Is tokenised investment right for you?

Ankita Rai

Mon 21 Aug 2023 5 minutesAre you considering diving into tokenised investments, but having reservations about their connection to blockchain—the technology that underpins all cryptocurrencies?

Rest assured, you're not the only one. Since scaling meteoric highs in 2021, cryptocurrencies have been weathering a period of price volatility, putting some investors off investing in anything blockchain related.

It's a common misconception: investors often mix up blockchain and cryptocurrency, whereas in fact they're fundamentally distinct. Blockchain acts as the underlying technology, whereas crypto is just one blockchain application.

In simple terms, blockchain is a decentralised database which can store transaction data fractionally on a massive scale. It offers some major benefits like quick settlements, substantial cost savings, and enhanced security and transparency.

Basically, it is touted as cheaper, faster, and safer as a basis for transactions.

But let's be honest, in the crypto scene, the whole "safe" thing hasn't played out well. Even stablecoins like USDC and Terra Luna have been depegged, while stablecoin crashes continue to occur.

In the midst of all these developments, the question investors be may asking is: are tokenised funds that rely on the power of blockchain worth investing in?

What are tokenised funds?

A tokenised fund uses blockchain technology to facilitate the purchase of tokenised assets, even illiquid ones like real estate, public infrastructure, and private equity.

Tokenised assets here mean digital securities that represent ownership of a real-world asset as a digital token on a blockchain. Unlike cryptocurrencies, which are not backed by real-world assets, tokenised funds derive their value from legal contracts tied to real-world assets.

Detractors often question blockchain’s relevance for this purpose when conventional databases seem perfectly functional. However, these viewpoints miss a crucial point in terms of the cost-efficient and instant settlements that tokenisation can provide. These advantages can reduce operational costs significantly.

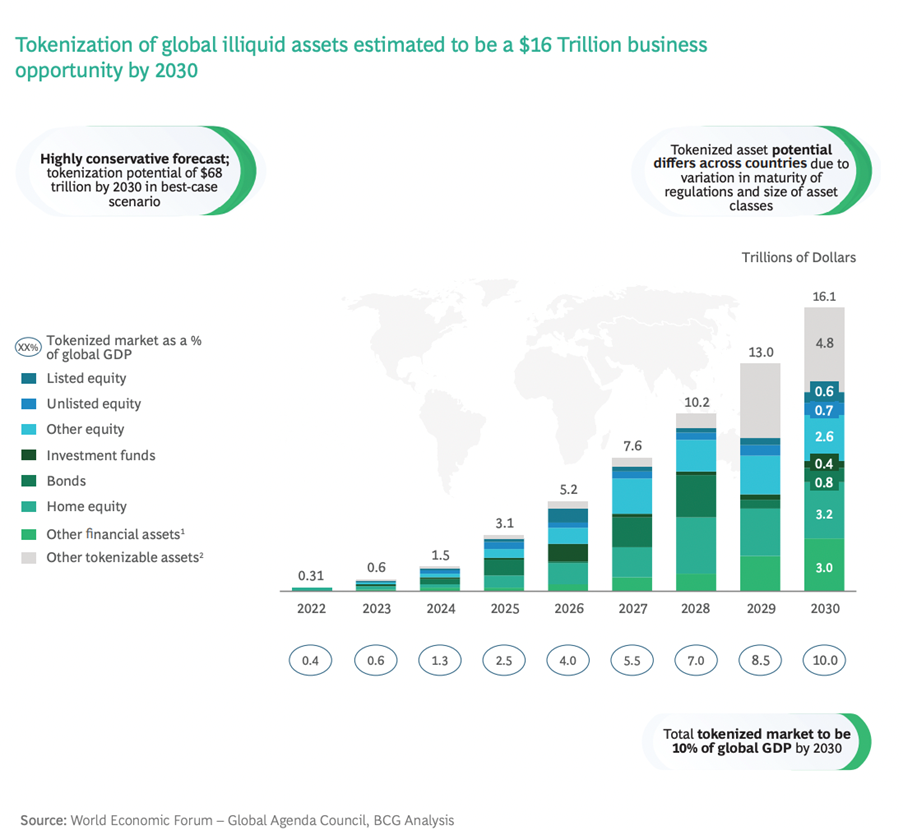

Given these benefits, traditional funds and asset managers are increasingly launching programmes to tokenise alternative assets. It’s big business. BCG estimates asset tokenisation is likely to become a US$16.1 trillion business opportunity by 2030 (as shown below).

Case in point…Wisdom Tree recently launched blockchain-enabled digital funds in the US offering investors exposure to a variety of asset classes, including equities, commodities, and floating-rate bonds.

Singapore-based ADDX, a private market exchange, also uses blockchain technology to provide access to alternative assets including private equities, hedge funds, venture capital, private credit, real estate and debt.

Likewise, in Australia, blockchain-based digital funds are being launched in the farming, property, and tech sectors to take advantage of unlisted opportunities and tap into private markets. For instance, Fintech FreshSupply uses blockchain to enhance credit terms for farmers. It has tokenised assets across the agrifood supply chain, linking processes like fulfilment, shipping, and customs to enable tracking and oversight for lenders.

Clearly the largest uptake in tokenised investment is happening in illiquid assets, which typically suffer from a scarcity of information, or have low trading volumes and poor price discovery, like livestock, plantation, alternate investments, fine art, or vineyards.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Targeting the massive private investment opportunity

Private markets are much larger than public markets, with industry estimates indicating that more than 90 per cent of companies with an annual turnover of US$100 million or more are private.

This explains why tokenised funds are becoming more popular in the vast world of pre-IPO stocks and private equity companies. They make it easier to invest in these unlisted assets by enabling investors to participate as fractional owners.

Illiquid assets such as real estate, natural resources, land, commodities, and mines/ports are also seeing fast adoption as tokenisation creates liquidity by making it easier for these assets to be distributed and traded among investors.

Navigating the tokenisation terrain

Traditional asset fractionalisation isn't new. It's been around for a while. There are many examples, such as Real Estate Investment Trusts, Mutual Funds etc. Up until now, it was more prevalent in public markets, which are already efficient compared to private markets which are slow and opaque. This is changing.

However, while tokenised assets offer a range of benefits, it doesn't come without risk, especially when it comes to illiquid assets, which could be hard to exit if prices drop.

As tokenised assets gain popularity and the fear of missing out kicks in, investors need to ask the right questions before investing their money.

For example, the rules around these assets are still taking shape, so there is uncertainty about how regulators will treat them.

Also, bear in mind tokenised assets aren't immune to market risks like volatility and liquidity troubles that can impact their value. Then there are technical risks tied to the evolving blockchain tech they rely on—think scalability hiccups, hacking and software glitches. These risks could hit investors' pockets.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Tokenisation is at a turning point

Although asset tokenisation hasn't scaled yet, the ecosystem is maturing, and the business cases are getting stronger.

Investors considering tokenised fund investments can gain from being early adopters. Early access to traditionally illiquid assets could offer favourable pricing and potential value growth. But keep in mind, things might be a bit unpredictable at the moment due to regulatory uncertainty and market volatility.

Do your homework before you dive in.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.