Chalmers to fast-track investments; home prices hit fresh peak; Google eyes paid AI search

Ankita Rai

Thu 4 Apr 2024 6 minutesWelcome to the essential investor brief, featuring handpicked news for the week ending 5th April 2024.

This week's highlights include:

-Chalmers to fast-track business investments in budget plan.

-Australian home values hit a record high.

-Lithium miner Greenbushes posts bumper profit.

-Google mulls premium AI-powered search services.

ECONOMY & FINANCE

Green energy and housing are key priorities in the upcoming federal budget.

News highlights:

Treasurer Jim Chalmers plans to expedite business investments in the upcoming budget by streamlining approvals for foreign and domestic investors. The aim is to attract more capital and boost productivity, especially in green energy, housing, and infrastructure.

A new report reveals that Australian households are facing a tax burden of up to 45% of their income. Total tax revenue is projected to hit 30% of GDP in 2023-24, a 23-year high.

Linfox executive chairman Peter Fox has pledged to sustain Armaguard for three years if banks and retailers pay an extra $50 million yearly.

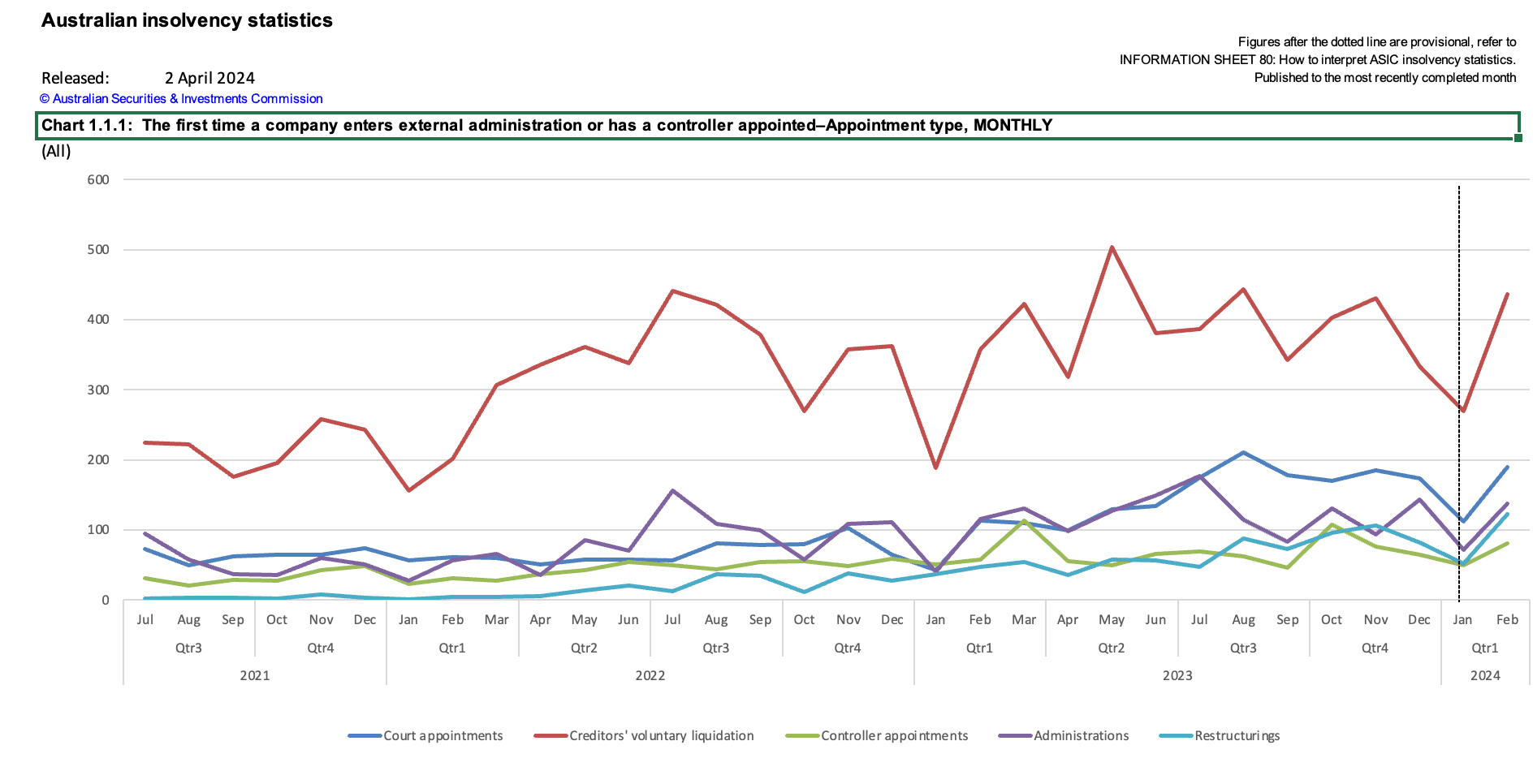

Short-seller Bronte Capital is targeting corporate debt amidst high insolvency rates. With over 900 companies entering administration in February, the hedge fund is shorting distressed debt, citing overvaluation.

What it means for investors:

- Heightened risk in corporate debt market: Australian investors holding corporate bonds or debt-related securities should exercise caution due to the potential impact of rising insolvencies on bond values. The surge in insolvencies may lead to defaults, resulting in losses for investors in corporate debt instruments.

- Investment opportunities: Investors may find lucrative opportunities in sectors like green energy, housing, and infrastructure due to increased investment activity.

- Opportunity evaluation: Investors in banking, logistics, and cash management sectors should monitor cash-in-transit industry updates. Caution is advised when evaluating Armaguard's future due to regulatory changes and shifts in payment preferences.

MINING

Despite recent price increases, the persistent weakness and production uncertainty in the global lithium market continue to present challenges.

News highlights:

Lithium mine Greenbushes reported a $6.3 billion profit, almost doubling from the previous year. It posted $9.8 billion in revenues, $5.47 billion of which came from Albemarle.

Iron ore prices plunged over 25% since January. Capital Economics predicts prices to hover around $100 per tonne throughout 2024, driven by weak global steel demand.

Citi analysts expect Newmont's ASX-listed shares to benefit from soaring gold prices (as shown in the chart below). They are projecting a $69 share price—20% higher than current trading levels.

The cost of Regis Resources' McPhillamys gold mine in NSW ballooned to nearly $1 billion, double initial estimates. Industry-wide inflation and design changes fuelled the surge.

What it means for investors:

- Lithium price volatility: Lithium prices have experienced significant volatility, posing challenges for investors assessing its long-term investment viability. Operational challenges and delays in production facilities could continue to disrupt supply chains. Investors should monitor production updates to mitigate risks.

- Iron ore market: The prolonged decline in iron ore prices could lead to lower revenues and profitability for miners, which could result in lower dividends or share prices.

-Gold price outlook: The record-high spot gold price exceeding $2300 per ounce provides a significant tailwind for Newmont.

- Cost escalation: The uncertainty surrounding Regis Resources' McPhillamys gold mine project could negatively impact the stock price. However, higher gold prices amid geopolitical tensions could offer some operating leverage.

PROPERTY

The housing market remains robust despite rate hikes and cost-of-living pressures.

News highlights:

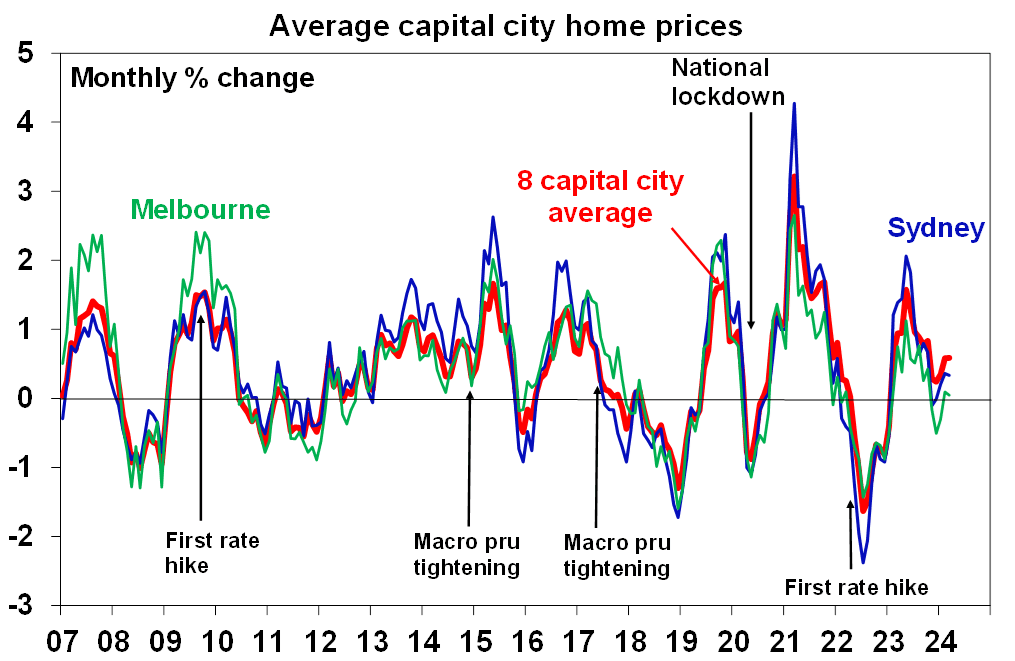

National home values hit a record high for the fifth consecutive month in March, reaching a median price of $772,730. Prices rose 0.6% in March, matching February's uptrend. All state capitals except Melbourne saw increases.

Major Chinese companies continue to divest Australian holdings, the latest being Dahua Group, which sold a Sydney project for over $120 million to DASCO.

A new JLL report has revealed a resurgence in Australia's top shopping centres. Positive metrics, population growth, and constrained supply are driving private buyers and institutional capital back into retail.

Cedar Pacific has teamed up with Japanese materials giant Sumitomo Forestry to develop a $1.2 billion build-to-rent apartment portfolio in Australia, prioritising sustainability.

What it means for investors:

- Diversfication potential: Cedar Pacific and Sumitomo Forestry's $1.2 billion joint venture in the build-to-rent sector offers investment opportunities in sustainable rentals, diversifying beyond traditional real estate assets.

- Demand and supply dynamics: Rising home values increases the likelihood of a delay in RBA rate cuts. Persistent high demand combined with chronic housing undersupply is likely to continue to drive prices up.

- Chinese divestment: Continued divestment by Chinese firms in Australia's property market may alter property dynamics and market sentiment. This may create opportunities for local developers and international investors.

- Resurgence in shopping centre investments: With offshore capital entering the market, there may be increased competition for assets, potentially driving retail property values higher. Positive leasing metrics and low vacancy rates suggest stability and potential returns for investors in retail real estate.

RETAIL

The retail sector continues to struggle with high costs and souring consumer confidence.

News highlights:

Marquee Retail Group, the owner of Colette and The Daily Edited, has entered voluntary administration. It aims to keep all stores open as it explores potential sale options.

Mighty Craft has sold Mismatch Brewing and 78 Degrees Distillery for $7.2 million to repay debt, including $20.9 million to Pure Asset Management and $8.8 million to the ATO.

Bell Potter's surprise downgrade caused Cettire shares to plummet 16%. Cettire’s market capitalisation has been under pressure due to scrutiny over tax payments in major markets.

Retailers seek relief in upcoming budget due to rising wage bills, energy costs, and insurance. National Retail Association has urged action in the upcoming budget to address these concerns.

What it means for investors:

- Retail sentiment: Pessimism among retail businesses may contribute to broader market volatility and impact investor sentiment. Potential policy changes targeting lower energy and insurance costs could benefit retail stocks.

- Minimum wage advocacy: Advocacy for higher minimum wages may increase costs for retailers, potentially affecting consumer spending patterns and profitability. Investors should assess the implications for retailers.

CORPORATE NEWS

AI-powered service innovations continue to drive growth for tech giants.

News highlights:

Samsung Electronics is poised for a nine-fold increase in first-quarter profit, driven by surging semiconductor prices. Operating profit is expected to reach 5.7 trillion won, the highest since Q3 2022.

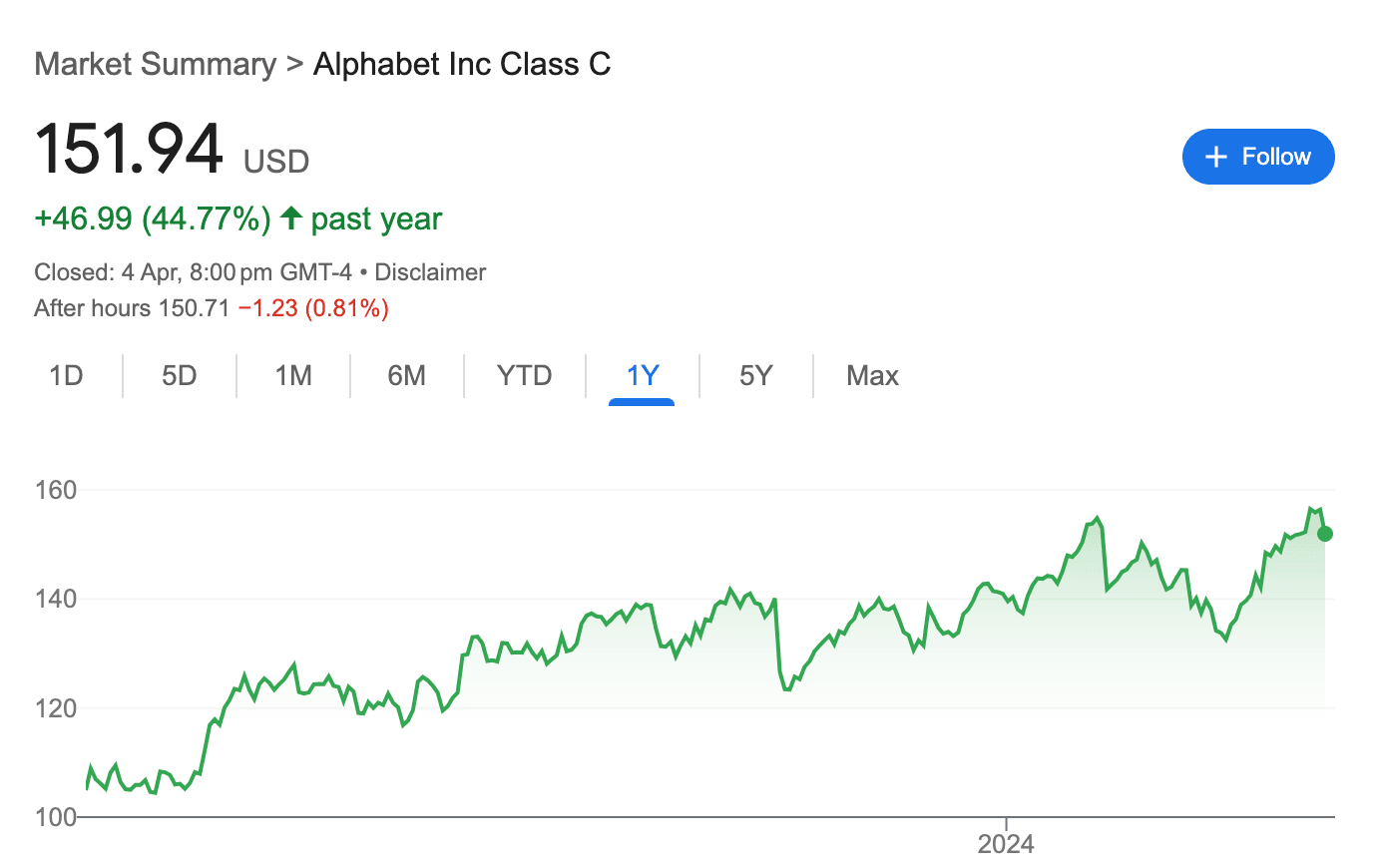

Google may start charging for AI-powered search features, a potential overhaul to its free search model. The move, driven by competition from ChatGPT, aims to maintain profits amidst soaring AI costs.

Canva's $3.6bn share sale has created instant millionaires among its staff. Oversubscribed by 150%, the sale valued the company at $26bn.

The US and UK signed a landmark AI agreement, pooling resources to test and mitigate risks from emerging AI models.

Treasury Wine Estates plans to raise prices for its premium Penfolds range following increased export demand. The price hike follows China's removal of tariffs on Australian wine.

Sydney Airport's earnings soared to $1.22 billion fuelled by increased post-pandemic flying. The company's net loss improved from $943 million to $588 million in 2023.

What it means for investors:

- Sectoral opportunities: Sydney Airport's earnings surge indicate post-pandemic travel resurgence, impacting infrastructure and aviation stocks. Ongoing infrastructure investments offer strategic investment opportunities.

- Positive outlook for wine Industry: The removal of tariffs on Australian wine offers growth potential for Australian investors, particularly those holding stocks in major wine producers like Treasury Wine Estates.

- AI chip demand: Investors in AI-focused firms and tech giants like Samsung and Apple should closely track the AI-related tech market. Rising demand for AI chipsets and services presents lucrative opportunities.

- Tech stocks: Investors in technology stocks, particularly those holding Alphabet shares, may see fluctuations in stock value as the company undergoes a significant shift in its business model.

Until next week...