January inflation holds steady, BHP reveals job cuts, Coles' profit dips

Ankita Rai

Thu 29 Feb 2024 7 minutesWeek ending 1st March 2024

Highlights:

-January inflation remains steady at a two-year low.

-BHP to cut jobs in global restructuring.

-Coles' first-half profit falls, sales rise.

-Ramsay Health Care warns of more hospital closures.

ECONOMY

Shrinking inflation supports expectations that interest rates are unlikely to increase further.

News highlights:

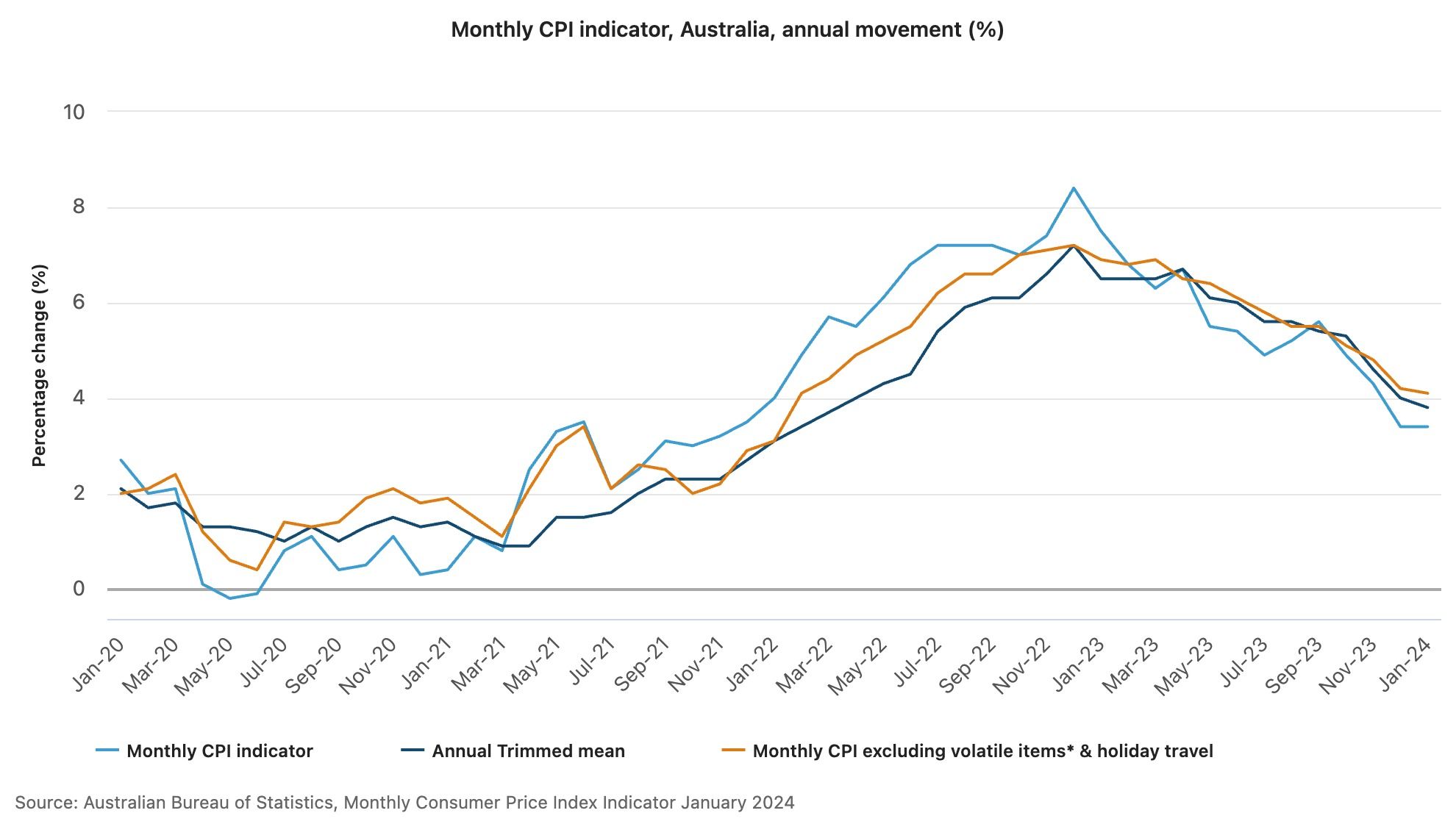

Inflation remained stable at 3.4% in January, its lowest since November 2021. However, price pressures remain in the housing sectors offsetting declines in pantry staples.

An Amazon Australia-commissioned report shows online competition and lower-priced products eased Australia's inflation in 2023. Without online sales, inflation would have been 0.7% higher yearly, prompting a 0.5% interest rate hike.

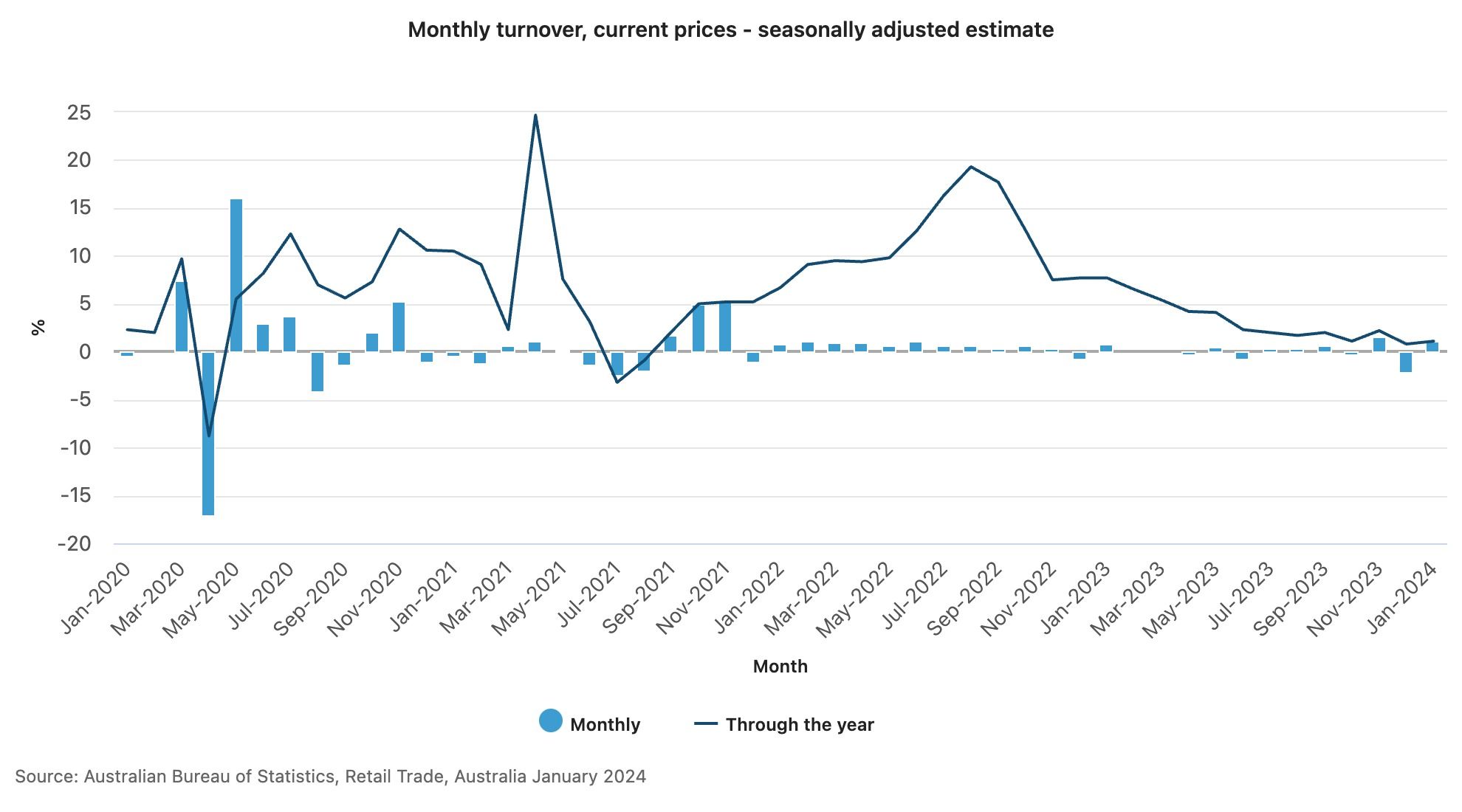

Retail sales rebounded in January, rising 1.1%, slightly below expectations. This follows a 2.1% decline in December, as consumers took advantage of Black Friday sales to move their spending forward.

In the US, the Fed’s preferred gauge of underlying inflation rose 0.4% in January, up 2.8% from a year ago, indicating that the central bank's 2% inflation target may take time to achieve.

What it means for investors:

- The more subdued sales and consumer price growth suggest that the RBA will likely maintain its cash rate at 4.35% next month while retaining a tightening bias to curb inflation further.

- The January CPI data indicates inflation is moving gradually towards RBA's target range. However, costs associated with renting and building new homes, which hold significant weight in the consumer price index, continue to rise rapidly.

- The January inflation reading in the US showed core prices rose as expected, not worse, but still not ideal for the Fed aiming to bring inflation down to 2%.

RETAIL

Higher interest rates continue to weigh on profits while sales beat estimates.

News highlights:

Coles reported stronger-than-expected sales amid scrutiny over rising food prices. While earnings remained flat at $1.06 billion and net profit dropped 3.6%, revenue saw a 4.9% increase in the December half.

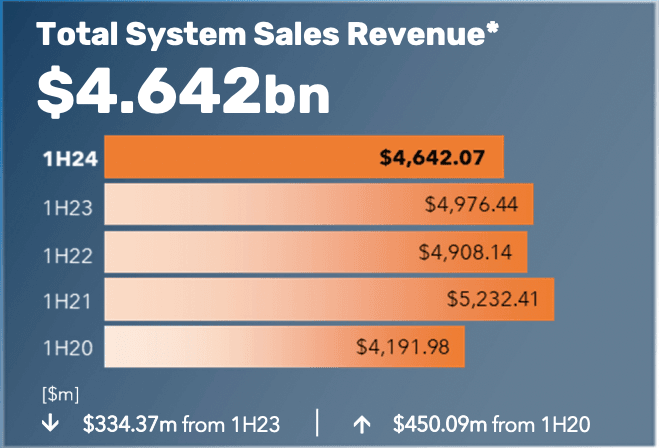

Harvey Norman's shares soared on better-than-expected profits. Sales fell to $4.64 billion, and pre-tax profit plummeted 45.7% to $283.6 million in the first half of the financial year.

Kogan.com returned to profitability for the first time since 2021, reporting $8.68 million in earnings for the first half. However, sales declined by 9.9% due to reduced household spending.

Endeavour Group's first-half revenue rose by 2.5% to reach $6.67 billion, primarily fuelled by the performance of its liquor chains and speciality brands. However, higher financing costs led to a 3.6% decline in its net profit, which fell to $351 million.

Guzman y Gomez delayed its ASX listing due to increased losses. Its net loss widened to $3.9 million in the first half while global sales rose 30% on the back of rapid store expansion.

Adore Beauty's sales hit $100 million, up 7%, driven by increased average order value and per-customer spending. Despite challenging market conditions, the company stuck with its earnings guidance of $2.4 million EBITDA.

What it means for investors:

- With inflation easing and demand weakening, retailers are prioritising cutting costs to maintain profit growth.

- The ongoing price gouging inquiries will keep supermarkets under pressure, potentially squeezing margins as they lower prices for shoppers.

- In the e-commerce sector, mounting competition from Amazon and Temu is a concern as reflected in the declining market share of incumbents such as Kogan.com and Catch.com.

MINING, RESOURCES & ENERGY

Nickel woes linger as the industry seeks tax relief.

News highlights:

The push to revive Australia’s struggling nickel industry by offering tax breaks could cost taxpayers about $825,000 per worker, prompting a mixed reception within the government.

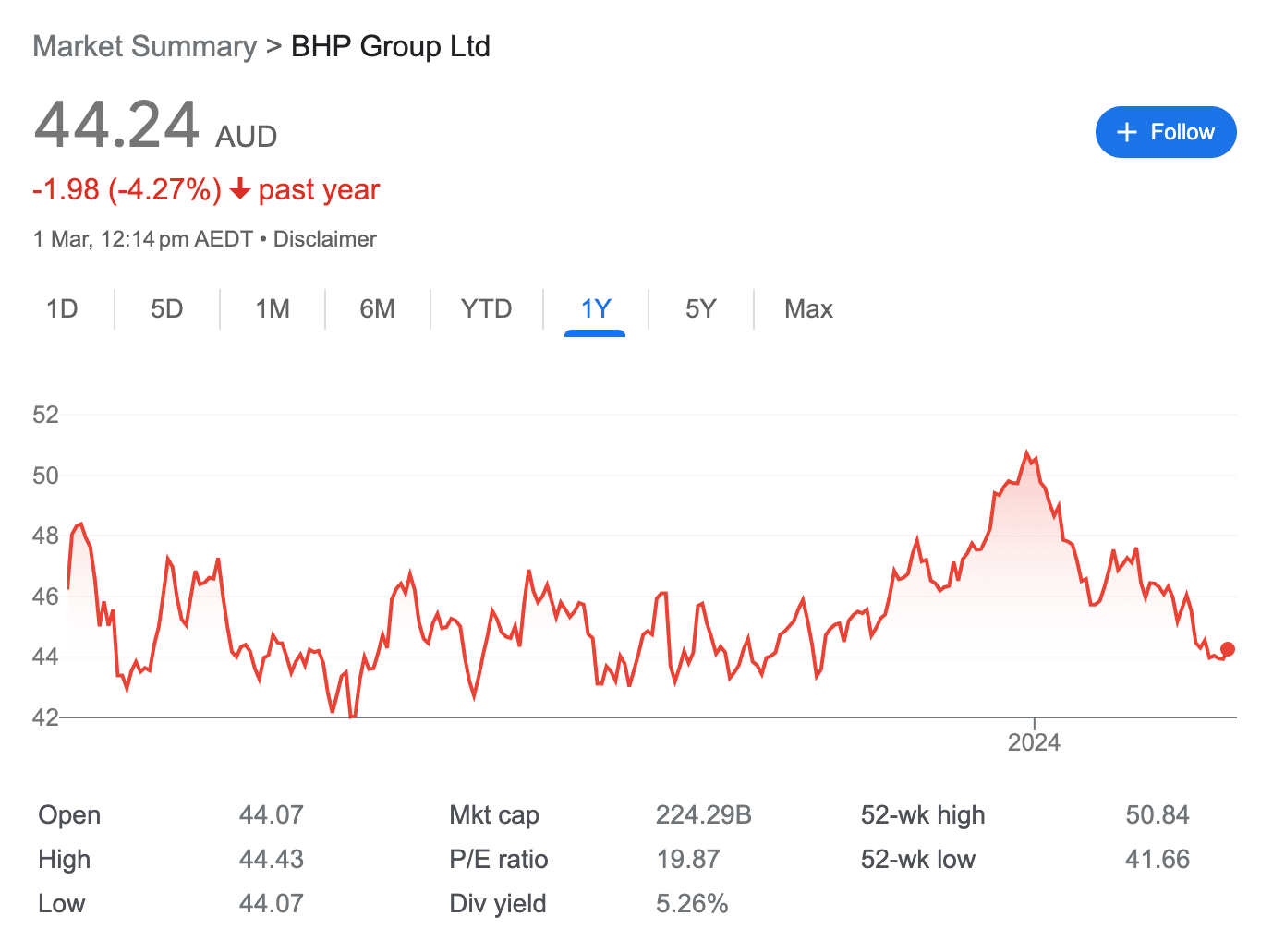

BHP is restructuring by cutting jobs in Australia to curb costs in the face of wage inflation and declining nickel prices. It could lay off thousands of workers at its nickel operation in Western Australia.

Nickel Industries reported record earnings in 2023 despite a 23.5% drop in net profit to $121.6 million. Group earnings reached $403.3 million, driven by record nickel production.

Australian coal exports to China surged after Beijing lifted a two-year ban. NSW coal exports to China in 2023 exceeded pre-pandemic levels, with Chinese importers purchasing 24% of the state’s coal exports.

Woodside Energy posted a 37% drop in full-year profit due to softer oil and gas prices. Bottom-line earnings fell 74% due to impairments. However, the company still managed to achieve an 80% payout ratio for dividends and declared a final dividend of US60¢ per share.

EnergyAustralia recorded a $35 million operating loss in 2023, although annual earnings surpassed $400 million. The improvement in generation reliability and market conditions helped mitigate the impact of the loss.

What it means for investors:

- The slowdown in the uptake of electric vehicles has made car makers more focused on costs, benefiting Indonesian nickel miners. Meanwhile, nickel operations in Western Australia continue to face a bleak future after being undercut by cheap nickel from Indonesia's coal-fired plants.

- Geopolitical tensions in the Middle East and Europe's shift from Russian gas could impact global LNG markets. OPEC and US actions will dictate sector outcomes.

- The uncertain outlook in Australia's energy market poses challenges. Although recent tariff hikes have helped energy retailers recover losses, impending announcements of lower tariffs by the energy regulator could increase pressure on retailers, impacting profit margins.

HEALTHCARE

The healthcare sector is grappling with a confluence of financial challenges, putting unprecedented strain on the operational viability of hospitals.

News highlights:

Ramsay Health Care warned of more hospital closures without additional funding. It reported a 23% drop in net profits, with total costs rising by 11.7%. Despite strong UK operations, margins in Australia remain tight due to high labour and medical supply costs.

Healius plans lab closures and asset sales following a $636 million loss in the December half. Revenue dropped 1.75% to $849 million while margins in the pathology division margins fell to 1% from 4.9%.

What it means for investors:

- Hospitals and diagnostic companies are grappling with soaring operational costs, including wages and medical supplies, while the lack of adequate funding from the government and insurers is putting further strain on healthcare companies.

- Health inflation surged 5.9% in 2023, severely impacting the health sector. The industry grapples with unprecedented challenges, resulting in the closure of over a dozen facilities due to insufficient reimbursements and mounting debt.

PROPERTY & CONSTRUCTION

Office tower valuations signal the market correction is nearing its end.

News highlights:

Major CBD office towers in Australia are selling at a 20% discount to peak values, leading to some experts believing the office market correction is nearing its bottom. Analysts suggest recent transactions will set pricing benchmarks for the next year.

Australian residential construction declined 5.2% in December. Despite a solid backlog of work, construction industry insolvencies rose, comprising nearly 28% of total Australian insolvencies this financial year.

Adbri reported robust demand for building materials despite concerns over a residential construction slowdown. It posted a revenue increase of 13.1% to $1.92 billion for 2023, while net profit after tax fell 9.5% to $92.9 million.

What it means for investors:

- The shift to remote work and rising interest rates have impacted office values globally. While the sector faces uncertainties from remote work and interest rate increases, analysts anticipate increased buying activity in the latter half of the year.

- The larger-than-expected contraction in residential construction is due to weak near-term building approvals, higher material prices, and labour shortages. However, the significant backlog of work should help soften some of the decline.

CORPORATE NEWS

Cost and margin management continues to be the key theme.

News highlights:

Westpac is slashing 132 jobs aiming to align with slower credit growth. The move is part of the bank's broader cost-cutting strategy amid sector-wide outsourcing trends and margin pressures.

Macquarie Group is outperforming major banks in deposit growth. It attracted over $5 billion in deposits in the last five months alone.

Star Entertainment's revenue dropped 14.6% in the December half due to competition and gaming restrictions, with Sydney's casino revenue down 17%.

What it means for investors:

- Deposit competition remains the primary factor impacting banks' net interest margins amidst regulatory pressure within the industry to ensure transparent pricing of interest rates on savings accounts.

- Competition with Crown Resorts and compliance costs continue to weigh on Star. Additionally, it is grappling with lawsuits and fines related to anti-money laundering breaches, putting further pressure on the company.

Until next week...