How the changing face of Australia affects investors

Simon Turner

Fri 15 Mar 2024 5 minutesDemographics are often at the heart of long term structural trends which affect a country’s economic and investment prospects. As such, being aware of Australia’s demographic trends is an important part of the puzzle for all long term investors. We unpack the key demographic trends at play for investors below.

Population growth amongst the highest in the developed world

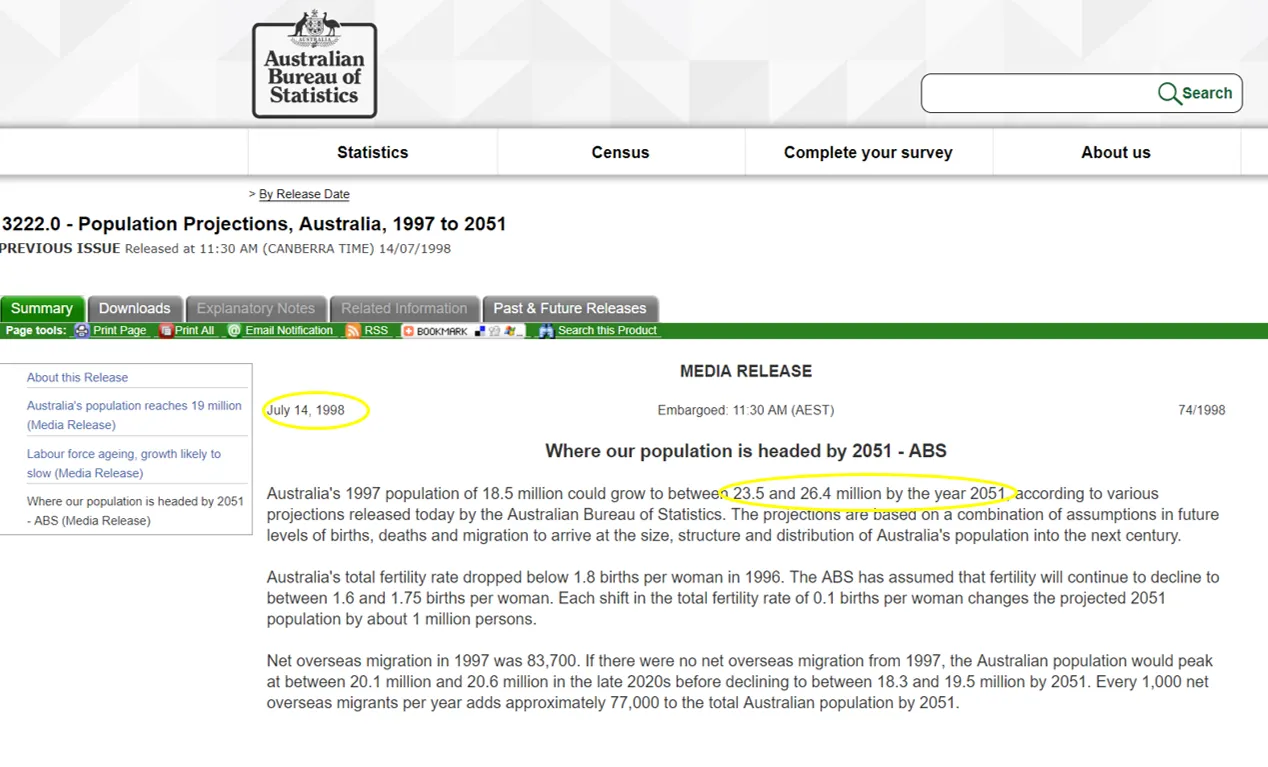

The first point to highlight is that Australia’s population growth is high by developed world standards. In fact, with Australia’s population fast approaching 27 million, it has already exceeded the government’s top end 2051 forecast made back in 1998:

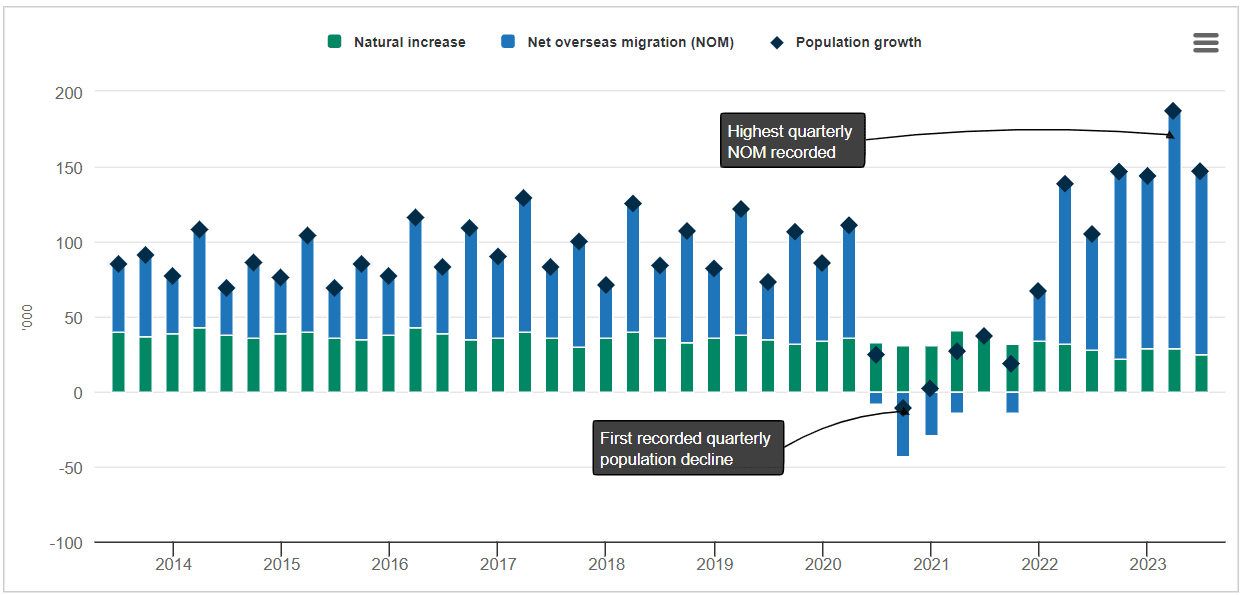

The country’s population growth has been gradual and consistent. Apart from during the pandemic, Australia’s migrant population growth has been trending upwards in recent years, as shown below:

Australia’s dramatic population growth versus expectations reflects three key drivers:

Migration policy changes have led to consistent growth in the number of migrants arriving each year. For example, during the 2023 financial year, there was a net annual gain of 518,000 migrants, representing almost 2% of the Australian population.

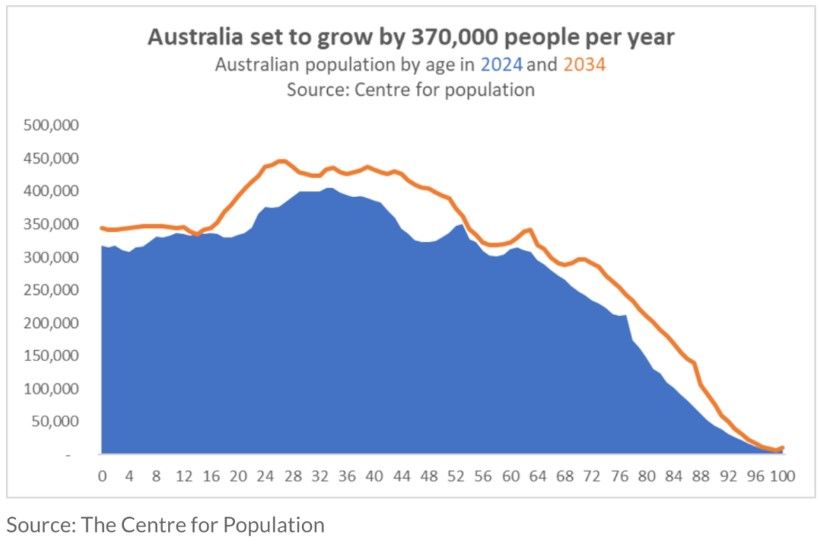

Longevity increases – Back in 1998, it was believed that life expectancy would reach 82 for men and 86 for women by 2051. However, those goals have already almost been achieved with male life expectancy reaching 81.2 years and female life expectancy reaching 85.3 years. As this trend continues, the population is expected to continue ageing as shown below.

3. A consistently solid birth rate – The fertility rate is running at 1.63 births per woman leading to a natural increase in the population of 106,000 in the 2023 financial year.

Implications for investors:

A high population growth rate versus other developed economies positions Australia to outperform developed economies with ageing populations and lower population growth rates.

A high migration rate creates the risk of higher unemployment and social welfare costs if arriving immigrants aren’t able to find gainful employment over time.

A high migration rate suggests demand for residential property will remain consistently high, particularly in the major cities where most of the jobs are located. This provides a natural tailwind for the residential property market and the services migrants require as they integrate into Australian society.

The gradual ageing of the Australian population and its increasing longevity suggests there will be strong growth prospects for the healthcare, medtech, and aged care sectors over the longer term.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The great post-pandemic migration is over

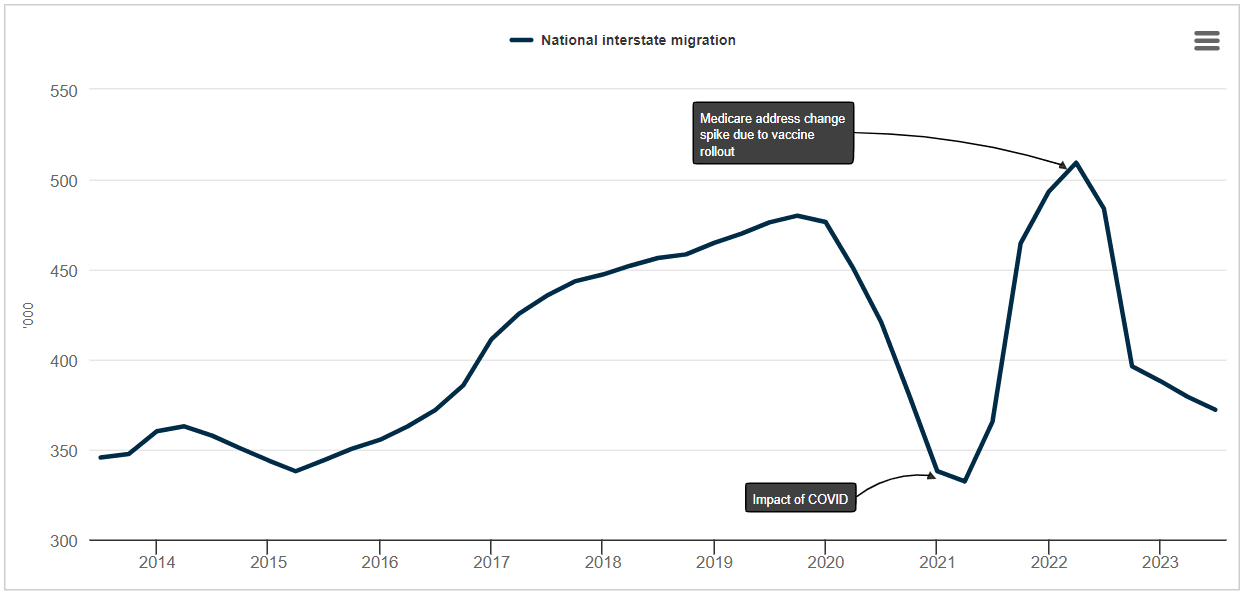

The other major demographic trend worthy of note for investors is that the great interstate migration has come to an end.

In fact, interstate migration has fallen back to pre-pandemic levels. The last government data is for the June 2023 quarter and it showed interstate moves were 372,000 in the preceding year, down from 509,000 the year before.

As shown below, it’s been a wild ride for interstate migration numbers in recent years:

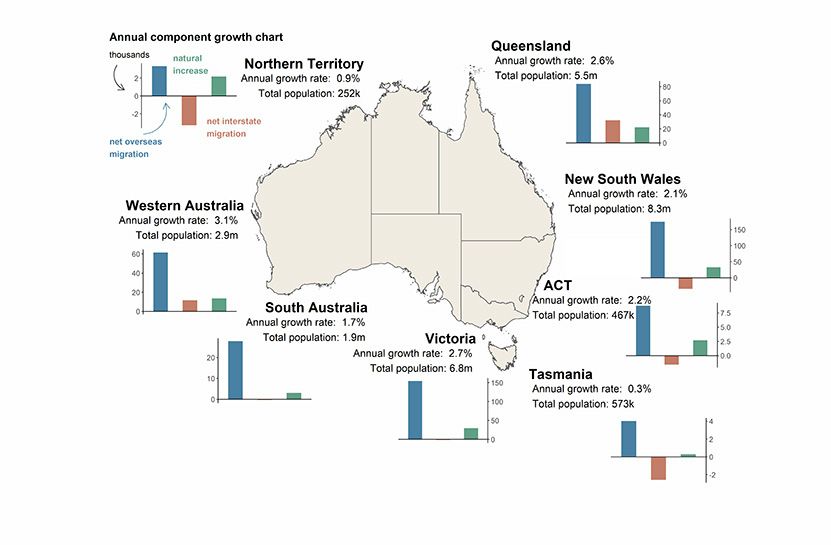

At a state level, Western Australia, Victoria, and Queensland stood out as the biggest population winners in the year to June 2023 (as shown below), whilst Tasmania, the Northern Territory and South Australia were at the back of the pack. However, the population of all states and territories has been on the rise.

Across the board, the key state/territory population growth driver has been an increase in overseas migrant arrivals and subdued migrant departures. It’s hardly surprising more migrants want to stay given the growing geopolitical challenges around the world, as well as the lifestyle advantages on offer down under.

Implications for investors:

Normality has officially returned to the world of interstate migration. Whilst the pandemic highlighted to many the attractions of emphasizing lifestyle and working from home, property investors should not assume that this is a long term trend. The pandemic may have served to catalyse interstate moves by those who were considering it anyway, but many of those people have already moved.

The big states keep getting bigger, and may continue to do so. Queensland and Western Australia are particularly well positioned to ride this structural trend longer term as they are the two states which are attracting more interstate migrants and overseas migrants alike. As the smaller of Australia’s large cities, Brisbane and Perth are perceived by many to offer lifestyle advantages combined with solid career prospects. Their property markets and local businesses appear well positioned to benefit from ongoing migrant-led population growth and economic development.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Australia’s structural advantage

From an economic perspective, Australia’s high population growth creates a structural advantage which suggests the country is likely to outgrow developed peers with weaker demographics trends.

In terms of investment winners, residential property is expected to benefit from this tailwind over the long term, particularly in lifestyle-advantaged cities like Brisbane and Perth. Businesses targeting aged care and healthcare are also well positioned to benefit as Australia’s population continues to age.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.