Alternatives No Longer Living Up to their Name

Simon Turner

Mon 24 Mar 2025 5 minutesAlternative investments have done what alternative music did in the 90s: become so mainstream that their name doesn’t apply any more.

They are no longer reserved for institutional investors and the wealthiest of the wealthy. Alternatives have become a staple component of most high net worth individuals’ portfolios, and are increasingly showing up in mass market portfolios.

We investigate the sector’s growth drivers for a steer as to what’s coming…

What are Alternatives?

Alternative investments are asset classes outside of traditional stocks and bonds, often with the potential for higher returns with low correlation to traditional assets. Examples include private equity, hedge funds, venture capital, real estate, commodities, cryptocurrency, and art.

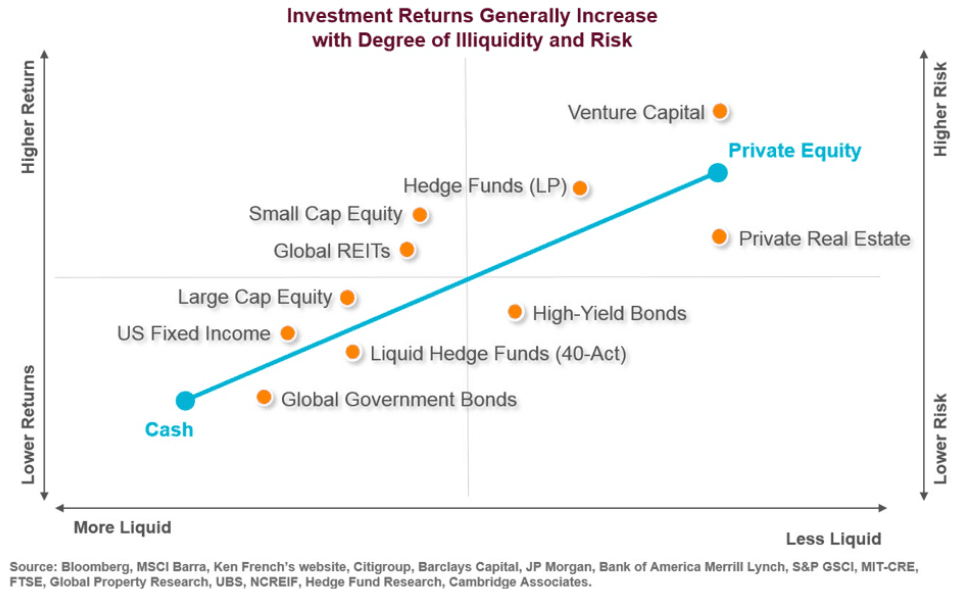

Alternatives’ returns tend to increase with the degree of illiquidity and risk. Private equity and venture capital are generally the highest risk, highest return alternative asset classes, while hedge funds are further down the risk and return curves—as shown below.

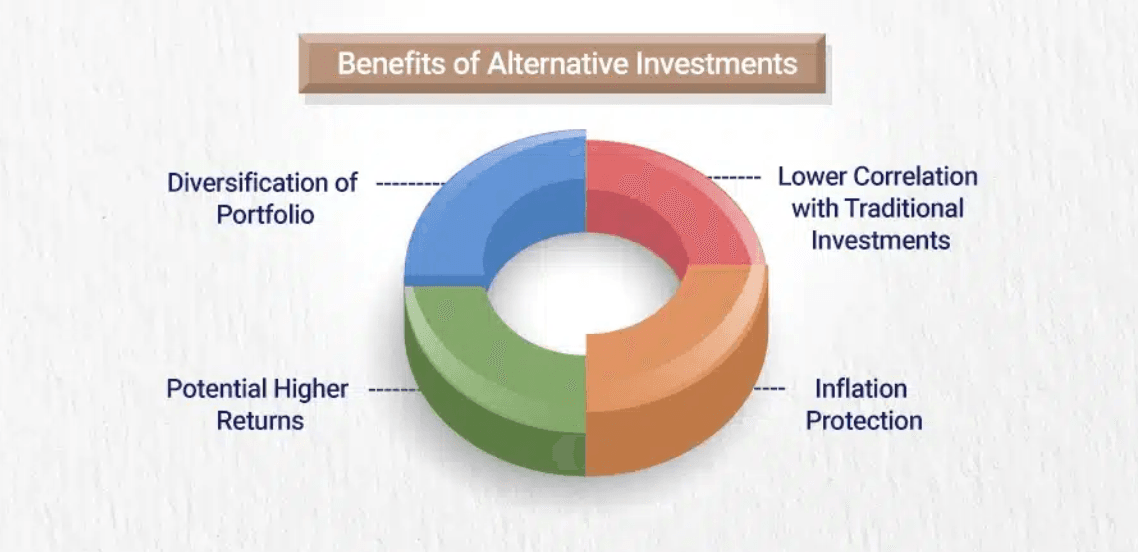

The attractions of alternatives include their diversification benefits, the potential for higher but uncorrelated returns than traditional assets, and inflation protection. However, they also come with higher risks and fees.

Alternatives’ Diverse Growth Drivers

The alternatives landscape is rapidly evolving, influenced by economic shifts, technological advancements, and changing investor preferences. Here are some of the most significant trends at play…

1. Faster AUM Growth than the Public Markets

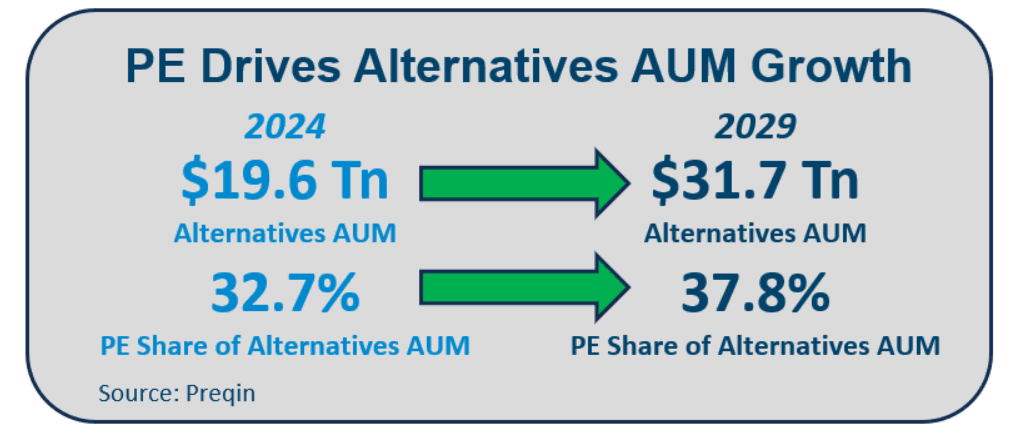

Private market assets under management (AUM) are growing much faster than public assets driven by growing demand for high-performing assets with a low correlation with broader financial markets.

According to most forecasts, alternatives AUM are growing at least twice as fast as publicly listed assets—largely driven by strong private equity AUM growth.

Alternatives’ main AUM growth driver is institutional and individual investors increasingly allocating capital to the sector to diversify their portfolios and enhance their risk-adjusted returns. They’re particularly focused on alternatives opportunities linked to technological innovation and structural shifts in the world – such as artificial intelligence.

2. Digital Assets & Tokenization Revolution

Digital assets, including cryptocurrencies and blockchain-based investments, are gaining traction in the alternatives world and democratizing investment opportunities previously reserved for high-net-worth individuals and institutions.

For example, blockchain is being leveraged for innovative investment structures, tokenization of assets, and enhancing transparency.

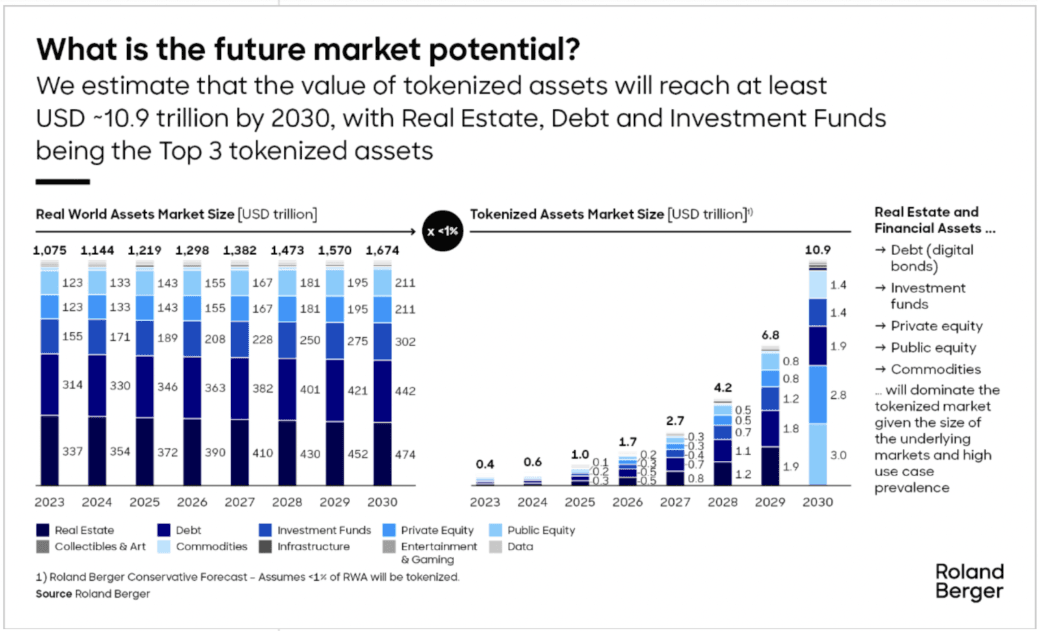

Tokenization is nothing short of a financial revolution for alternatives investors since it expands the ways in which investments are stored, traded, and managed.

Instead of relying on traditional ownership records, alternative assets – such as real estate, private equity stakes, infrastructure, and art – can be represented as blockchain-based tokens. Tokenization also makes alternative assets more liquid and enables better secondary market trading.

As a result of these benefits, tokenization growth is expected to be dramatic in the coming years, which will help drive alternatives growth.

3. Impact Investing & ESG Integration

There’s been a marked shift across the alternatives world toward impact investing in recent years, with financial returns increasingly being coupled with social and environmental goals.

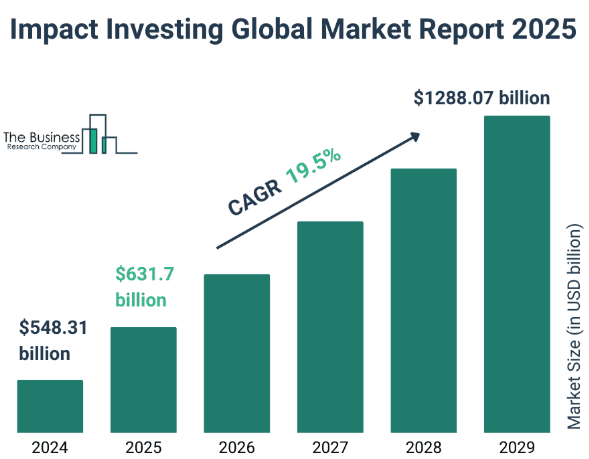

As a result, the impact investing market is expected to grow at 19.5% p.a. through to 2029 – as shown below.

This trend is not only driven by ethical considerations but also risk management and long-term sustainability. It’s the same with ESG integration, which is being used to improve risk-adjusted returns across the alternatives world.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

4. Alternative Data Boom

The use of alternative data—such as satellite imagery, social media sentiment, and purchasing patterns—is revolutionizing alternatives investment strategies. Hedge funds and private equity firms are increasingly employing these sophisticated data analytics to gain insights and drive their decision-making, helping to them uncover alpha in less efficient markets.

Investors should expect more of this looking forward, which is good news for future returns.

5. Regulatory Evolution

As alternatives grow as an asset class, so too is the sector’s regulatory scrutiny. New regulations aimed at protecting investors and ensuring market integrity are being implemented globally. Investors are navigating these complexities by requiring more robust compliance and reporting mechanisms from their fund managers.

Regulatory changes may also lead to industry consolidation. If that happens, smaller crypto firms and start-ups’ development may be hindered by the escalating capital and prudential requirements.

But overall, improved regulatory oversight is likely to prove helpful for individual investors navigating the alternatives world.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Alternatives not Alternative Anymore

The alternatives investment landscape has become increasingly dynamic, driven by investor demand, technological advancements, and evolving investor preferences. As these trends continue to shape the market, prudent investors are adapting their strategies to capitalise on the opportunities presented by this diverse and complex asset class.

Funds Positioned to Benefit

Private Equity:

Crypto/Digital Assets:

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.