How to use ESG scores to your advantage

Simon Turner

Fri 30 Jun 2023 6 minutesAs more investors understand the performance-enhancing and risk-reducing benefits of investing in ESG oriented strategies, demand for ESG data is on the rise.

That’s all good and well, but how can individual investors benefit from integrating ESG scores into their decision-making process without being ESG experts?

What are ESG scores?

ESG scores are usually a mark out of 100 which amalgamate a company’s performance across a vast array of ESG issues such as emission reduction, waste/water management, employee diversity/inclusion, and business ethics.

It’s important to understand there are two main types of ESG scores:

i) Analyst-created ESG scores – these are the result of subjective research conducted by specialist ESG analysts,

ii) AI–derived ESG scores – these come from objective research compiled by AI systems which trawl through vast amounts of unstructured data in ways humans are not capable of.

Both types of ESG score are useful in their own way.

For example, analyst ESG scores are often more in-depth, and are a useful way to assess the information accessible within a company’s sustainability report (published annually).

In contrast, AI-derived ESG scores are generally better at incorporating the latest ESG information which isn’t accessible within the sustainability report.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why are ESG scores useful?

It’s all about investment performance.

There’s overwhelming evidence to show that on average companies which perform well in the management of ESG issues, tend to outperform over the long term.

For example, a recent ESG Book study illustrated a European portfolio tilted toward ESG leaders outperformed by 1.59% p.a. between 2017 and 2022

This makes intuitive sense.

Management teams who are focused on ESG issues, are by definition focused on risk mitigation in the face of the structural risks their businesses face—for example, climate change.

As many successful investors have shown, outperforming is often more about controlling your downside risks than picking the outperformers.

So ESG scores offer a potential investment performance benefit for savvy investors who know how to use them to their advantage.

How to access ESG scores for free

The bad news for individual investors is that most ESG data providers charge a hefty subscription fee to access their ESG data and scores.

The good news is that limited ESG data is now available online.

On that note, here’s a tip to help you gain access to some basic ESG data to incorporate into your investment process…

Let’s use Microsoft as an example.

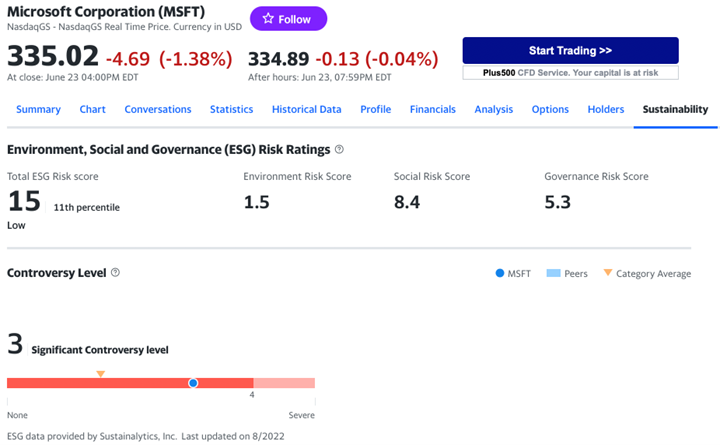

If you google ‘Microsoft ESG score’, you’ll find Yahoo Finance provides an ESG scoreboard using Sustainalytics’ headline data for the company as per below.

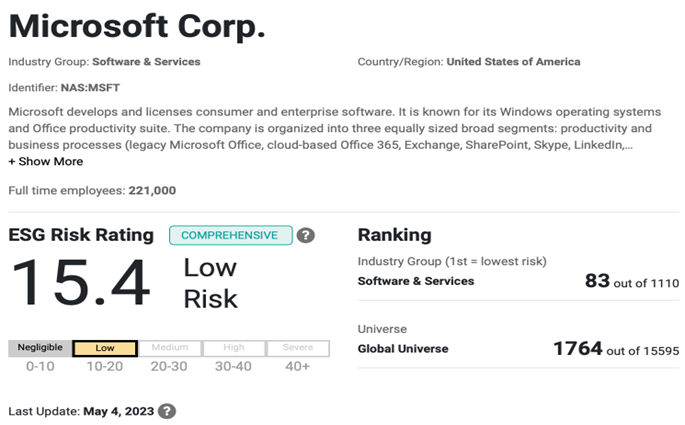

And if you search for Microsoft on Sustainalytics’ website, you’ll also find the company’s industry ESG rankings as per below.

As an individual investor, we now have enough (free) basic ESG information from the one source to incorporate into our investment process with a view to improving long term returns.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Using ESG scores to your advantage

The first question to ask is what type of ESG data are we accessing?

In the Microsoft example, the data comes from Sustainalytics, a leading ESG rating agency which primarily relies upon human analysts with some AI support.

That tells us that the ESG data is subjective and mainly backward-looking.

Using the Sustainalytics data, the key investor takeaways regarding Microsoft ESG performance are:

The company’s overall ESG risk profile is low.

The company is ranking in the top decile of its industry and the top quartile of the global universe for ESG performance – so it’s an ESG leader.

The one ESG risk which is significant is the company’s ‘Significant Controversy level’.

These takeaways provide a degree of comfort that Microsoft’s ESG performance is supportive of longer term outperformance (assuming the stock’s fundamentals concur).

However, this analysis also raises a potential red flag which is worthy of further investigation…why is the company’s Significant Controversy level showing up as a high risk?

Material ESG issues help investors improve their investment analysis

The term materiality is used in the ESG world to define how relevant an ESG issue is for investors.

It’s a useful concept to consider whenever you’re investigating any standout ESG issues as it allows you to make sense of the data within a broader investment context.

In the Microsoft example, a quick google search into the company’s potential controversy risks reveals the company has a track record of dealing with anti-competitive challenges. For example, Microsoft has been accused in the past of monopolising supply chains and designing products which are not easy to repair.

This is a business ethics issue which is classified as a governance (G) factor within ESG.

So is this a material issue? Considering the US regulatory authorities have been focused on curtailing the dominance of big technology leaders in recent years, and they have the power to investigate and potentially fine the company, it is indeed material.

The good news for investors is that Microsoft has escaped regulatory scrutiny in recent years, but being aware of this material ESG risk is likely to be helpful for investors when gauging the stock’s longer term risk profile.

ESG scores can help investors

In summary, with the help of the basic ESG data which is freely available, investors are able to glean useful information they can use to enhance their stock analysis.

As illustrated in the Microsoft example, the great advantage ESG data offers investors is it provides a picture of how a management team are managing their business risks, as well as any standout risks which are worthy of further investigation.

Why look a gift horse in the mouth? It’s time to use ESG scores to your advantage.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.