Why uranium should be on your radar

Simon Turner

Tue 6 Jun 2023 6 minutesUranium is a commodity which tends to inspire impassioned debate amongst investors and the population at large. Some remember Chernobyl and Fukushima and retain a blanket negativity toward nuclear energy and uranium as a result. However, change is afoot across the sector. Nuclear energy’s position in the global energy mix is once again on the rise which means the world will need a lot more uranium looking forward. With supply set to remain constrained for many years, it could well be worth keeping an eye on the uranium sector for potentially supersized returns in the coming years.

Nuclear energy is making a global comeback

There’s no escaping the fact that nuclear energy ticks the boxes the world needs as we transition toward net zero by 2050. Beyond the carbon emissions from constructing nuclear plants, nuclear energy is carbon free and is a reliable course of baseload energy. As renewables generate a larger portion of the global energy mix, the importance of strategic carbon free baseload energy to guard against supply disruptions has never been more important.

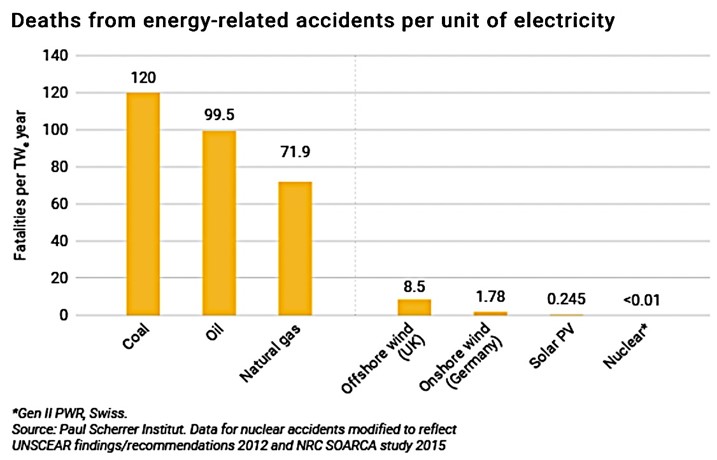

What about the safety of nuclear energy, the naysayers may ask? There’s good news on that front as well. Nuclear energy’s safety has significantly improved in recent decades. As shown below, nuclear energy is now by far the safest form of energy in terms of accidents per unit of electricity.

And of course, there’s the global context of energy demand and supply. The need for alternative low carbon energy sources is being compounded by the relatively low level of investment into oil and gas discoveries over the past decade—due largely to the climate change implications. In other words, oil supply is struggling to keep up with demand, and this dynamic could become more pronounced when global economic growth improves.

As a result, alternative low carbon energy sources such as renewables and nuclear energy need to contribute a larger portion of the global energy supply mix sooner rather than later.

Uranium’s growing deficit

While the debate over nuclear energy’s role in the global energy mix has raged in recent years, uranium supply has stagnated. That’s hardly surprising. Investment markets don’t tend to invest capital into contentious investments during times of uncertainty. After Fukushima, the outlook for nuclear and uranium was both contentious and uncertain. Fast forward to 2023, and there are no large uranium mines planned to come online in the coming five years. That’s a long lead time for the commodity’s supply to adjust regardless of what happens to demand in the interim. So the supply side of the uranium market is unusually constrained at a time when demand for nuclear energy appears to be entering a structural growth phase.

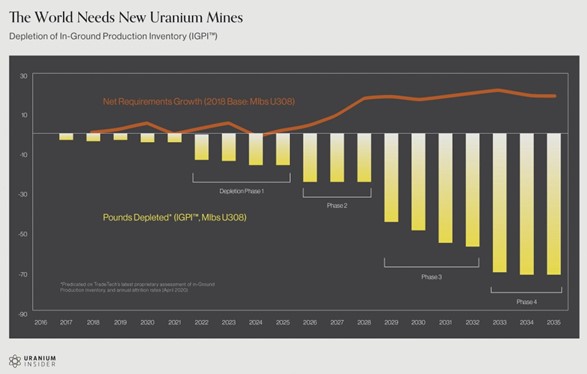

Check out the chart below for a picture of how uranium’s in-ground inventory is expected to deplete versus the commodity’s net requirement growth.

It’s rare to come across a commodity facing such a significant and structural deficit which can’t be resolved by higher supply capacity for so many years.

The uranium spot market versus the term market

Investors are used to looking at commodity spot markets for a picture of how a commodity is performing. As shown below, uranium has roughly doubled in the spot market over the past five years.

However, the uranium spot market doesn’t tell the full story. Most of the action is in the term contract market because utilities need reliable long term supply which they prefer to secure via contracts. Year to date, demand growth in the term contract market has escalated more than the spot market price may imply. At the current rate of contract signings, the term market is on track to commit the delivery of around 300 million pounds of uranium in 2023. While the usual Western buyers have been active, what’s more noteworthy is the significant step up in demand from Eastern players such as CNNC in China. This isn’t surprising since China has committed to generating 150GW from nuclear energy by 2035 which represents a near tripling versus current levels. With more players competing for uranium term contracts, industry experts expect term contract capacity may dry up soon which would lead to more buying on the uranium spot market.

If these were the only factors at play, most investors would agree the uranium outlook is becoming more bullish.

However, there’s another significant shift at play which is further accentuating the expected uranium undersupply…growing investment demand. Sprott’s $US4 billion physical uranium vehicle has been a significant buyer of physical uranium in recent years. And it’s no longer the only player in town. Zuri Invest recently raised $US50-100 million to invest in physical uranium, while ANU Energy are currently raising $US500 million for the same purpose. In addition, rumours are circulating of another physical uranium fund being set up with the same ambition.

A sea change is clearly happening in the uranium market. With more investors understanding uranium’s potential to generate outsized returns longer term, investment demand is on the rise. Some investors are even comparing the evolving situation in uranium to the way the Hunt Brothers cornered the silver market which led to moonshot returns at the time.

Uranium’s shifting risk profile could be creating a long term opportunity

The key takeaway for investors is that uranium has entered a structural deficit phase which is creating underappreciated upside risks for the uranium price. With demand growing and supply likely to remain constrained for many years, the uranium investment case is arguably more derisked now than for the past decade or so. Having said that, uranium is a volatile commodity which should be weighted accordingly.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.