When tailwinds turn into headwinds

Simon Turner

Fri 23 Jun 2023 7 minutesCommercial property has been a staple source of solid income returns and capital growth for decades, particularly in the unlisted world. However, a number of the strongest commercial property tailwinds have recently turned into headwinds, impacting upon the outlook for the various commercial property asset classes.

Should investors reduce their commercial property exposure, or are these headwinds a short term opportunity in the making?

The RBA calls time on the commercial property party

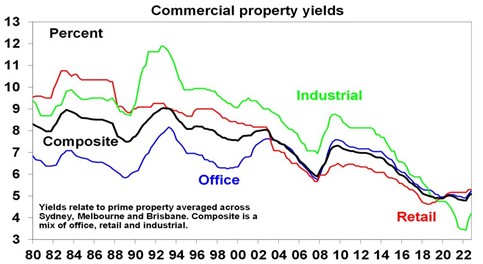

Let’s start with the elephant in the room…higher interest rates. Unsurprisingly, the RBA’s aggressive interest rate raising is impacting upon commercial property yields (as shown below). For good reason…this is the fastest tightening cycle in Australian history.

Whilst high leverage allowed unlisted commercial property funds to generate 20%+ p.a. returns over the past decade, the same leverage is becoming a weight around some of these funds’ necks.

In response, investor attitudes to gearing have changed. Loan to value ratios of 60%+ were regarded by many as prudent while interest rates fell, but these days 30-40% is regarded as more acceptable.

The issue with gearing isn’t just the impact of higher interest rates on a commercial property fund’s ability to maintain its distributions. It’s also the impact of higher rates upon net asset valuations which is sometimes triggering asset sales due to loan covenants.

As distressed sellers tap the market for liquidity in order to reduce their debt pile, pay redemptions, or fund an existing development pipeline, the number of property sales at below perceived book value is on the rise.

That means lower property prices in some market segments.

The key question for investors is…are we facing a bone fide commercial property bear market? Or is this a short term market pullback?

This outlook question is best addressed separately for office, retail, and industrial property…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Empty desks becoming the norm

Let’s start with the bad news.

The pandemic has forever changed most peoples’ expectations of where they work. You’ll have probably faced these questions in your own life or within your close circle. After experiencing the lifestyle and stress reduction benefits of working from home throughout the pandemic, most workers want more of it.

As a result, hybrid working (usually 2-3 days in the office and 2-3 days at home) has become the norm, while the population of full time work-from-homers has also boomed.

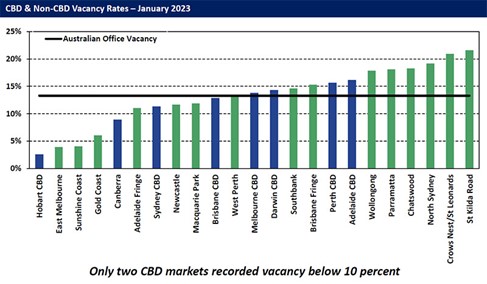

So the office sector is facing a long term reduction in demand for space which is leading to higher vacancy rates. The Australian office vacancy rate as at January 2023 was 13.3% (shown below), the highest it’s been since the mid-90s.

The geographic differences provide valuable context. Vacancy rates are particularly high in Sydney and Melbourne, and particularly low in Hobart, the Sunshine Coast, and the Gold Coast. Translation: more people are leaving the big cities behind to move to lifestyle-focused locations.

Lifestyle is trumping work proximity on a level we’ve never witnessed before.

Low office vacancy rates aren’t just an issue in Australia. By way of comparison, Manhattan’s office vacancy rate has increased from 11% to 23% since the pandemic. Despite this rise, New York’s office occupancy rate is running at only 49%. In other words, there’s ample room for vacancy rates to continue rising in the short term if office tenants become more efficient at managing their space requirements.

With vacancy rates expected to continue rising, the post pandemic headwinds appear to be here to stay in the global office sector. And we’re likely to see more distressed selling in this sector.

Successful office property investors are likely to focus on long-term leased properties with large defensive corporate or public sector tenants at yields which reflect the heightened risks.

Alternatively, buying office property at a discounted valuation which allows the asset to be repurposed into high-density residential apartments, warehousing, childcare, or student accommodation could be a lucrative strategy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Retail property proving to be steady ground

Ready for some better news?

Australian retail property remains a desired asset class for a vast array of buyers globally.

Whilst higher interest rates are taking their toll on lower quality retail property valuations, the relatively low supply of high quality stock coming to market is holding yields reasonably steady.

In addition, the return of net migration as well as international tourists and students provides a natural consumer demand growth driver which is supportive of this asset class.

What about the impact of growing online spending? Whilst that’s a headwind for some retailers, sales are increasingly being generated from the same retail property regardless of whether they were placed online or in-store.

So the outlook for high quality retail assets is neutral to positive despite the interest rate headwinds.

Successful investors in the sector will be focused on acquiring land-rich assets with long leases as well as properties with the potential to add value.

Industrial property still the market darling

And the bright spot within commercial property is…industrial property.

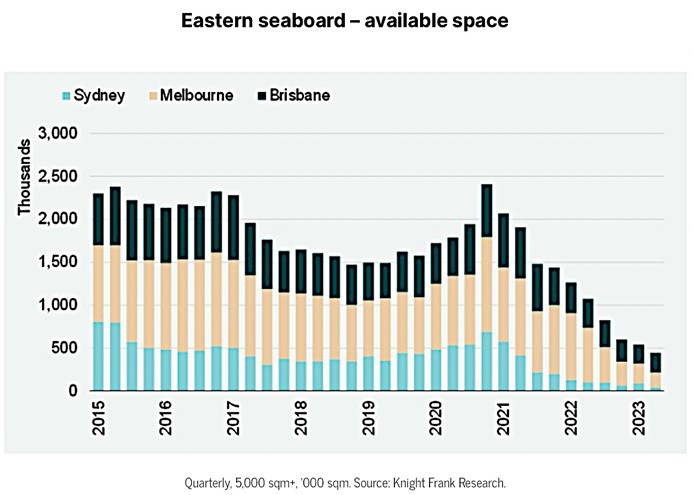

With the pandemic fast-tracking online consumer demand growth, demand for logistics and warehousing space has increased to unprecedented levels. As a result, industrial property vacancy rates have fallen to record lows across the Eastern seaboard cities (shown below).

Amidst the intense competition for industrial leases, rents are on the rise across the board. We’re talking big rent increases in the major cities. Sydney and Perth have both seen rental growth of over 35% in the year to March 2023, while Brisbane, Melbourne, and Adelaide all reported double digit increases.

These are extraordinary times in the industrial property world.

In response, industrial property supply growth is expected to be increase significantly this year but almost half the pipeline is pre-committed and 10% is owner occupied. In addition, around 20% of expected new industrial supply has been cut from 2023 forecasts due primarily to material and labour shortages. So the amount of speculative space entering the market remains low in the context of the ultra-low vacancy rate.

With its unique tailwinds continuing to blow, the outlook for industrial property remains bullish despite higher interest rates.

A caveat on valuations

With interest rates taking their toll on some commercial property valuations, it’s important for investors to focus on the net asset values (NAVs) they pay at the time of investment in both listed and unlisted property funds.

It’s generally advisable to invest in property funds which are regularly valued by independent experts with reference to current market valuations. The more often the NAV is independently revalued, the better.

Time to be picky

In summary, the outlook for commercial property depends on the type of asset and the investment strategy being implemented.

As with all market cycles, some investors will benefit from the interest rate-created headwinds which appear to be creating a short term market pullback rather than a longer term commercial property bear market.

Industrial property investors are well positioned to benefit from low vacancy rates, while there are customised strategies in both office and retail property which are likely to generate solid longer term returns.

Remember, not all commercial property assets are created equal. It’s a good time to be picky.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.