Private Credit Fund Unit Pricing – Overvalued?

Rixon Capital

Fri 14 Apr 2023 3 minutesAmong the attractions of an investment in an unlisted private credit fund is avoiding the volatility associated with the public markets. There is a downside to not marking-to-market, as it risks a fund holding assets at a Book Value well in excess of Market Value.

A topical example is the impact of recent interest rate rises, with higher rates driving a (downward) repricing of listed asset valuations. Yet the market has not observed wholesale revaluations in the private credit sector. While it may be argued that a loan not in default should not be subject to a negative revaluation, the illustration below indicates otherwise.

First, we establish the two basic building blocks of a headline interest rate:

Base Rate: A floor rate reflecting the current funding environment (e.g., bank bill swap rate, LIBOR)

Margin: A funding premium determined by the lender to reflect factors including risk

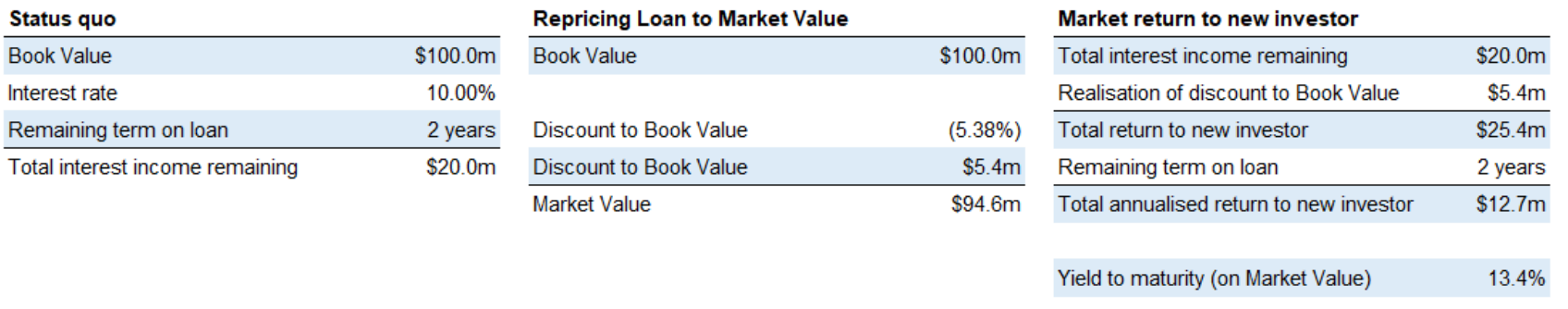

Next, we consider a hypothetical private credit fund holding $100m of loans written in March 2022 with a 3-year term at a fixed rate of 10.0% p.a. – fixed rates prominent in pre-1H CY22 portfolios – implying the following:

0.1% Base Rate (1-month bank bill swap rate in March 2022)

9.9% Margin

Fast forward 1 year and observe the impact of the higher March 2023 bank bill swap rate on the same loan portfolio.

3.5% Base Rate (1-month bank bill swap rate in March 2023)

9.9% Margin

The market now requires a return of 13.4% from the same portfolio, with no change in risk.

Should the fund seek to trade this $100m portfolio, no fully-informed acquirer would pay 100c on the dollar as the 10.0% return is below market benchmarks. Utilising a Yield-to-Maturity calculator we see that a Market Value return of 13.4% can only be achieved if the loan is revalued to $95m or a 5% discount to Book Value.

This reflects several concerns for investors, chiefly:

Incoming investors acquiring units in the fund risk overpaying by 5%

Exiting investors will do so at a premium to Fair Value (100c vs 95c on the dollar) at the expense of investors who remain

This Market Value challenge is not only driven by the impact of higher interest rates on the Base Rate. Equally, loans that were sized utilising valuation reports drafted in early 2022 risk reflecting higher LVRs in 2023 and may be a refinance risk. Consider how the valuation of a property development site will have moved over the last 12 months.

The key message to investors is to understand the composition of a private credit fund loan book, as this illustration shows how an attractive headline return and stable valuation may hide meaningful challenges.

The author’s advice to prospective and existing private credit fund investors is to read documents in full, ask questions, and seek professional advice.

Disclaimer: This article is prepared by Rixon Capital. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.