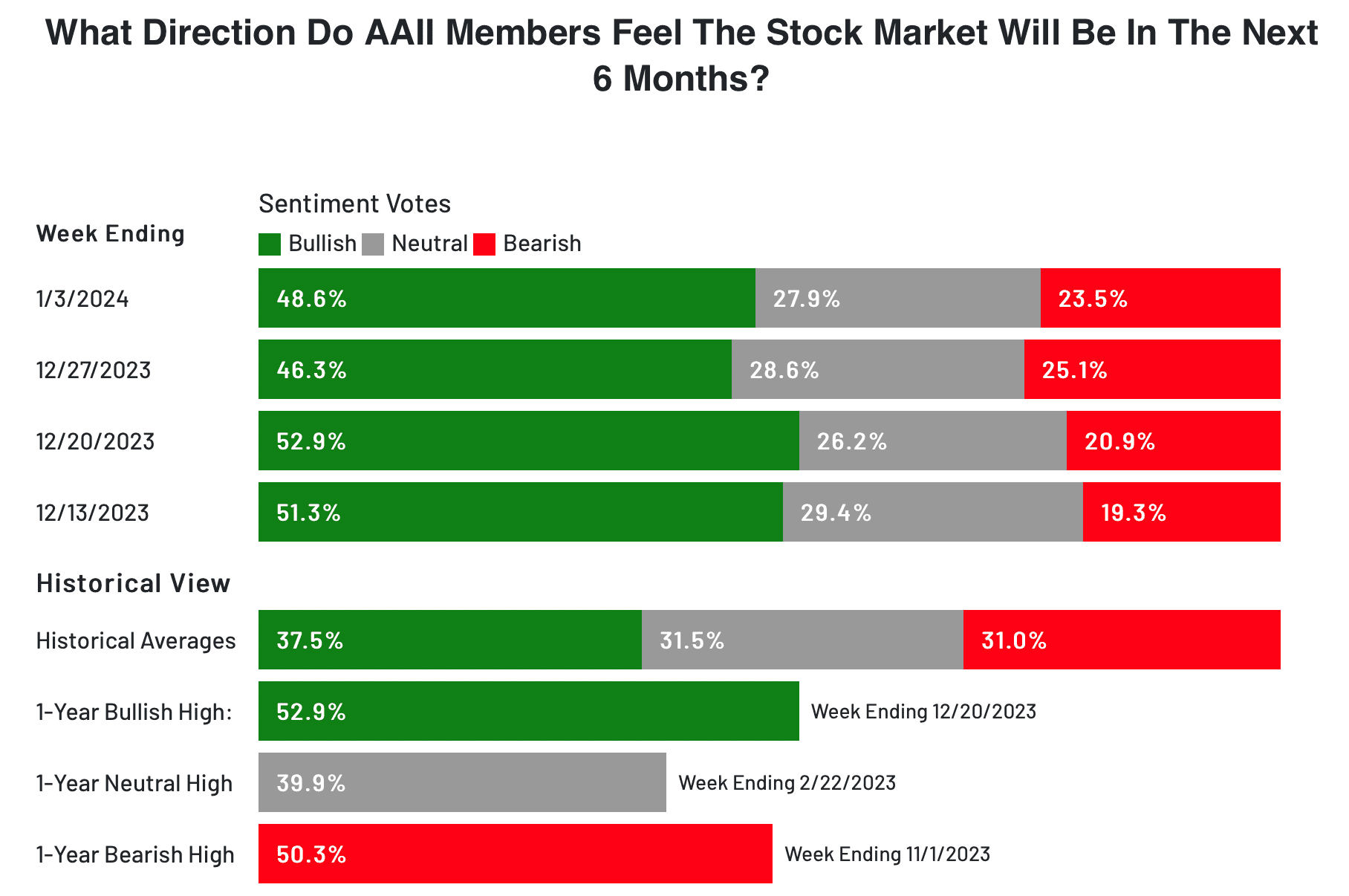

However, somewhat at odds with this positioning is the AAII bull-bear ratio which shows that US investors are unusually bullish right now. As shown below, 48.6% of respondents are bullish versus an historic average of 37.5%.

In other words, investors are positioned unusually defensively and yet they are unusually bullish on the stock market right now. Confused? You’re not alone:

An attempt at a rational explanation

A potential rational explanation of this dichotomy is that whilst investors are cautious on global economic growth, they remain bullish on equities for non-economic reasons.

For example, investors who don’t believe inflation has been conquered by central banks may be investing in equities for their inflation protection benefits despite their caution on the global economy. Hence, the overweight in defensive equities.

However, you’d be right to highlight that focusing on inflation protection is inconsistent with the massive global overweight in bonds which indicates markets believe inflation has been conquered.

OK, so let’s forget about rational explanations. There’s no escaping the fact markets are starting 2024 with contradictory assumptions being priced in.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

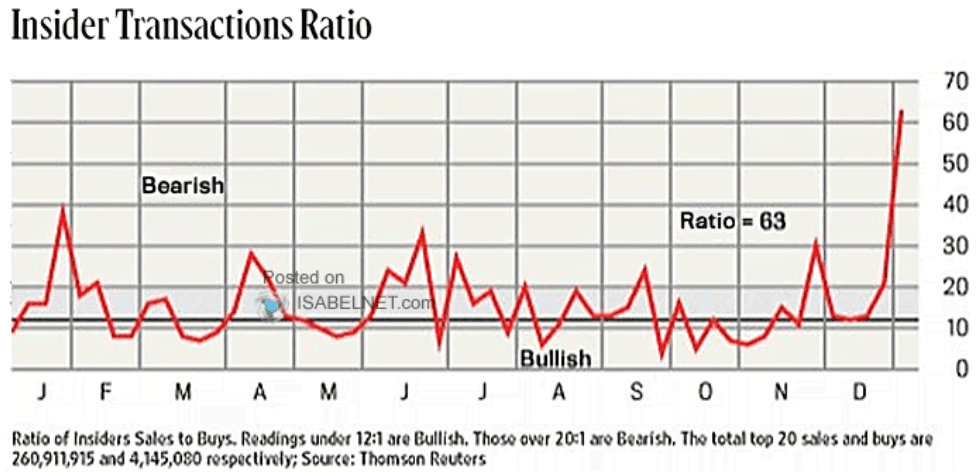

Insiders are running for the exits

One final piece of key information to highlight as the year begins … the insider transaction ratio is unusually bearish right now—as shown below:

Insiders have an excellent track record of selling at market peaks and buying at market troughs so it’s noteworthy that insiders have turned extremely bearish when the rest of the market is unusually bullish.

Positioning matters in 2024

2024 is shaping up as another year when being aware of how investors are positioned could well provide the most informative steer as to how to outperform. Contradictory as it is, global investment positioning is currently defensive despite the market’s bullish equity market expectations and an insider sell ratio which is off the charts.

The implications are clear … the short term risk to markets appears to be on the downside as investors have chased stocks higher despite ongoing global economic challenges. And the fact that investors are so overweight bonds and defensive stocks suggests those normally defensive asset classes are less likely to trade with defensive attributes in the event of a more significant market selloff.

Investors may be well advised to prepare for market volatility in 2024 without too much emphasis on what normally works.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.